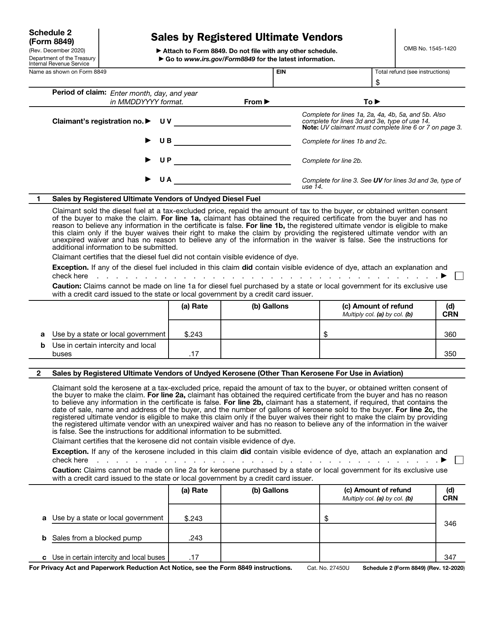

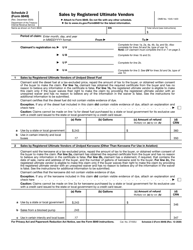

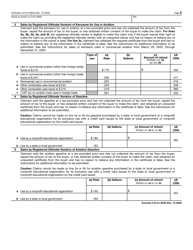

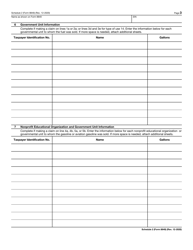

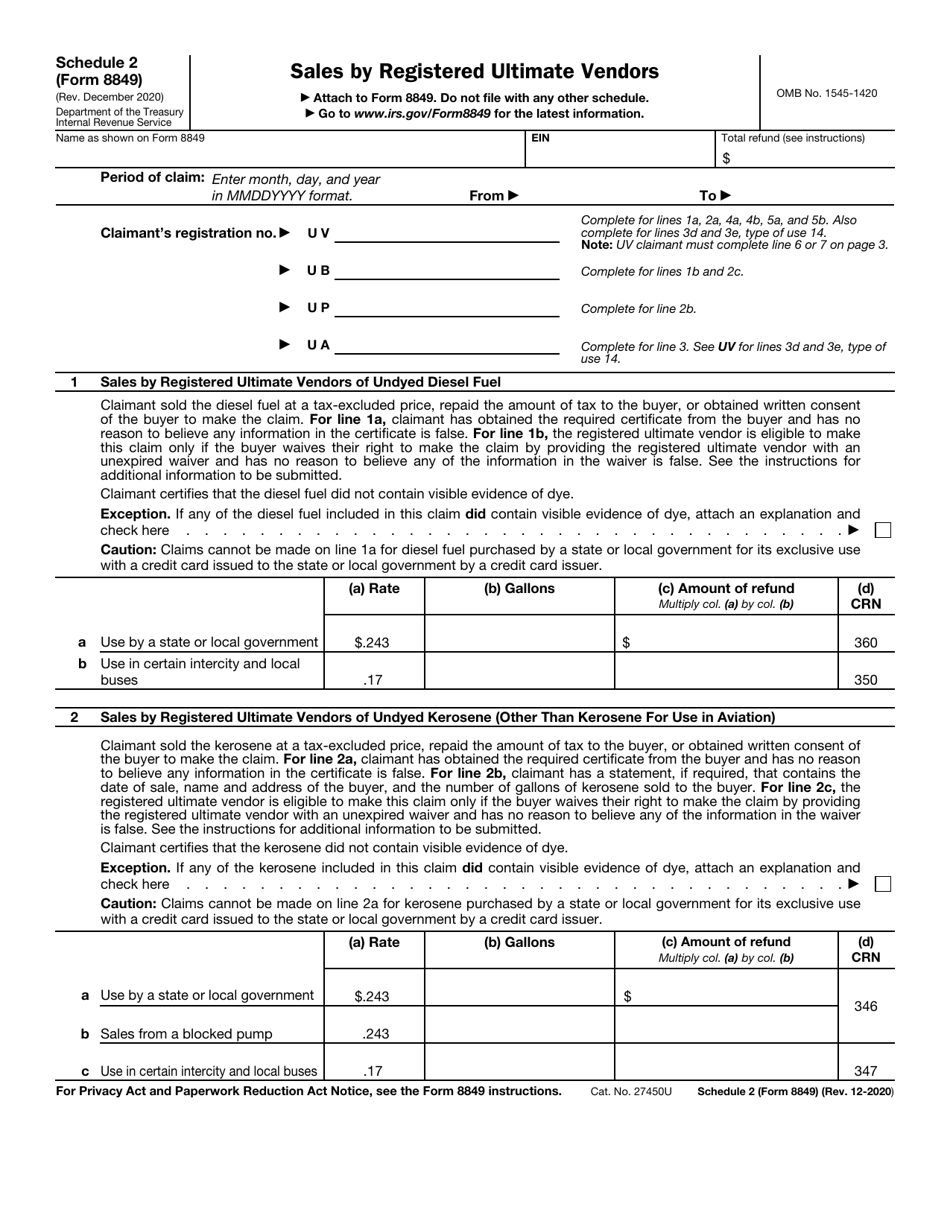

