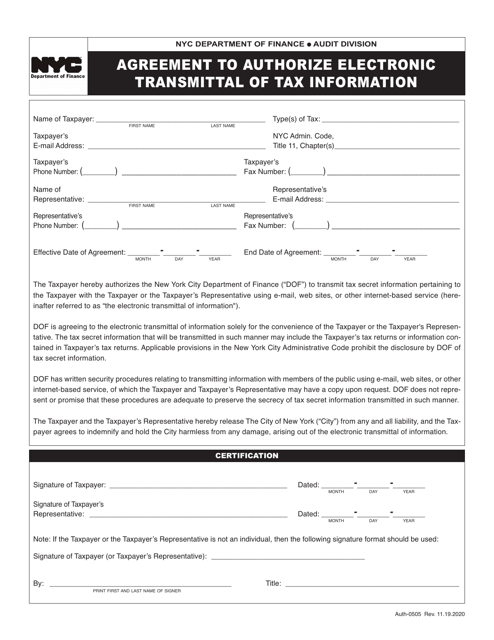

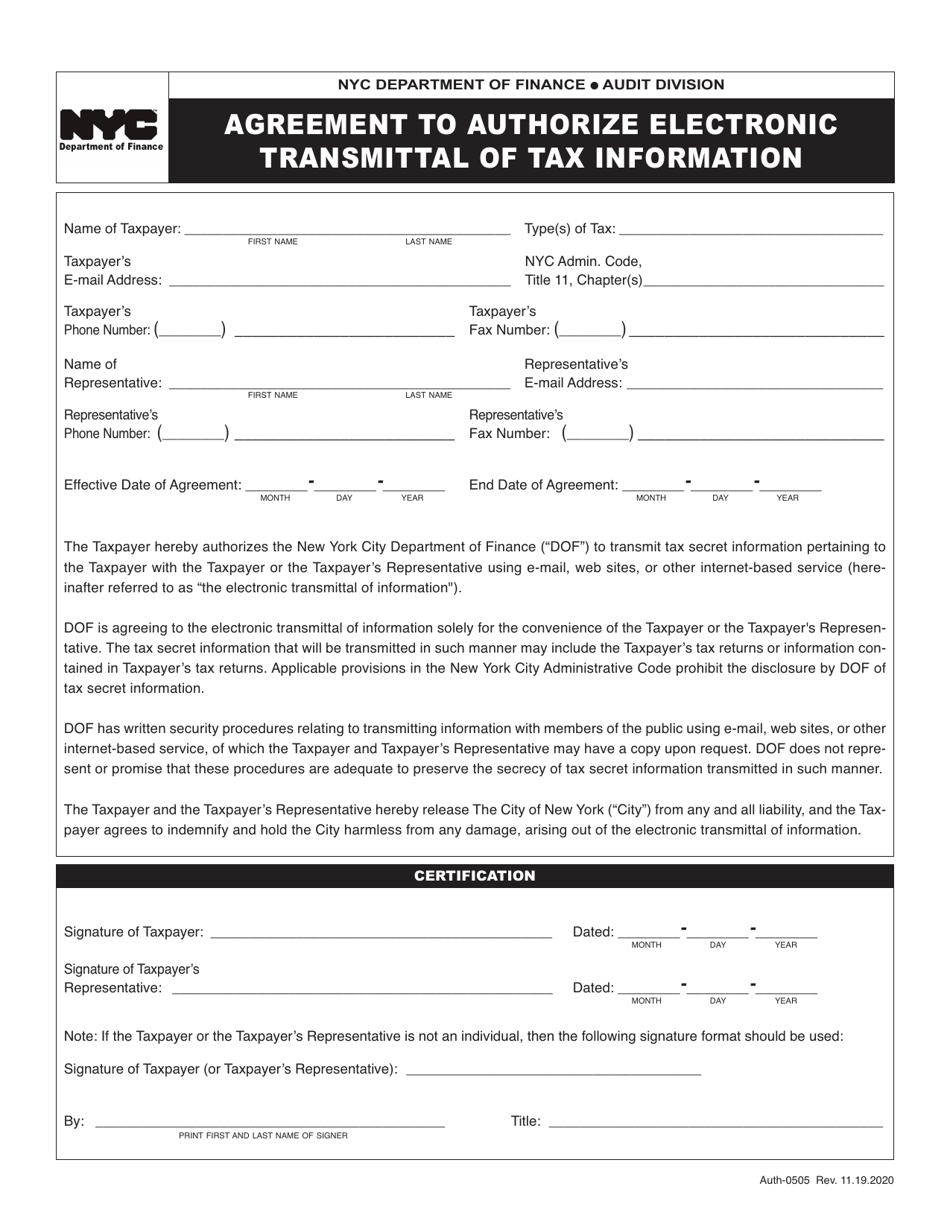

Form Auth-0505 Agreement to Authorize Electronic Transmittal of Tax Information - New York City

What Is Form Auth-0505?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form Auth-0505 Agreement to Authorize Electronic Transmittal of Tax Information?

A: The Form Auth-0505 Agreement is a document used in New York City to authorize the electronic transmittal of tax information.

Q: Who needs to fill out this form?

A: Individuals or businesses who want to authorize the electronic transmittal of their tax information in New York City need to fill out this form.

Q: What is the purpose of this form?

A: The purpose of this form is to provide consent for the electronic transmission of tax information to the New York City Department of Finance.

Q: What information is needed to fill out this form?

A: You will need to provide your personal or business information, including your name, address, social security number or taxpayer identification number, and contact information.

Q: Is there a deadline for submitting this form?

A: There is no specified deadline for submitting this form, but it is recommended to submit it at least 30 days before the tax filing deadline.

Q: What happens after I submit this form?

A: After you submit this form, the New York City Department of Finance will process your authorization and begin electronically transmitting your tax information.

Q: Can I revoke the authorization provided in this form?

A: Yes, you can revoke the authorization provided in this form by submitting a written request to the New York City Department of Finance.

Q: Is there a fee for submitting this form?

A: No, there is no fee for submitting this form.

Form Details:

- Released on November 19, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form Auth-0505 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.