This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

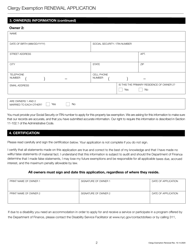

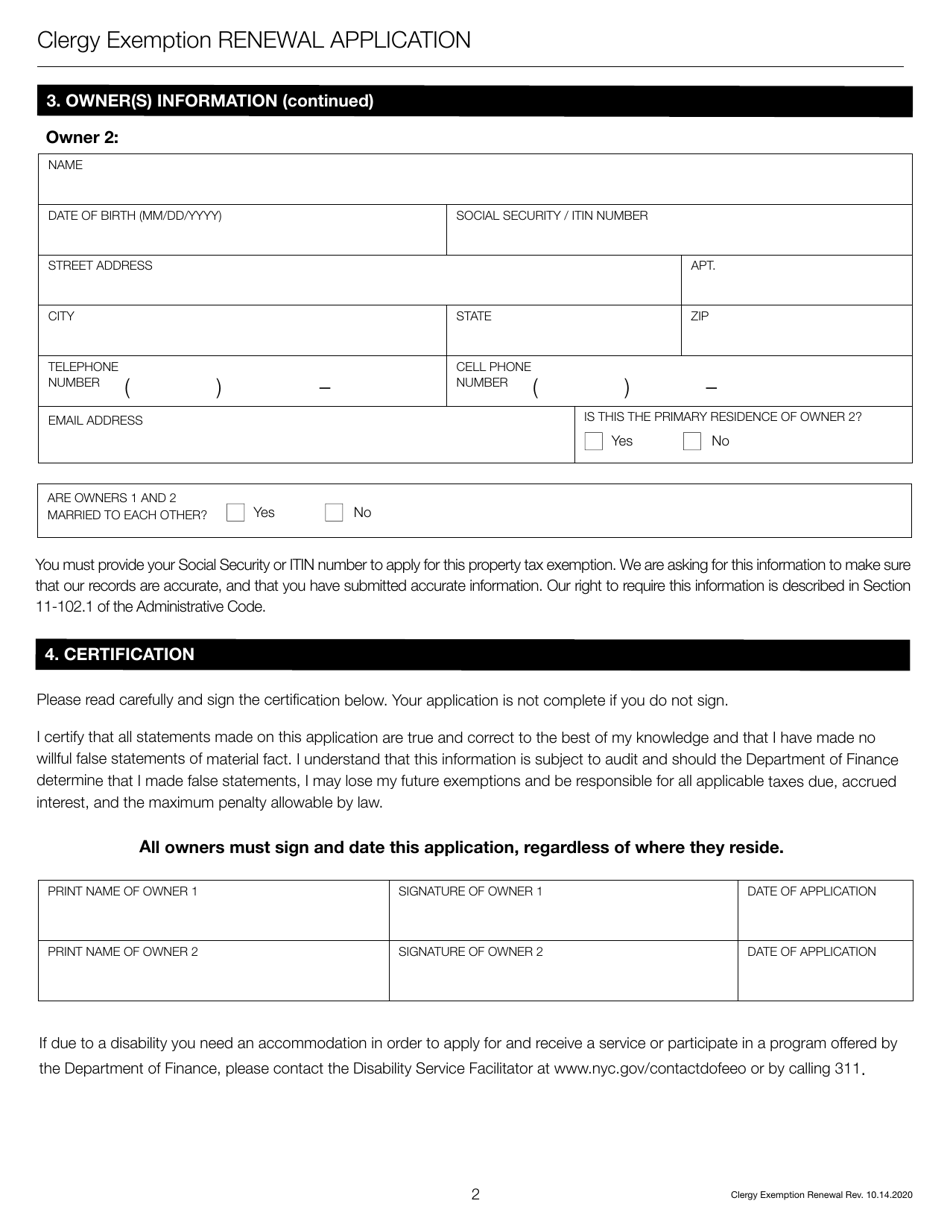

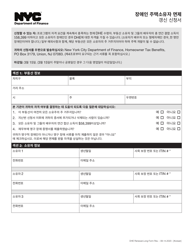

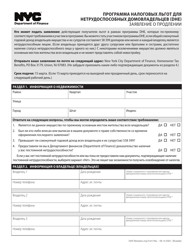

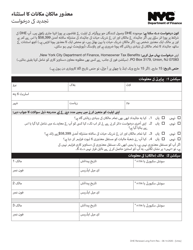

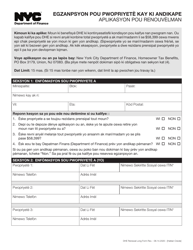

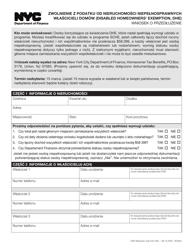

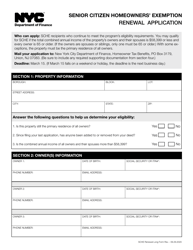

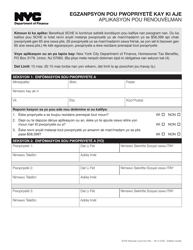

