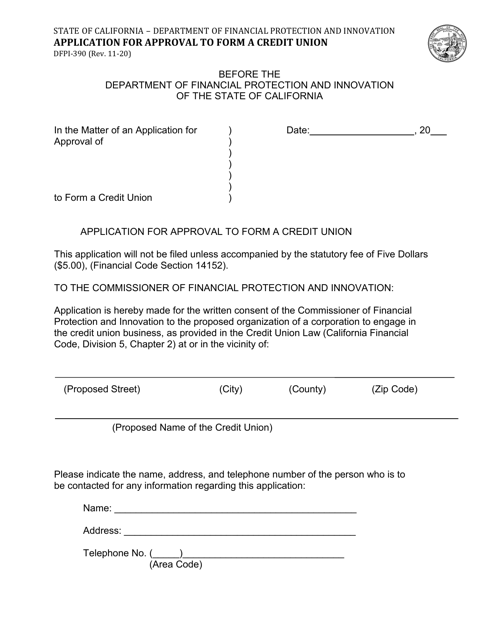

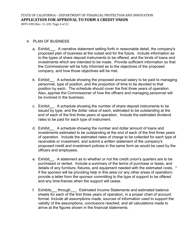

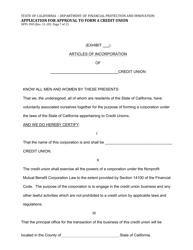

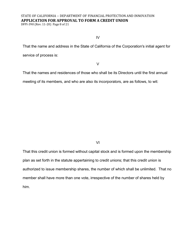

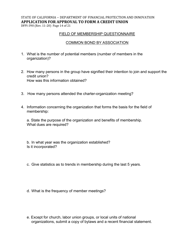

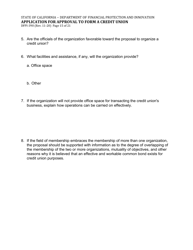

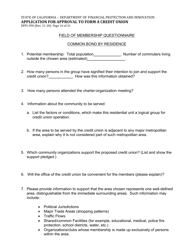

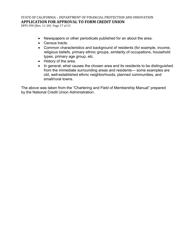

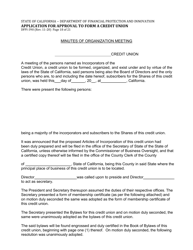

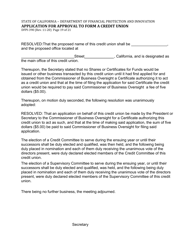

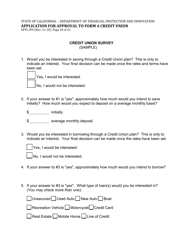

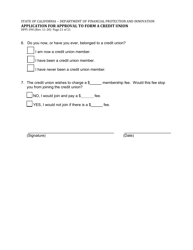

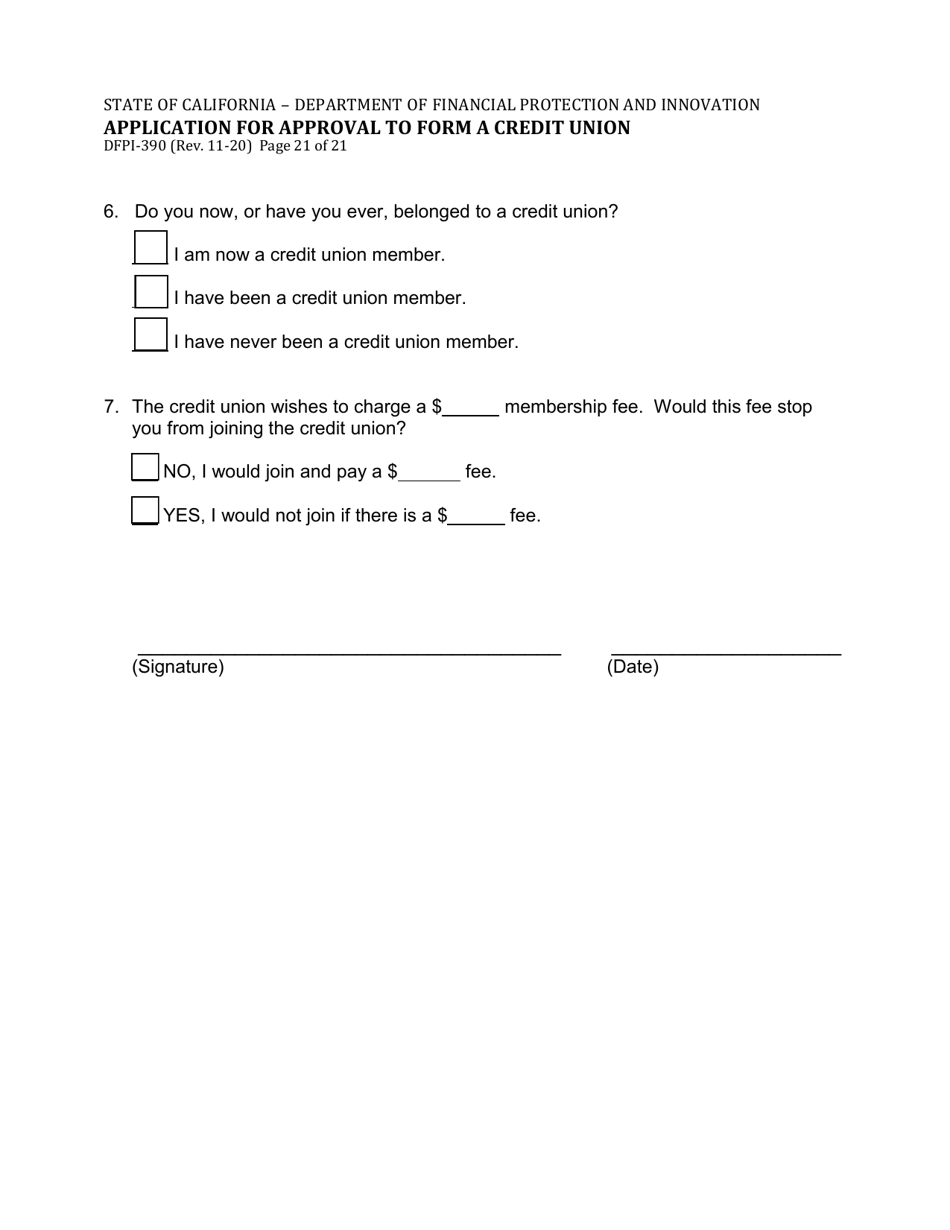

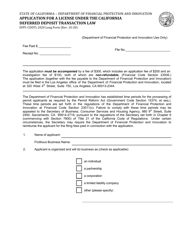

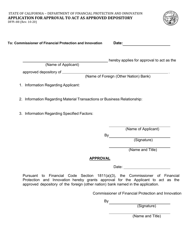

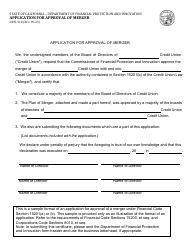

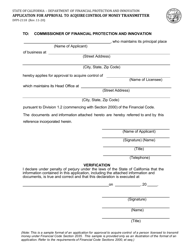

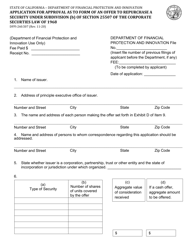

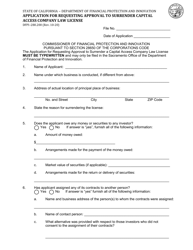

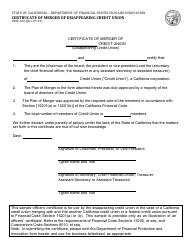

Form DFPI-390 Application for Approval to Form a Credit Union - California

What Is Form DFPI-390?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DFPI-390?

A: The Form DFPI-390 is the Application for Approval to Form a Credit Union in California.

Q: What is a credit union?

A: A credit union is a financial cooperative owned and controlled by its members, who pool their savings to provide low-cost loans and other financial services.

Q: Who needs to complete the Form DFPI-390?

A: Anyone who wants to form a credit union in California needs to complete the Form DFPI-390.

