This version of the form is not currently in use and is provided for reference only. Download this version of

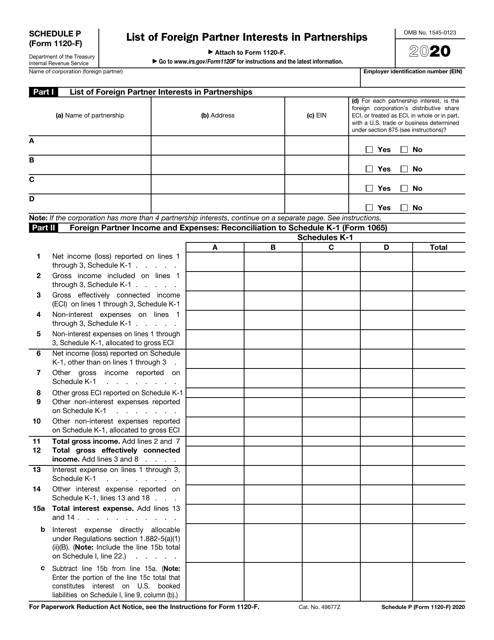

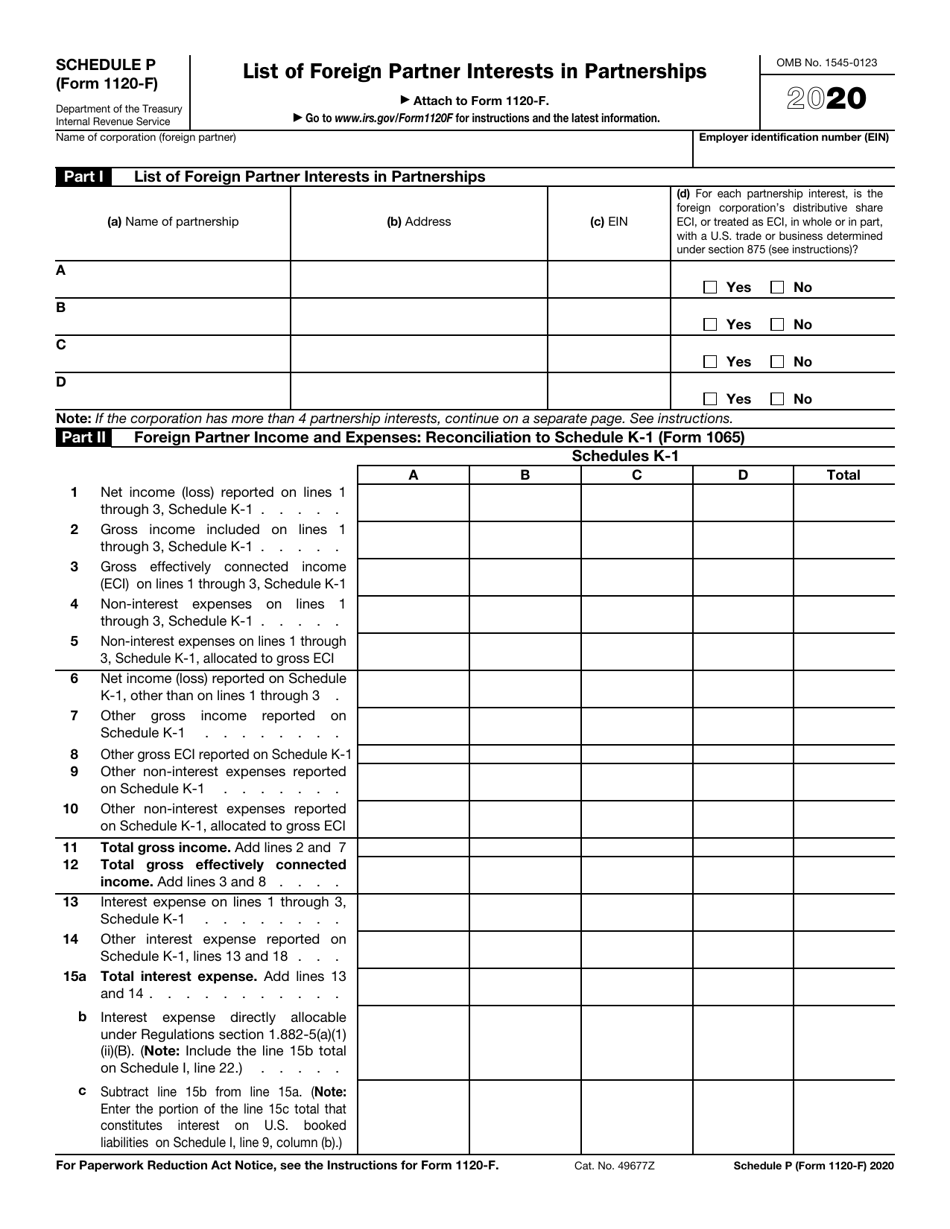

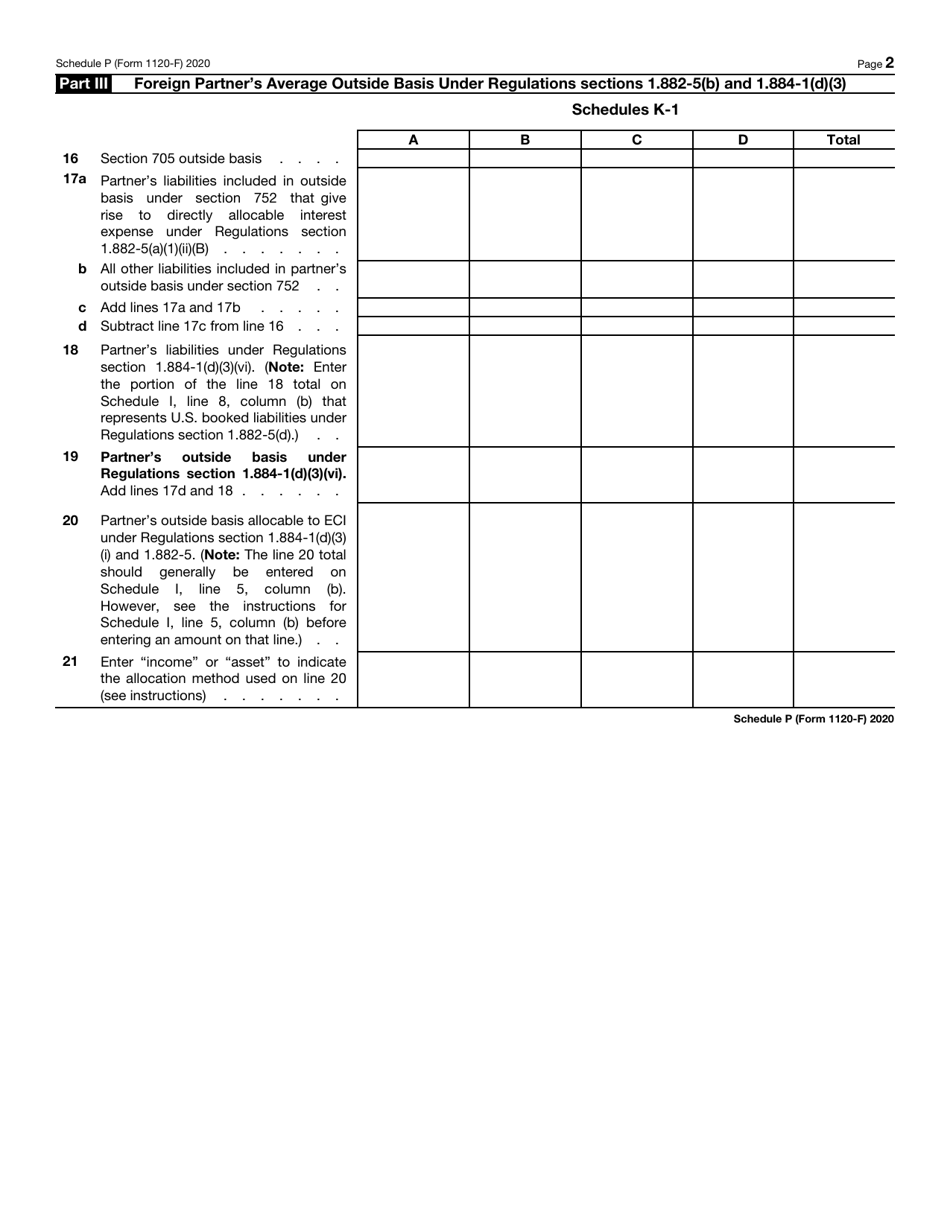

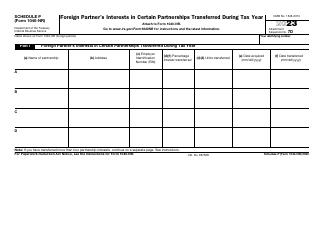

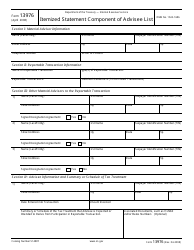

IRS Form 1120-F Schedule P

for the current year.

IRS Form 1120-F Schedule P List of Foreign Partner Interests in Partnerships

What Is IRS Form 1120-F Schedule P?

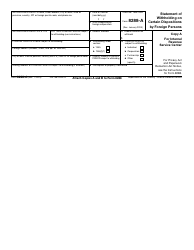

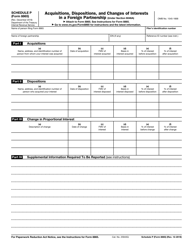

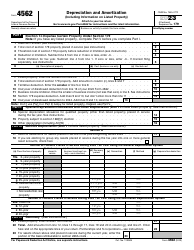

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1120-F?

A: Form 1120-F is a U.S. Income Tax Return for a Foreign Corporation.

Q: What is Schedule P?

A: Schedule P is a part of Form 1120-F that lists the foreign partner interests in partnerships.

Q: Who needs to file Form 1120-F?

A: Foreign corporations engaged in a U.S. trade or business need to file Form 1120-F.

Q: What is meant by 'foreign partner interests in partnerships'?

A: It refers to investments in partnerships held by foreign corporations.

Q: Why is it important to list these interests on Schedule P?

A: Listing foreign partner interests helps the IRS track the income and tax liabilities of foreign corporations.

Q: Are there any specific requirements for reporting these interests?

A: Yes, the details of each partnership interest, including income and deductions, must be reported accurately on Schedule P.

Q: What if a foreign corporation does not have any partnership interests?

A: If a foreign corporation does not have any partnership interests, it does not need to file Schedule P.

Q: Is Form 1120-F Schedule P the only schedule that needs to be filed?

A: No, in addition to Schedule P, foreign corporations may need to file other schedules depending on their specific circumstances.

Q: What are the consequences of not filing Form 1120-F?

A: Failure to file Form 1120-F and its related schedules can result in penalties and potential audits by the IRS.

Form Details:

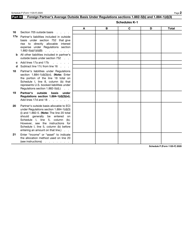

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule P through the link below or browse more documents in our library of IRS Forms.