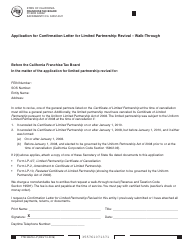

This version of the form is not currently in use and is provided for reference only. Download this version of

Form LP-5

for the current year.

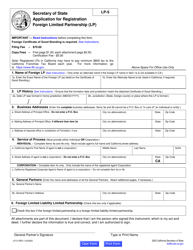

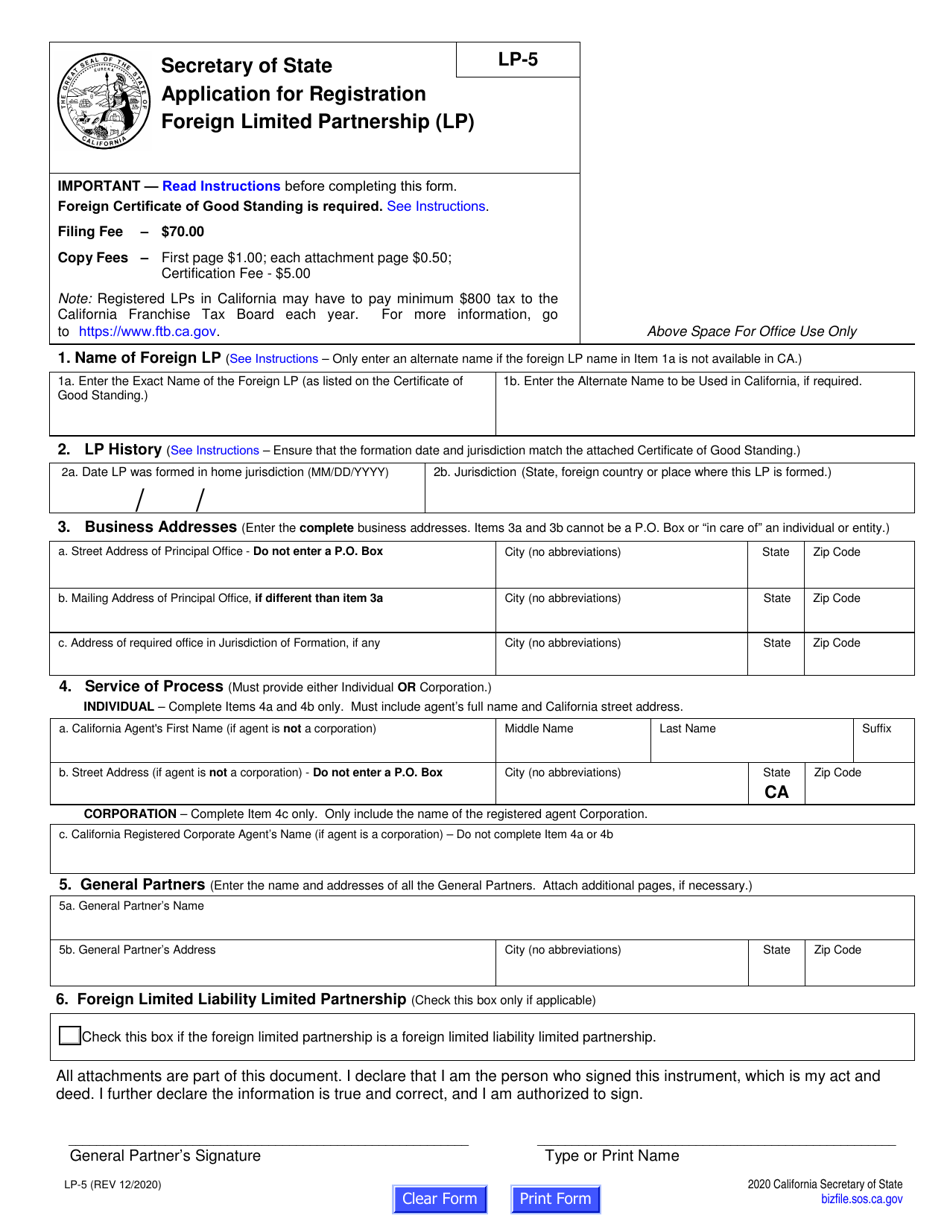

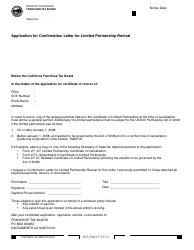

Form LP-5 Application for Registration Foreign Limited Partnership (Lp) - California

What Is Form LP-5?