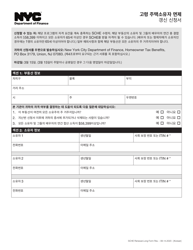

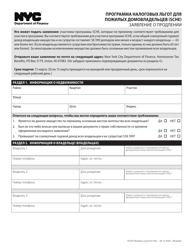

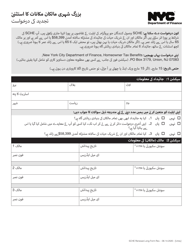

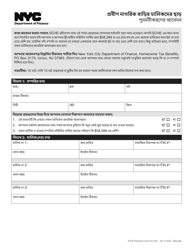

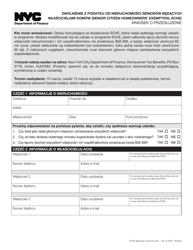

Clergy Exemption Renewal Application - New York City

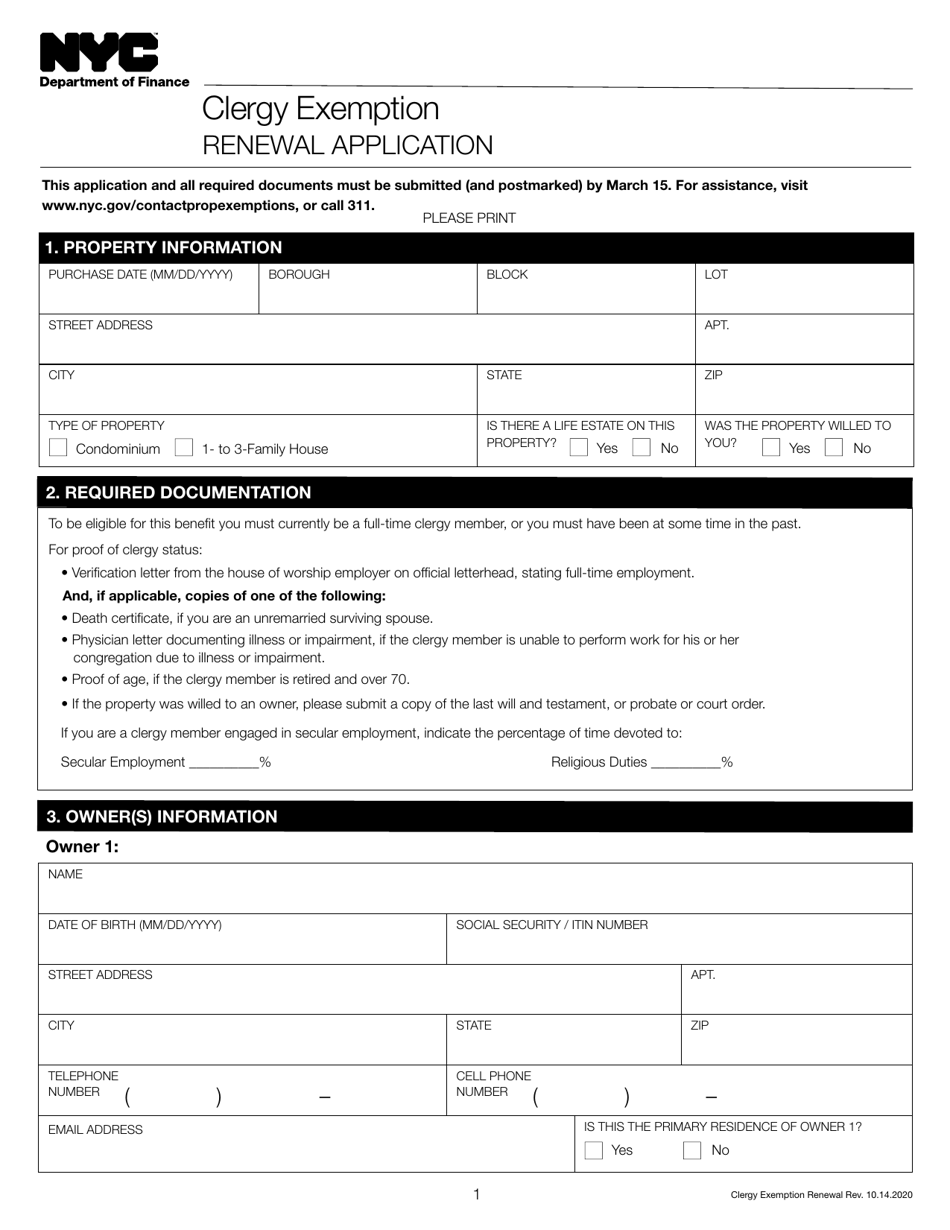

Clergy Exemption Renewal Application is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is a Clergy Exemption Renewal Application?

