This version of the form is not currently in use and is provided for reference only. Download this version of

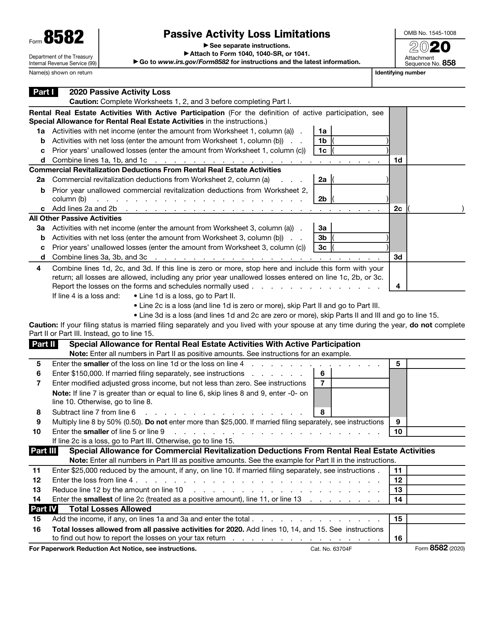

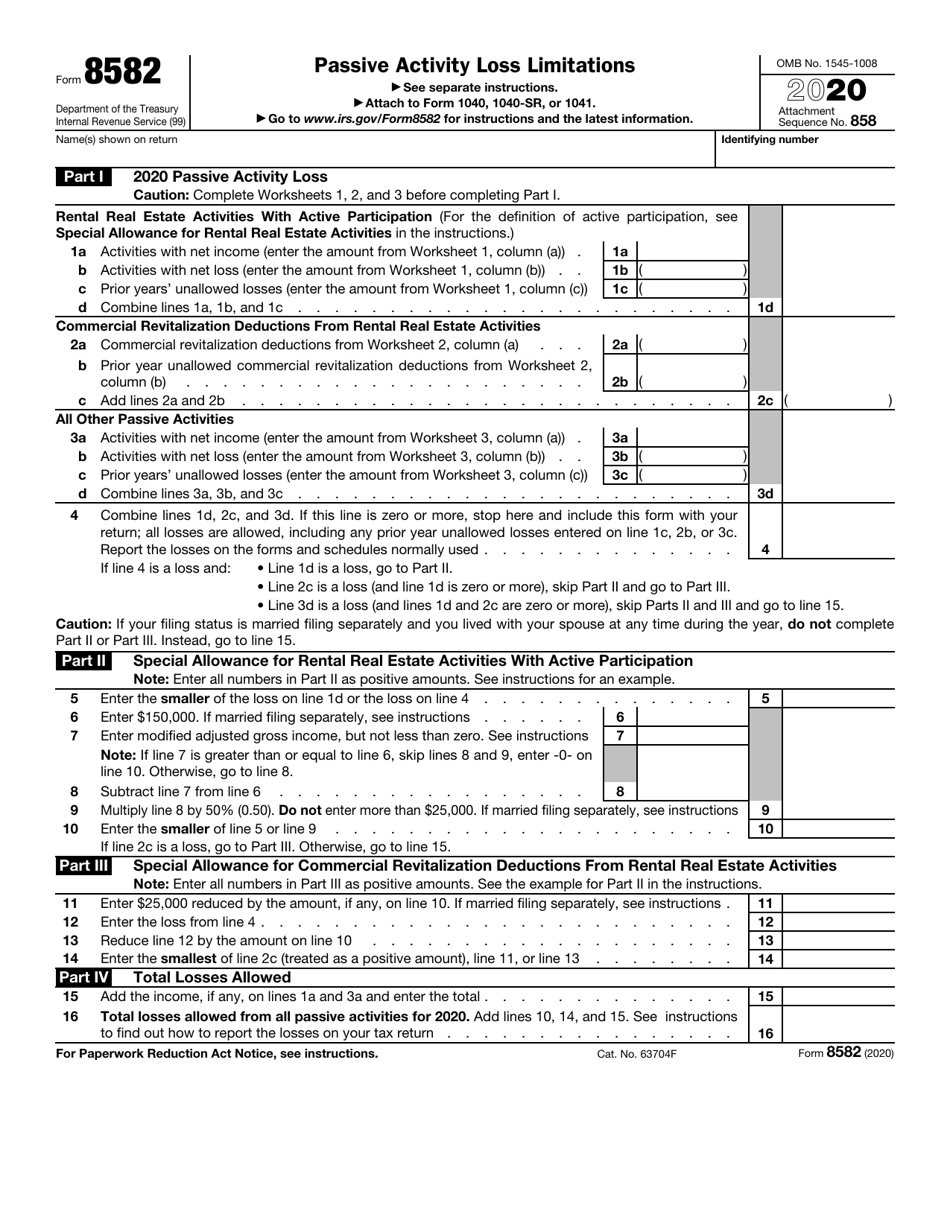

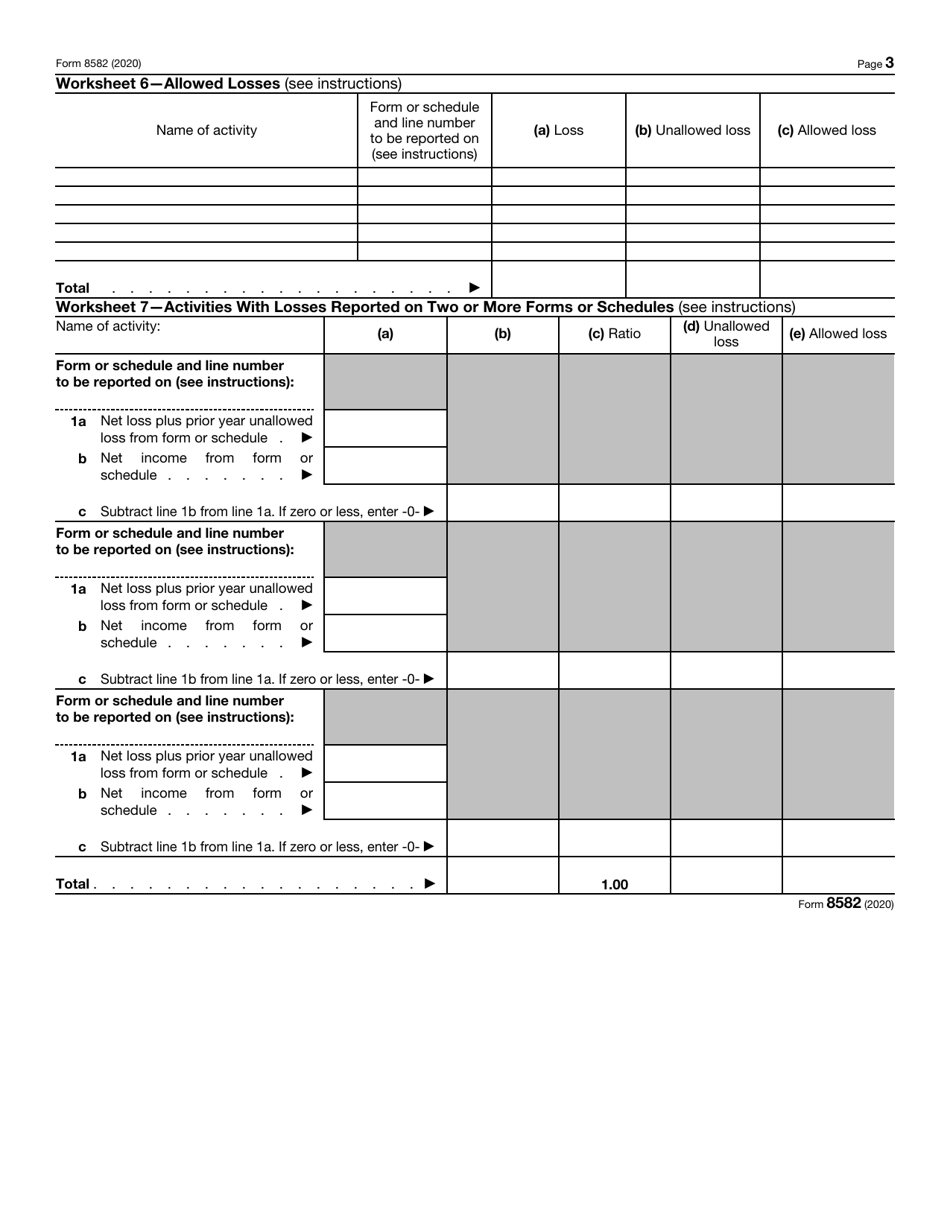

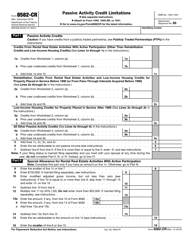

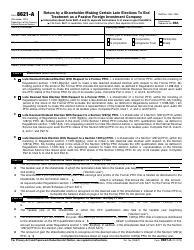

IRS Form 8582

for the current year.

IRS Form 8582 Passive Activity Loss Limitations

What Is IRS Form 8582?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8582?

A: IRS Form 8582 is used to calculate and report passive activity loss limitations.

Q: What are passive activity losses?

A: Passive activity losses are losses incurred from participation in rental real estate, limited partnerships, or other activities in which the taxpayer does not materially participate.

Q: Why do I need to file Form 8582?

A: You need to file Form 8582 if you have passive activity losses or income that need to be reported or if you are subject to passive activity loss limitations.

Q: What are passive activity loss limitations?

A: Passive activity loss limitations are rules set by the IRS that restrict the ability to deduct passive activity losses against other types of income.

