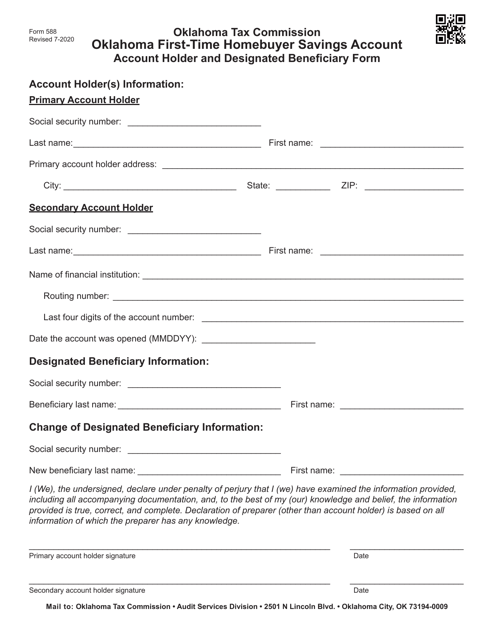

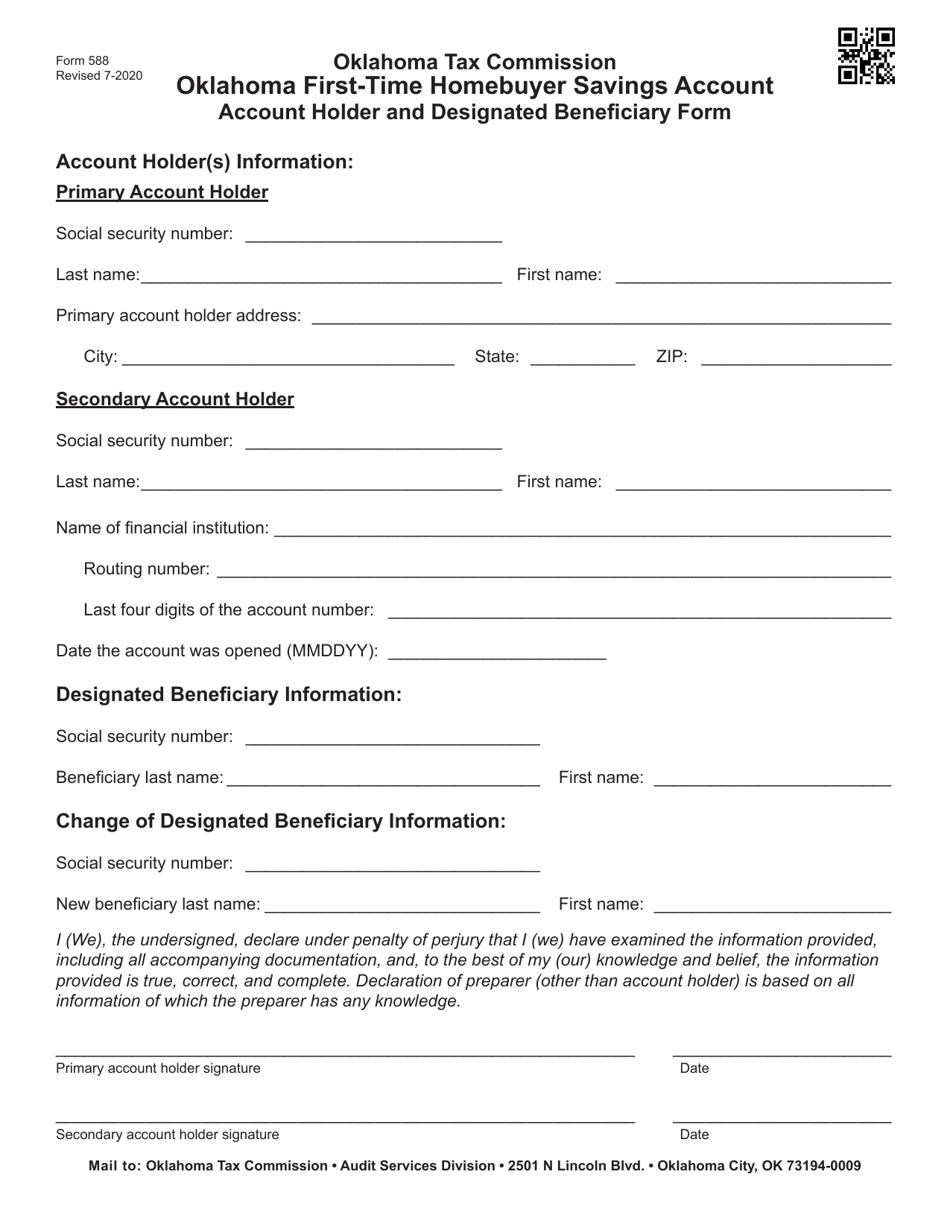

OTC Form 588 Oklahoma First-Time Homebuyer Savings Account - Account Holder and Designated Beneficiary Form - Oklahoma

What Is OTC Form 588?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 588?

A: OTC Form 588 is the Oklahoma First-Time Homebuyer Savings Account - Account Holder and Designated Beneficiary Form.

Q: What is the purpose of OTC Form 588?

A: The purpose of OTC Form 588 is to establish a First-Time Homebuyer Savings Account in Oklahoma.

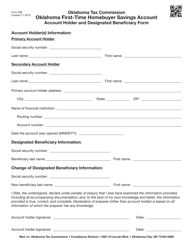

Q: Who is the Account Holder in OTC Form 588?

A: The Account Holder is the individual who establishes the First-Time Homebuyer Savings Account.

Q: Who is the Designated Beneficiary in OTC Form 588?

A: The Designated Beneficiary is the individual designated by the Account Holder to receive the funds from the First-Time Homebuyer Savings Account.

Q: What is a First-Time Homebuyer Savings Account?

A: A First-Time Homebuyer Savings Account is a savings account specifically designed to help individuals save money for the purchase of their first home.

Q: Why would someone want to open a First-Time Homebuyer Savings Account?

A: Opening a First-Time Homebuyer Savings Account can provide tax benefits and incentives for individuals saving for their first home purchase.

Q: Is OTC Form 588 specific to Oklahoma residents only?

A: Yes, OTC Form 588 is specific to Oklahoma residents who want to establish a First-Time Homebuyer Savings Account in the state.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 588 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.