This version of the form is not currently in use and is provided for reference only. Download this version of

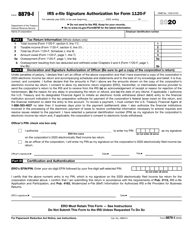

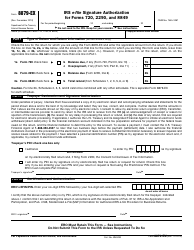

IRS Form 8879-I

for the current year.

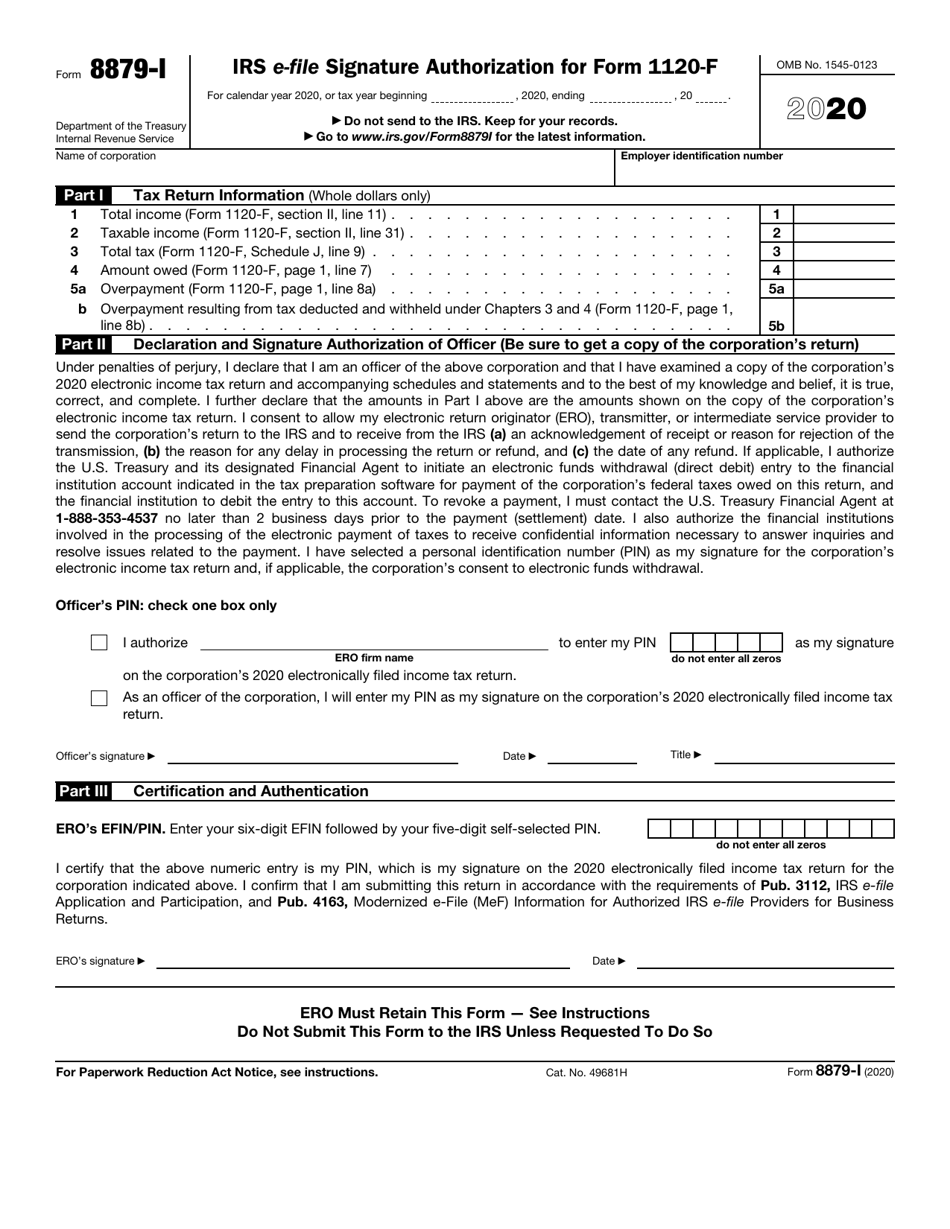

IRS Form 8879-I IRS E-File Signature Authorization for Form 1120-f

What Is IRS Form 8879-I?

