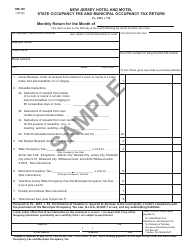

This version of the form is not currently in use and is provided for reference only. Download this version of

Form LF-5

for the current year.

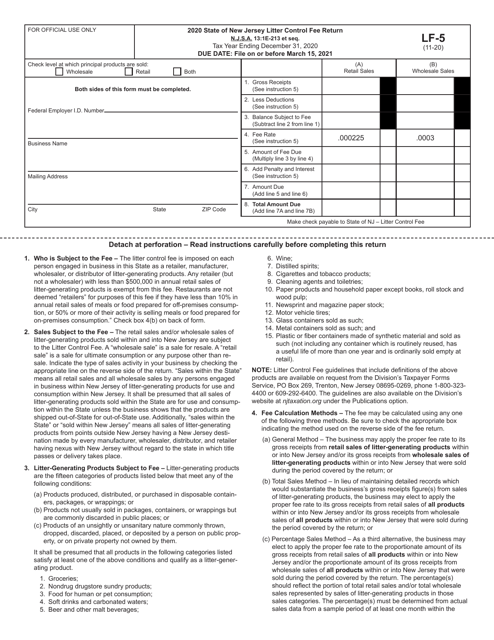

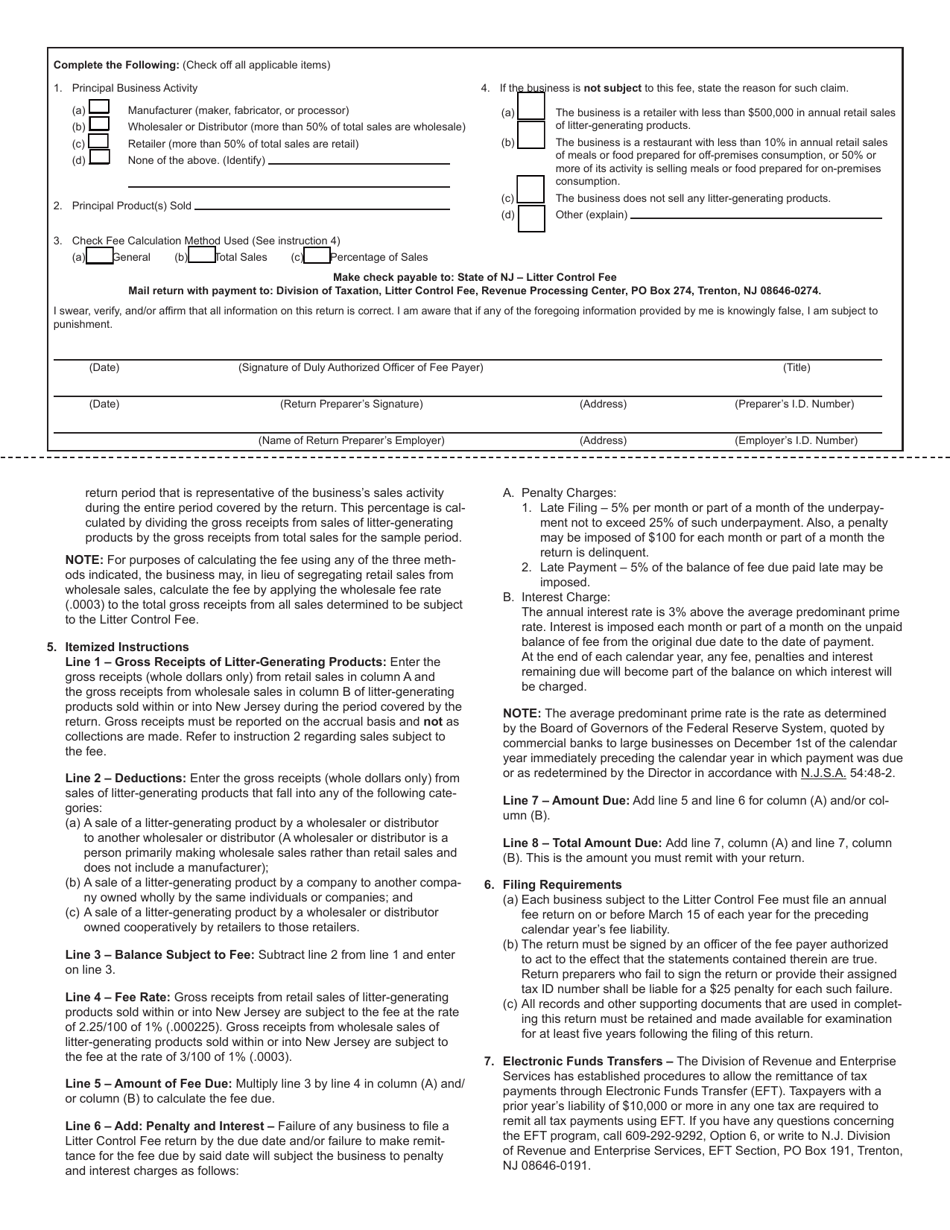

Form LF-5 State of New Jersey Litter Control Fee Return - New Jersey

What Is Form LF-5?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LF-5?