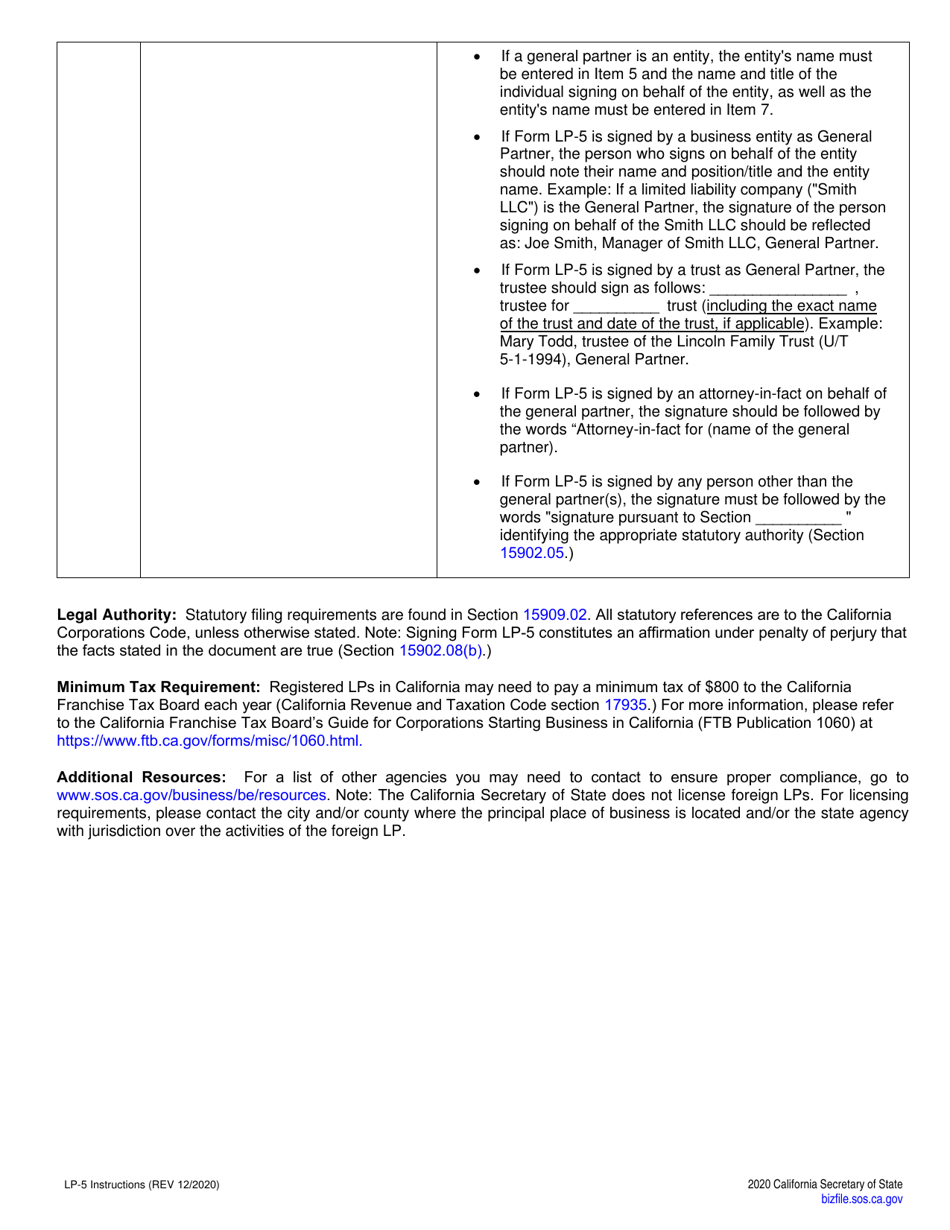

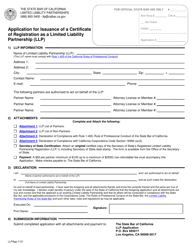

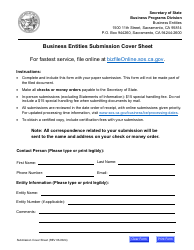

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LP-5?

A: Form LP-5 is an application for registration of a foreign limited partnership (LP) in California.

Q: What is a foreign limited partnership?

A: A foreign limited partnership is a partnership formed under the laws of another state or country.

Q: Why do I need to register a foreign limited partnership in California?

