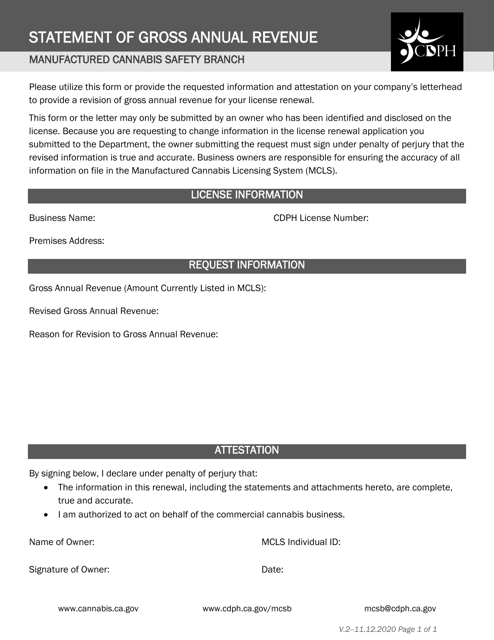

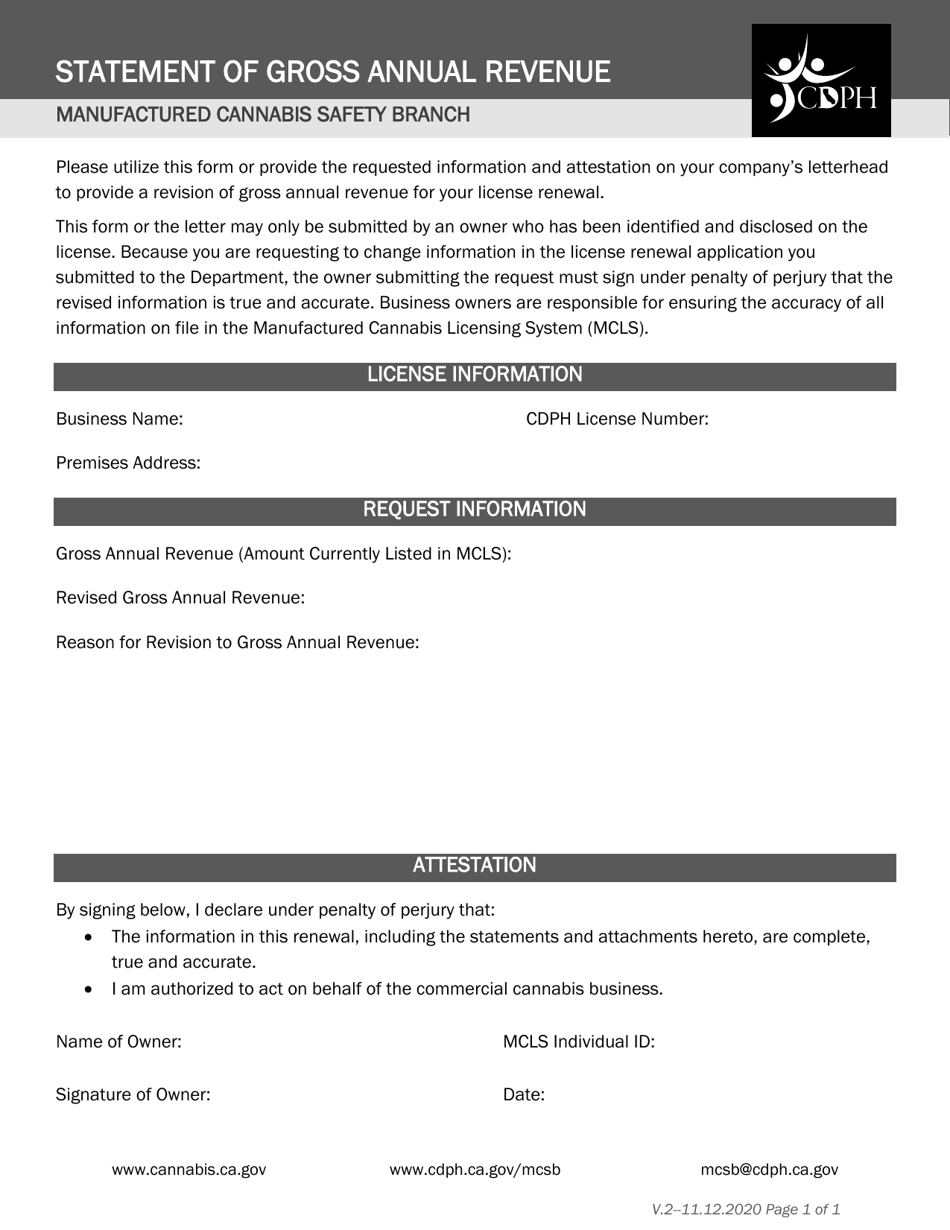

Statement of Gross Annual Revenue - California

Statement of Gross Annual Revenue is a legal document that was released by the California Department of Public Health - a government authority operating within California.

FAQ

Q: What is Gross Annual Revenue?

A: Gross Annual Revenue refers to the total amount of money earned by a business in a year before deducting any expenses.

Q: Why is Gross Annual Revenue important?

A: Gross Annual Revenue is important because it provides a measure of a business's overall financial performance and is used for various purposes such as taxation, loan applications, and business valuation.

Q: How is Gross Annual Revenue calculated?

A: Gross Annual Revenue is calculated by adding up all the income generated by a business in a year, including sales revenue, rental income, and other sources of revenue.

Q: What is the significance of Gross Annual Revenue for businesses in California?

A: Gross Annual Revenue is significant for businesses in California as it is used to determine eligibility for certain tax incentives and exemptions, as well as for reporting purposes to the California Franchise Tax Board.

Q: Are there any exemptions or deductions available for Gross Annual Revenue in California?

A: Yes, California offers certain exemptions and deductions for Gross Annual Revenue, such as the Small Business Exemption for businesses with revenue below a certain threshold.

Form Details:

- Released on November 12, 2020;

- The latest edition currently provided by the California Department of Public Health;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Public Health.