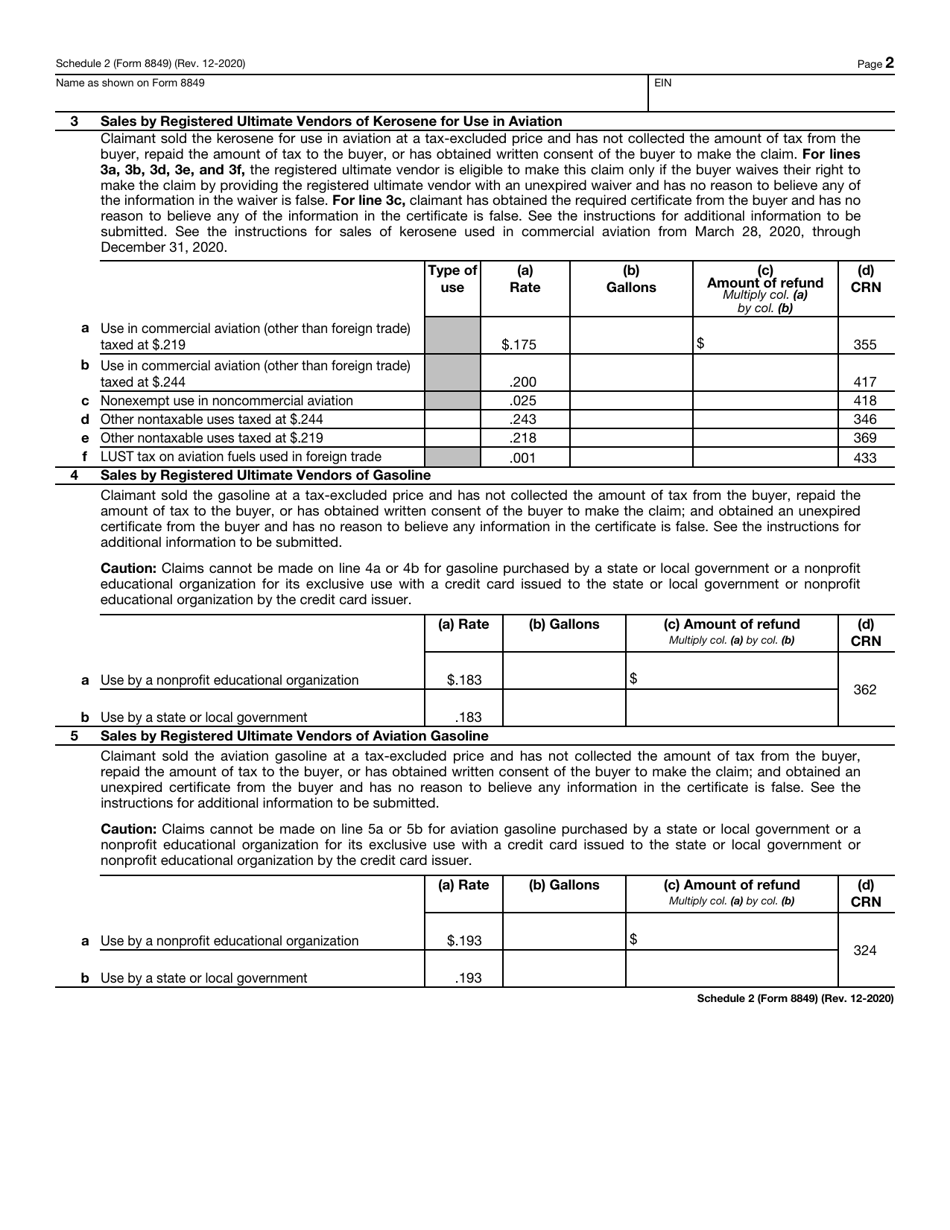

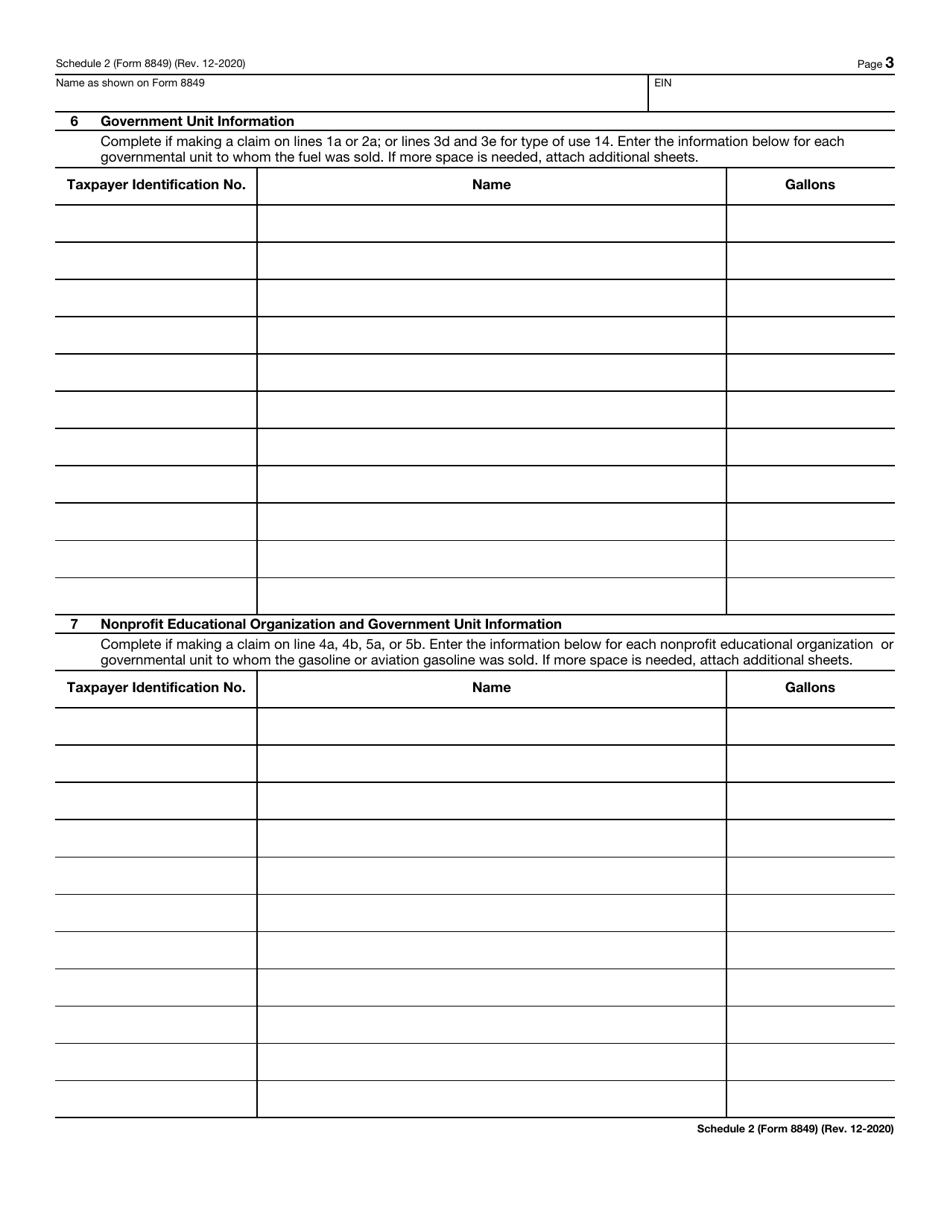

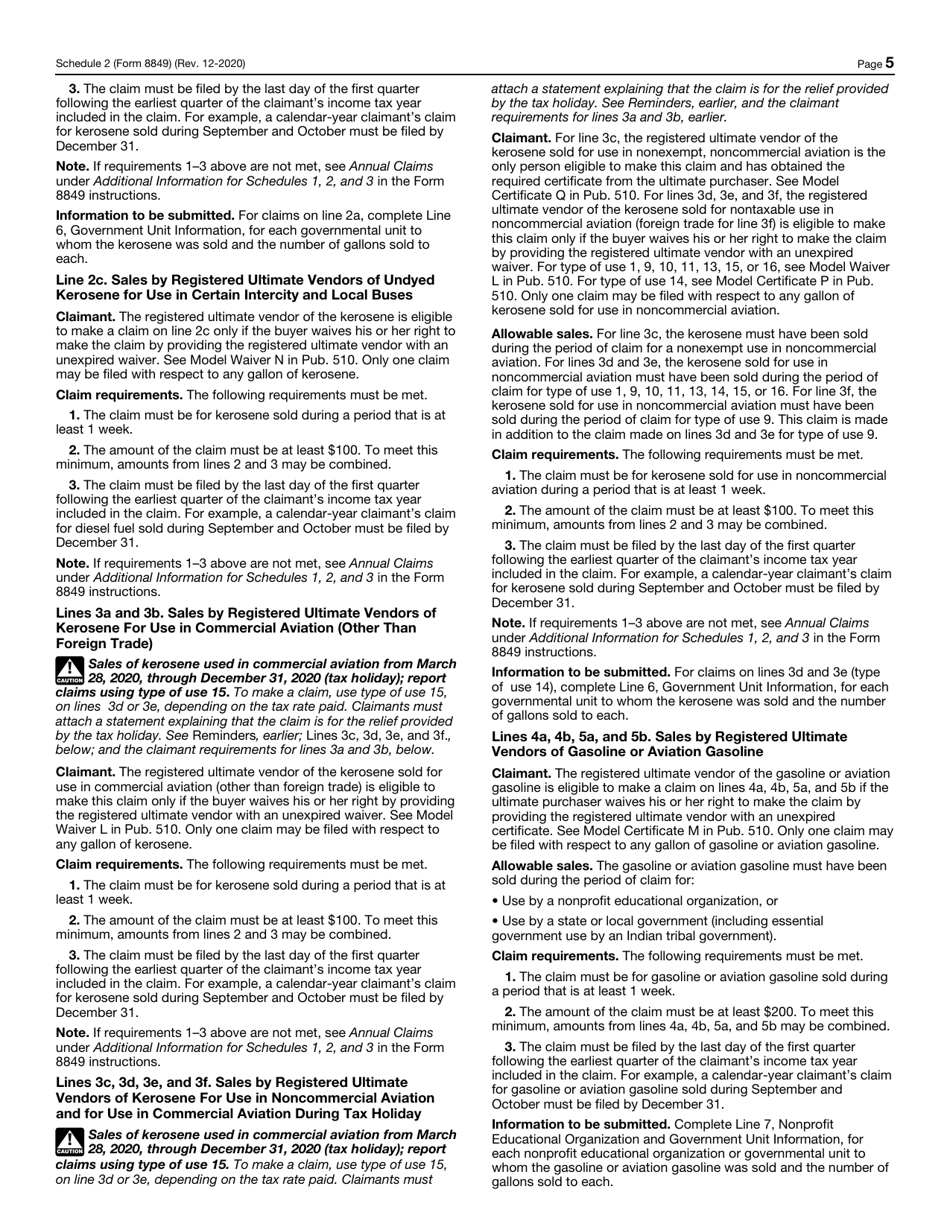

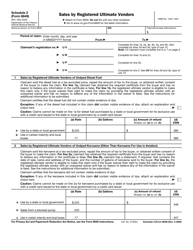

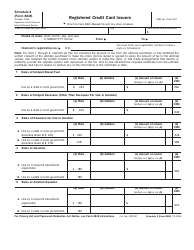

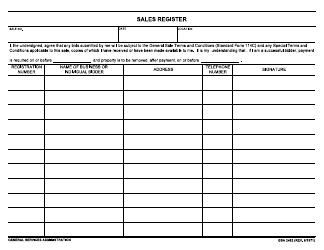

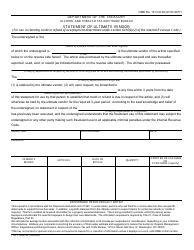

IRS Form 8849 Schedule 2 Sales by Registered Ultimate Vendors

What Is IRS Form 8849?

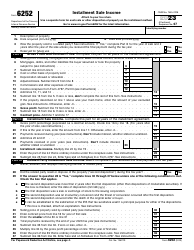

This is a legal form that was released by the U.S. Department of the Treasury - Office of the Comptroller of the Currency on December 1, 2020 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IRS Form 8849?

