This version of the form is not currently in use and is provided for reference only. Download this version of

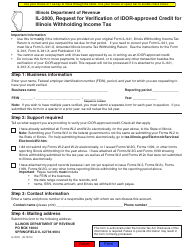

Form IDOR-6-LNR-SUB

for the current year.

Form IDOR-6-LNR-SUB Subscription for State Tax Lien Registry Information - Illinois

What Is Form IDOR-6-LNR-SUB?

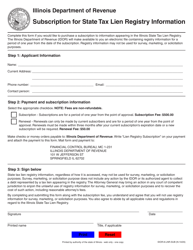

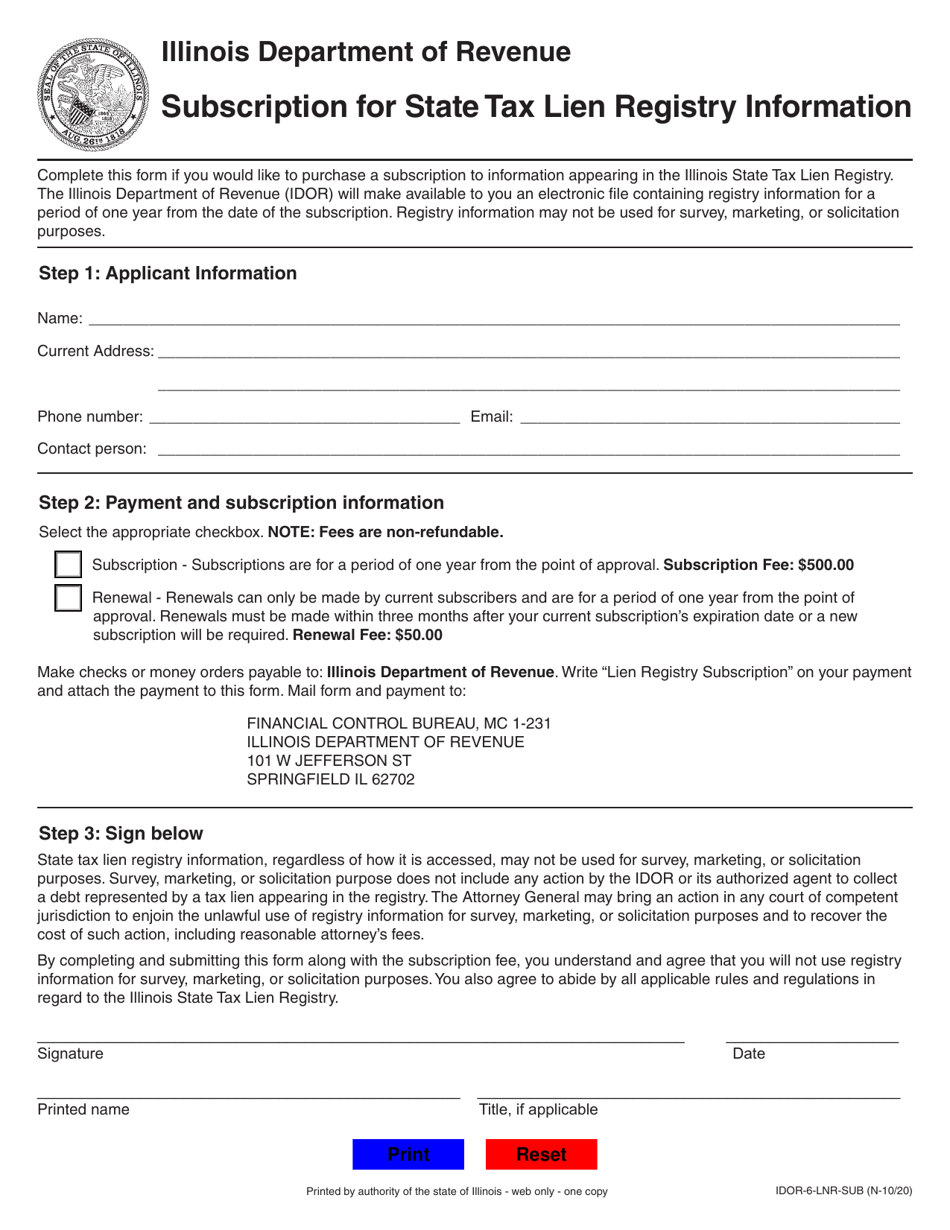

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IDOR-6-LNR-SUB?

A: Form IDOR-6-LNR-SUB is a subscription form for State Tax Lien Registry Information in Illinois.

Q: What is the purpose of Form IDOR-6-LNR-SUB?

A: The purpose of Form IDOR-6-LNR-SUB is to subscribe to receive State Tax Lien Registry Information in Illinois.

Q: Who needs to fill out Form IDOR-6-LNR-SUB?

A: Anyone who wants to receive State Tax Lien Registry Information in Illinois needs to fill out Form IDOR-6-LNR-SUB.

Q: How long does it take to process Form IDOR-6-LNR-SUB?

A: The processing time for Form IDOR-6-LNR-SUB may vary. It is best to check with the Illinois Department of Revenue for an estimate of the processing time.

Q: Can I cancel my subscription to State Tax Lien Registry Information in Illinois?

A: Yes, you can cancel your subscription to State Tax Lien Registry Information in Illinois. You will need to contact the Illinois Department of Revenue to cancel your subscription.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IDOR-6-LNR-SUB by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.