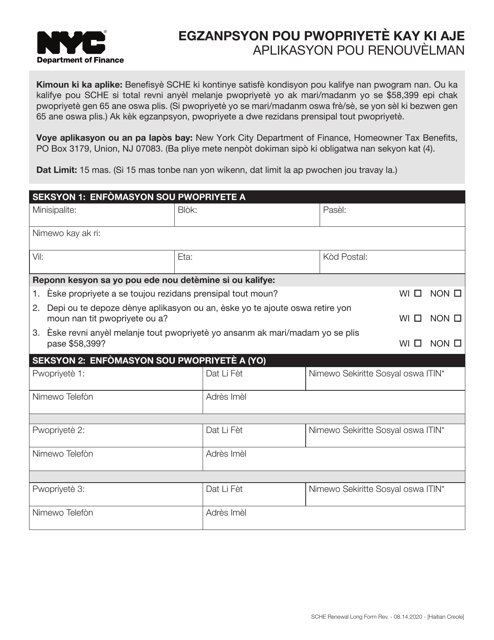

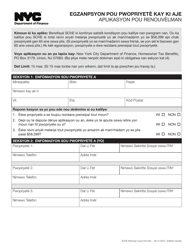

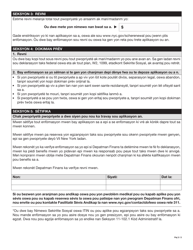

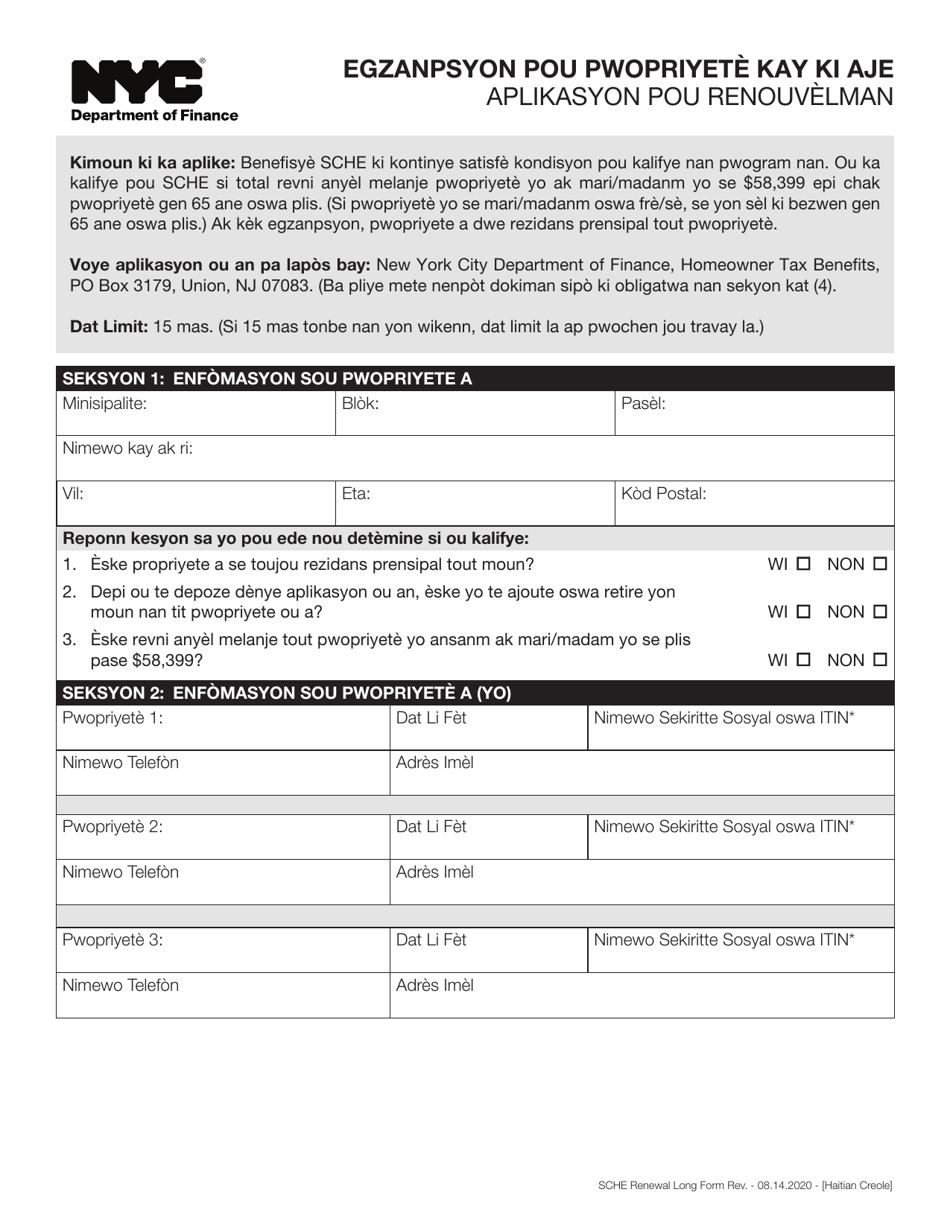

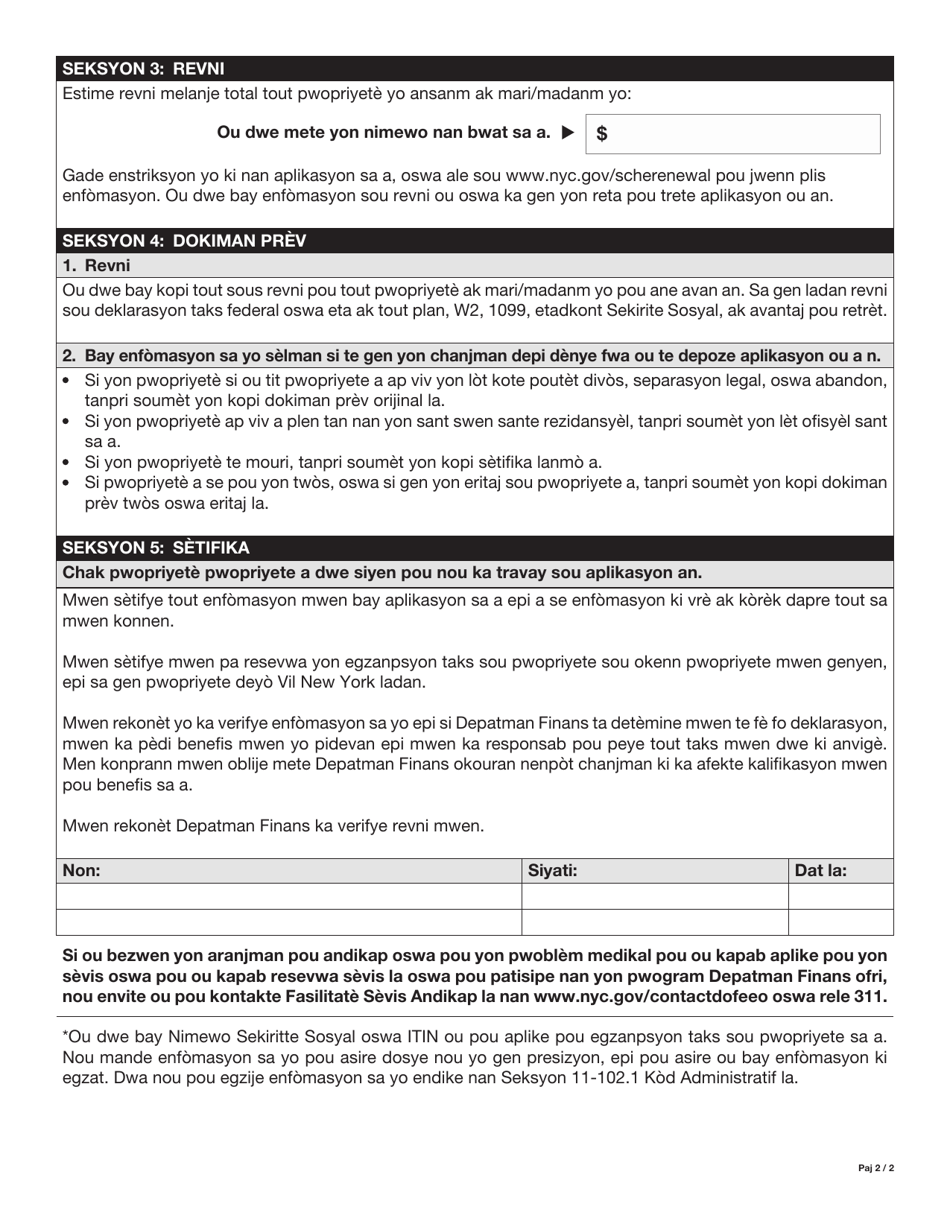

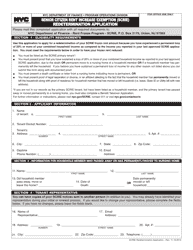

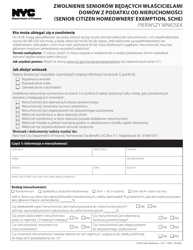

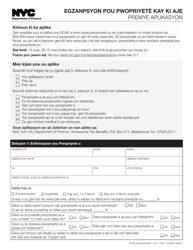

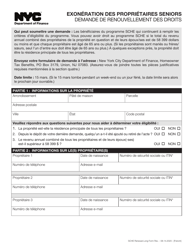

Senior Citizen Homeowners' Exemption Renewal Application - New York City (Haitian Creole)

This is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

The document is provided in Haitian Creole.

FAQ

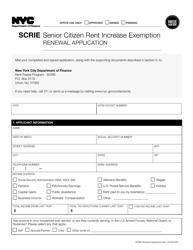

Q: What is the Senior Citizen Homeowners' Exemption Renewal Application?

A: The Senior Citizen Homeowners' Exemption Renewal Application is a form to renew a property tax exemption for eligible senior citizens in New York City.