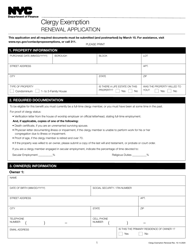

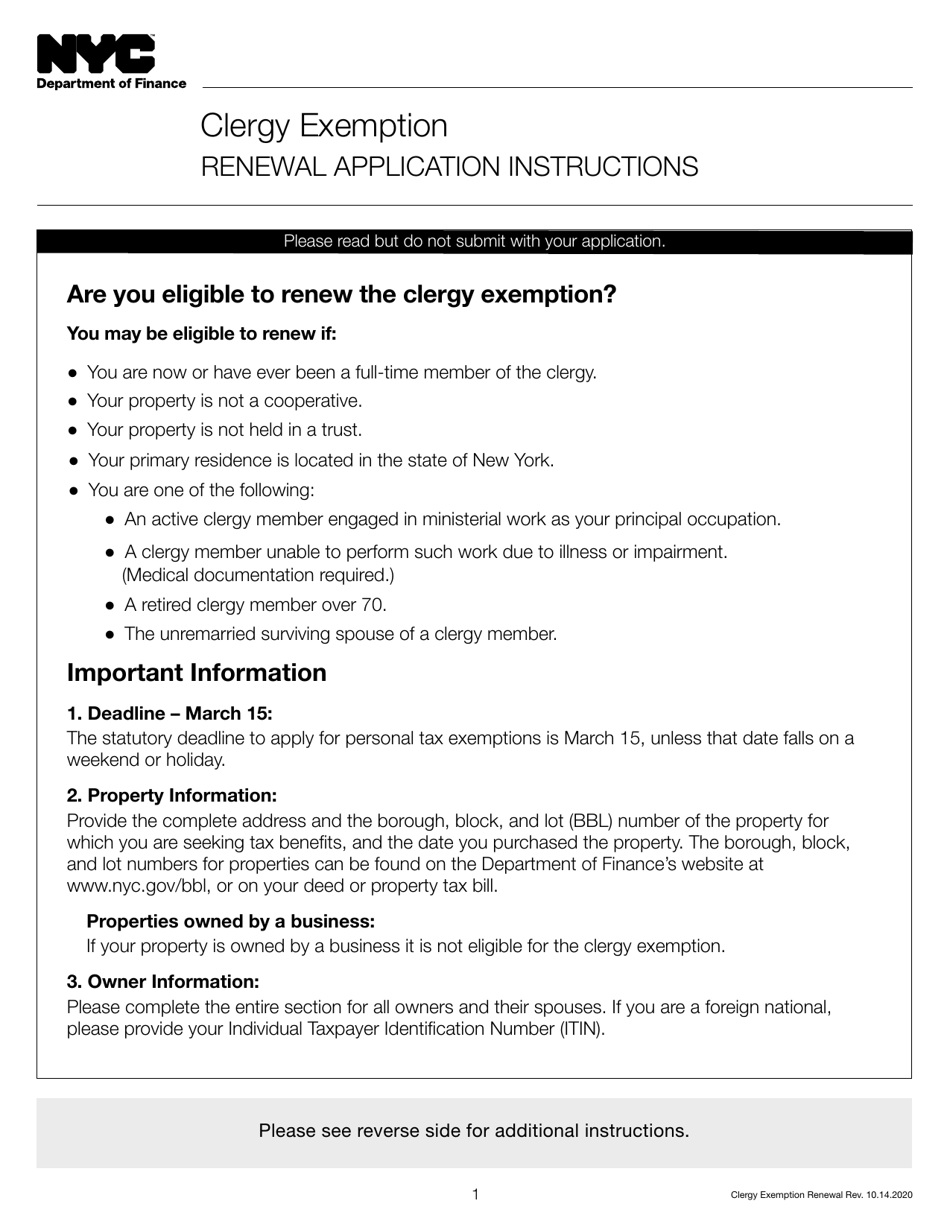

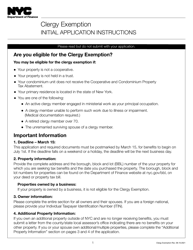

A: The Clergy Exemption Renewal Application is a form that allows clergy members in New York City to renew their property tax exemption.

Q: Who is eligible for the Clergy Exemption Renewal?

