This version of the form is not currently in use and is provided for reference only. Download this version of

Form ARTS-GS

for the current year.

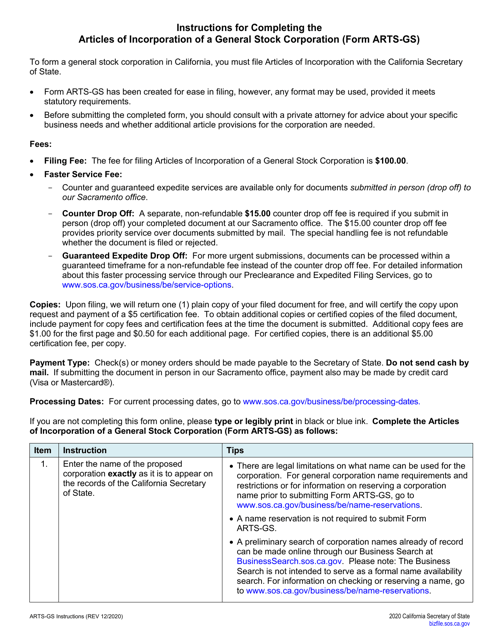

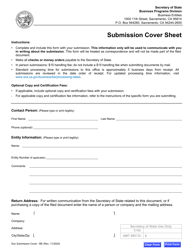

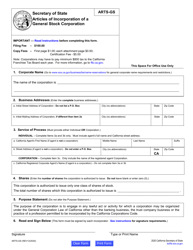

