This version of the form is not currently in use and is provided for reference only. Download this version of

Form D.V.S.S.E.

for the current year.

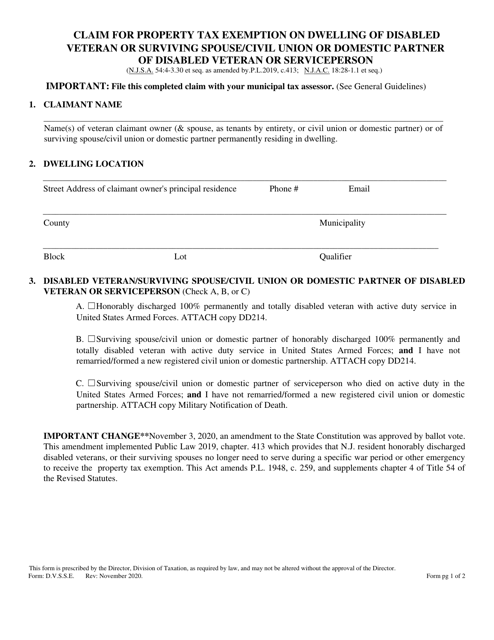

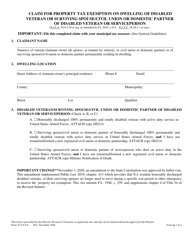

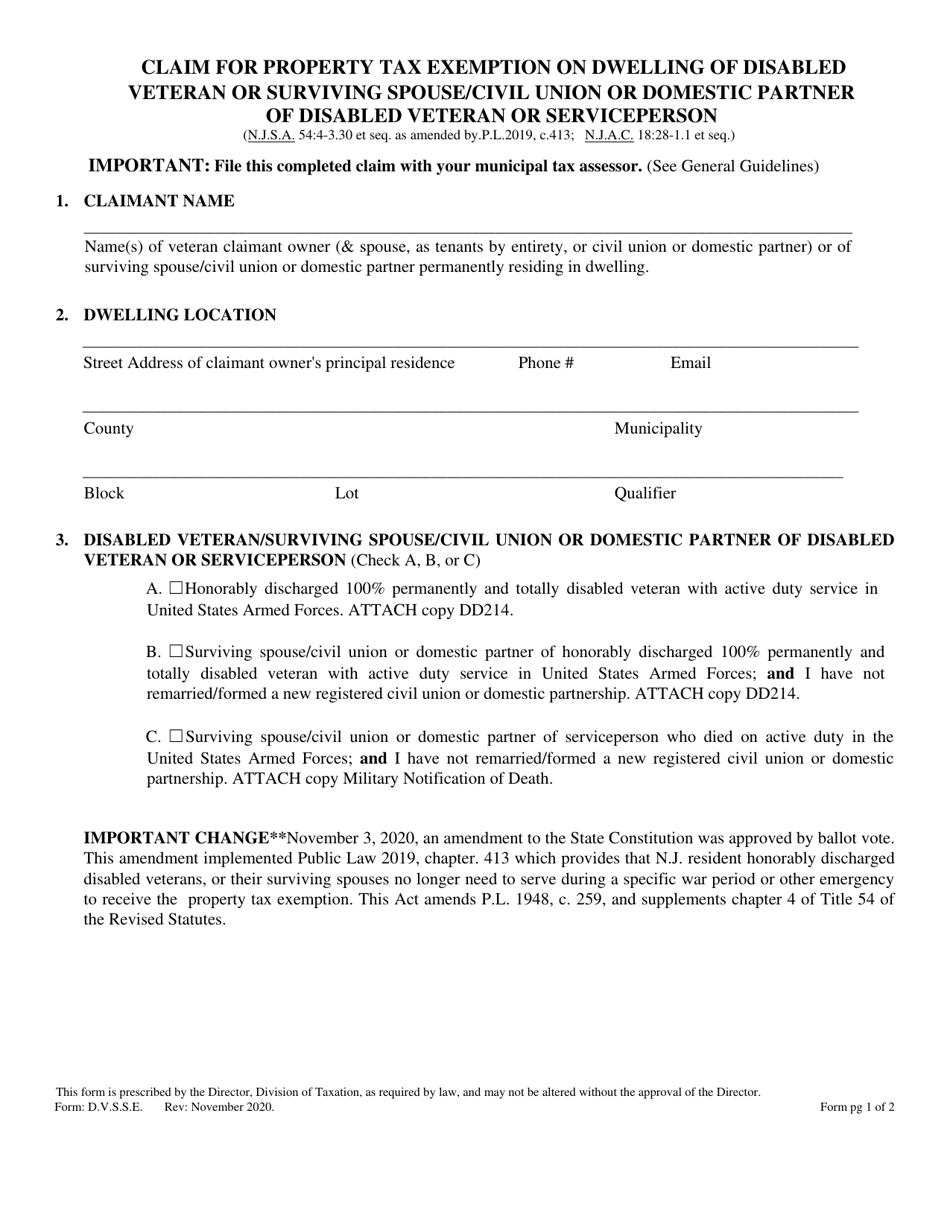

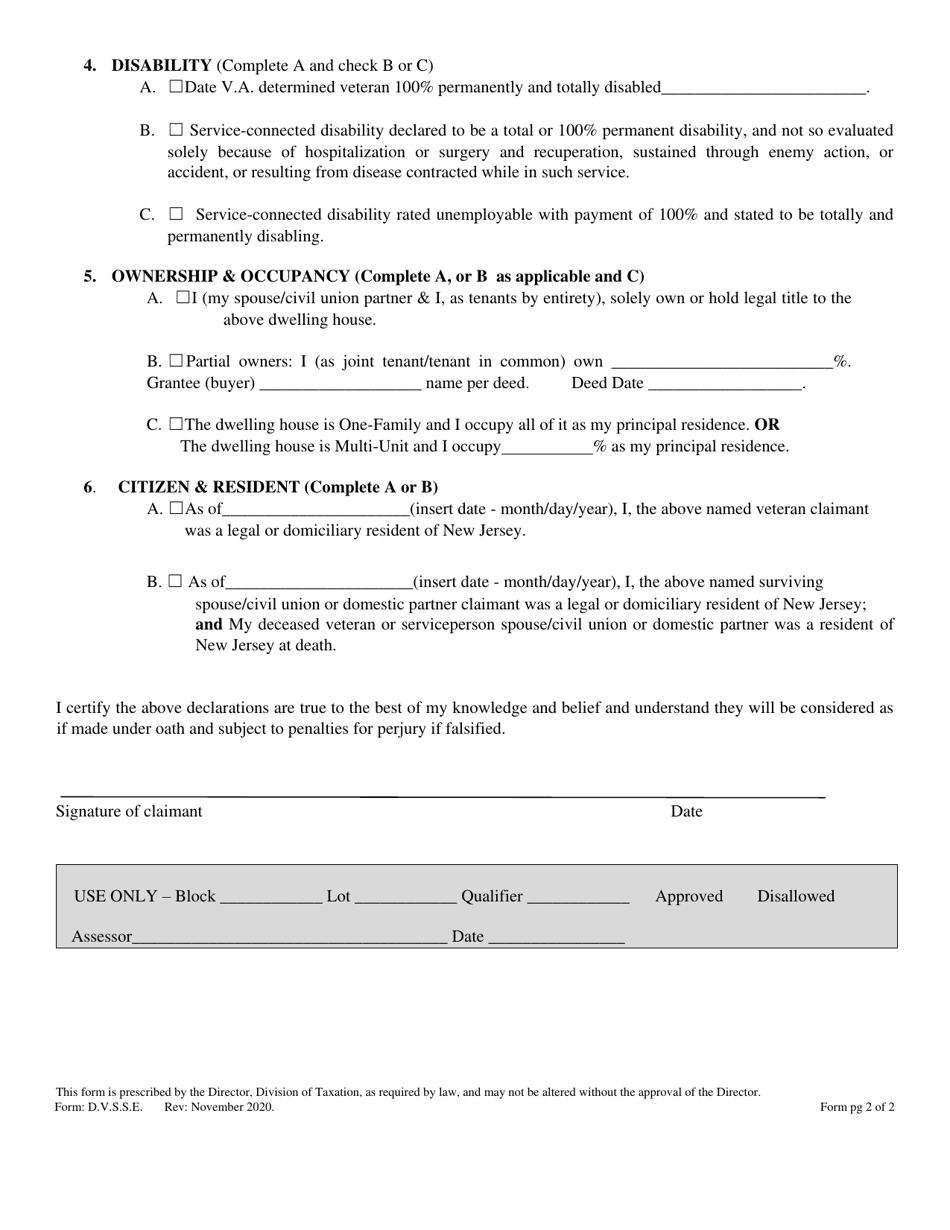

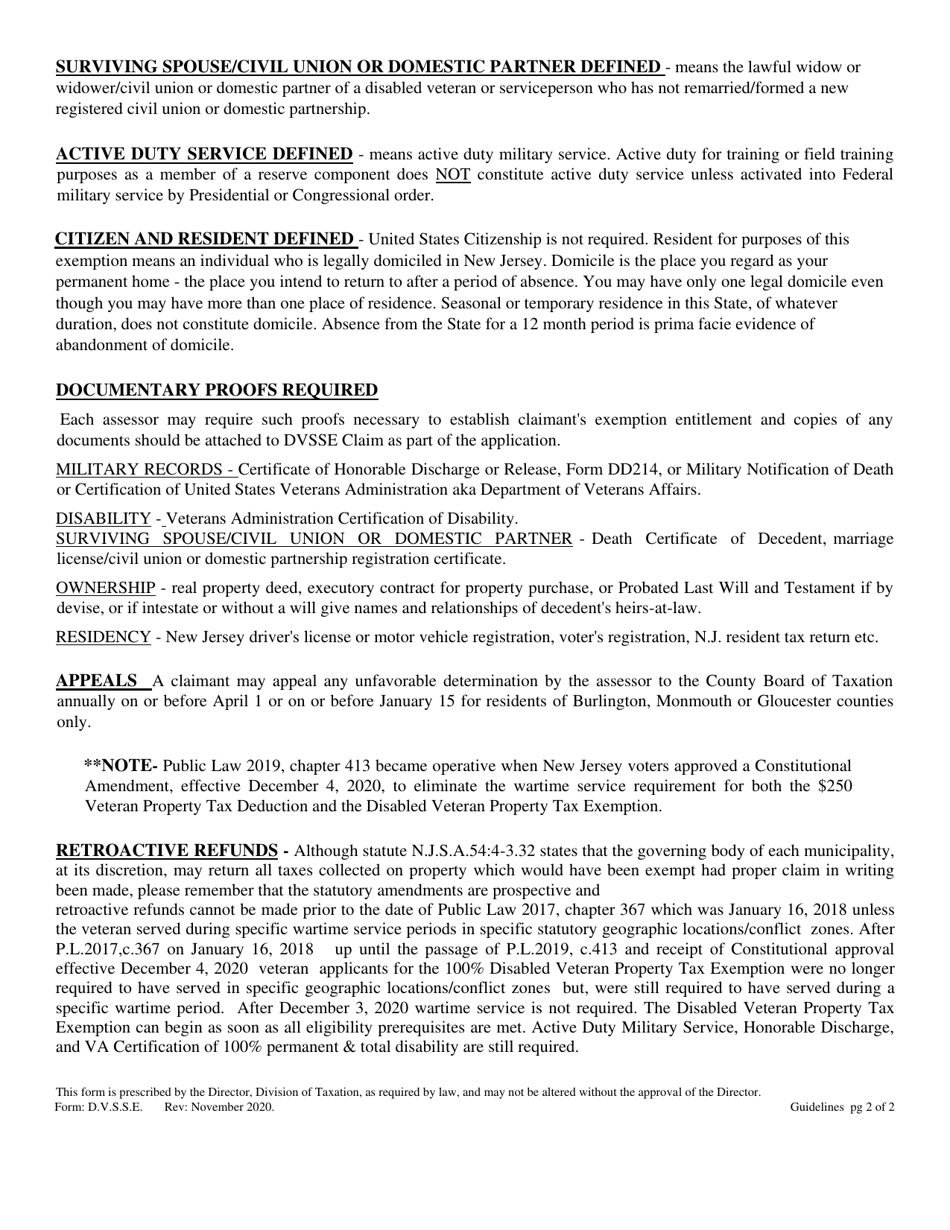

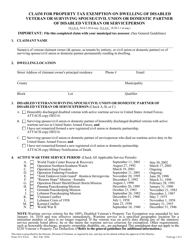

