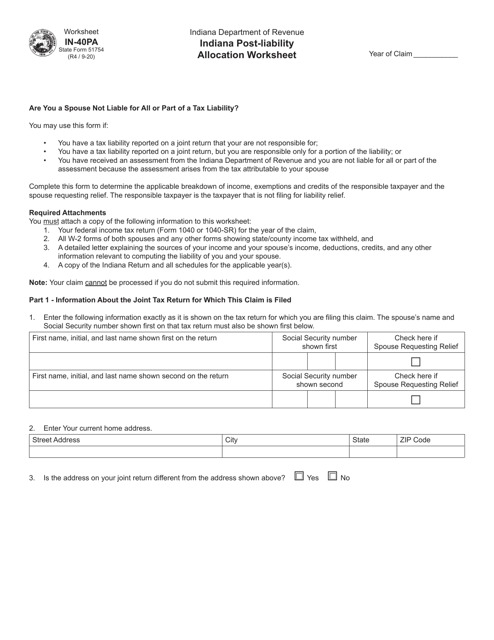

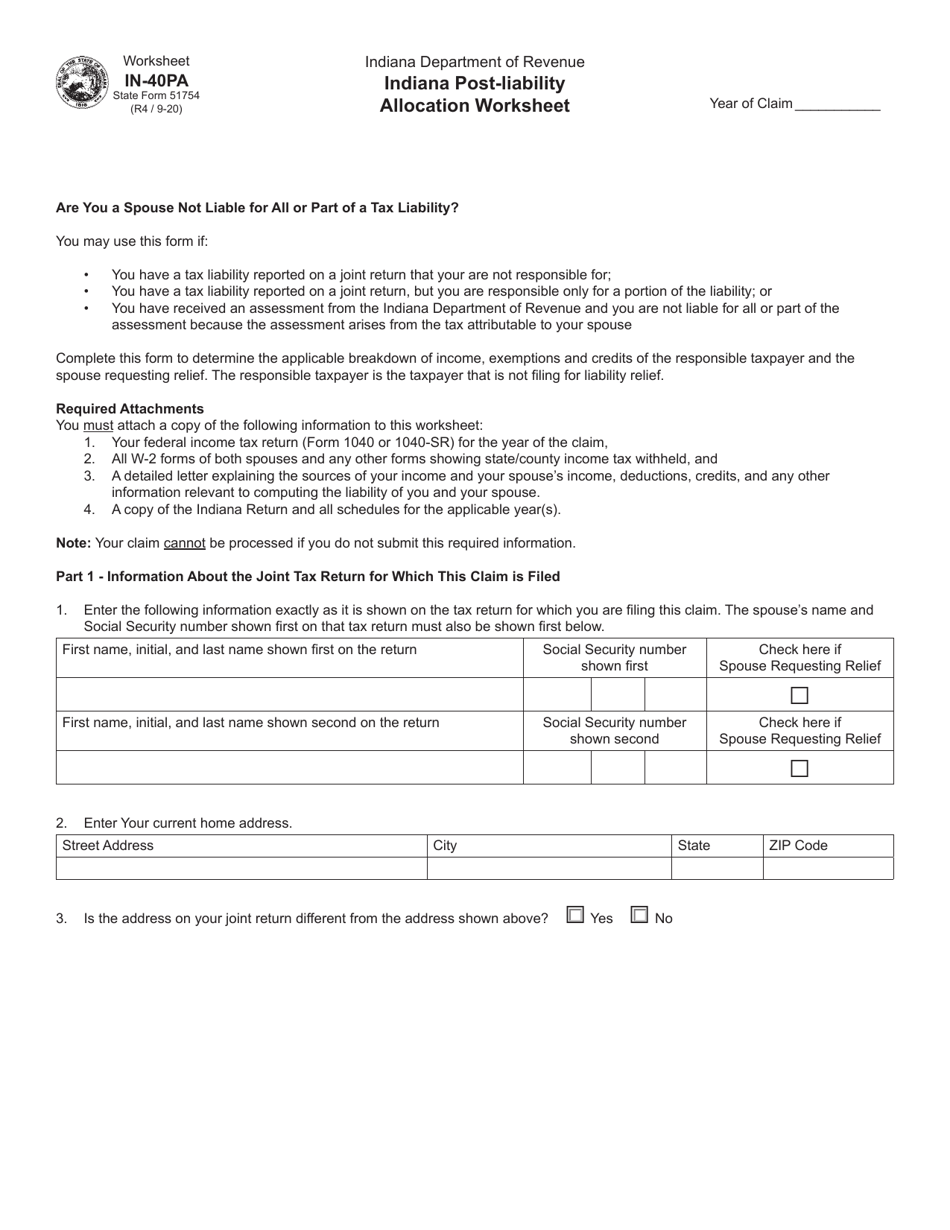

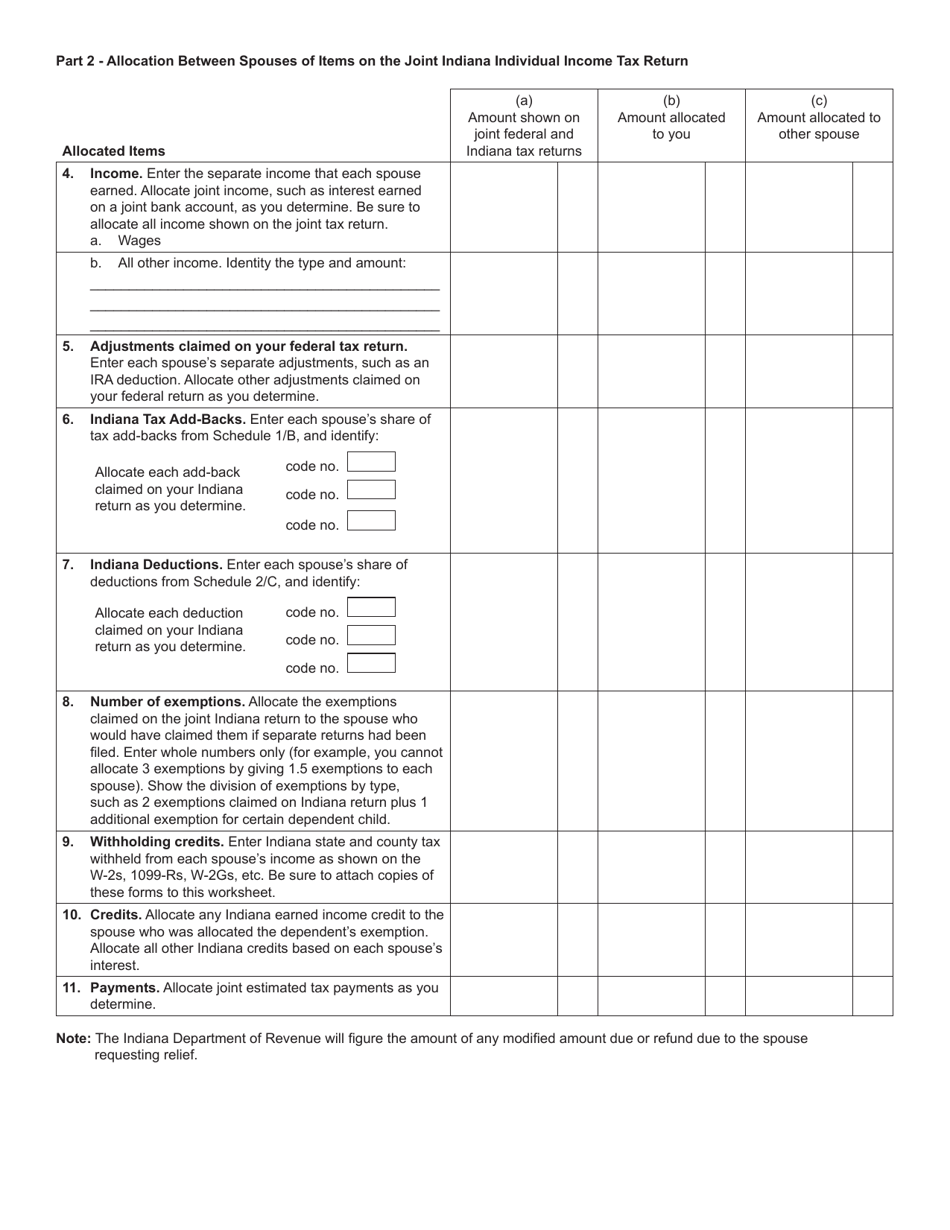

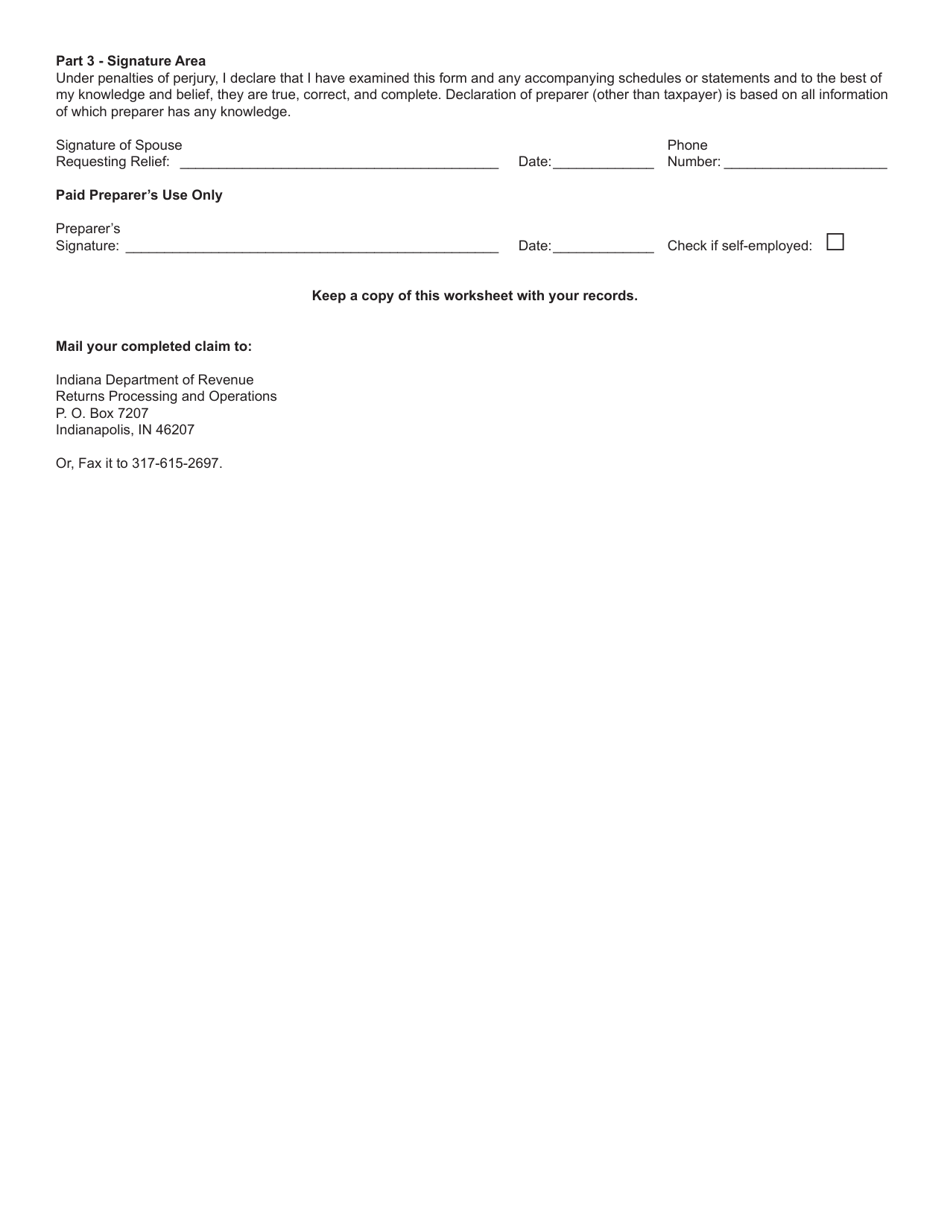

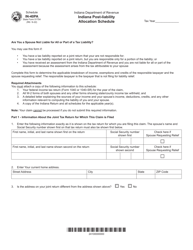

State Form 51754 Worksheet IN-40PA Indiana Post-liability Allocation Worksheet - Indiana

What Is State Form 51754 Worksheet IN-40PA?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to State Form 51754, Indiana Innocent Spouse Allocation Worksheet. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 51754?

A: State Form 51754 is a worksheet used for post-liability allocation in Indiana.

Q: What is IN-40PA?

A: IN-40PA is the name of the Indiana tax form that includes the post-liability allocation worksheet.

Q: What is the purpose of the Indiana Post-liability Allocation Worksheet?

A: The purpose of the worksheet is to allocate a liability among multiple taxpayers in Indiana.

Q: When is the Indiana Post-liability Allocation Worksheet used?

A: The worksheet is used when multiple taxpayers share a liability and need to allocate it amongst themselves.

Q: What information is required on the Indiana Post-liability Allocation Worksheet?

A: The worksheet requires information about the taxpayers involved, their respective percentages of ownership, and the amount of liability being allocated.

Q: Is the Indiana Post-liability Allocation Worksheet mandatory?

A: The worksheet is mandatory if you need to allocate a liability among multiple taxpayers in Indiana.

Q: Can I file the Indiana Post-liability Allocation Worksheet electronically?

A: Yes, you can file the worksheet electronically if you are using tax preparation software or e-filing services.

Q: Are there any penalties for not completing the Indiana Post-liability Allocation Worksheet?

A: Failure to complete the worksheet properly may result in penalties or additional tax liabilities.

Q: Can I use the Indiana Post-liability Allocation Worksheet for federal taxes?

A: No, the worksheet is specific to Indiana state taxes and cannot be used for federal tax purposes.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51754 Worksheet IN-40PA by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.