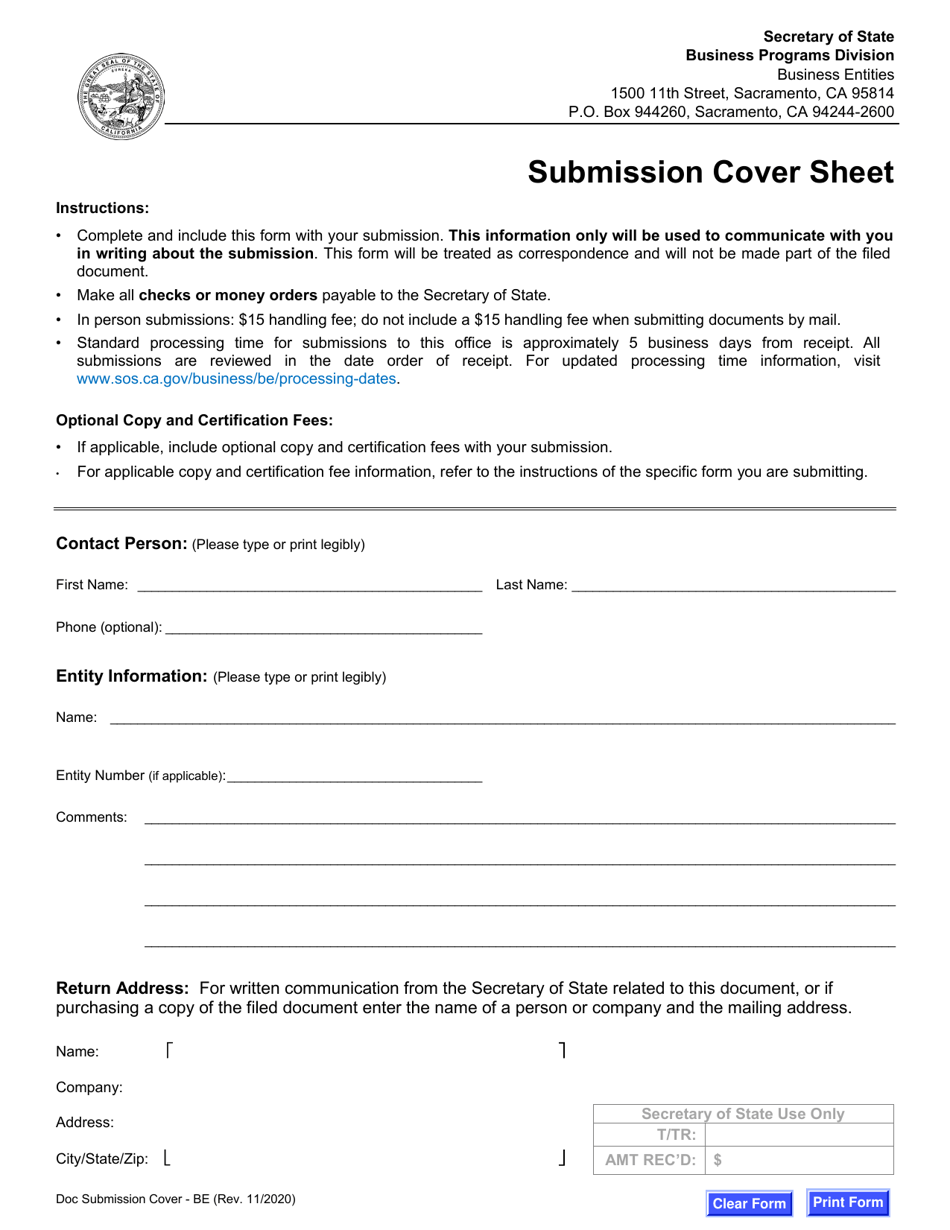

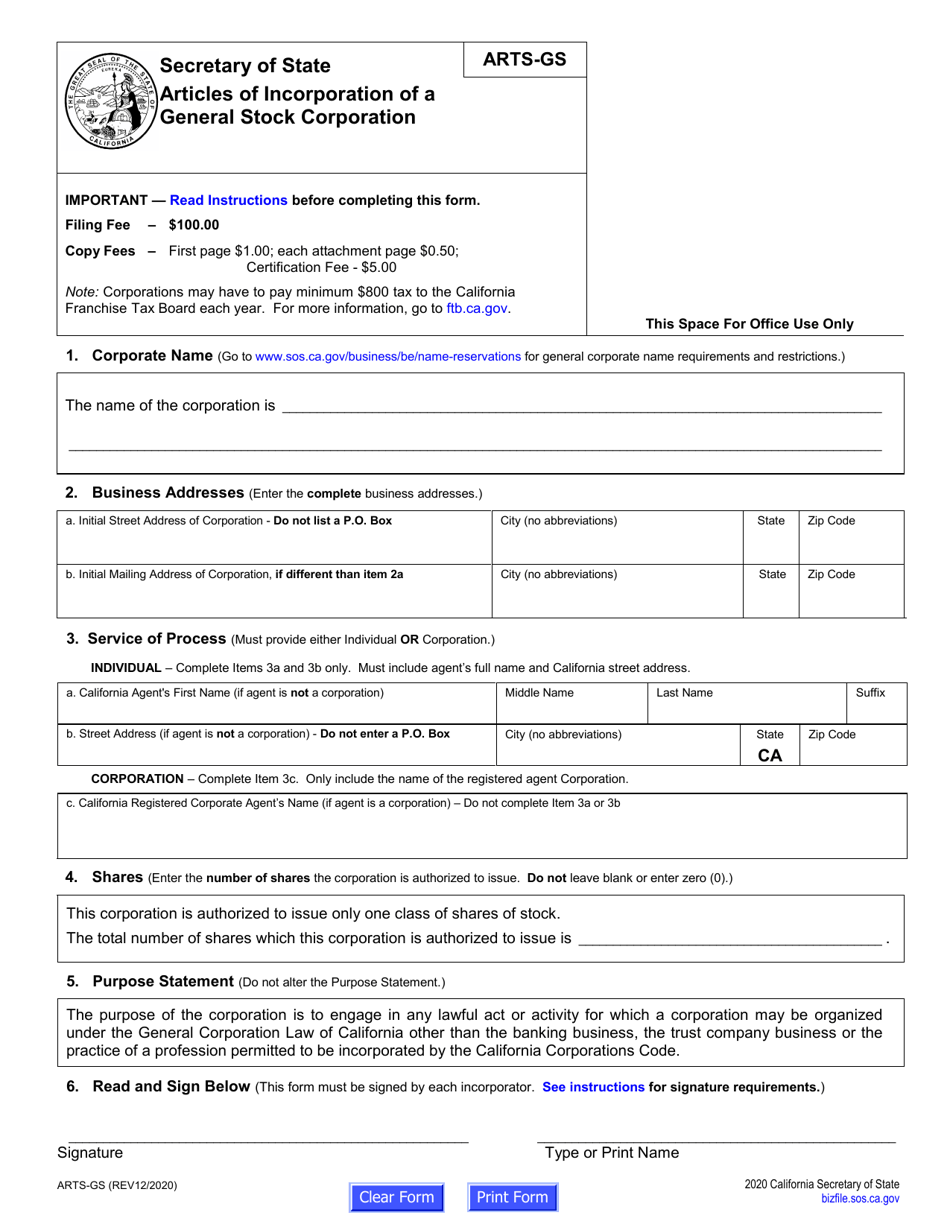

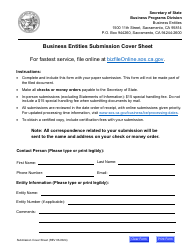

Form ARTS-GS Articles of Incorporation of a General Stock Corporation - California

What Is Form ARTS-GS?