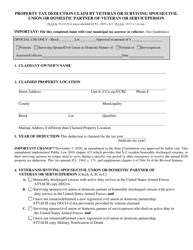

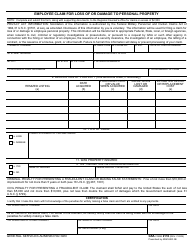

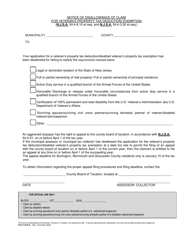

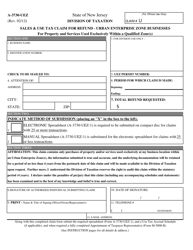

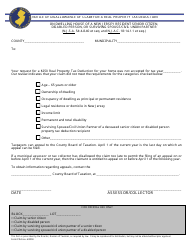

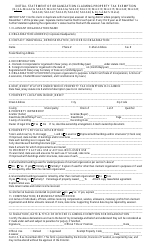

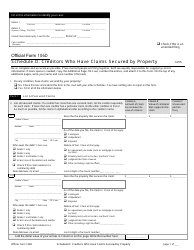

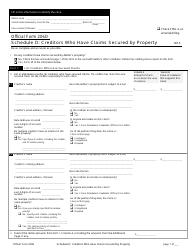

Form D.V.S.S.E. Claim for Property Tax Exemption on Dwelling of Disabled Veteran or Surviving Spouse / Civil Union or Domestic Partner of Disabled Veteran or Serviceperson - New Jersey

What Is Form D.V.S.S.E.?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form D.V.S.S.E.?

A: The Form D.V.S.S.E. is a claim form for property tax exemption on the dwelling of a disabled veteran or surviving spouse/civil union or domestic partner of a disabled veteran or serviceperson in New Jersey.

Q: Who can use the Form D.V.S.S.E.?

A: The Form D.V.S.S.E. can be used by disabled veterans or surviving spouse/civil union or domestic partner of a disabled veteran or serviceperson in New Jersey.

Q: What is the purpose of the Form D.V.S.S.E.?

A: The purpose of the Form D.V.S.S.E. is to claim a property tax exemption for eligible individuals.

