This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form RP-458-A

for the current year.

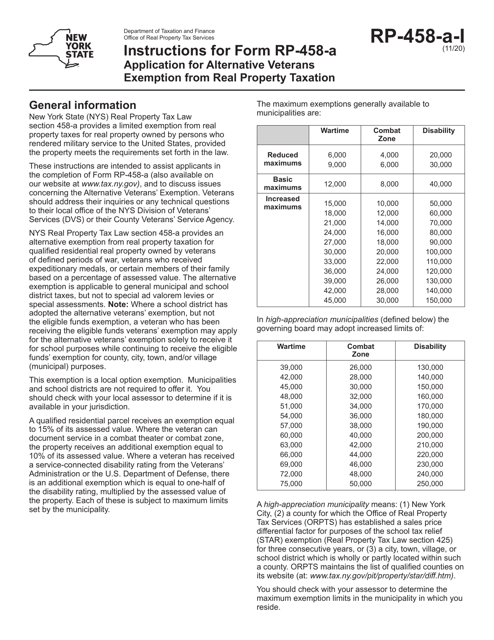

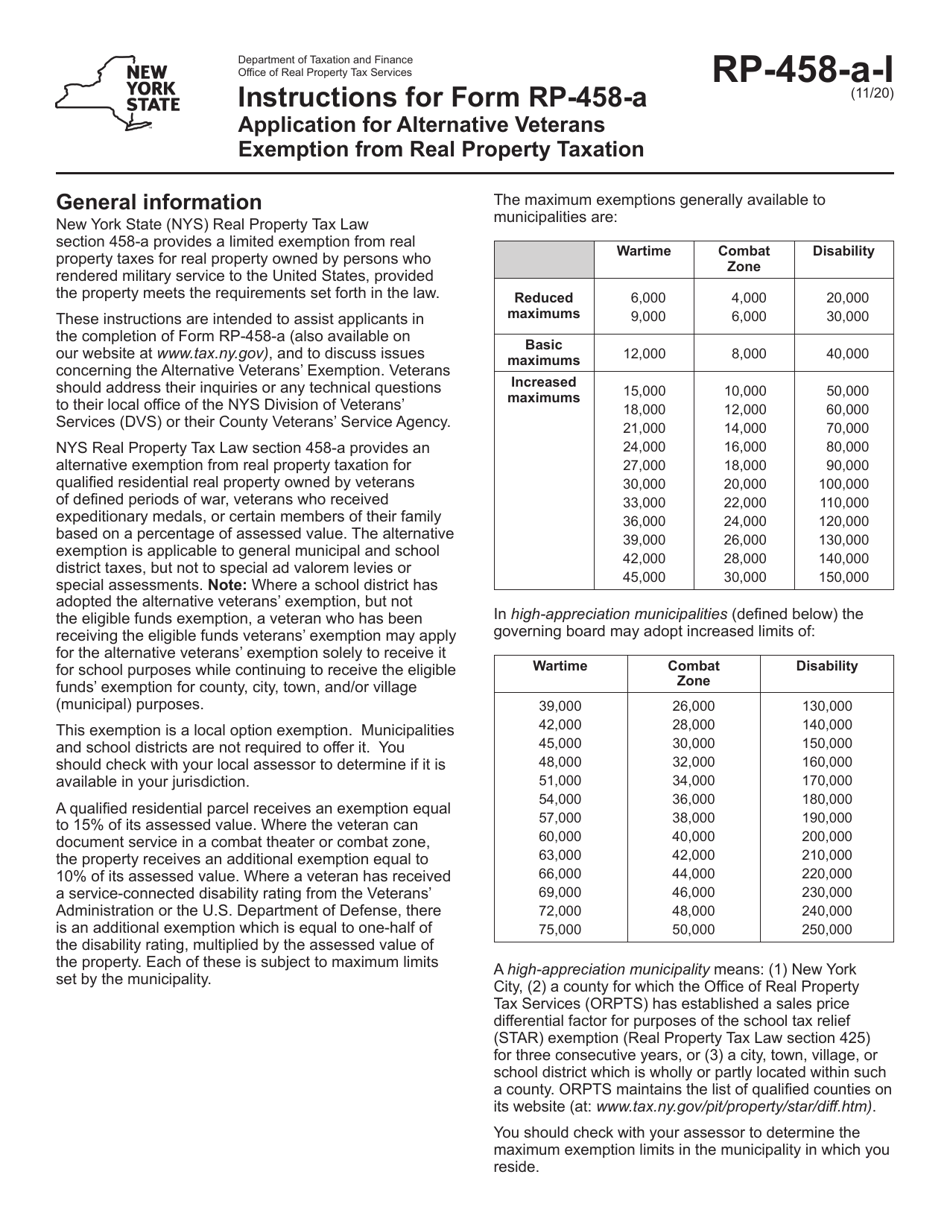

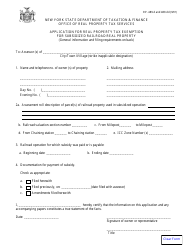

Instructions for Form RP-458-A Application for Alternative Veterans Exemption From Real Property Taxation - New York

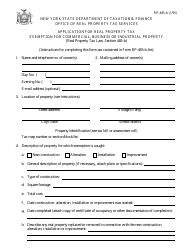

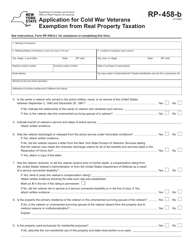

This document contains official instructions for Form RP-458-A , Application for Alternative Real Property Taxation - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form RP-458-a is available for download through this link.

FAQ

Q: What is Form RP-458-A?

A: Form RP-458-A is an application for the Alternative Veterans Exemption from Real Property Taxation in New York.

Q: Who is eligible to use Form RP-458-A?

A: Veterans who meet the eligibility requirements for the Alternative Veterans Exemption in New York can use Form RP-458-A.

Q: What is the Alternative Veterans Exemption?

A: The Alternative Veterans Exemption is a benefit that reduces the property tax burden for eligible veterans in New York.

Q: What are the eligibility requirements for the Alternative Veterans Exemption?

A: Eligibility requirements include being a veteran, meeting specific service requirements, and being the owner of the property.

Q: Is there a deadline for submitting Form RP-458-A?

A: The deadline for submitting Form RP-458-A varies by municipality. Contact your local assessor's office for the specific deadline.

Q: What documents do I need to include with Form RP-458-A?

A: You will need to provide proof of your veteran status and any other documents required by your local assessor's office.

Q: What happens after submitting Form RP-458-A?

A: After submitting Form RP-458-A, your local assessor's office will review your application and determine your eligibility for the Alternative Veterans Exemption.

Q: How long does the Alternative Veterans Exemption last?

A: The Alternative Veterans Exemption typically lasts for a period of time specified by your local municipality, such as 10 or 15 years.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.