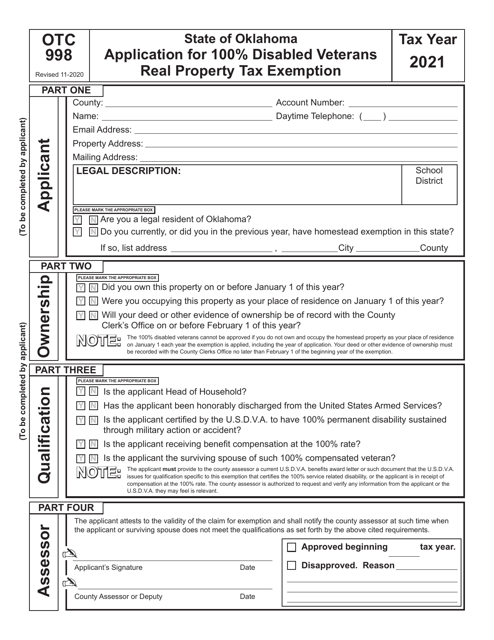

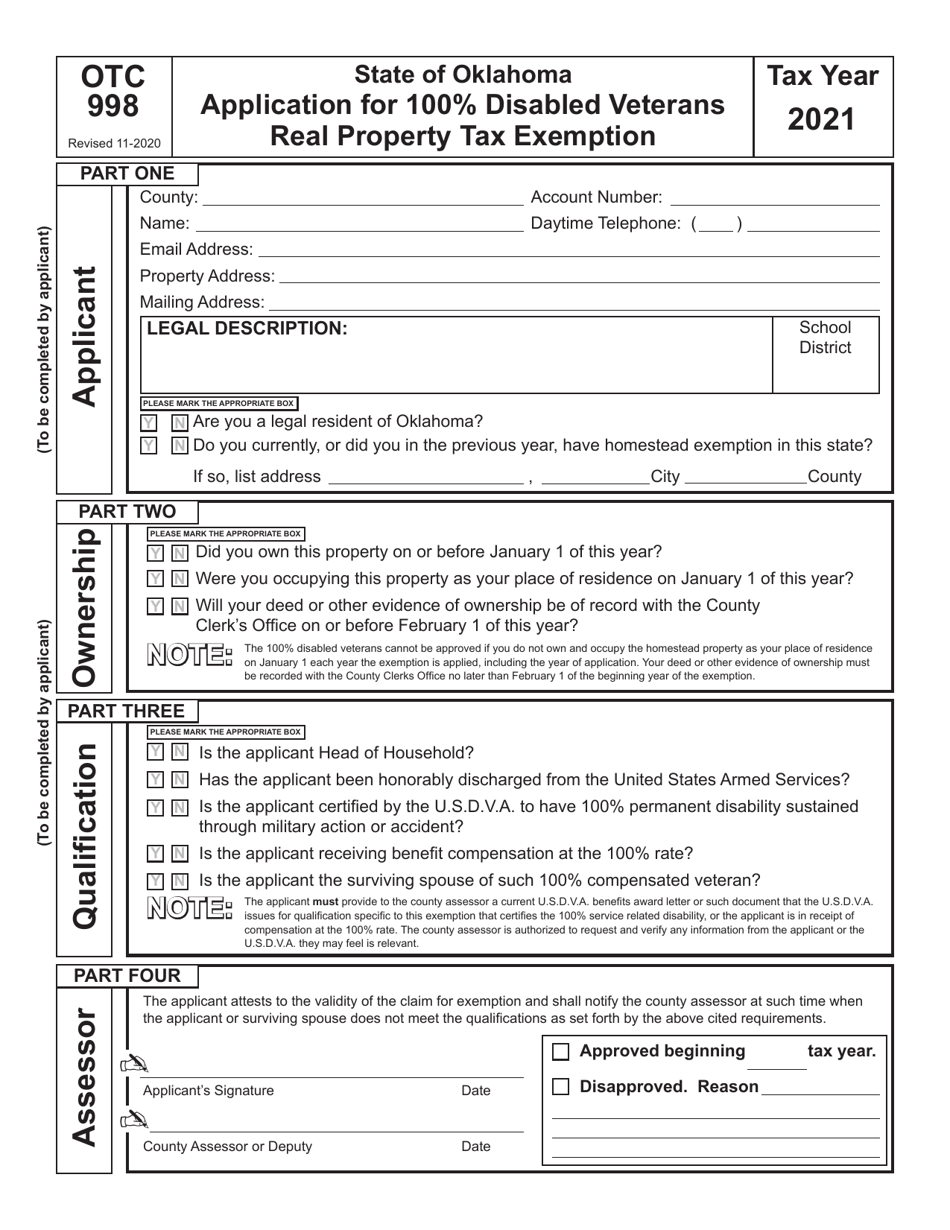

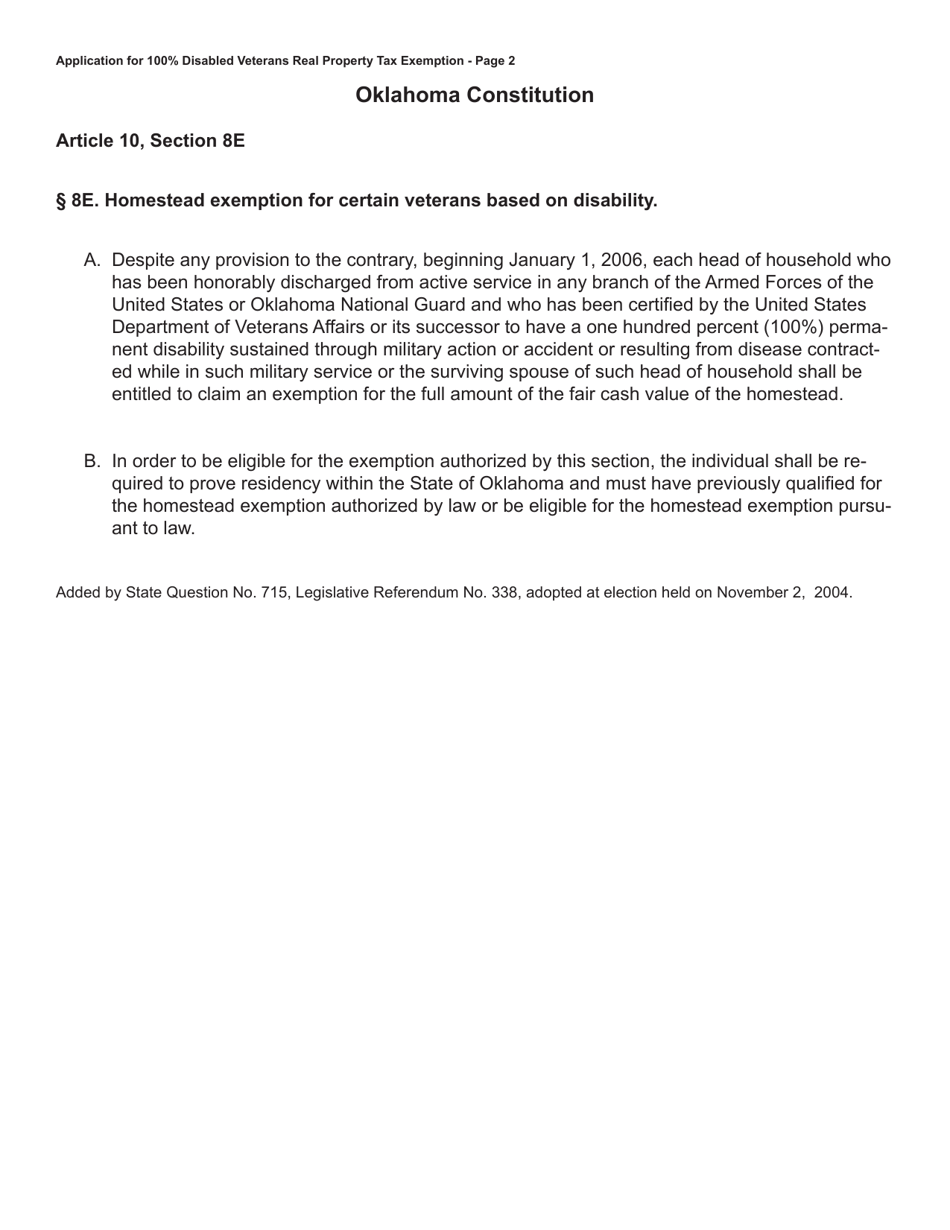

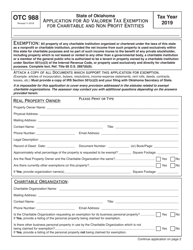

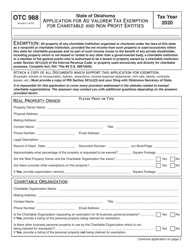

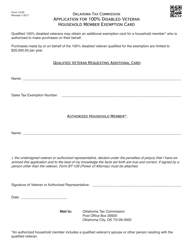

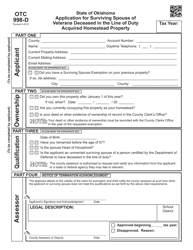

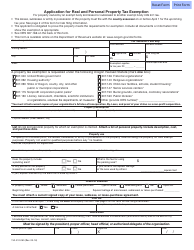

OTC Form 998 Application for 100% Disabled Veterans Real Property Tax Exemption - Oklahoma

What Is OTC Form 998?

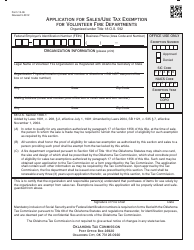

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

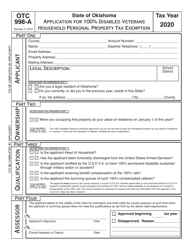

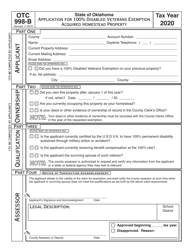

Q: What is OTC Form 998?

A: OTC Form 998 is an application for 100% Disabled VeteransReal Property Tax Exemption in Oklahoma.

