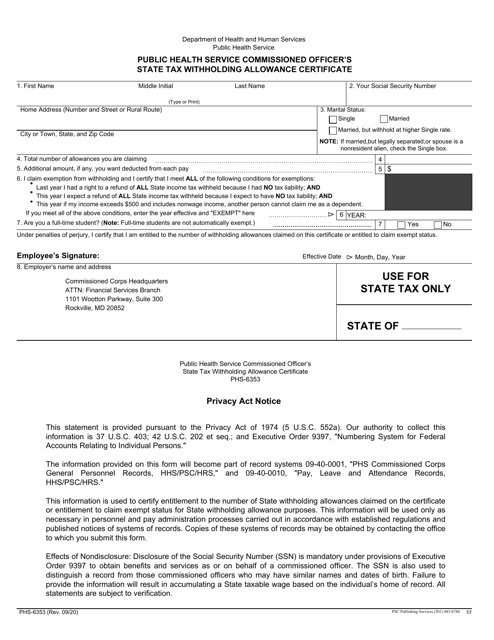

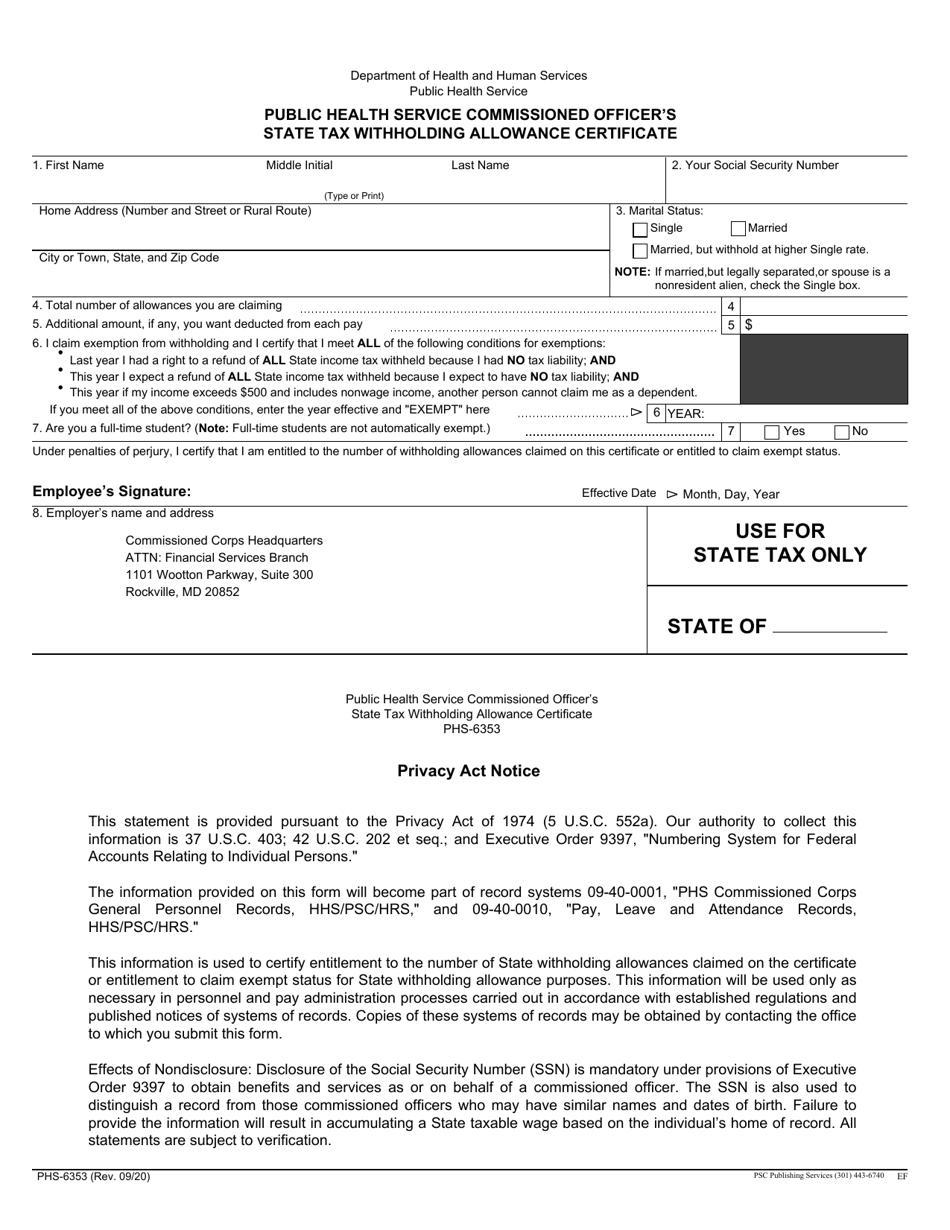

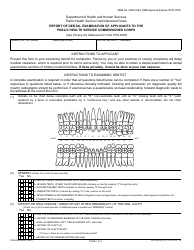

Form PHS-6353 Public Health Service Commissioned Officer's State Tax Withholding Allowance Certificate

What Is Form PHS-6353?

This is a legal form that was released by the U.S. Department of Health and Human Services - Public Health Service Commissioned Corps on September 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PHS-6353?

A: Form PHS-6353 is the Public Health Service Commissioned Officer's State Tax Withholding Allowance Certificate.

Q: What is the purpose of Form PHS-6353?

A: The purpose of Form PHS-6353 is to determine the correct amount of state tax to withhold from a Public Health Service Commissioned Officer's pay.

Q: Who needs to fill out Form PHS-6353?

A: Public Health Service Commissioned Officers who want to have state tax withheld from their pay need to fill out Form PHS-6353.

Q: How can I obtain Form PHS-6353?

A: Form PHS-6353 can be obtained from the National Oceanic and Atmospheric Administration (NOAA) Commissioned Personnel Center.

Q: Is Form PHS-6353 for both US and Canadian residents?

A: No, Form PHS-6353 is only for US residents.

Q: Can I claim exemptions on Form PHS-6353?

A: Yes, you can claim exemptions on Form PHS-6353 if you meet certain criteria.

Q: When should I submit Form PHS-6353?

A: Form PHS-6353 should be submitted as soon as possible after you are commissioned as a Public Health Service Officer.

Q: Are there any penalties for not filling out Form PHS-6353?

A: Not filling out Form PHS-6353 may result in additional taxes being withheld from your pay.

Q: Can I make changes to my Form PHS-6353?

A: Yes, you can make changes to your Form PHS-6353 at any time by submitting a new form to the National Oceanic and Atmospheric Administration (NOAA) Commissioned Personnel Center.

Form Details:

- Released on September 1, 2020;

- The latest available edition released by the U.S. Department of Health and Human Services - Public Health Service Commissioned Corps;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PHS-6353 by clicking the link below or browse more documents and templates provided by the U.S. Department of Health and Human Services - Public Health Service Commissioned Corps.