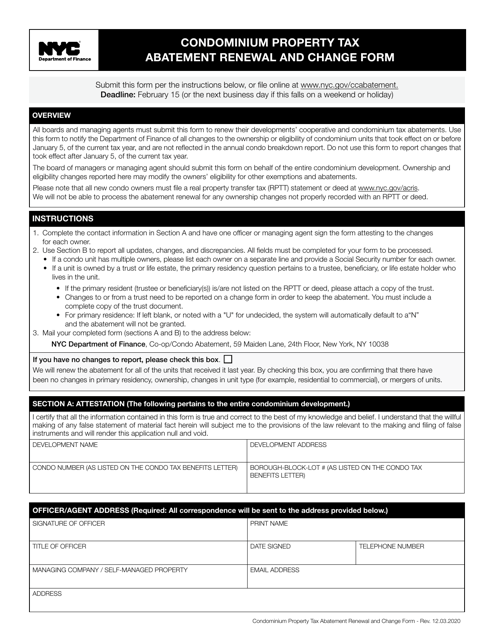

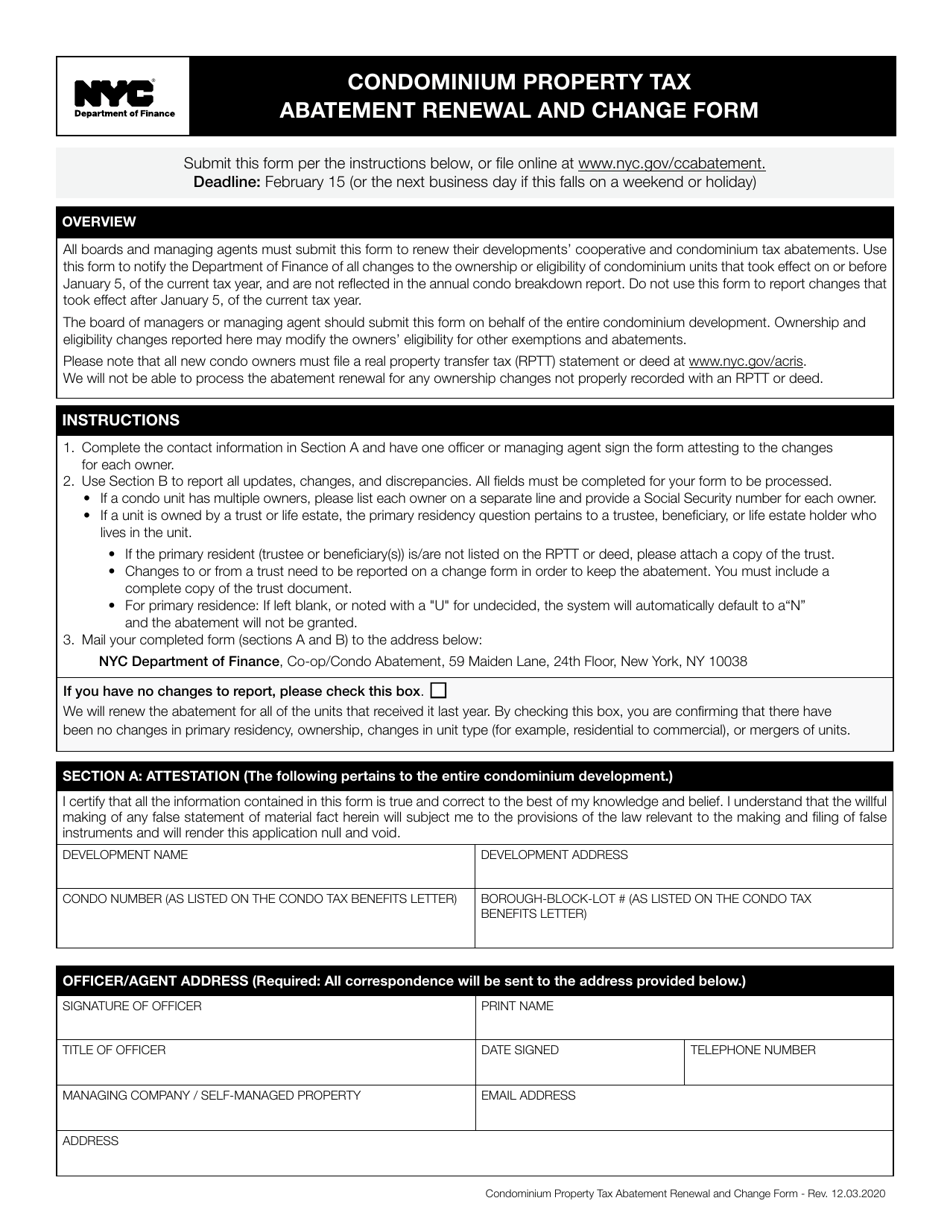

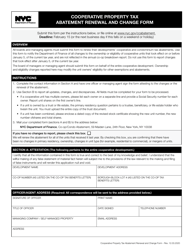

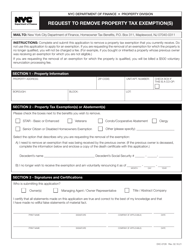

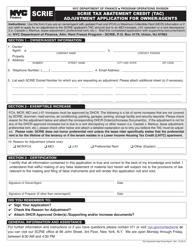

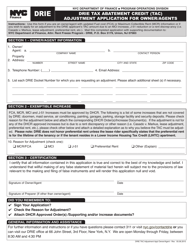

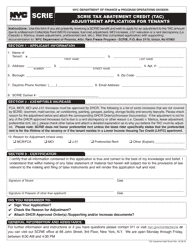

Condominium Property Tax Abatement Renewal and Change Form - New York City

Condominium Property Tax Abatement Renewal and Change Form is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

