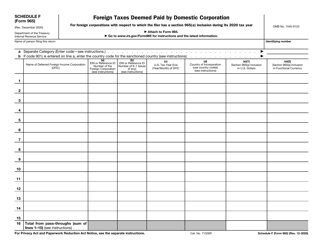

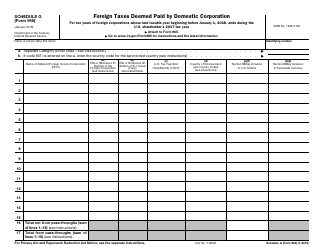

This version of the form is not currently in use and is provided for reference only. Download this version of

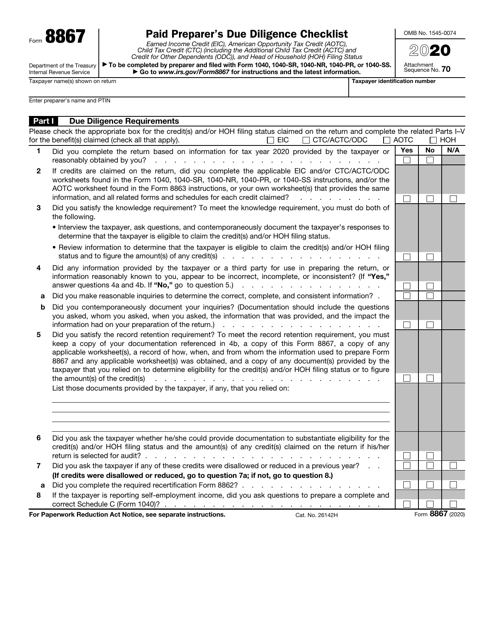

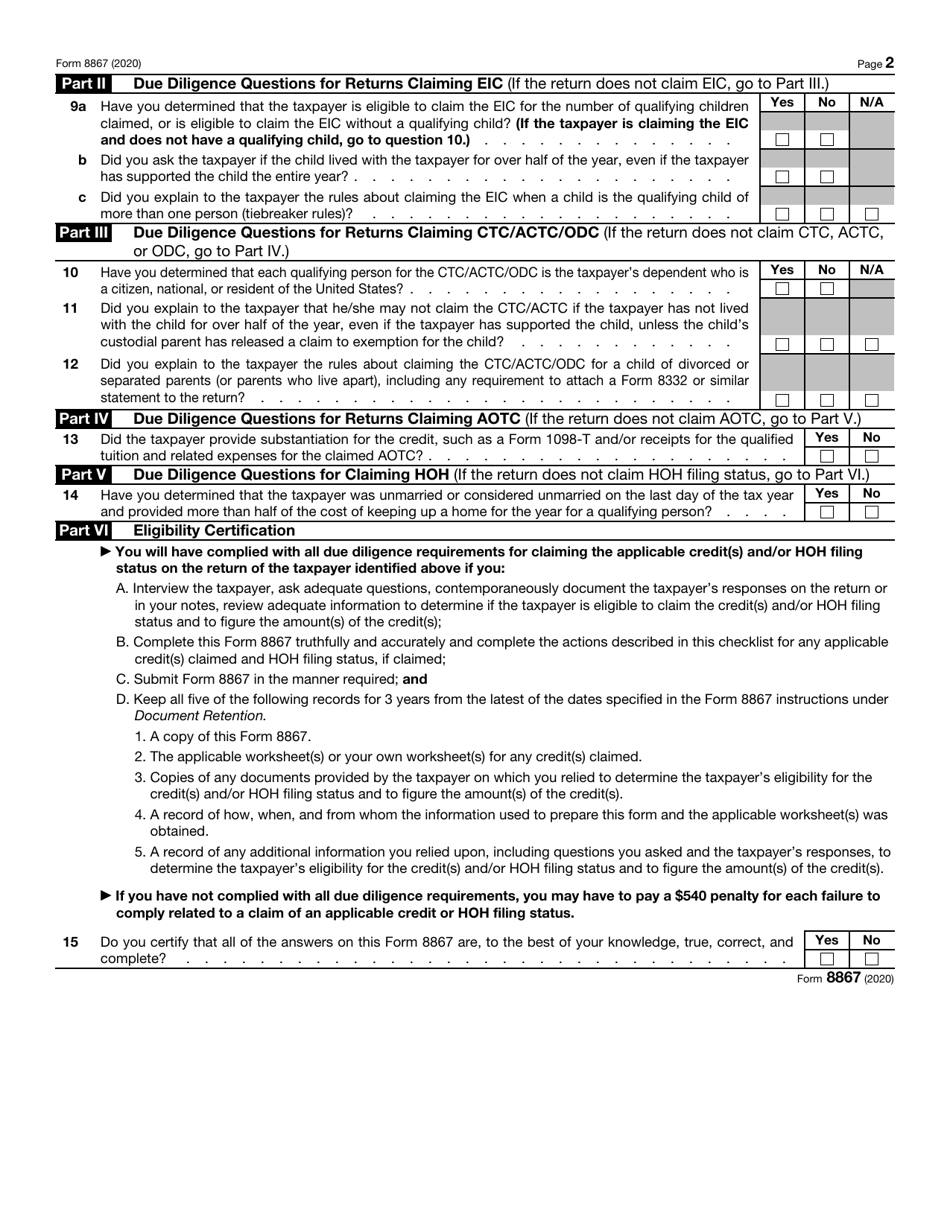

IRS Form 8867

for the current year.

