This version of the form is not currently in use and is provided for reference only. Download this version of

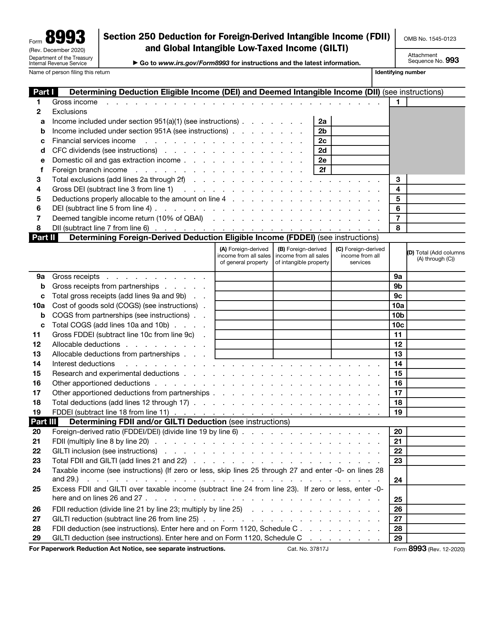

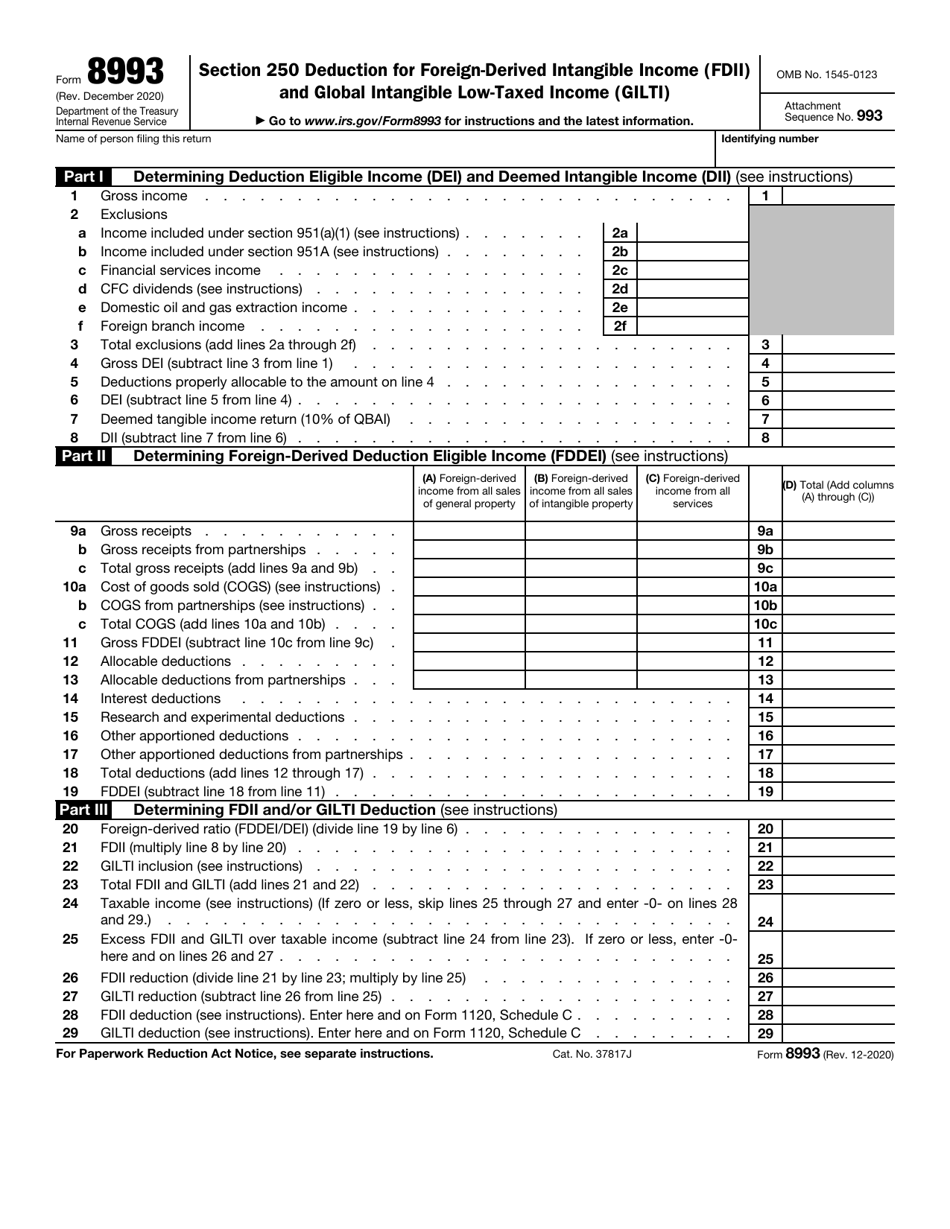

IRS Form 8993

for the current year.

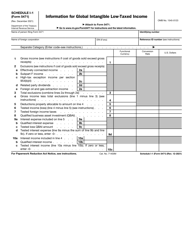

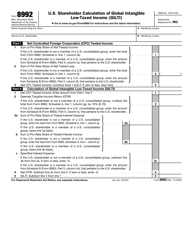

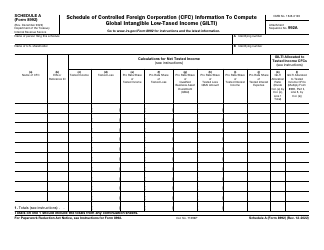

IRS Form 8993 Section 250 Deduction for Foreign Derived Intangible Income (Fdii) and Global Intangible Low-Taxed Income (Gilti)

What Is IRS Form 8993?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8993?

A: IRS Form 8993 is a tax form used to report the deduction for Foreign Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI).

Q: What is the Section 250 deduction?

A: The Section 250 deduction is a tax deduction available to certain businesses that have income from foreign derived intangible income (FDII) and global intangible low-taxed income (GILTI).

Q: What is Foreign Derived Intangible Income (FDII)?

A: Foreign Derived Intangible Income (FDII) is a type of income for certain businesses that is derived from sales or services made to foreign markets or foreign customers.

Q: What is Global Intangible Low-Taxed Income (GILTI)?

A: Global Intangible Low-Taxed Income (GILTI) is a type of income that certain businesses earn from intangible assets, such as patents and trademarks, held by foreign subsidiaries.

Q: Who is eligible for the Section 250 deduction?

A: Certain domestic corporations and individuals who own stock in certain foreign corporations may be eligible for the Section 250 deduction.

Q: How is the Section 250 deduction calculated?

A: The Section 250 deduction is calculated based on a percentage of a taxpayer's FDII and GILTI.

Q: Are there any limitations or requirements for claiming the Section 250 deduction?

A: Yes, there are several limitations and requirements for claiming the Section 250 deduction. It is recommended to consult a tax professional or refer to the IRS instructions for Form 8993 for detailed information.

Q: When is the deadline to file IRS Form 8993?

A: The deadline to file IRS Form 8993 is usually the same as the taxpayer's federal income tax return due date, including any extensions.

Q: Are there any penalties for not filing or filing IRS Form 8993 incorrectly?

A: Yes, there may be penalties for not filing IRS Form 8993 or for filing it incorrectly. It is important to ensure accurate and timely filing to avoid any potential penalties.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8993 through the link below or browse more documents in our library of IRS Forms.