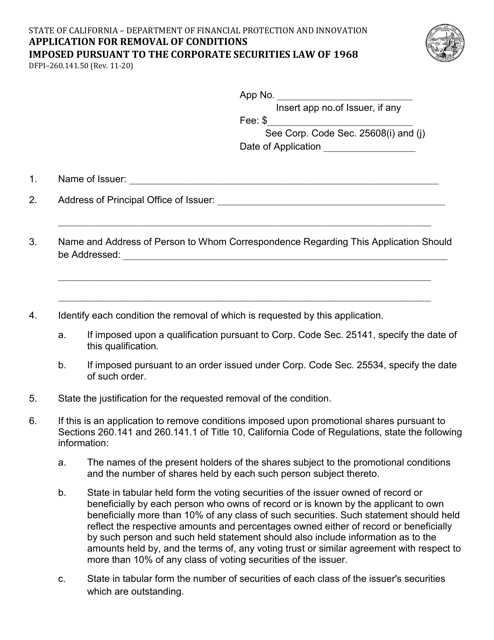

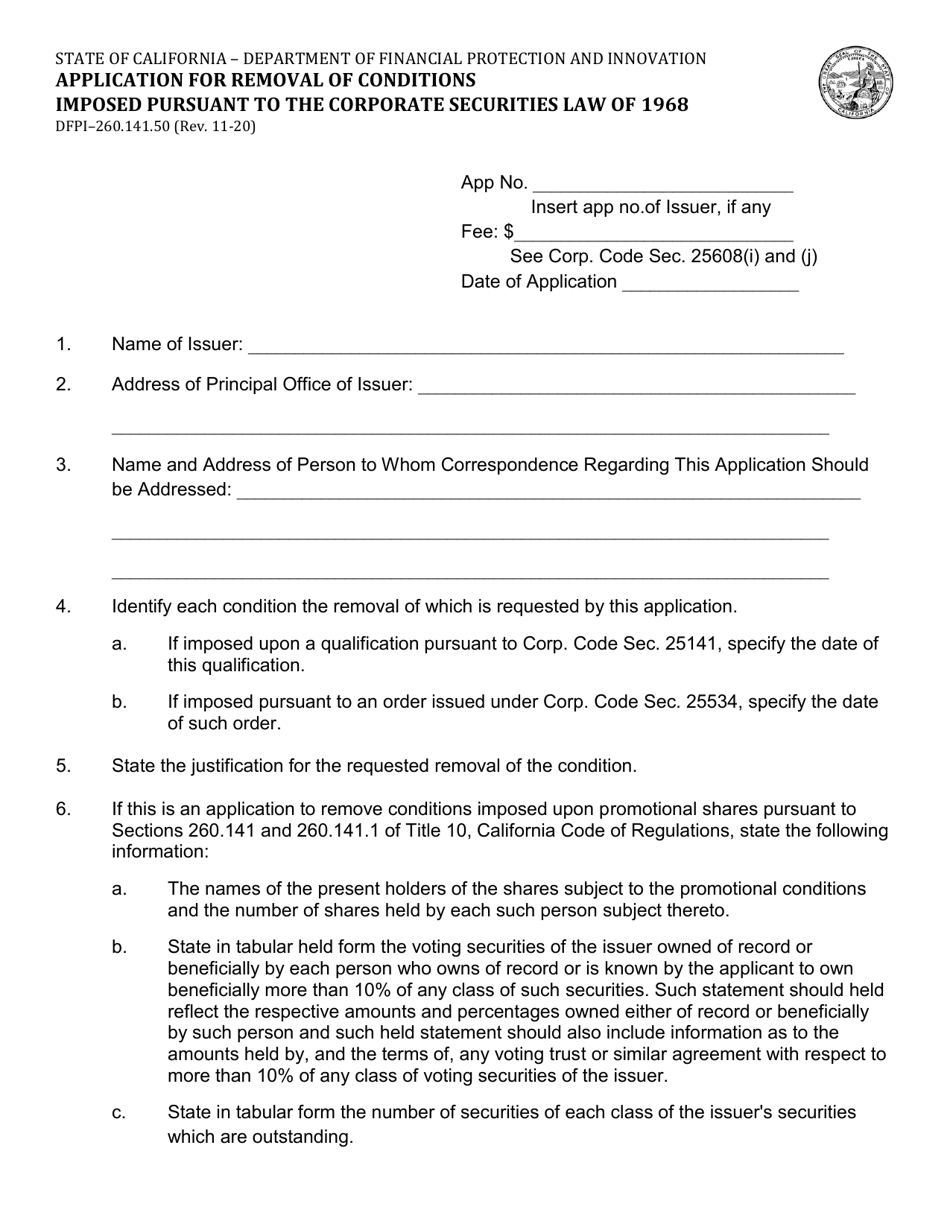

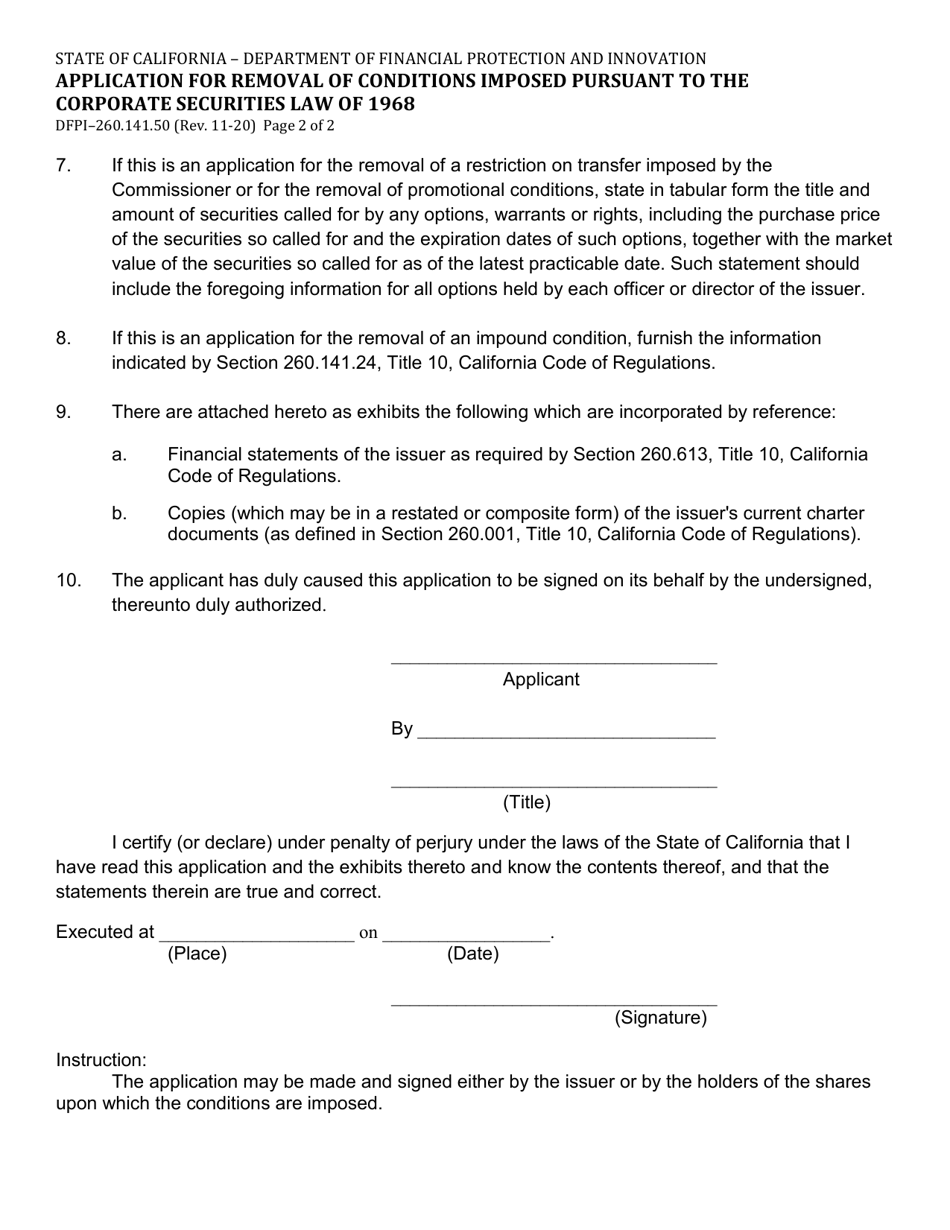

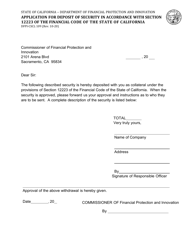

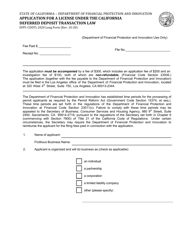

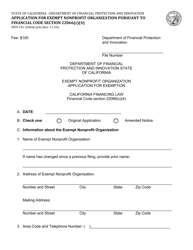

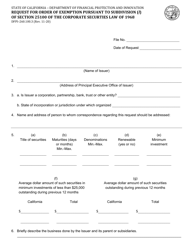

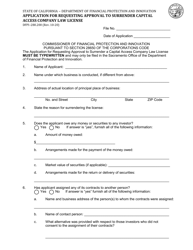

Form DFPI-260.141.50 Application for Removal of Conditions Imposed Pursuant to the Corporate Securities Law of 1968 - California

What Is Form DFPI-260.141.50?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DFPI-260.141.50?