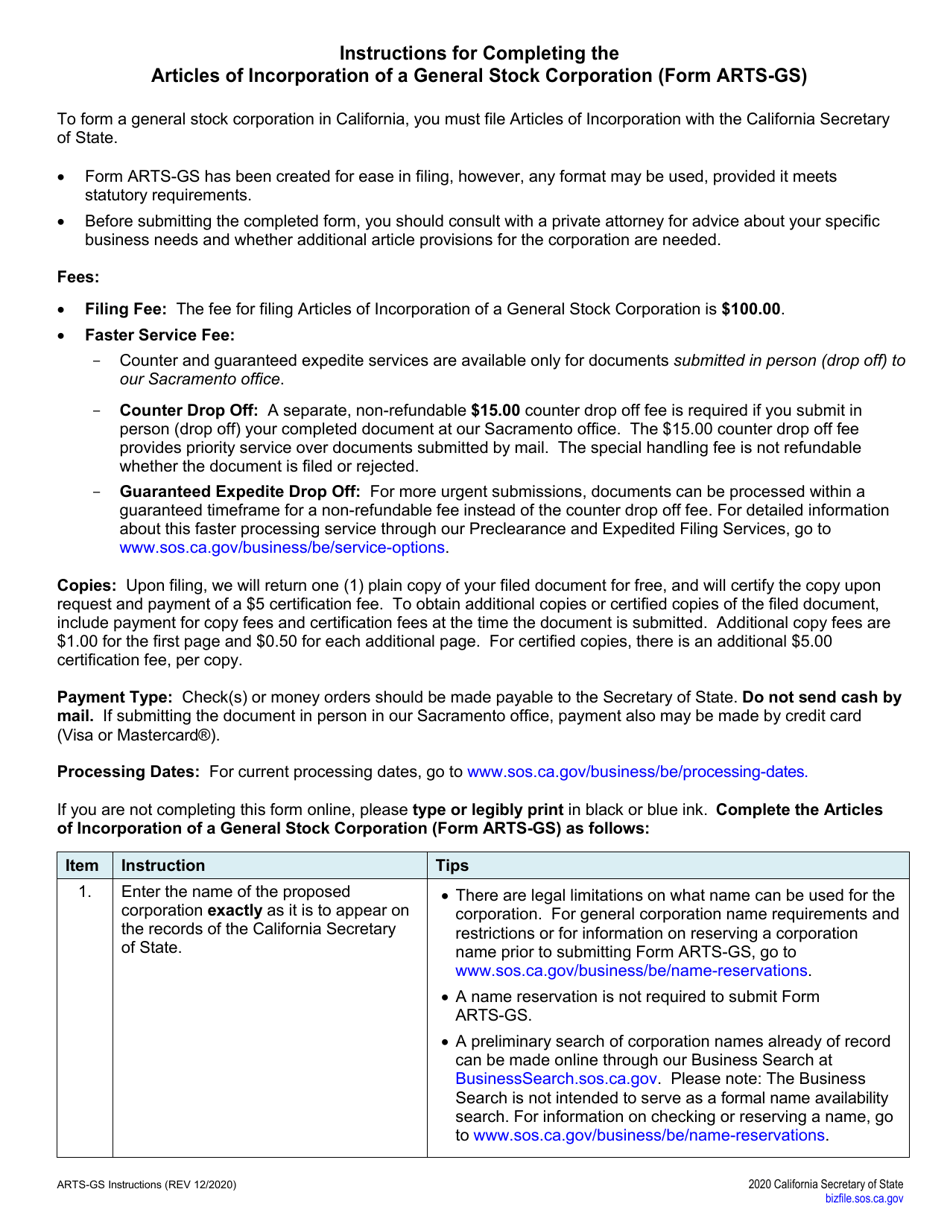

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an ARTS-GS Articles of Incorporation?

A: ARTS-GS stands for Articles of Incorporation of a General Stock Corporation. It is a legal document used to establish a general stock corporation in the state of California.

Q: What is a general stock corporation?

A: A general stock corporation is a type of business entity that is owned by shareholders and whose ownership is represented by shares of stock.

Q: What is the purpose of filing ARTS-GS Articles of Incorporation?

A: Filing the ARTS-GS Articles of Incorporation is necessary to formally create a general stock corporation and provide important information about the corporation, its purpose, and its structure.