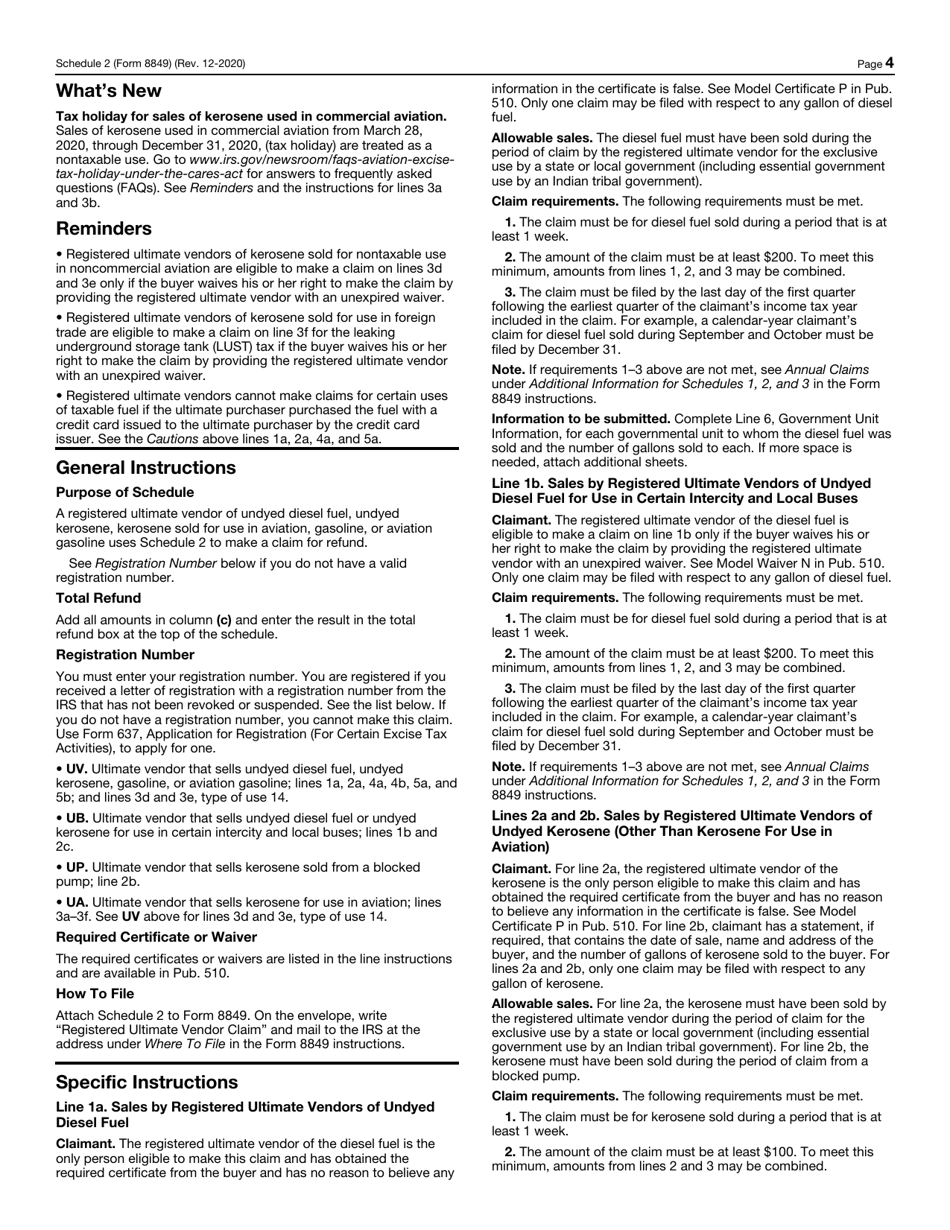

A: IRS Form 8849 is a tax form used to claim refunds or credits for certain excise taxes, such as those related to fuels, vehicles, and certain other excise taxes.

Q: Who can use IRS Form 8849?

A: IRS Form 8849 can be used by registered ultimate vendors to claim refunds or credits for certain excise taxes they have paid or are liable for.

Q: What is a registered ultimate vendor?

A: A registered ultimate vendor is a person who is registered under IRS regulations and sells certain fuels, vehicles, or taxable medical devices.

Q: What kind of taxes can be claimed on IRS Form 8849?

A: IRS Form 8849 can be used to claim refunds or credits for certain excise taxes, such as those related to fuels, vehicles, and certain other excise taxes.

Q: Is there a deadline for filing IRS Form 8849?

A: Yes, there is a deadline for filing IRS Form 8849. Generally, it must be filed by the last day of the first quarter following the quarter in which the tax was paid or became due.

Form Details:

- Released on December 1, 2020;

- The latest available edition released by the U.S. Department of the Treasury - Office of the Comptroller of the Currency;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8849 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Office of the Comptroller of the Currency.