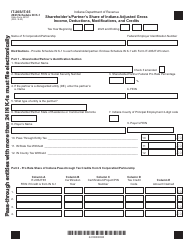

This version of the form is not currently in use and is provided for reference only. Download this version of

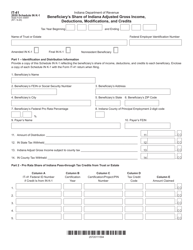

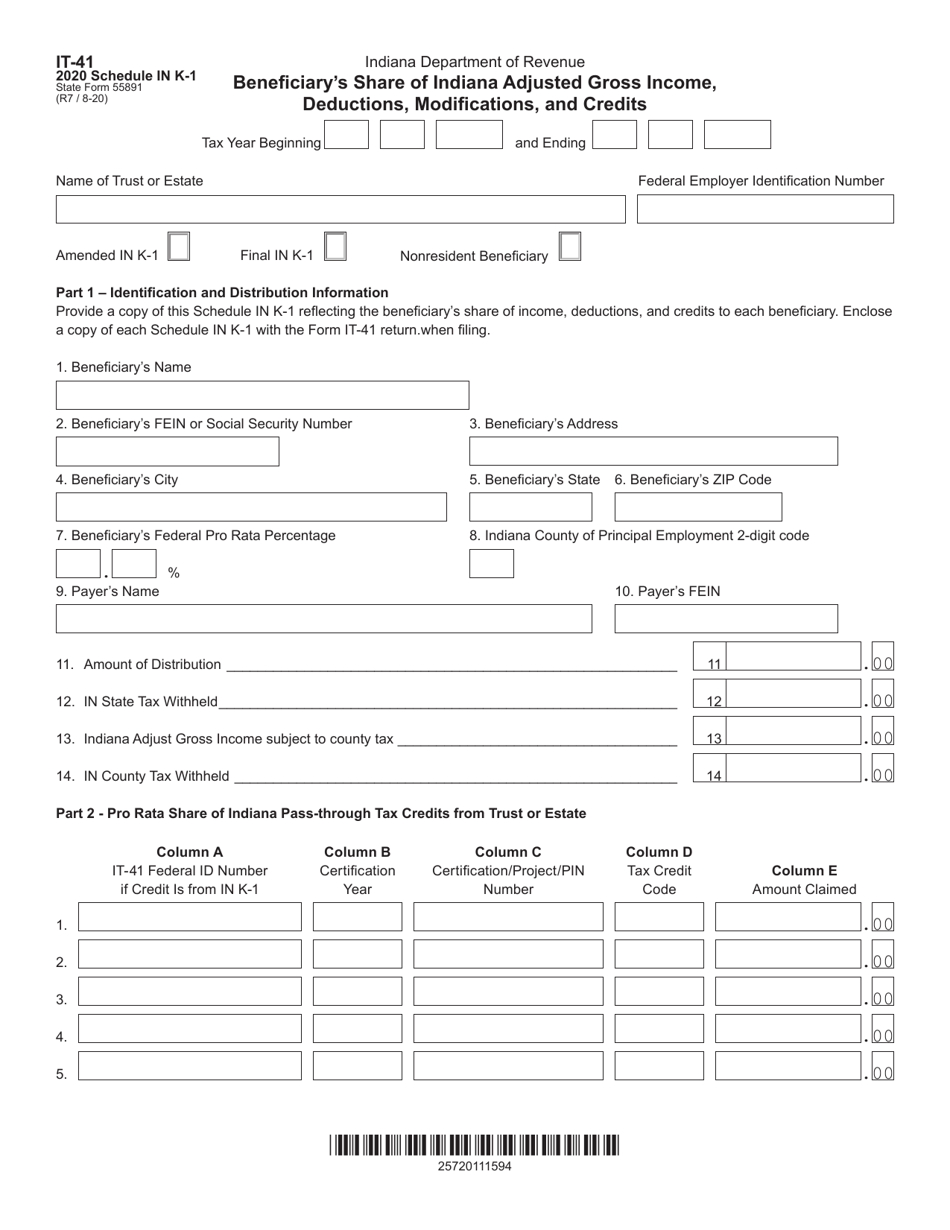

Form IT-41 (State Form 55891) Schedule IN K-1

for the current year.

Form IT-41 (State Form 55891) Schedule IN K-1 Beneficiary's Share of Indiana Adjusted Gross Income, Deductions, Modifications, and Credits - Indiana

What Is Form IT-41 (State Form 55891) Schedule IN K-1?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-41?

A: Form IT-41 is a tax form used by taxpayers in Indiana to report their adjusted gross income, deductions, modifications, and credits.

Q: What is Schedule IN?

A: Schedule IN is a specific part of Form IT-41 used to report the beneficiary's share of Indiana adjusted gross income, deductions, modifications, and credits.

Q: What is a K-1?

A: A K-1 is a tax form used to report the income, deductions, and credits allocated to shareholders or partners in a partnership or S corporation.

Q: What is a beneficiary's share of Indiana adjusted gross income?

A: A beneficiary's share of Indiana adjusted gross income refers to the portion of the partnership or S corporation's income that is allocated to the beneficiary and subject to Indiana state taxes.

Q: What are deductions?

A: Deductions are expenses or allowances that can be subtracted from a taxpayer's gross income, reducing their taxable income.

Q: What are modifications?

A: Modifications are adjustments made to a taxpayer's income or deductions to reflect Indiana-specific tax rules or exemptions.

Q: What are credits?

A: Credits are reductions in a taxpayer's tax liability, often based on specific circumstances or behaviors, such as education expenses or renewable energy investments.

Q: Who needs to fill out Form IT-41?

A: Taxpayers who are residents of Indiana and have income, deductions, modifications, or credits to report for the tax year need to fill out Form IT-41.

Q: When is the deadline to file Form IT-41?

A: The deadline to file Form IT-41 is usually the same as the federal incometax filing deadline, which is April 15th.

Q: Is Form IT-41 required for non-residents of Indiana?

A: No, non-residents of Indiana do not need to file Form IT-41 unless they have specific Indiana-source income that is subject to state taxation.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-41 (State Form 55891) Schedule IN K-1 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.