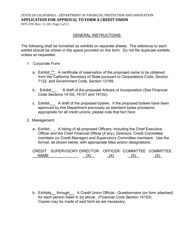

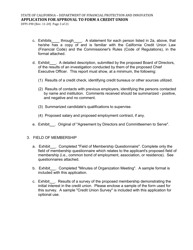

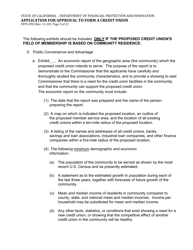

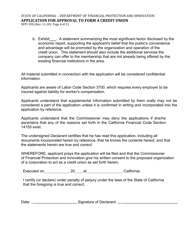

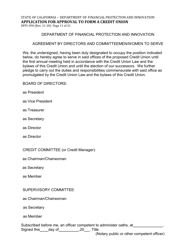

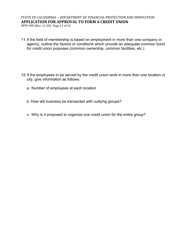

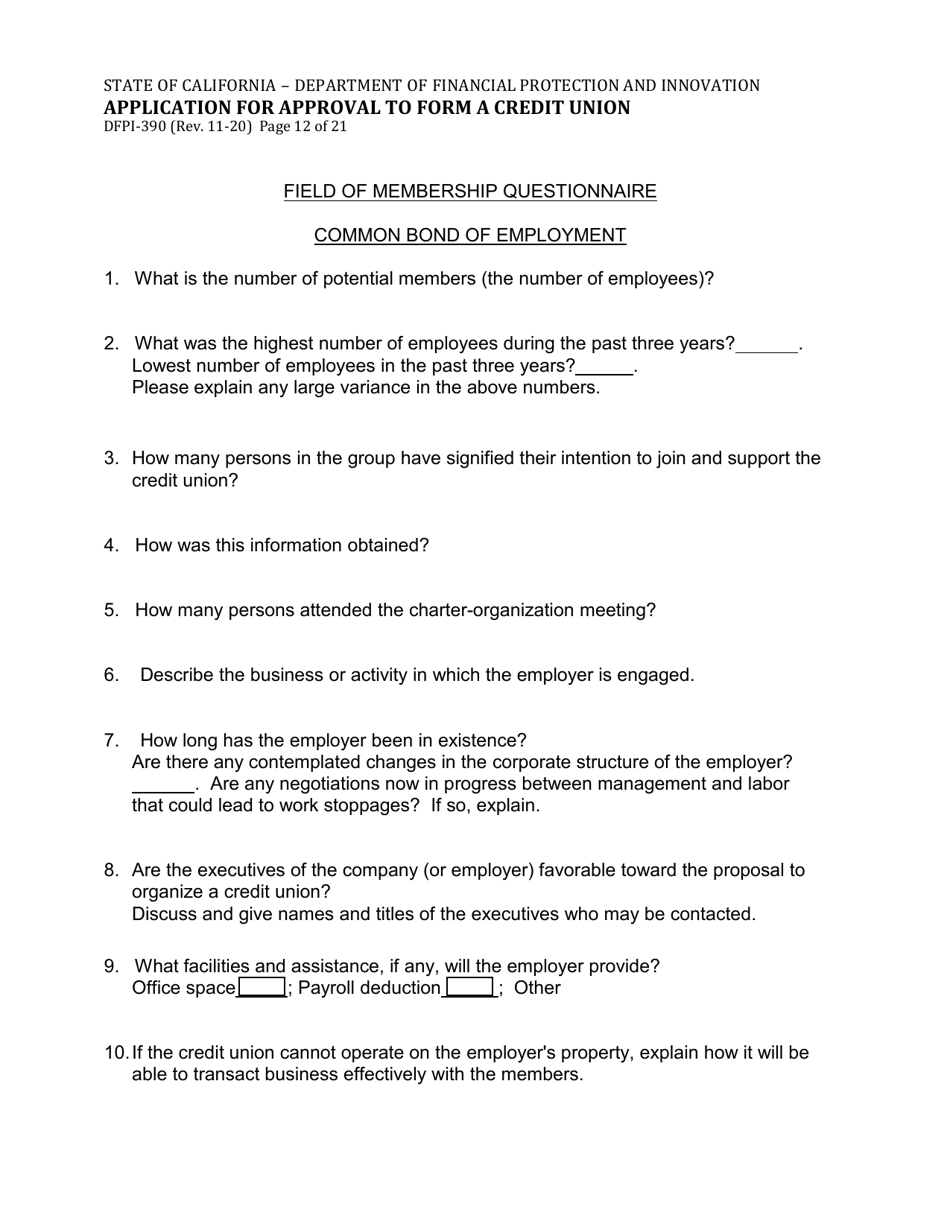

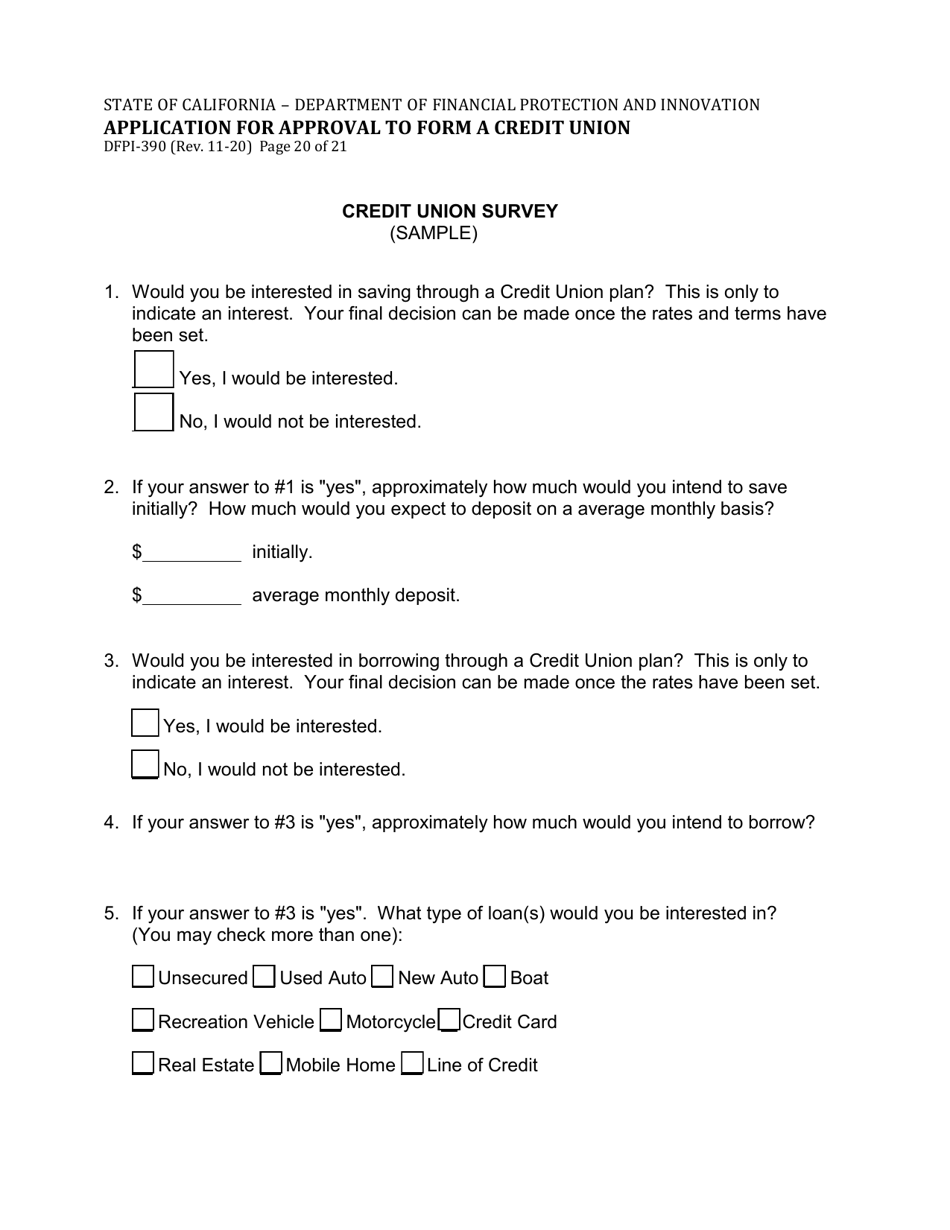

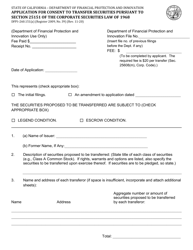

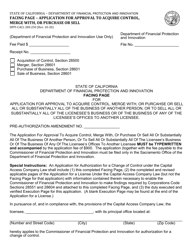

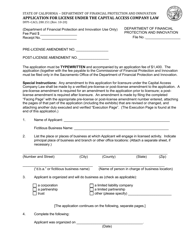

Q: What information is required on the Form DFPI-390?

A: The Form DFPI-390 requires information about the proposed credit union's organizers, business plan, financial projections, and compliance with relevant laws and regulations.

Q: How long does it take to process the Form DFPI-390?

A: The processing time for the Form DFPI-390 can vary. It is recommended to contact the DFPI for more information on the current processing timeframe.

Q: What happens after submitting the Form DFPI-390?

A: After submitting the Form DFPI-390, the DFPI will review the application and may request additional information or clarification. If approved, the credit union can proceed with the formation process.

Q: Can I apply to form a credit union in California if I am not a resident of the state?

A: Yes, non-residents can apply to form a credit union in California. However, they must meet certain requirements and comply with all applicable laws and regulations.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFPI-390 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.