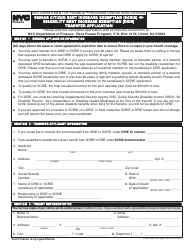

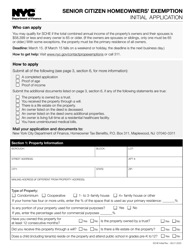

Q: Who is eligible for the Senior Citizen Homeowners' Exemption?

A: Senior citizens who are 65 years or older, own a residential property, and meet certain income requirements may be eligible for the exemption.

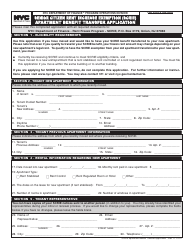

Q: How do I renew the Senior Citizen Homeowners' Exemption?

A: You need to complete the renewal application form and submit it to the New York City Department of Finance.

Q: What are the income requirements for the Senior Citizen Homeowners' Exemption?

A: The income requirements vary depending on the tax year and the borough where the property is located. You should refer to the instructions on the application form for the specific income limits.

Q: What documents do I need to provide with the renewal application?

A: You may be required to provide proof of age, ownership, and income. The specific documents needed are listed on the application form.

Q: When is the deadline to submit the renewal application?

A: The deadline to submit the renewal application is usually March 15th of each year. However, you should check the application form or contact the Department of Finance for the exact deadline.

Q: Can I apply for the Senior Citizen Homeowners' Exemption if I am a renter?

A: No, the exemption is only available to senior citizens who own residential properties.

Q: Is there a fee to apply for the Senior Citizen Homeowners' Exemption?

A: No, there is no fee to apply for the Senior Citizen Homeowners' Exemption.

Form Details:

- Released on August 14, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.