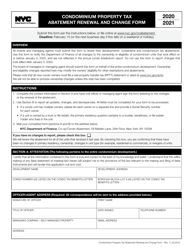

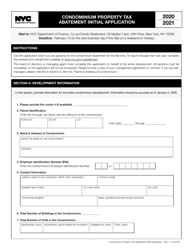

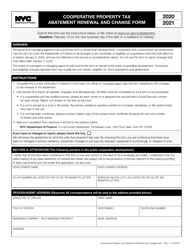

Q: What is a Condominium Property Tax Abatement Renewal and Change Form?

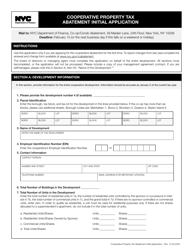

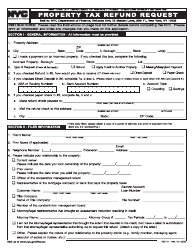

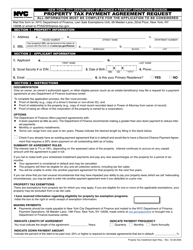

A: The Condominium Property Tax Abatement Renewal and Change Form is a document used in New York City to renew or make changes to a condominium property tax abatement.

Q: Who needs to use the Condominium Property Tax Abatement Renewal and Change Form?

A: Condominium owners in New York City who are eligible for a property tax abatement need to use this form to renew or make changes to their abatement.

Q: What is a property tax abatement?

A: A property tax abatement is a reduction or exemption in property taxes provided to eligible individuals or properties by the government.

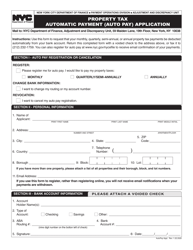

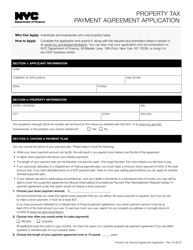

Q: How do I renew or make changes to a property tax abatement?

A: To renew or make changes to a property tax abatement, you need to complete the Condominium Property Tax Abatement Renewal and Change Form and submit it to the appropriate city agency.

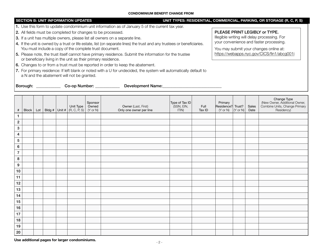

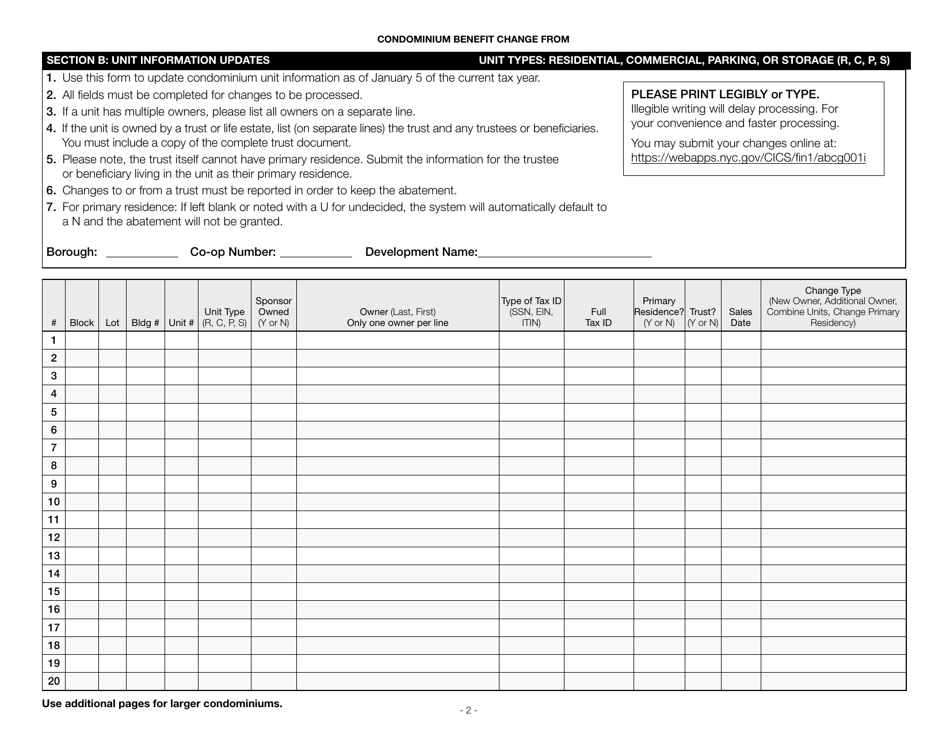

Q: What information do I need to complete the Condominium Property Tax Abatement Renewal and Change Form?

A: You will need to provide information about the condominium property, including its address and apartment number, as well as information about the current owner.

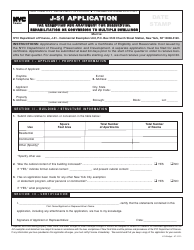

Form Details:

- Released on December 3, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.