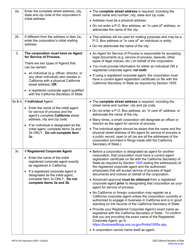

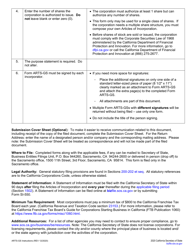

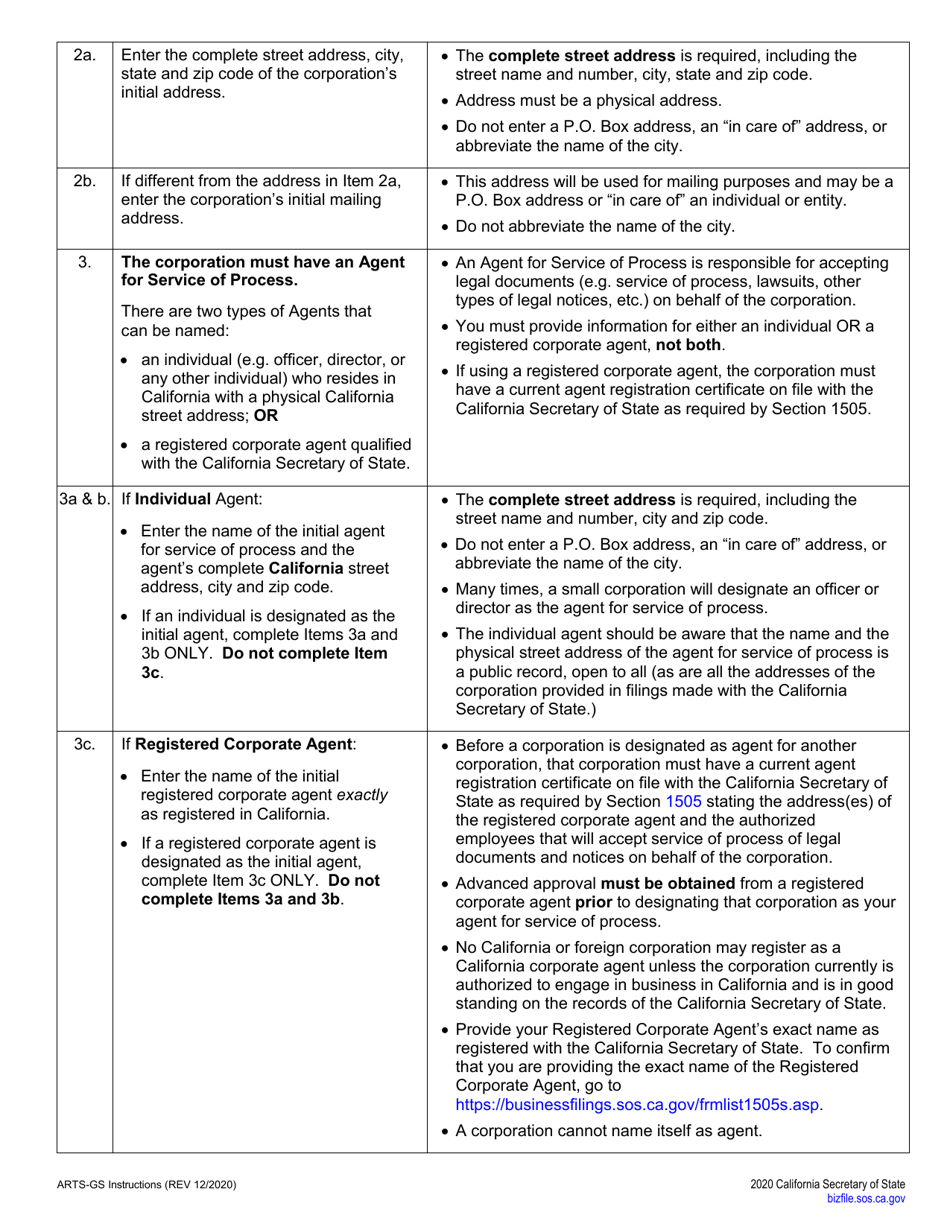

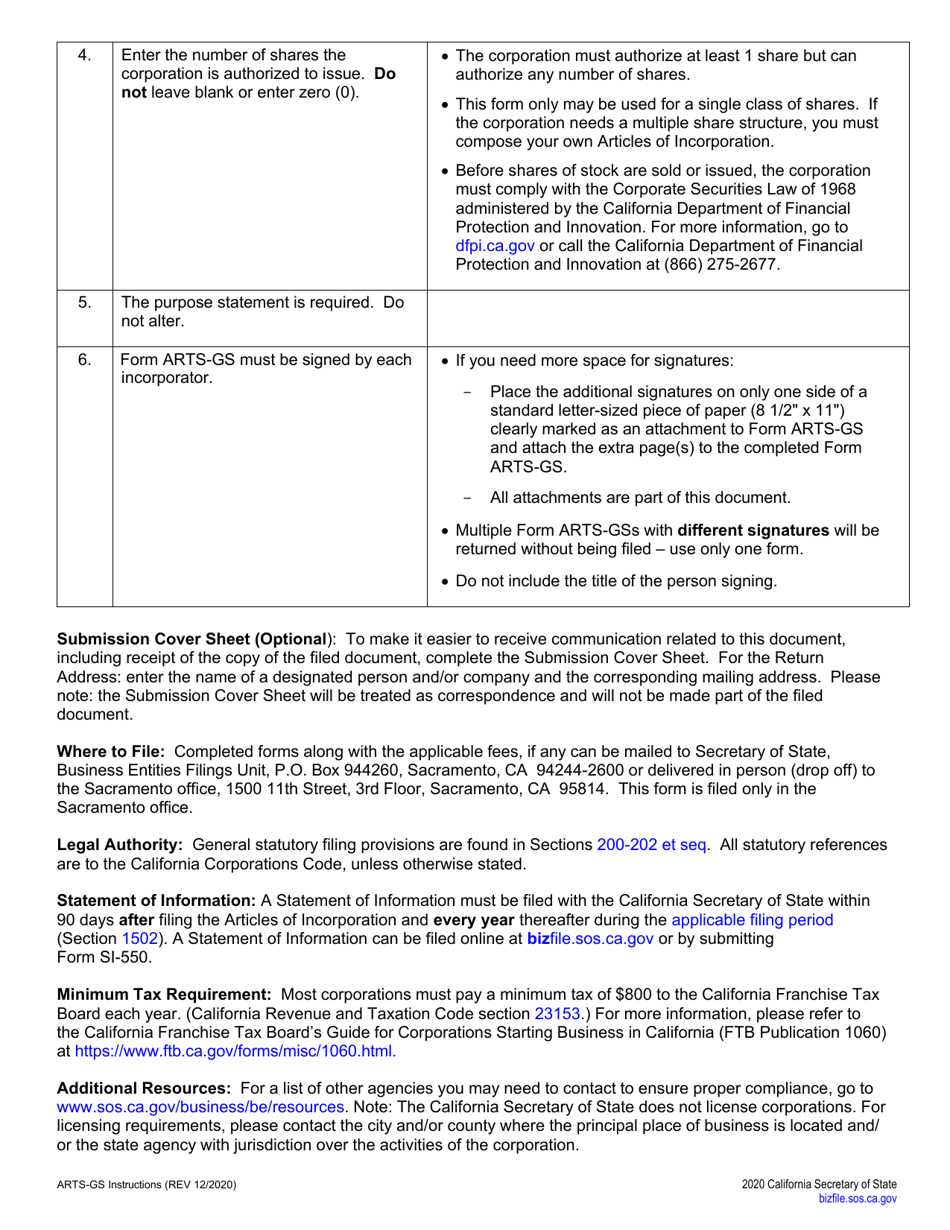

Q: What information is required in the ARTS-GS Articles of Incorporation?

A: The ARTS-GS Articles of Incorporation requires information such as the corporation's name, purpose, registered agent, number of shares authorized, and the names of the initial directors.

Q: Do I need a lawyer to file ARTS-GS Articles of Incorporation?

A: While it is not required to have a lawyer, it is recommended to consult with an attorney or a professional to ensure that the Articles of Incorporation is completed correctly and accurately.

Q: What happens after filing ARTS-GS Articles of Incorporation?

A: After filing the ARTS-GS Articles of Incorporation, the California Secretary of State will review the document. If everything is in order, the corporation will be officially formed and a Certificate of Incorporation will be issued.

Q: What are the ongoing requirements for a general stock corporation in California?

A: A general stock corporation in California must comply with certain ongoing requirements, such as filing annual reports, paying taxes, and maintaining proper corporate records.

Q: Can a general stock corporation be converted into a different type of entity?

A: Yes, a general stock corporation can be converted into a different type of entity, such as a limited liability company (LLC) or a nonprofit corporation, by following the appropriate legal procedures.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ARTS-GS by clicking the link below or browse more documents and templates provided by the California Secretary of State.