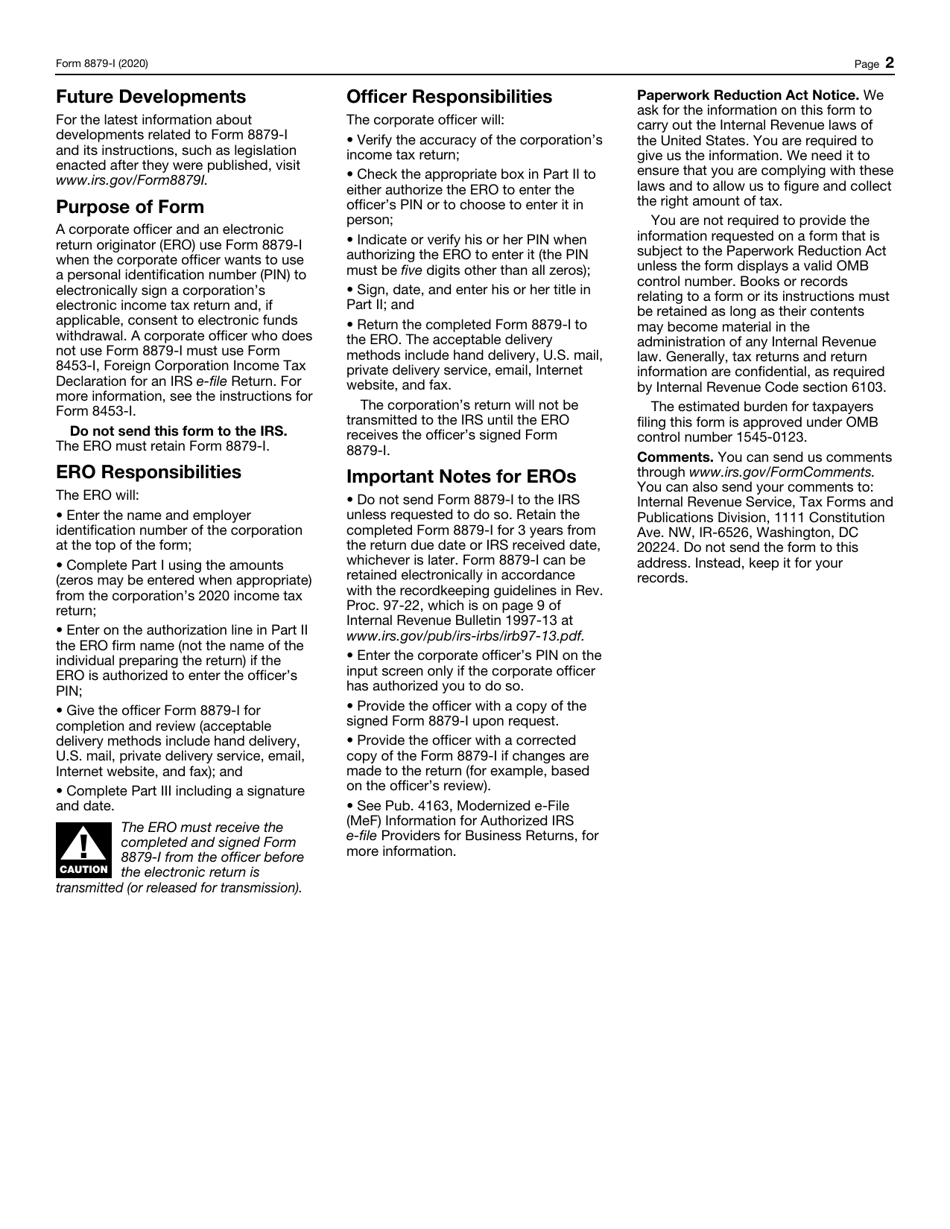

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8879-I?

A: IRS Form 8879-I is the E-File Signature Authorization form specifically for Form 1120-F.

Q: What is the purpose of IRS Form 8879-I?

A: The purpose of IRS Form 8879-I is to authorize the electronic filing of Form 1120-F for corporations engaged in foreign trade or business in the United States.

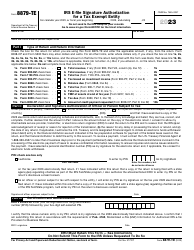

Q: Who needs to file IRS Form 8879-I?

A: Corporations that are engaged in foreign trade or business in the United States and are required to file Form 1120-F electronically.

Q: When is IRS Form 8879-I due?

A: IRS Form 8879-I is typically due at the same time as Form 1120-F, which is the 15th day of the 6th month after the end of the corporation's tax year.

Q: Can IRS Form 8879-I be filed electronically?

A: Yes, IRS Form 8879-I is specifically designed for electronic filing (e-filing) and should be submitted electronically.

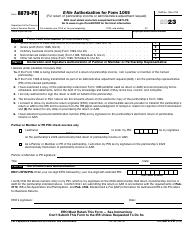

Q: What information is required on IRS Form 8879-I?

A: IRS Form 8879-I requires the taxpayer's name, address, EIN, tax year, and the signature of the authorized representative.

Q: Can IRS Form 8879-I be signed electronically?

A: Yes, IRS Form 8879-I can be signed electronically using a self-selected Personal Identification Number (PIN).

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8879-I through the link below or browse more documents in our library of IRS Forms.