Q: How do I calculate passive activity loss limitations?

A: You can calculate passive activity loss limitations by completing the appropriate sections of IRS Form 8582.

Q: Can I carry forward unused passive activity losses?

A: Yes, if you cannot fully deduct your passive activity losses in the current year, you can carry them forward to future years to offset future passive activity income.

Q: Can I e-file Form 8582?

A: Yes, you can e-file Form 8582 if you are filing your tax return electronically.

Q: What documentation should I keep when filing Form 8582?

A: You should keep all supporting documentation related to your passive activities, including records of income and expenses, for at least three years from the date you file your tax return.

Q: Do I need to file Form 8582 every year?

A: You need to file Form 8582 only in the years when you have passive activity losses or income that need to be reported or if you are subject to passive activity loss limitations.

Form Details:

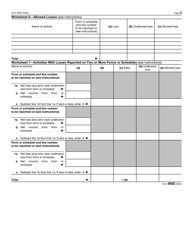

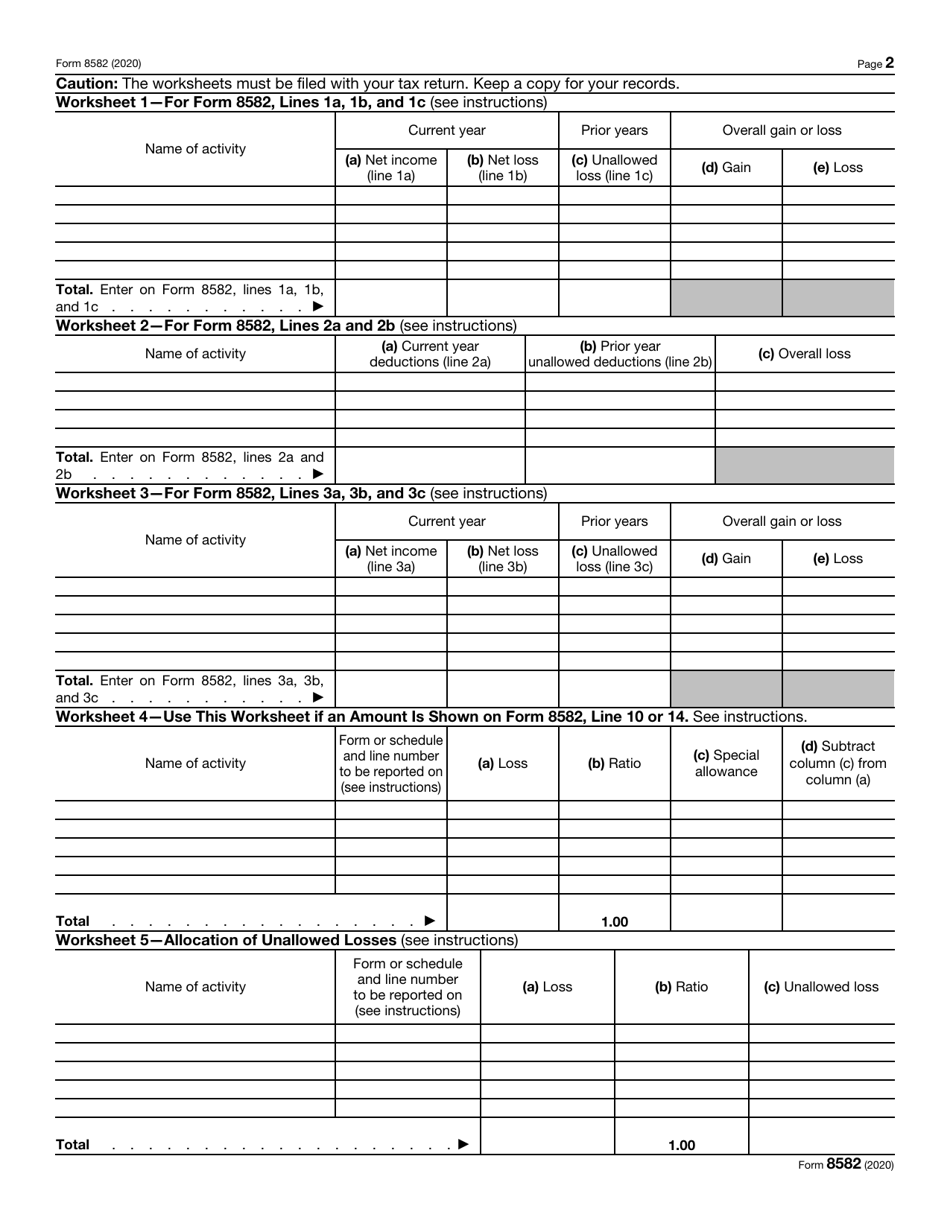

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8582 through the link below or browse more documents in our library of IRS Forms.