This version of the form is not currently in use and is provided for reference only. Download this version of

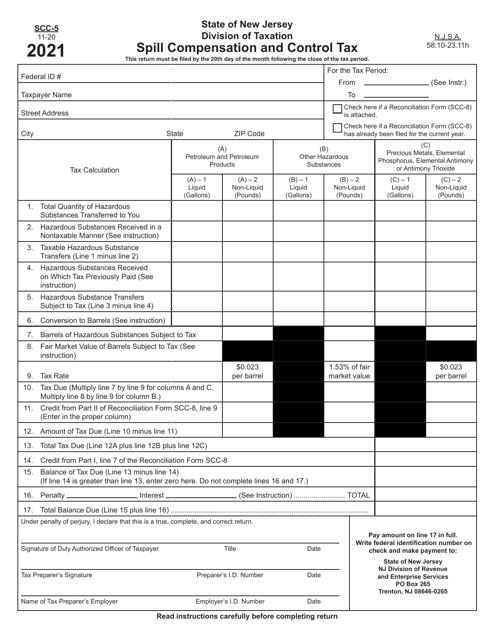

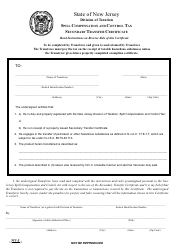

Form SCC-5

for the current year.

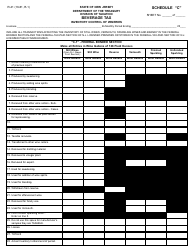

Form SCC-5 Spill Compensation and Control Tax - New Jersey

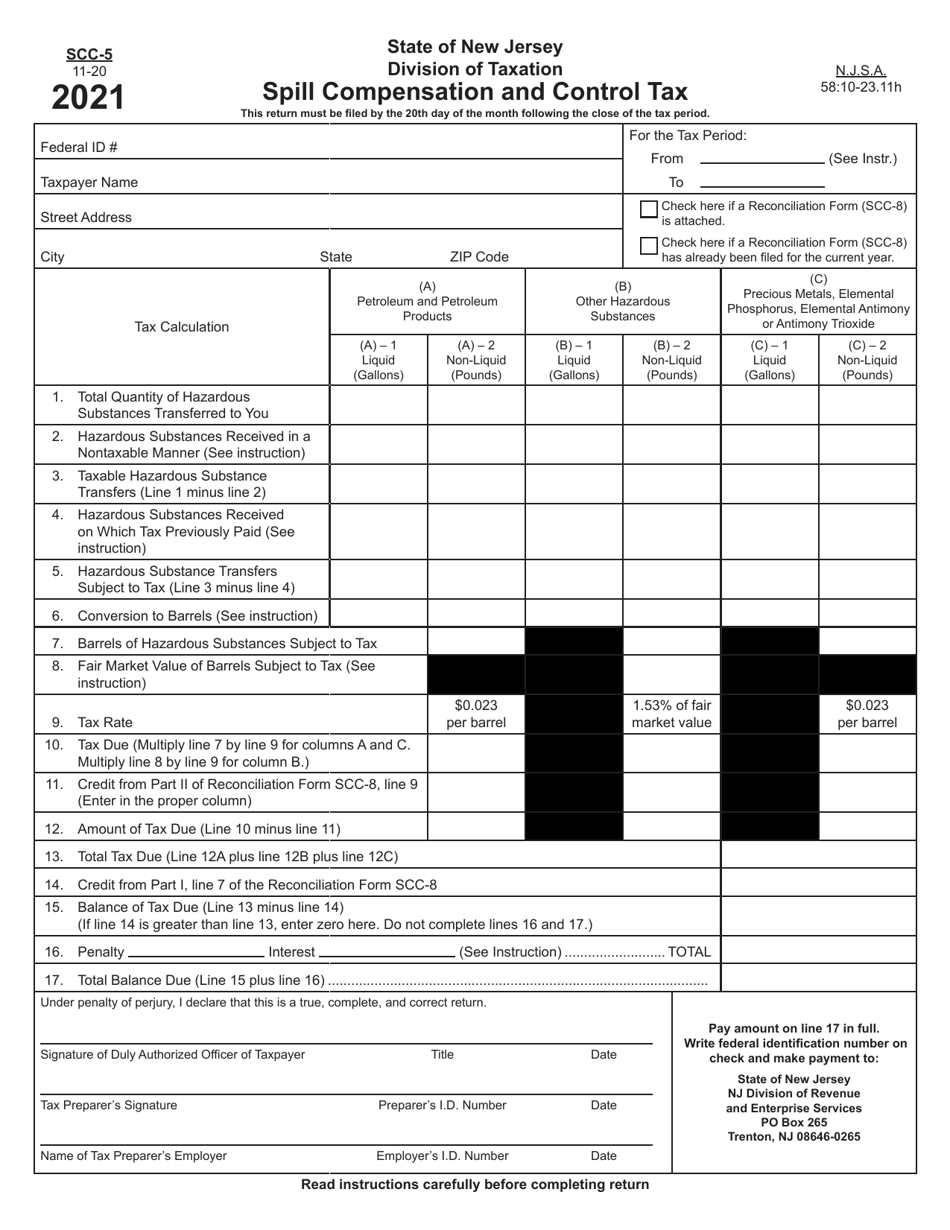

What Is Form SCC-5?