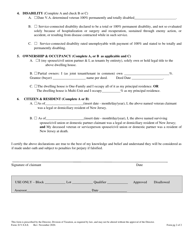

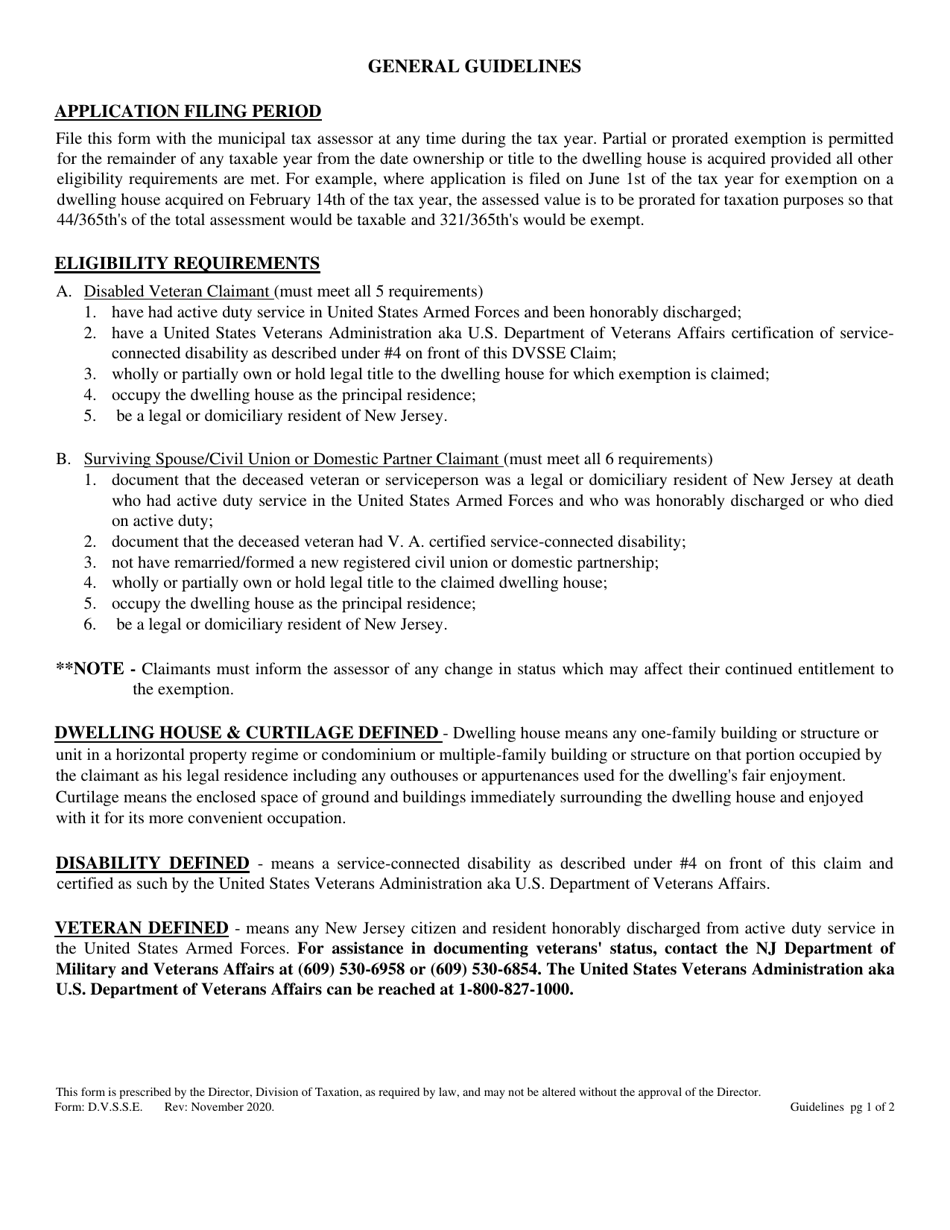

Q: What are the eligibility criteria for the property tax exemption?

A: The eligibility criteria for the property tax exemption include being a disabled veteran or a surviving spouse/civil union or domestic partner of a disabled veteran or serviceperson, and meeting certain residency requirements in New Jersey.

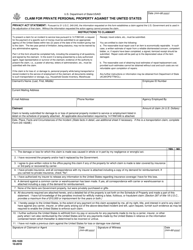

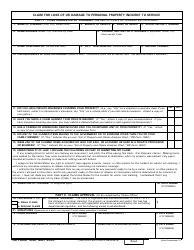

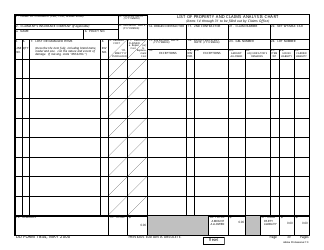

Q: What documents do I need to submit with the Form D.V.S.S.E.?

A: You may need to submit supporting documents such as proof of disability, proof of military service, and proof of residency.

Q: Is there a deadline for submitting the Form D.V.S.S.E.?

A: Yes, the Form D.V.S.S.E. must be filed annually with your local tax assessor's office by a certain deadline, usually on or before October 1st of the tax year.

Q: What happens after I submit the Form D.V.S.S.E.?

A: After you submit the Form D.V.S.S.E., your local tax assessor's office will review your application and determine if you are eligible for the property tax exemption.

Q: Can I appeal if my Form D.V.S.S.E. application is denied?

A: Yes, if your Form D.V.S.S.E. application is denied, you have the right to appeal the decision with your county tax board.

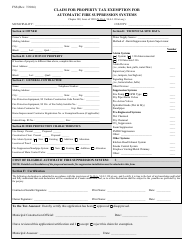

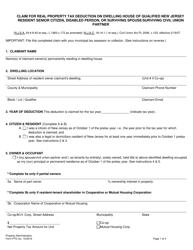

Q: Are there any other property tax relief programs for veterans in New Jersey?

A: Yes, in addition to the Form D.V.S.S.E., there are other property tax relief programs available for veterans in New Jersey, such as the Disabled Veterans Real Property Tax Exemption and the Veterans' Property Tax Deduction.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D.V.S.S.E. by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.