IRS Form 8867 Paid Preparer's Due Diligence Checklist

What Is IRS Form 8867?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8867?

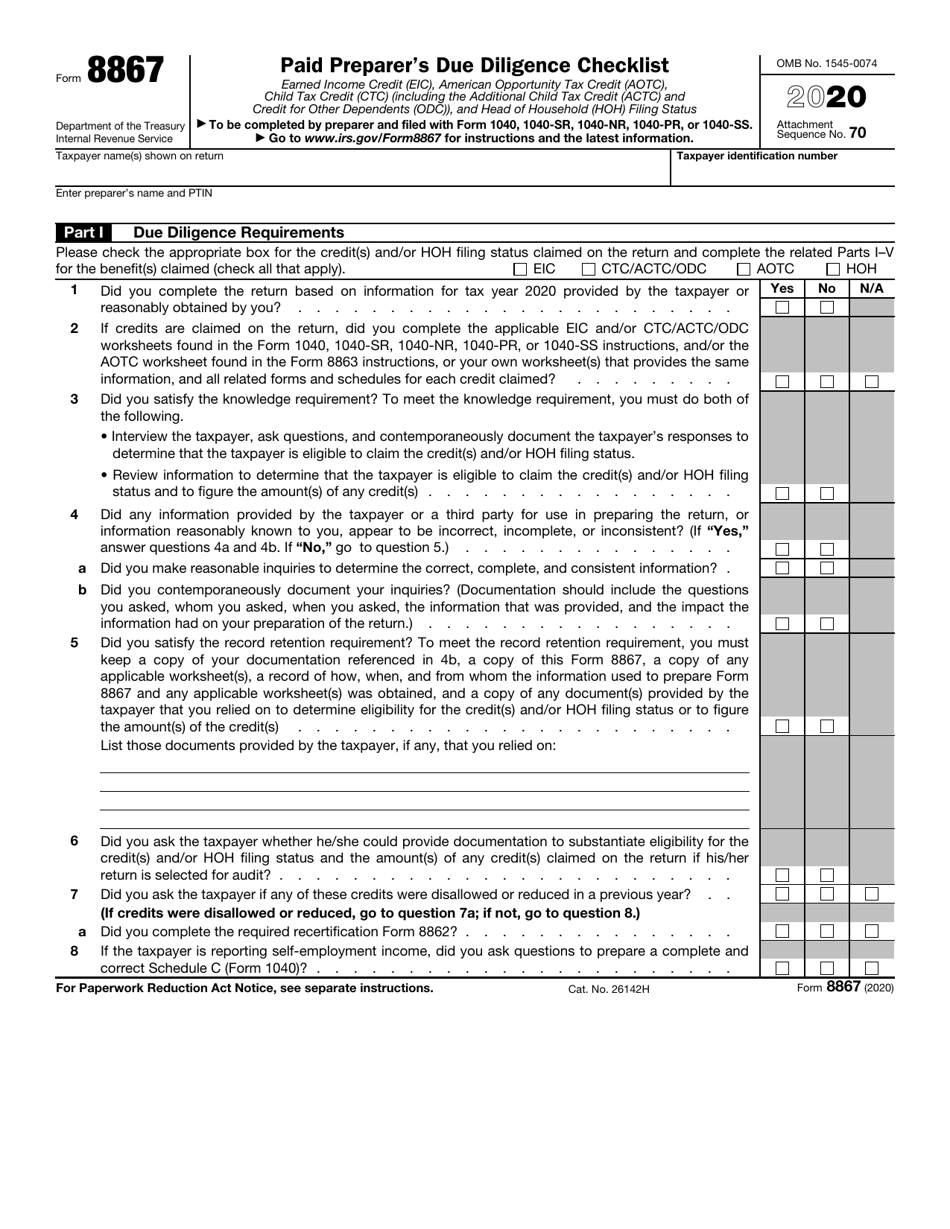

A: IRS Form 8867 is the Paid Preparer's Due Diligence Checklist.

Q: Who fills out Form 8867?

A: Paid tax preparers fill out Form 8867.

Q: What is the purpose of Form 8867?

A: The purpose of Form 8867 is to help tax preparers determine if they have met due diligence requirements.

Q: What is due diligence in tax preparation?

A: Due diligence in tax preparation refers to the thoroughness and accuracy of the information provided.

Q: What information is included in Form 8867?

A: Form 8867 includes questions about the taxpayer's eligible dependents, earned income, and other related details.

Q: Is Form 8867 mandatory?

A: Yes, Form 8867 is mandatory for paid tax preparers who claim the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), or American Opportunity Credit (AOTC) for their clients.

Q: What happens if a tax preparer doesn't fill out Form 8867?

A: If a tax preparer fails to fill out Form 8867, they may be subject to penalties or face consequences for not meeting the due diligence requirements.

Q: Can taxpayers fill out Form 8867 themselves?

A: No, Form 8867 is specifically for paid tax preparers and cannot be filled out by taxpayers.

Q: Are there any other requirements for tax preparers besides Form 8867?

A: Yes, tax preparers must also have the necessary qualifications, maintain client records, and follow other IRS guidelines in addition to filling out Form 8867.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8867 through the link below or browse more documents in our library of IRS Forms.