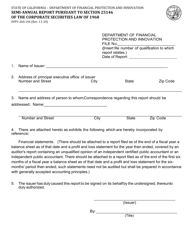

A: Form DFPI-260.141.50 is an application used in California to request the removal of conditions imposed by the Corporate Securities Law of 1968.

Q: What is the purpose of Form DFPI-260.141.50?

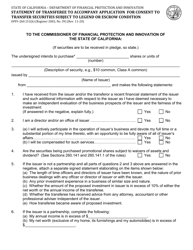

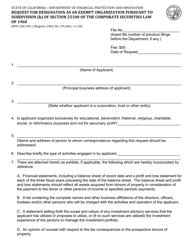

A: The purpose of Form DFPI-260.141.50 is to apply for the removal of certain conditions or restrictions that have been imposed on a business entity under the Corporate Securities Law of 1968.

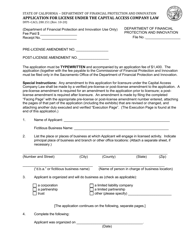

Q: Who can use Form DFPI-260.141.50?

A: Any business entity that is subject to conditions or restrictions under the Corporate Securities Law of 1968 in California can use Form DFPI-260.141.50 to apply for their removal.

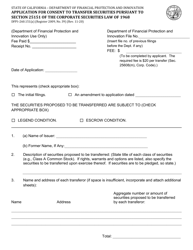

Q: What are the conditions or restrictions imposed by the Corporate Securities Law of 1968?

A: The specific conditions or restrictions imposed by the Corporate Securities Law of 1968 may vary depending on the circumstances, but they generally relate to the issuance, sale, or transfer of securities by a business entity.

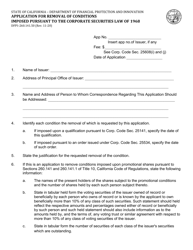

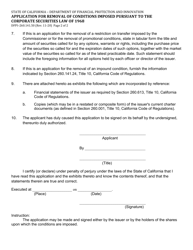

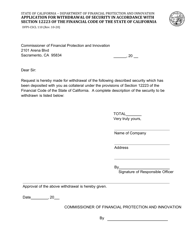

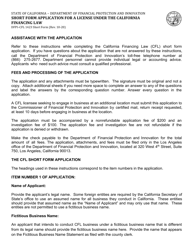

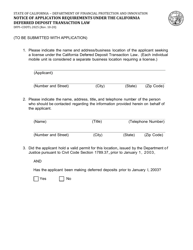

Q: How do I fill out Form DFPI-260.141.50?

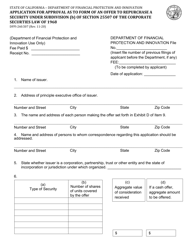

A: To fill out Form DFPI-260.141.50, you will need to provide information about your business entity, the conditions or restrictions you are seeking to have removed, and any supporting documents or evidence.

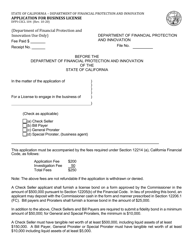

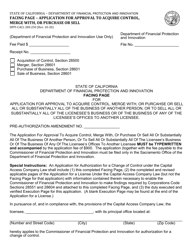

Q: Are there any fees associated with submitting Form DFPI-260.141.50?

A: There may be fees associated with the submission of Form DFPI-260.141.50. You should consult the most current fee schedule provided by the California DFPI to determine the applicable fees.

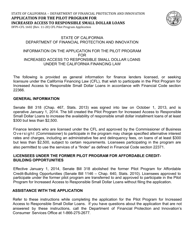

Q: What happens after I submit Form DFPI-260.141.50?

A: After you submit Form DFPI-260.141.50, the California DFPI will review your application and may request additional information or documentation. They will then make a decision on whether to grant or deny the removal of the conditions or restrictions.

Q: Can I appeal a decision made on my Form DFPI-260.141.50 application?

A: Yes, if your application to remove conditions or restrictions is denied, you may have the opportunity to appeal the decision through an administrative appeals process.

Q: Is legal assistance required to complete Form DFPI-260.141.50?

A: Legal assistance is not required to complete Form DFPI-260.141.50, but you may choose to consult with an attorney if you have questions or need guidance on the process.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFPI-260.141.50 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.