This version of the form is not currently in use and is provided for reference only. Download this version of

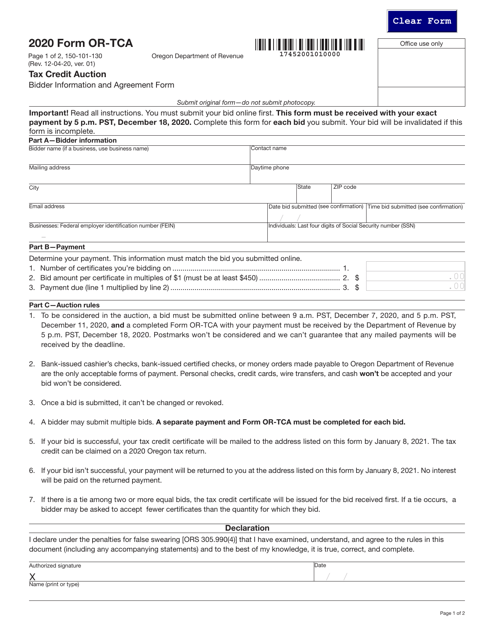

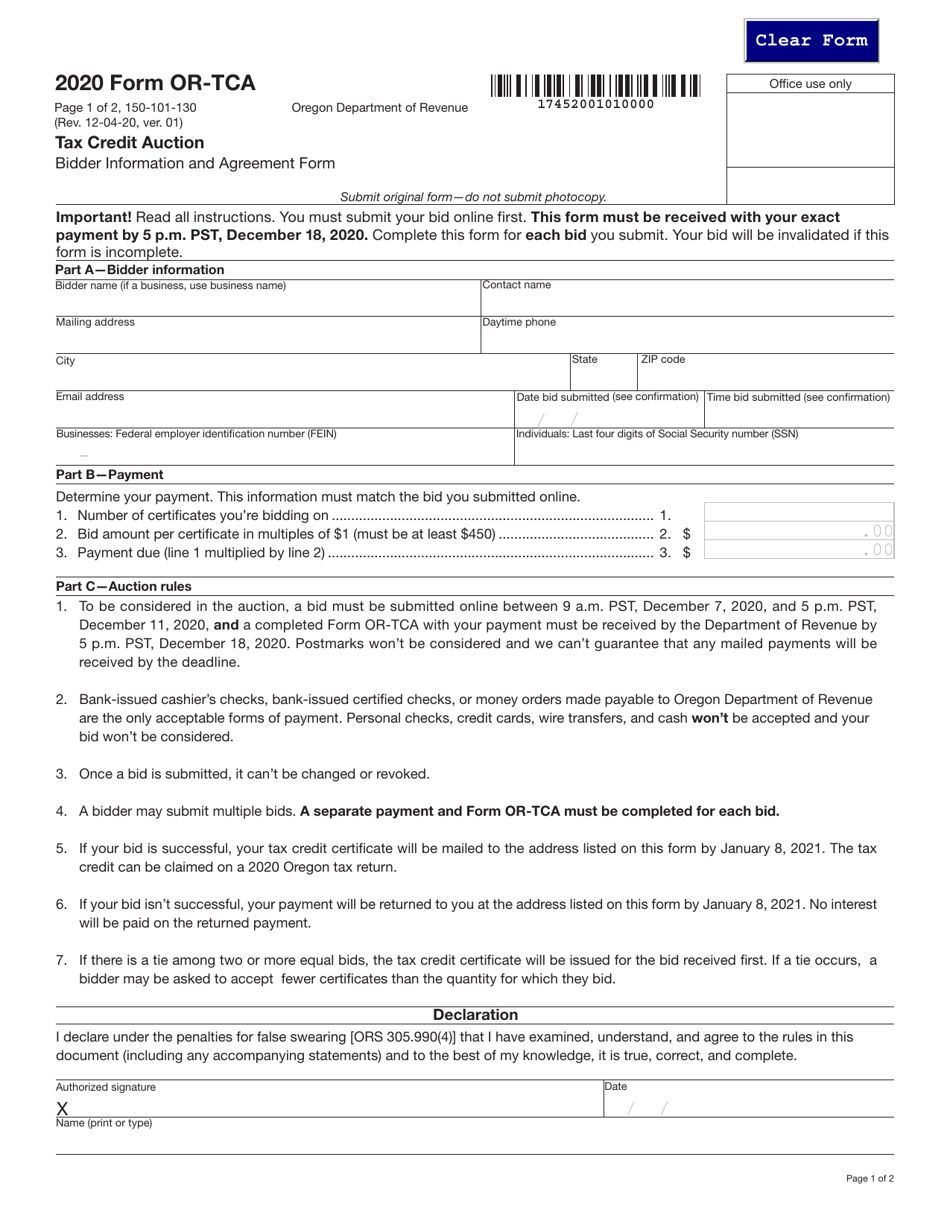

Form OR-TCA (150-101-130)

for the current year.