A: Clergy members who own or rent a residence in New York City and meet certain criteria are eligible for the exemption.

Q: How often do I need to renew my Clergy Exemption?

A: The Clergy Exemption needs to be renewed annually, typically by February 15th.

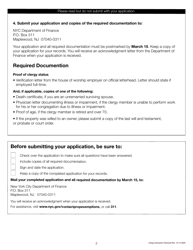

Q: What are the requirements for the Clergy Exemption Renewal Application?

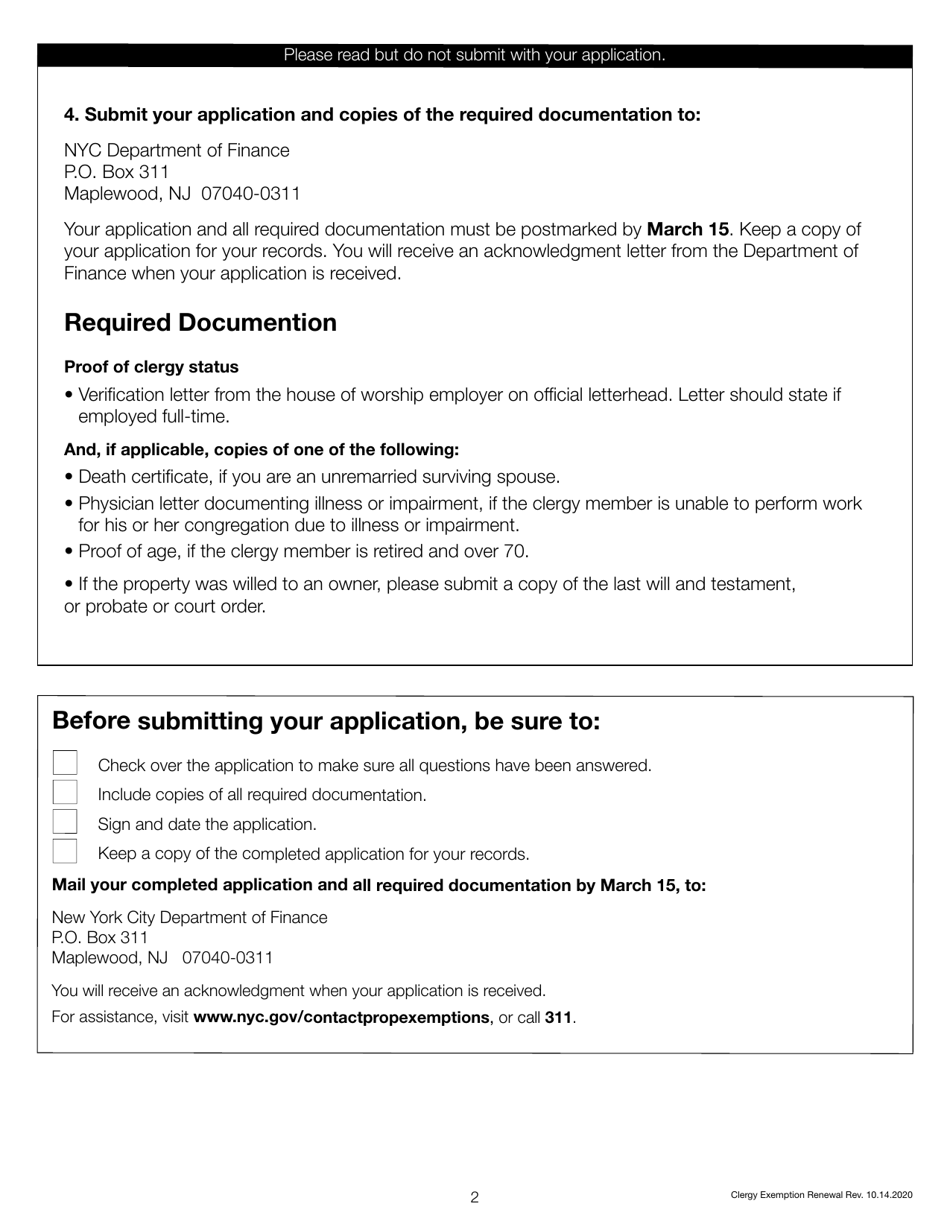

A: To be eligible for the renewal, clergy members need to provide proof of their ordination or appointment by a religious organization and demonstrate that their main duties are related to religious worship or instruction.

Q: Are there any fees associated with the Clergy Exemption Renewal Application?

A: No, there is no fee to submit the Clergy Exemption Renewal Application.

Q: What should I do if my Clergy Exemption Renewal is denied?

A: If your renewal is denied, you have the right to appeal the decision. Contact the Department of Finance for more information on the appeals process.

Form Details:

- Released on October 14, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.