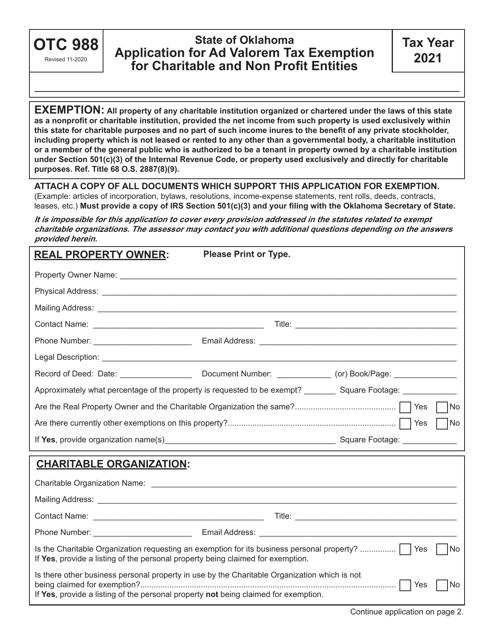

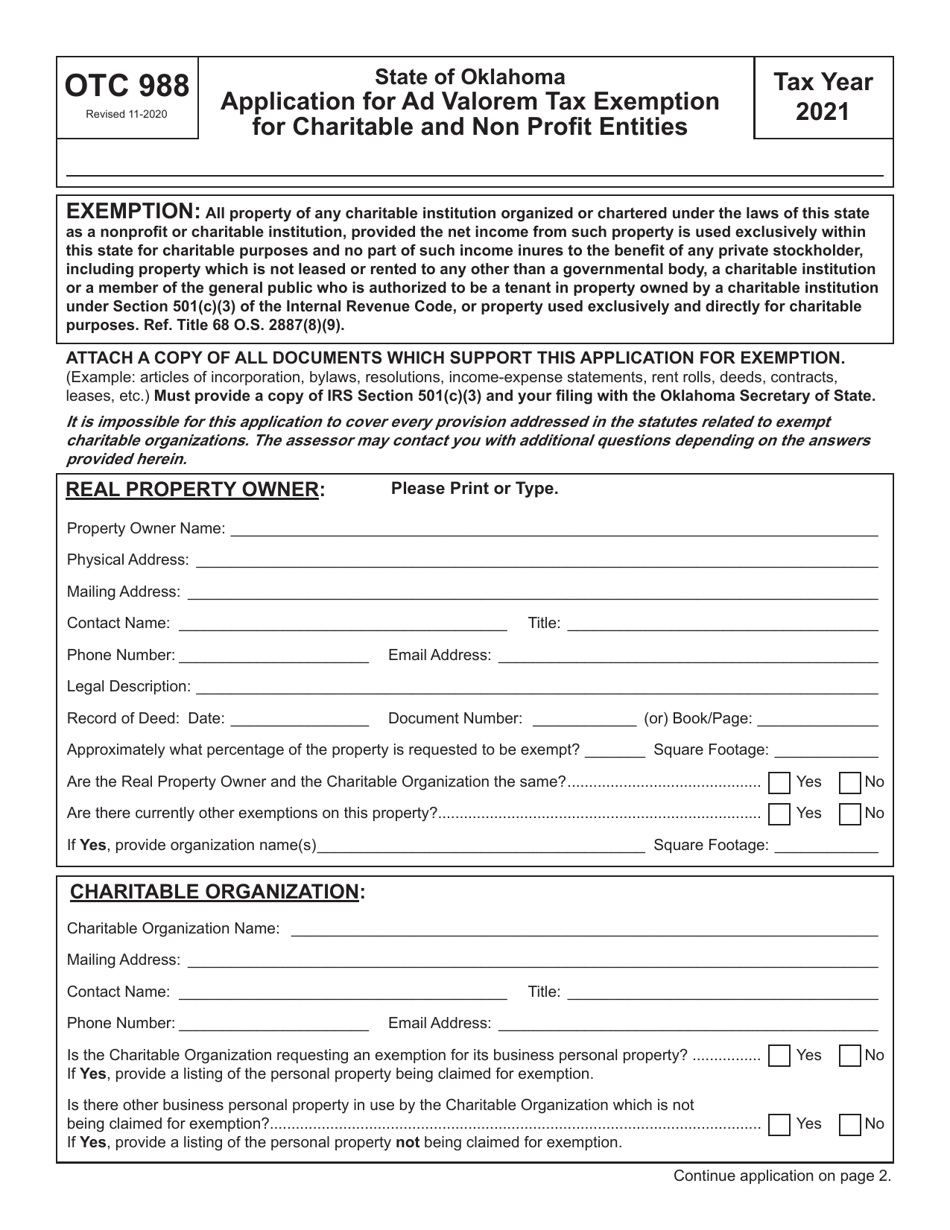

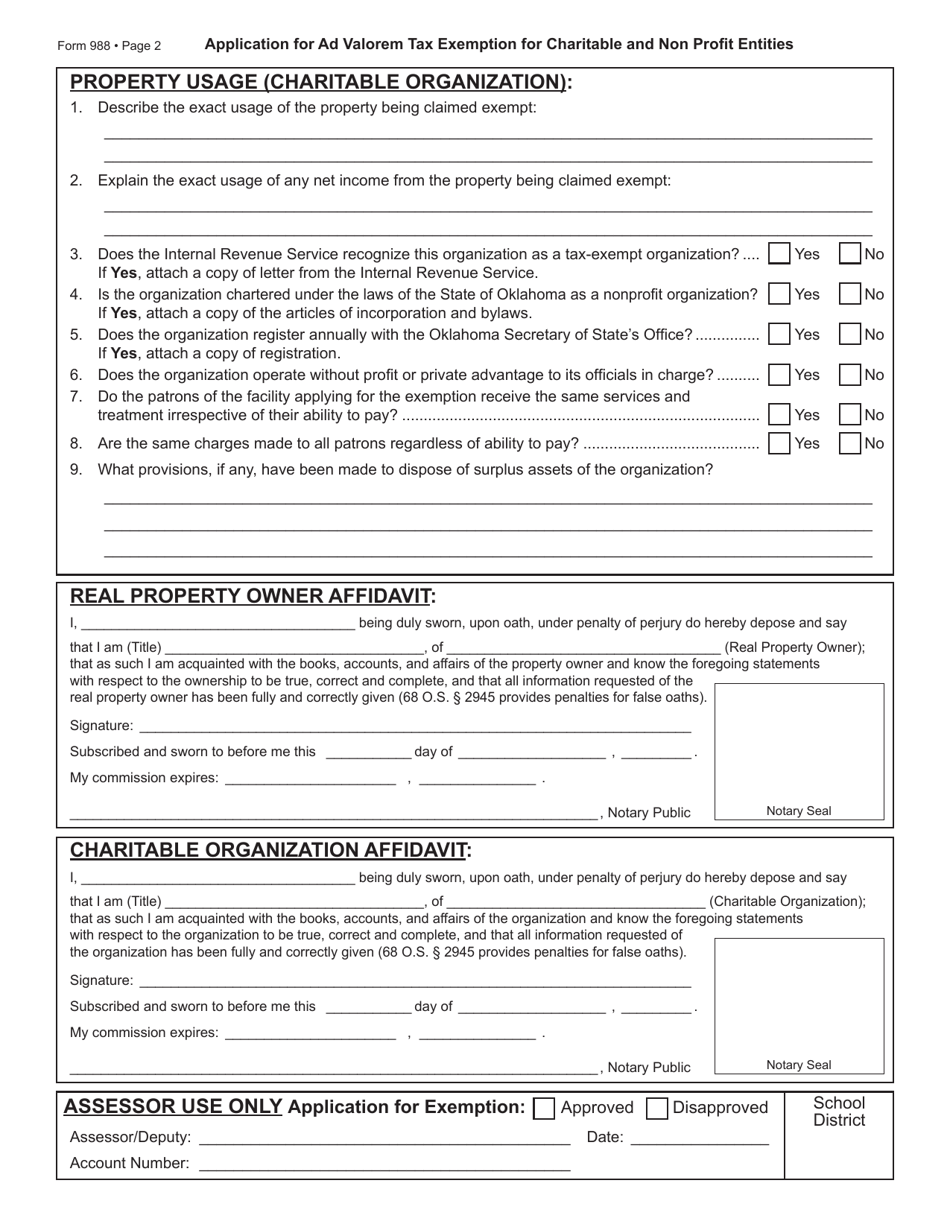

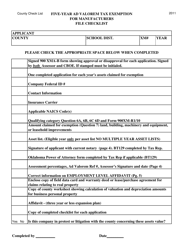

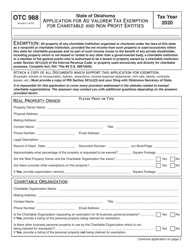

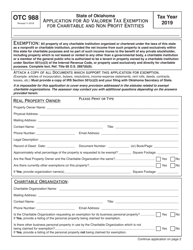

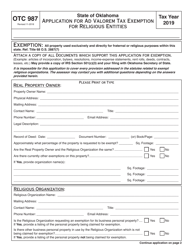

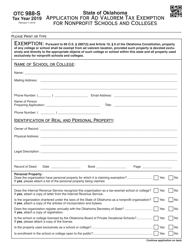

Form OTC988 Application for Ad Valorem Tax Exemption for Charitable and Non Profit Entities - Oklahoma

What Is Form OTC988?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC988?

A: OTC988 is an application form for Ad Valorem Tax Exemption for Charitable and Non-Profit Entities in Oklahoma.

Q: Who can use OTC988?

A: Charitable and non-profit entities in Oklahoma can use OTC988.

Q: What does Ad Valorem Tax Exemption mean?

A: Ad Valorem Tax Exemption refers to exemption from property taxes based on the value of the property.

Q: How do I apply for Ad Valorem Tax Exemption?

A: You can apply for Ad Valorem Tax Exemption by filling out the OTC988 form.

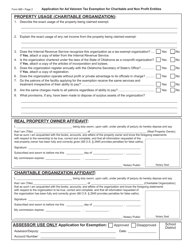

Q: What information is required in OTC988?

A: The OTC988 form requires information about the entity, its purpose, ownership, and property details.

Q: Is there a fee for applying for Ad Valorem Tax Exemption?

A: No, there is no fee for applying for Ad Valorem Tax Exemption.

Q: What is the deadline for submitting OTC988?

A: The deadline for submitting OTC988 is January 15th of the year for which the exemption is requested.

Q: How long does it take to process the application?

A: The processing time for Ad Valorem Tax Exemption application varies, but it can take several weeks.

Q: Can I appeal if my application is denied?

A: Yes, you can appeal the denial of your Ad Valorem Tax Exemption application.

Q: Who can I contact for more information?

A: For more information, you can contact the Oklahoma Tax Commission.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTC988 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.