This version of the form is not currently in use and is provided for reference only. Download this version of

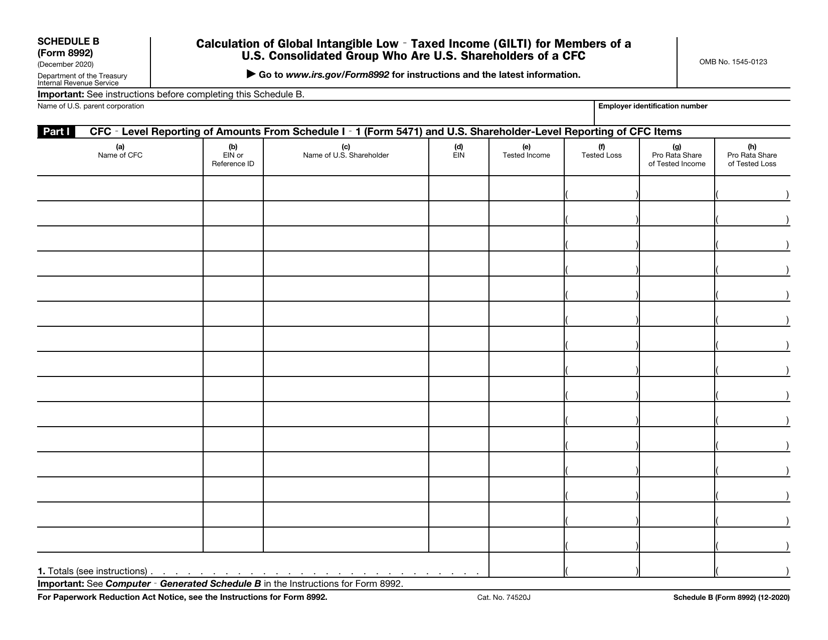

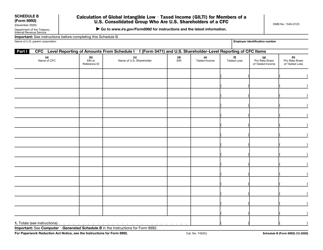

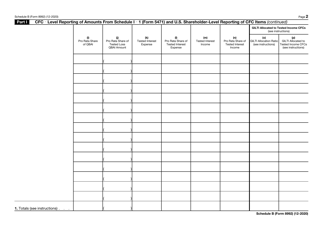

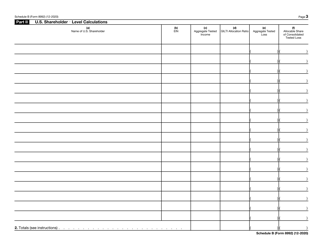

IRS Form 8992 Schedule B

for the current year.

