This version of the form is not currently in use and is provided for reference only. Download this version of

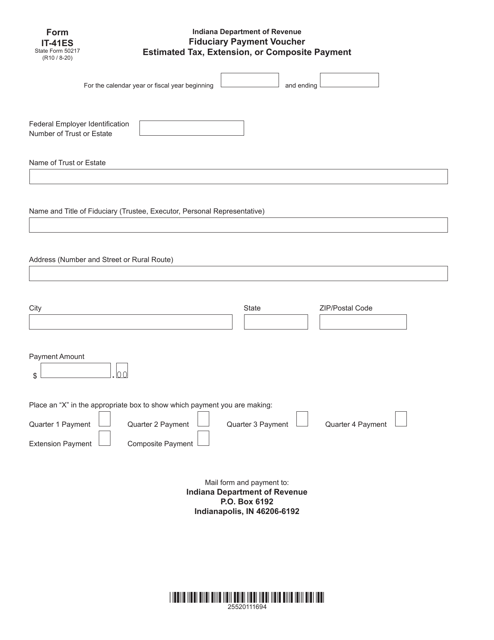

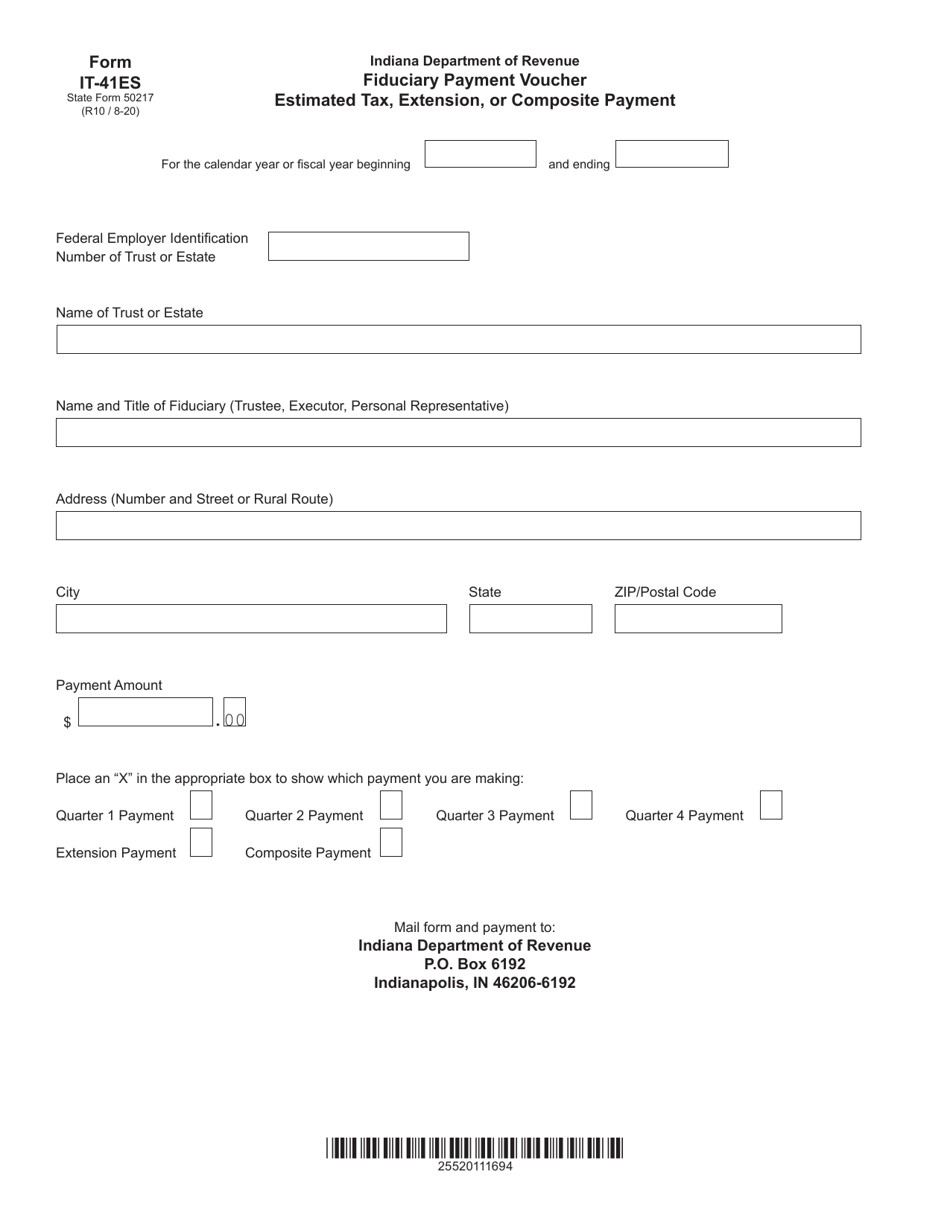

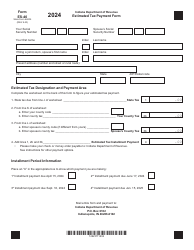

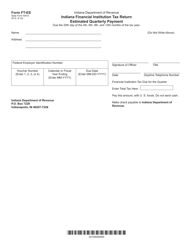

Form IT-41ES (State Form 50217)

for the current year.

Form IT-41ES (State Form 50217) Fiduciary Payment Voucher Estimated Tax, Extension, or Composite Payment - Indiana

What Is Form IT-41ES (State Form 50217)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-41ES?

A: Form IT-41ES is the Fiduciary Payment Voucher for making estimated tax, extension, or composite payments in Indiana.

Q: What is the purpose of Form IT-41ES?

A: The purpose of Form IT-41ES is to make estimated tax, extension, or composite payments for fiduciaries in Indiana.

Q: Who needs to file Form IT-41ES?

A: Fiduciaries in Indiana who need to make estimated tax, extension, or composite payments.

Q: What information is required on Form IT-41ES?

A: Form IT-41ES requires information such as the taxpayer's name, address, Social Security number or Employer Identification Number, payment amount, and payment type (estimated tax, extension, or composite payment).

Q: When is Form IT-41ES due?

A: Form IT-41ES payments are due on or before the original due date of the fiduciary income tax return, which is generally April 15th.

Q: Is Form IT-41ES mandatory?

A: Filing Form IT-41ES is mandatory for fiduciaries in Indiana who need to make estimated tax, extension, or composite payments.

Q: What happens if I don't file Form IT-41ES?

A: Failure to file Form IT-41ES or make the required payments may result in penalties and interest.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-41ES (State Form 50217) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.