This version of the form is not currently in use and is provided for reference only. Download this version of

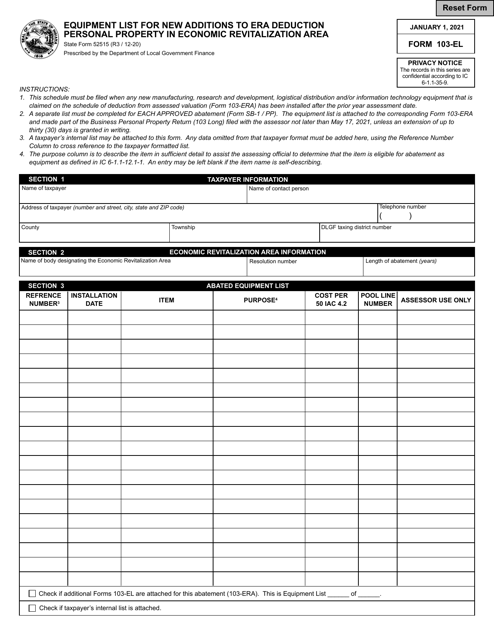

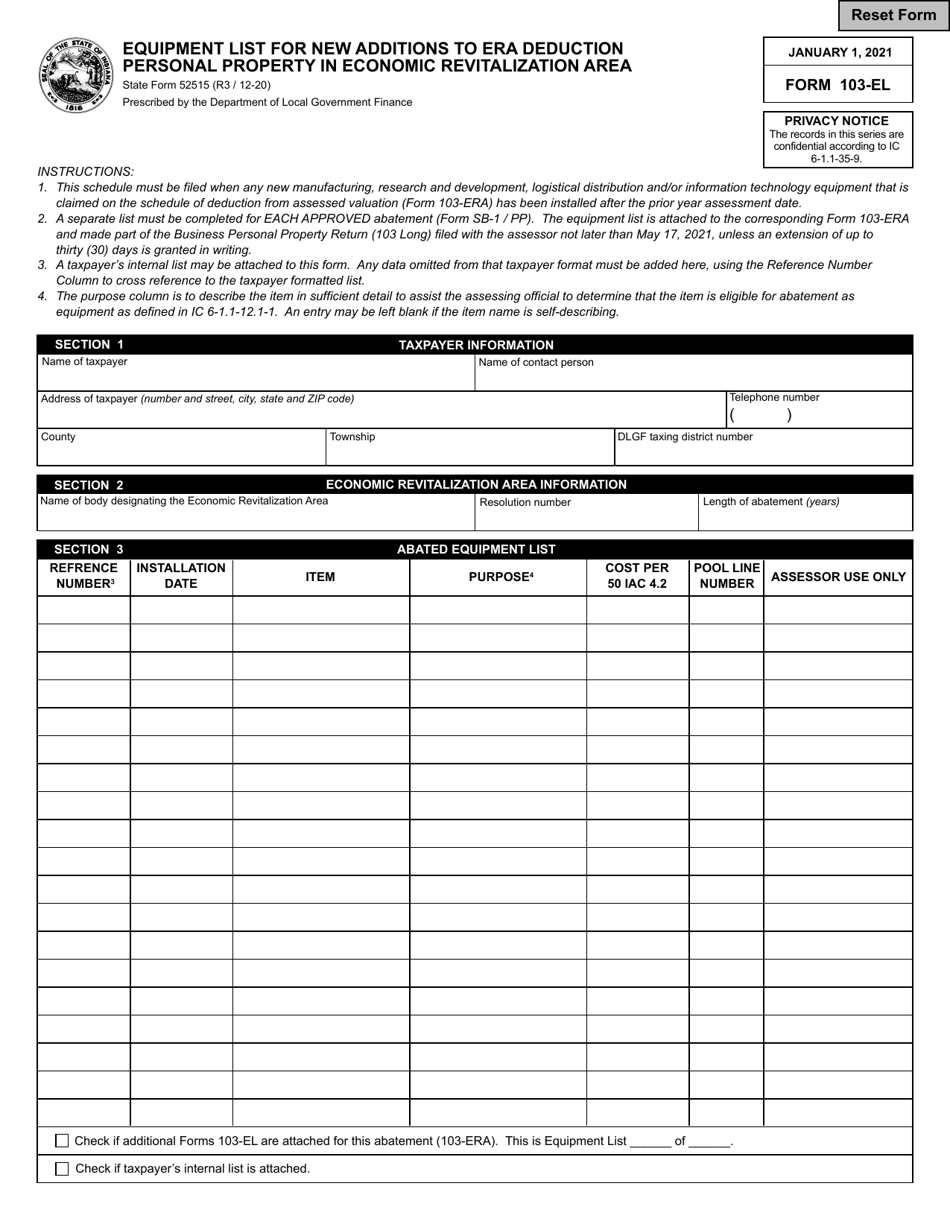

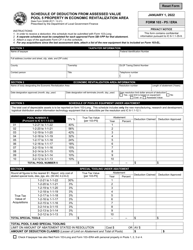

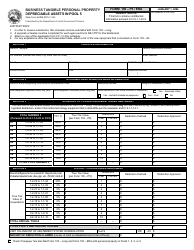

State Form 52515 (103-EL)

for the current year.

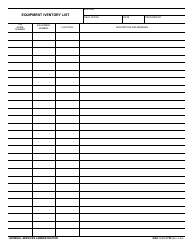

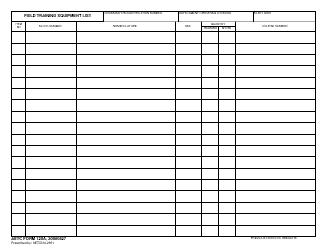

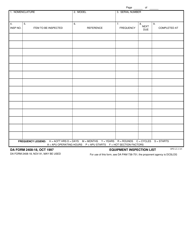

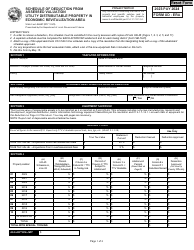

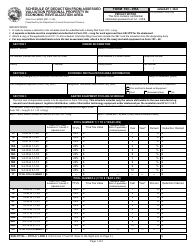

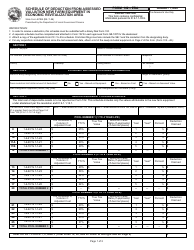

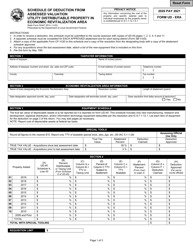

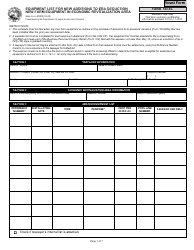

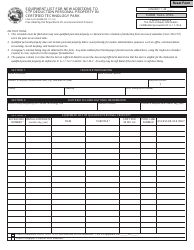

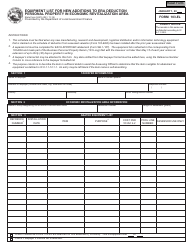

State Form 52515 (103-EL) Equipment List for New Additions to Era Deduction Personal Property in Economic Revitalization Area - Indiana

What Is State Form 52515 (103-EL)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 52515?

A: State Form 52515 is a form used in Indiana.

Q: What is the purpose of State Form 52515?

A: State Form 52515 is used to list equipment for new additions to Era Deduction Personal Property in Economic Revitalization Area in Indiana.

Q: Who needs to fill out State Form 52515?

A: Any individual or business that has new additions to Era Deduction Personal Property in Economic Revitalization Area in Indiana needs to fill out State Form 52515.

Q: What information is required on State Form 52515?

A: State Form 52515 requires the listing of equipment for new additions to Era Deduction Personal Property in Economic Revitalization Area in Indiana.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 52515 (103-EL) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.