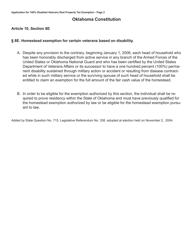

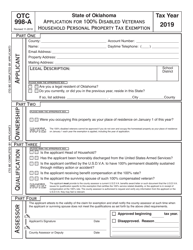

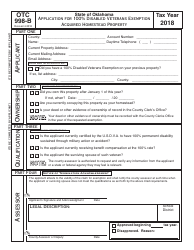

Q: Who is eligible for the 100% Disabled Veterans Real Property Tax Exemption?

A: Eligible individuals are veterans who have been certified by the U.S. Department of Veterans Affairs as having a 100% service-connected disability.

Q: What does the exemption provide?

A: The exemption provides a complete exemption from property taxes on the veteran's primary residence.

Q: What documents are required to accompany the application?

A: Applicants must provide a copy of their certification letter from the U.S. Department of Veterans Affairs and any additional information requested by the county assessor.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be filed with the county assessor between January 1 and March 15 of each year.

Q: How long does the exemption last?

A: The exemption is valid for the calendar year in which it is approved and must be renewed annually.

Q: Are there any income limitations for the exemption?

A: No, there are no income limitations for the 100% Disabled Veterans Real Property Tax Exemption.

Q: Can the exemption be transferred to a new property?

A: Yes, the exemption can be transferred to a new property if the veteran moves.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 998 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.