A: You need to register a foreign limited partnership in California if you want to conduct business in the state.

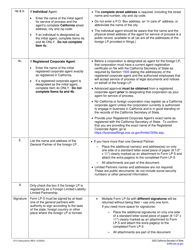

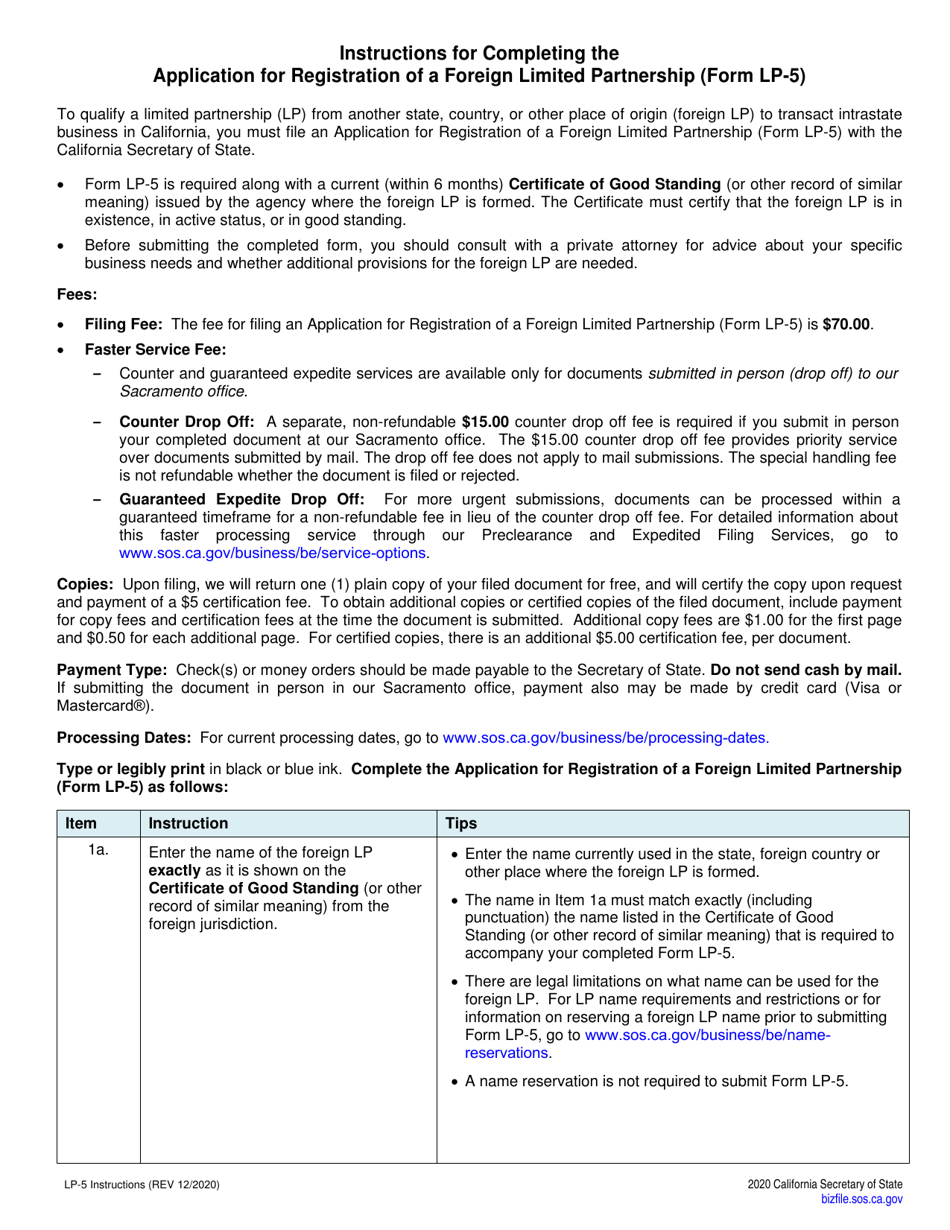

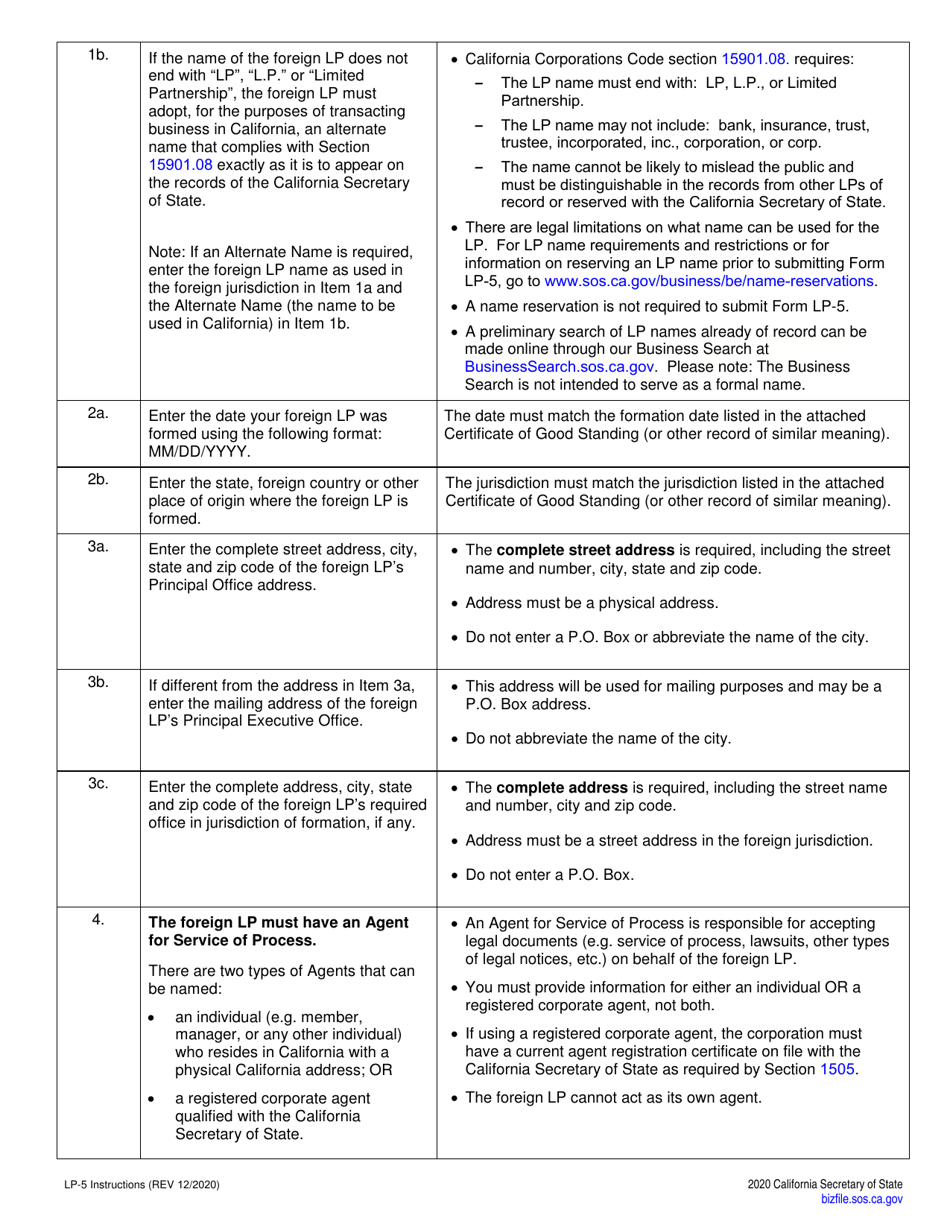

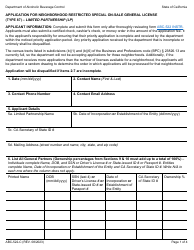

Q: How do I fill out Form LP-5?

A: You can fill out Form LP-5 by providing all required information, including the name and address of the partnership, the names and addresses of the general partners, and the signature of a partner.

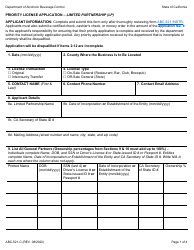

Q: What happens after I file Form LP-5?

A: After you file Form LP-5, your foreign limited partnership will be registered to conduct business in California, and you will receive a certificate of registration.

Q: Do I need to renew the registration of my foreign limited partnership?

A: Yes, you need to renew the registration of your foreign limited partnership every five years.

Q: What happens if my registration is not renewed?

A: If your registration is not renewed, your foreign limited partnership will lose its status to conduct business in California.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LP-5 by clicking the link below or browse more documents and templates provided by the California Secretary of State.