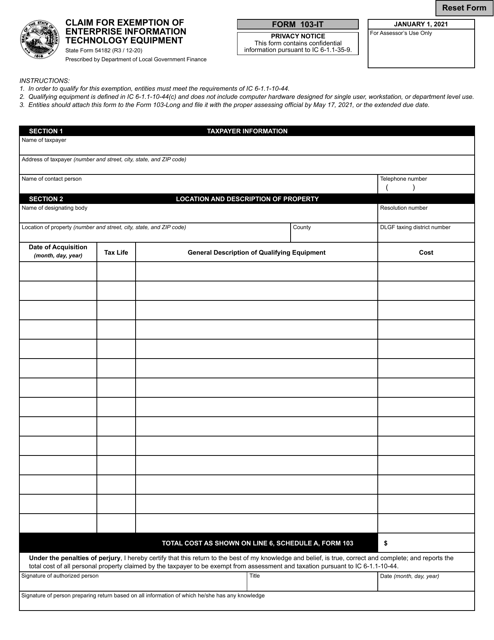

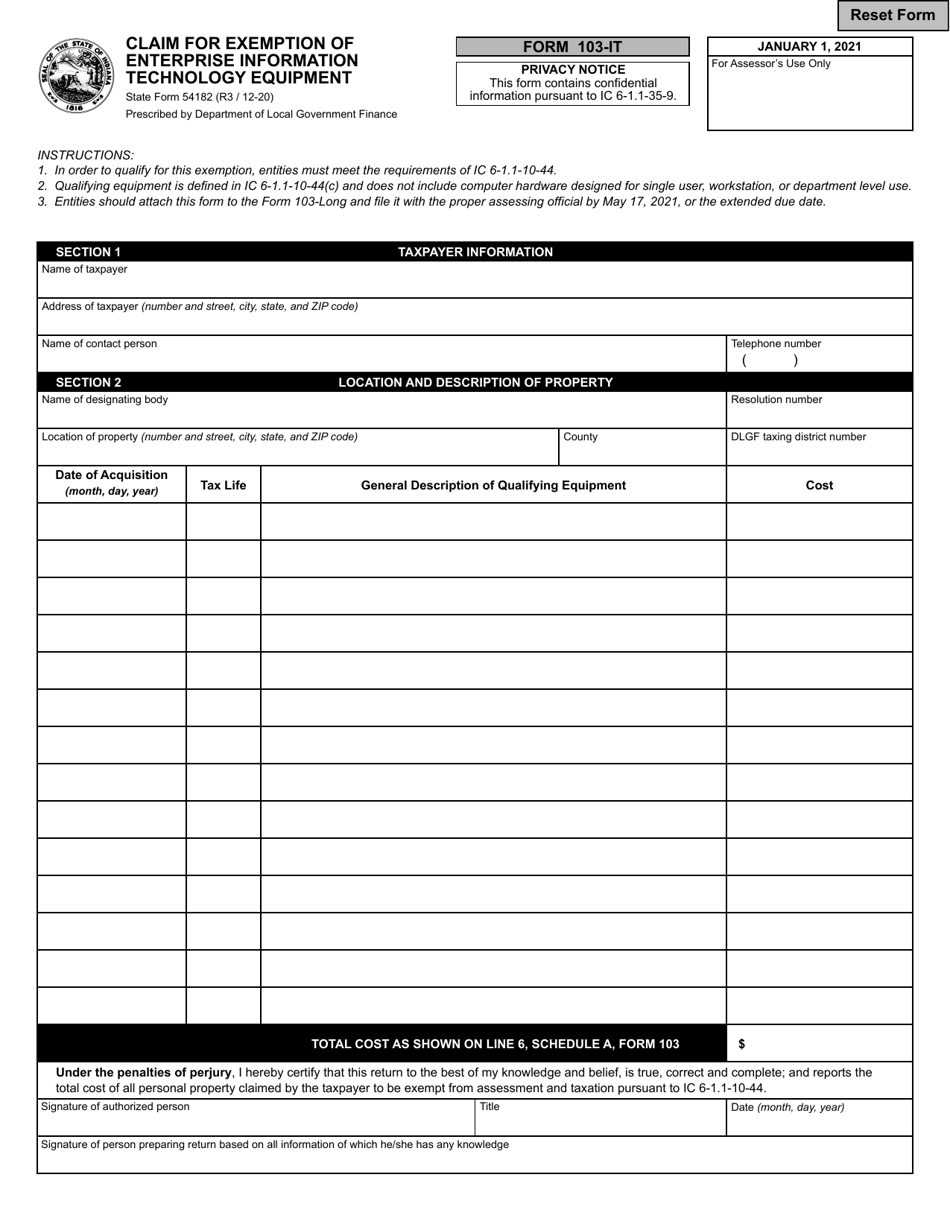

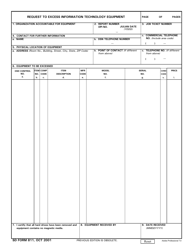

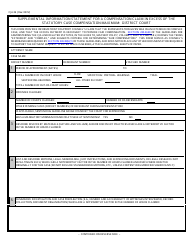

Form 103-IT (State Form 54182) Claim for Exemption of Enterprise Information Technology Equipment - Indiana

What Is Form 103-IT (State Form 54182)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 103-IT (State Form 54182)?

A: Form 103-IT (State Form 54182) is a claim for exemption of enterprise information technology equipment in Indiana.

Q: What is the purpose of Form 103-IT?

A: The purpose of Form 103-IT is to claim an exemption for enterprise information technology equipment.

Q: Who can use Form 103-IT?

A: Form 103-IT can be used by businesses and organizations in Indiana.

Q: What is considered enterprise information technology equipment?

A: Enterprise information technology equipment includes computers, software, servers, and related equipment used for business purposes.

Q: How do I file Form 103-IT?

A: Form 103-IT can be filed by submitting it to the Indiana Department of Revenue.

Q: Is there a deadline for filing Form 103-IT?

A: Yes, Form 103-IT must be filed by April 1st of each year.

Q: Are there any fees associated with filing Form 103-IT?

A: No, there are no fees for filing Form 103-IT.

Q: Can I claim an exemption for used information technology equipment?

A: Yes, you can claim an exemption for used information technology equipment if it meets the criteria outlined in the form.

Q: What happens if my Form 103-IT is approved?

A: If your Form 103-IT is approved, you will be exempt from paying certain taxes on your enterprise information technology equipment.

Q: What should I do if I have additional questions about Form 103-IT?

A: If you have additional questions about Form 103-IT, you can contact the Indiana Department of Revenue for assistance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 103-IT (State Form 54182) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.