A: Form LF-5 is the State of New Jersey Litter Control Fee Return.

Q: Who should file Form LF-5?

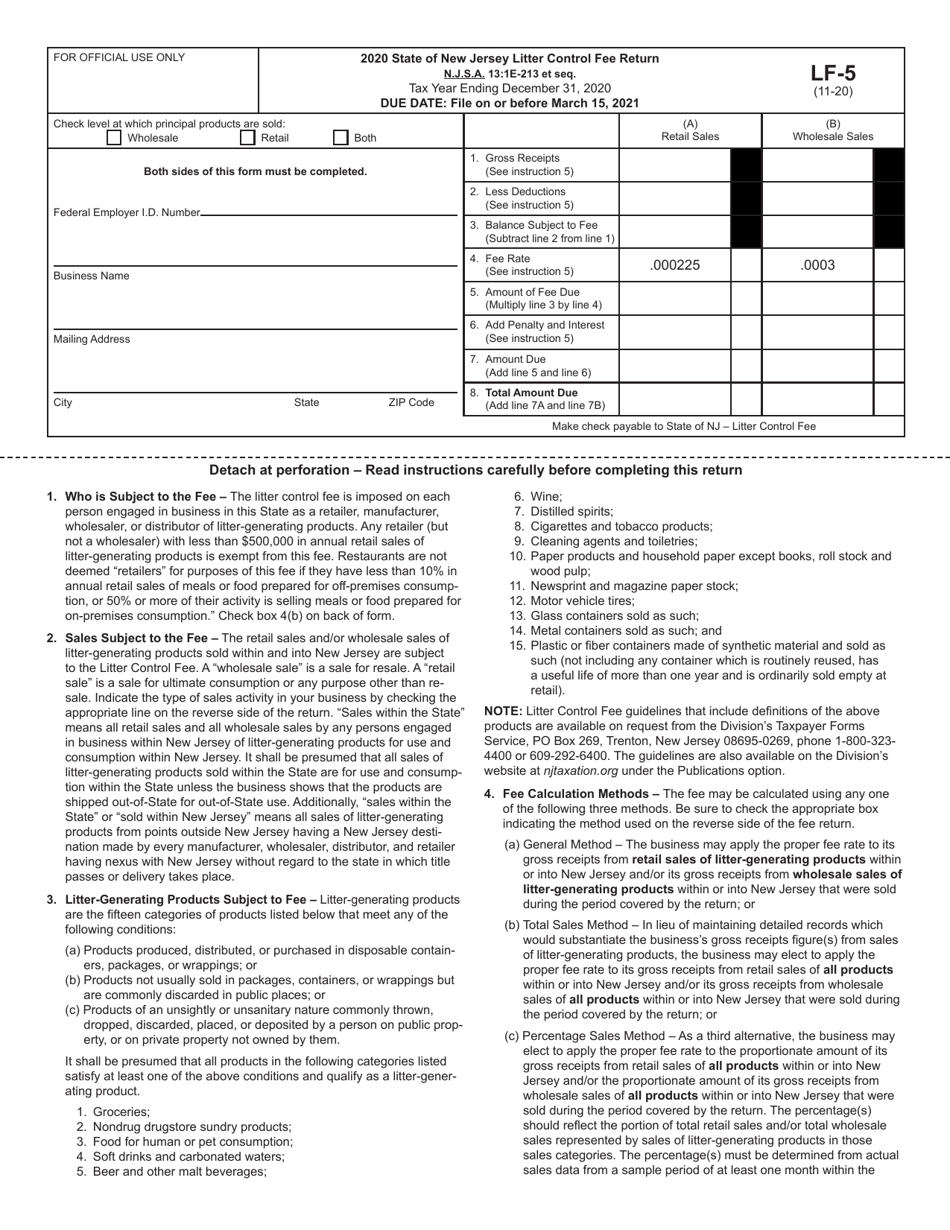

A: Businesses engaged in the sale of litter-generating products in New Jersey should file Form LF-5.

Q: What is the purpose of Form LF-5?

A: Form LF-5 is used to calculate and report the litter control fee owed by businesses in New Jersey.

Q: When should Form LF-5 be filed?

A: Form LF-5 should be filed annually by May 15th.

Q: What information is required on Form LF-5?

A: Form LF-5 requires information such as the business name, address, total sales of litter-generating products, and the amount of litter control fee due.

Q: Are there any penalties for late or non-filing of Form LF-5?

A: Yes, there are penalties for late or non-filing of Form LF-5, including interest charges and possible legal action.

Q: Is Form LF-5 applicable to individuals?

A: No, Form LF-5 is only applicable to businesses engaged in the sale of litter-generating products in New Jersey.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LF-5 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.