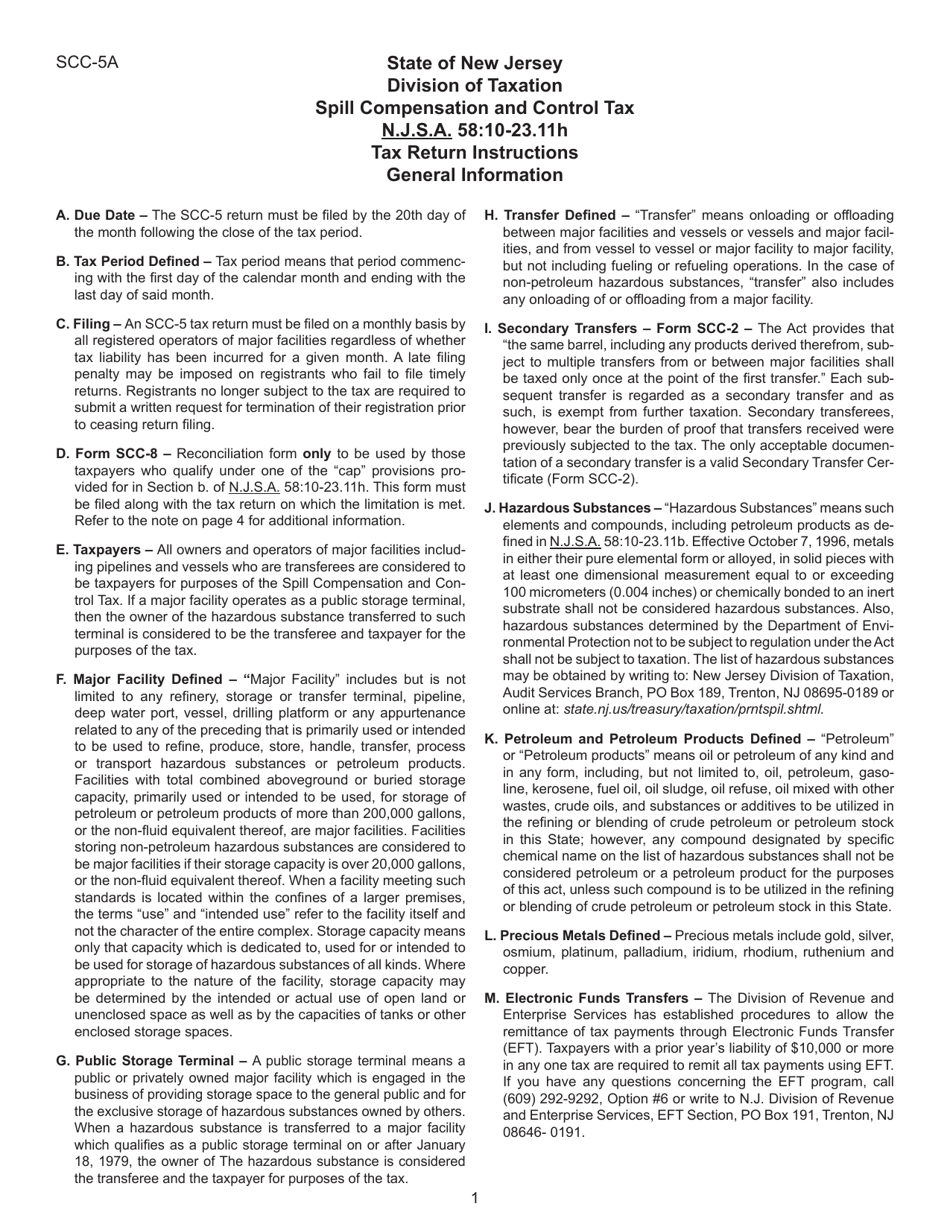

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

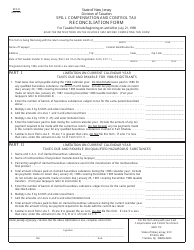

Q: What is Form SCC-5?

A: Form SCC-5 is the Spill Compensation and Control Tax form in New Jersey.

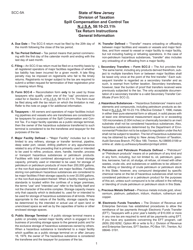

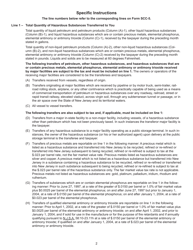

Q: What is the purpose of Form SCC-5?

A: The purpose of Form SCC-5 is to report and pay the Spill Compensation and Control Tax in New Jersey.

Q: Who needs to file Form SCC-5?

A: Businesses that produce, refine, transport, or store hazardous substances in New Jersey need to file Form SCC-5.

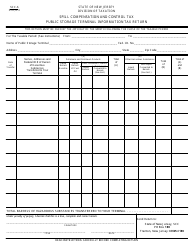

Q: How often do you need to file Form SCC-5?

A: Form SCC-5 should be filed on a quarterly basis.

Q: What is the due date for filing Form SCC-5?

A: The due date for filing Form SCC-5 is the last day of the month following the end of each calendar quarter.

Q: What happens if you fail to file Form SCC-5?

A: Failure to file Form SCC-5 can result in penalties and interest.

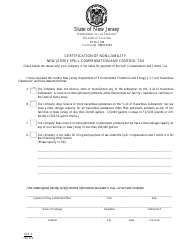

Q: Are there any exemptions to the Spill Compensation and Control Tax?

A: Yes, certain exemptions may apply. It is recommended to consult the New Jersey Department of Environmental Protection for more information.

Q: Is Form SCC-5 only applicable to businesses in New Jersey?

A: Yes, Form SCC-5 is specific to businesses operating in New Jersey and subject to the Spill Compensation and Control Tax.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCC-5 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.