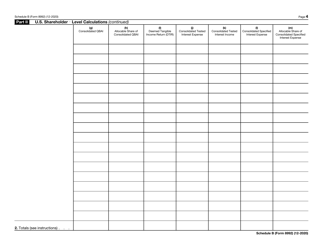

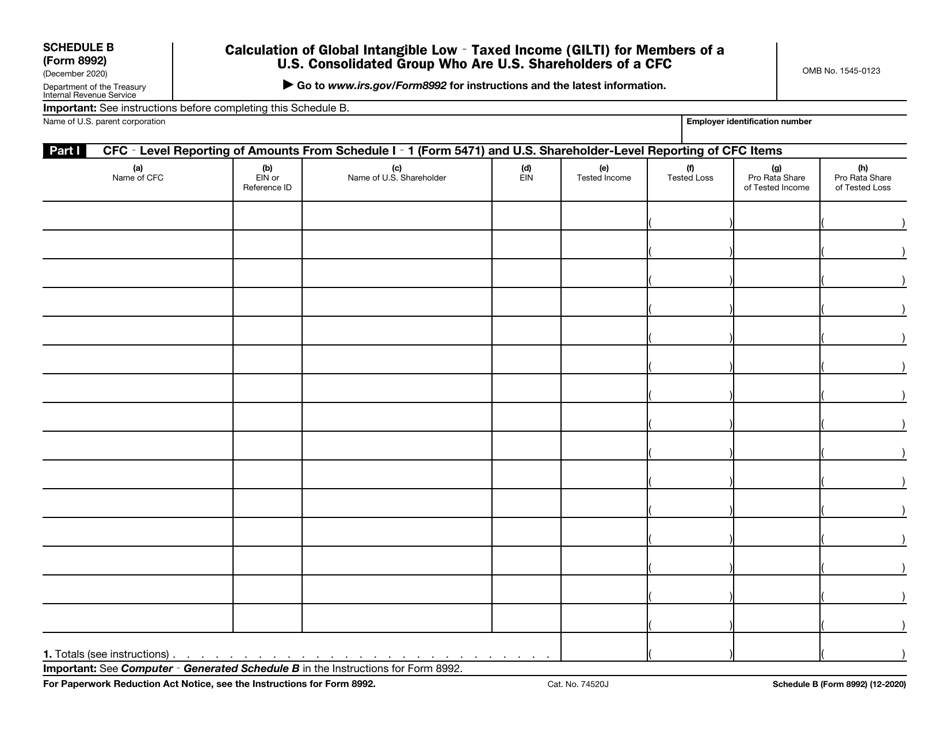

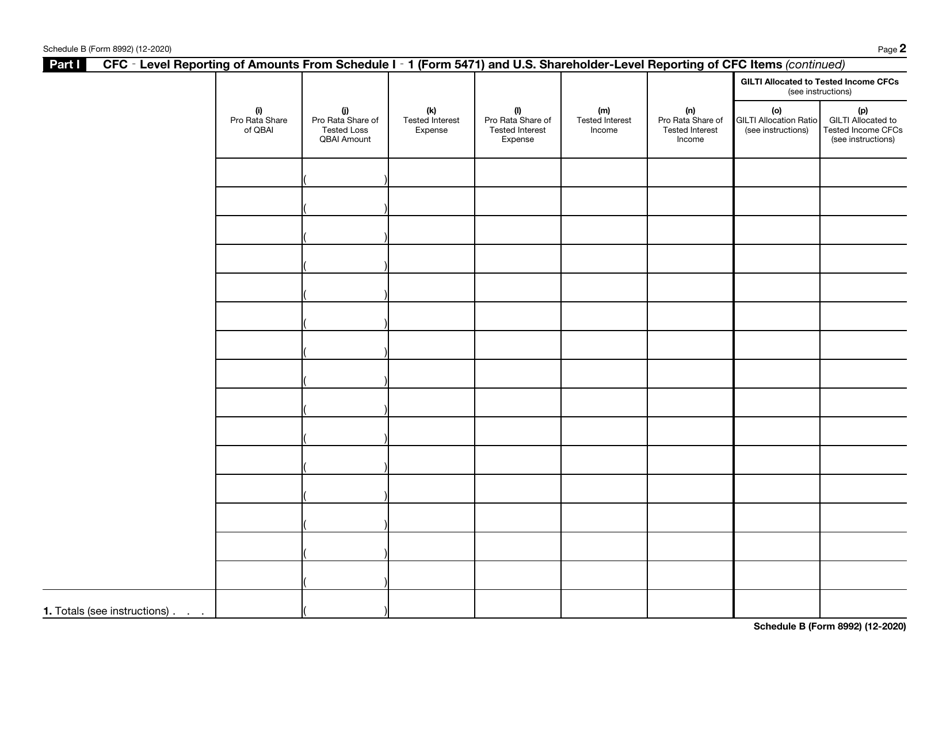

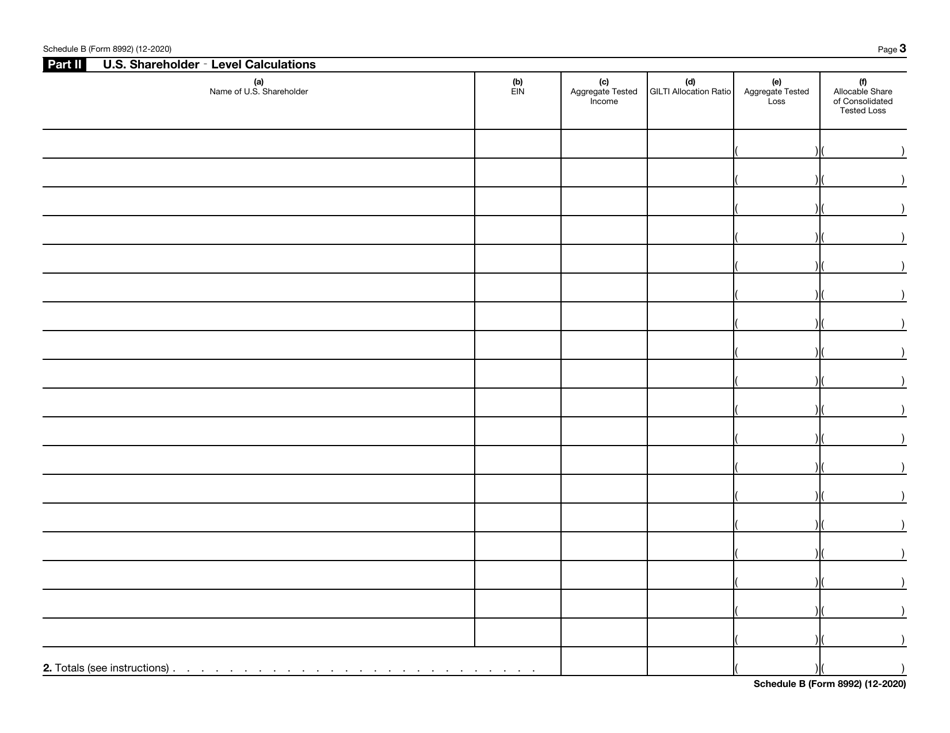

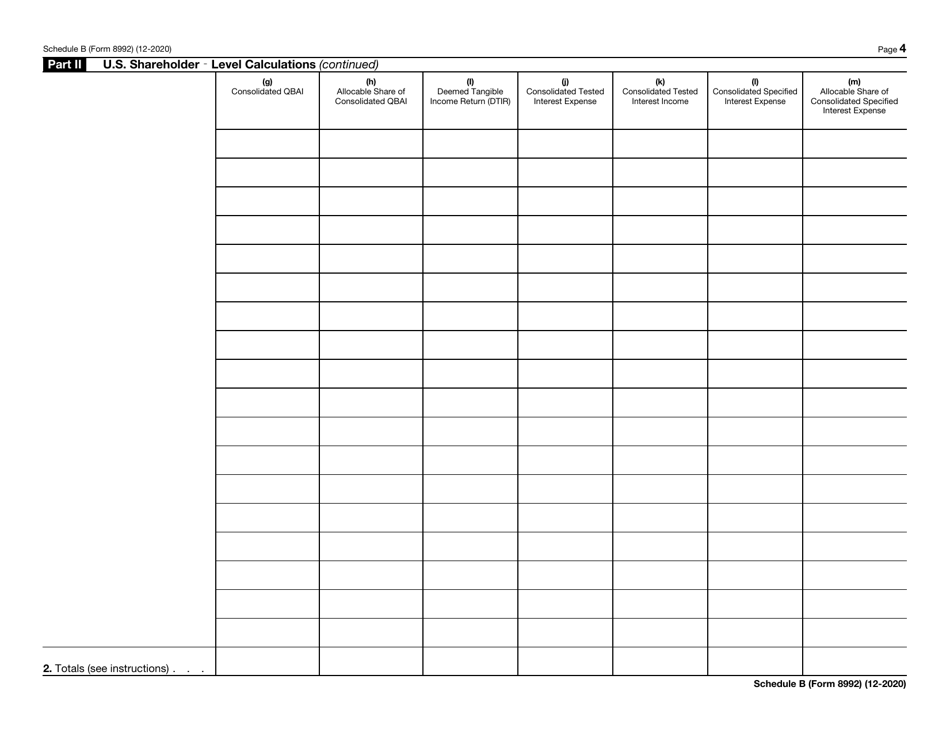

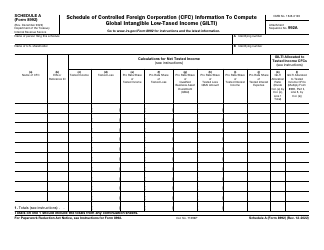

IRS Form 8992 Schedule B Calculation of Global Intangible Low-Taxed Income (Gilti) for Members of a U.S. Consolidated Group Who Are U.S. Shareholders of a Cfc

What Is IRS Form 8992 Schedule B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2020. The document is a supplement to IRS Form 8992, U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti). As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8992?

A: IRS Form 8992 is used to calculate Global Intangible Low-Taxed Income (GILTI) by members of a U.S. Consolidated Group who are U.S. shareholders of a Controlled Foreign Corporation (CFC).

Q: What does GILTI mean?

A: GILTI stands for Global Intangible Low-Taxed Income. It refers to the income derived from intangible assets such as patents, copyrights, and trademarks that is subject to a low level of foreign taxation.

Q: Who needs to use Schedule B?

A: Members of a U.S. Consolidated Group who are U.S. shareholders of a Controlled Foreign Corporation (CFC) need to use Schedule B of Form 8992 to calculate their GILTI.

Q: What is a Controlled Foreign Corporation (CFC)?

A: A Controlled Foreign Corporation (CFC) is a foreign corporation in which U.S. shareholders hold more than 50% of the voting power or value.

Q: Why is calculating GILTI important?

A: Calculating GILTI is important for U.S. shareholders of CFCs as it helps determine the amount of income subject to U.S. taxation and any potential tax liability.

Q: When is Form 8992 Schedule B due?

A: Form 8992 Schedule B is typically due on the same date as the taxpayer's income tax return, which is generally April 15th of the following year.

Q: Can I file Form 8992 Schedule B electronically?

A: Yes, Form 8992 Schedule B can be filed electronically using the IRS e-file system.

Q: Are there any penalties for not filing Form 8992 Schedule B?

A: Failure to file Form 8992 Schedule B or submitting an incorrect or incomplete form may result in penalties imposed by the IRS.

Q: Can I get help with filling out Form 8992 Schedule B?

A: Yes, you can seek assistance from a tax professional or use available IRS resources such as instructions and publications to help you fill out Form 8992 Schedule B.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8992 Schedule B through the link below or browse more documents in our library of IRS Forms.