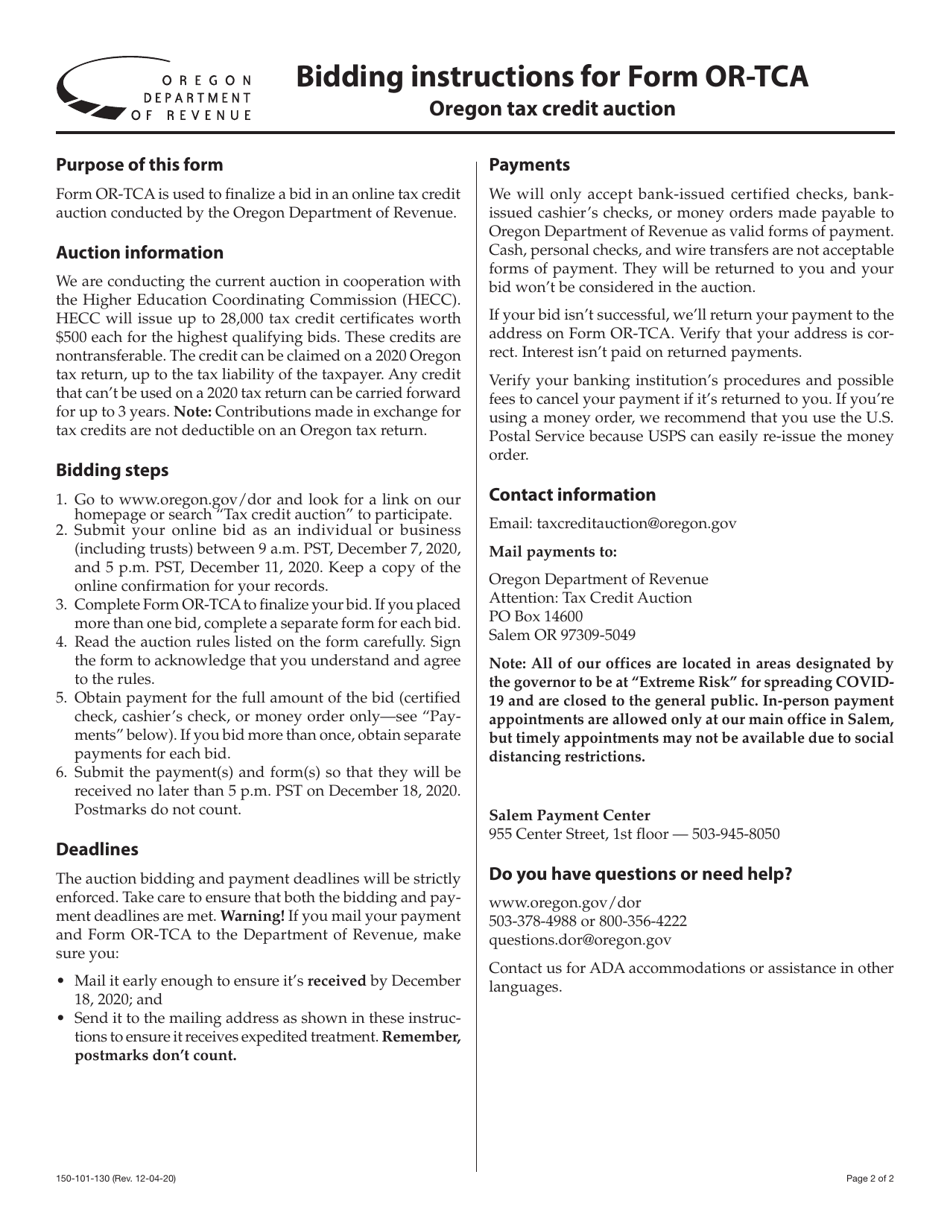

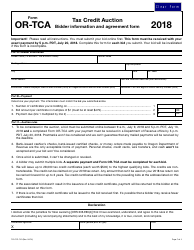

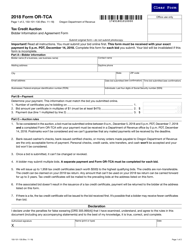

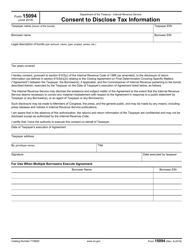

Form OR-TCA (150-101-130) Tax Credit Auction Bidder Information and Agreement Form - Oregon

What Is Form OR-TCA (150-101-130)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OR-TCA (150-101-130) form?

A: The OR-TCA (150-101-130) form is the Tax Credit Auction Bidder Information and Agreement Form specific to the state of Oregon.

Q: What is the purpose of the OR-TCA form?

A: The purpose of the OR-TCA form is to provide bidder information and establish an agreement for participating in the tax credit auction in Oregon.

Q: What information is required on the OR-TCA form?

A: The OR-TCA form will require you to provide bidder information such as your name, contact details, and other relevant information as specified in the form.

Q: What is the tax credit auction in Oregon?

A: The tax credit auction in Oregon is a mechanism through which individuals or entities can bid and potentially acquire certain tax credits offered by the state.

Form Details:

- Released on December 4, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-TCA (150-101-130) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.