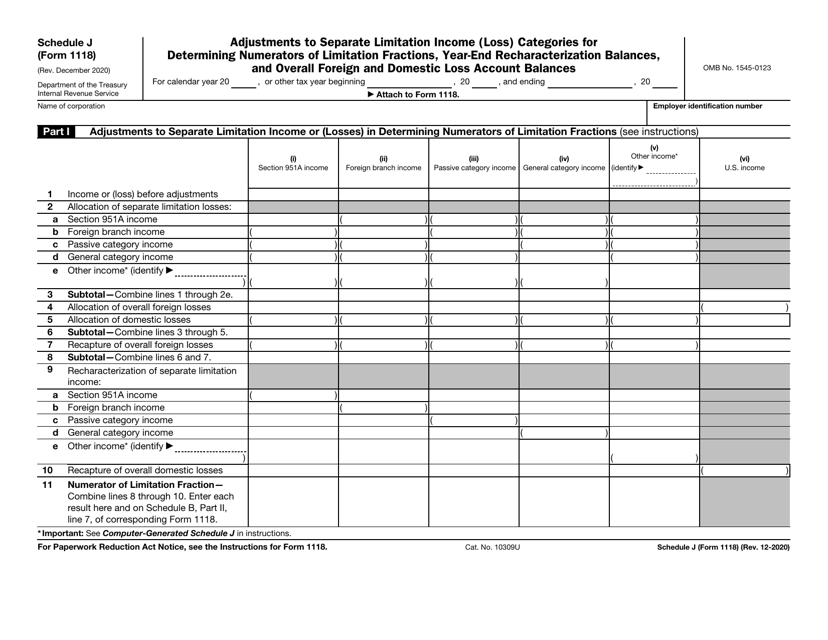

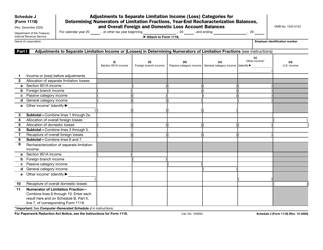

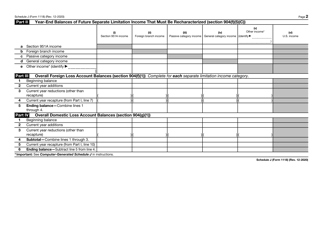

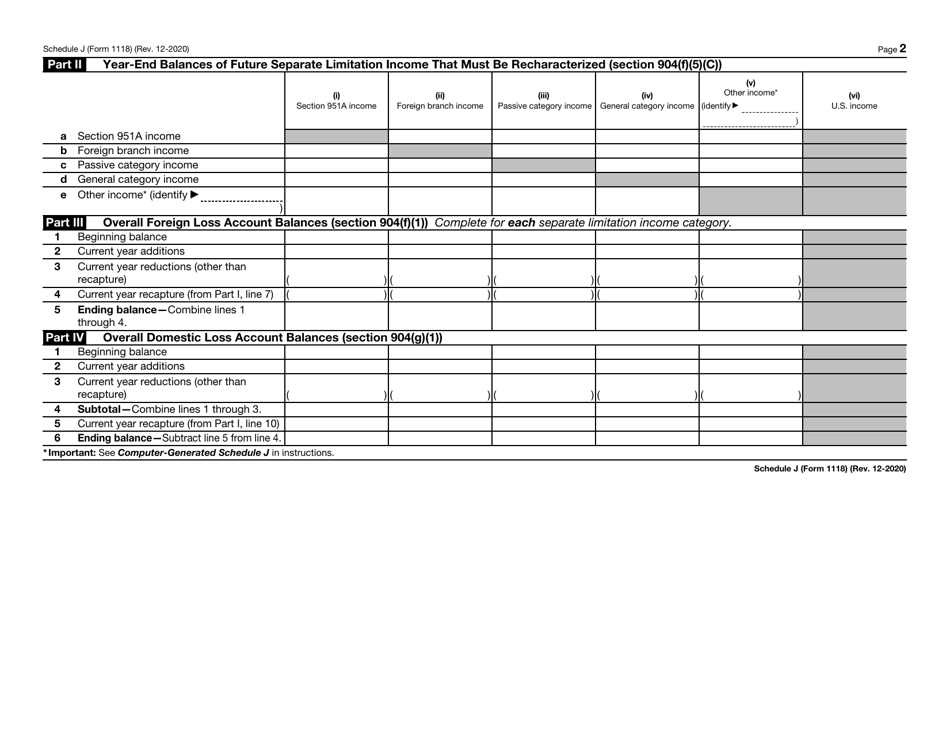

IRS Form 1118 Schedule J Adjustments to Separate Limitation Income (Loss) Categories for Determining Numerators of Limitation Fractions, Year-End Recharacterization Balances, and Overall Foreign and Domestic Loss Account Balances

What Is IRS Form 1118 Schedule J?

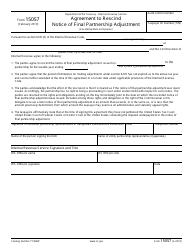

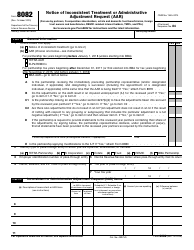

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2020. The document is a supplement to IRS Form 1118, Foreign Tax Credit - Corporations. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1118?

A: IRS Form 1118 is a form used to report adjustments to separate limitation income (loss) categories.

Q: What is Schedule J?

A: Schedule J is a part of IRS Form 1118 and is used to report adjustments to separate limitation income (loss) categories for determining numerators of limitation fractions.

Q: What are the adjustments reported on Schedule J?

A: The adjustments reported on Schedule J are for determining numerators of limitation fractions, year-end recharacterization balances, and overall foreign and domestic loss account balances.

Q: Who needs to file IRS Form 1118?

A: Taxpayers who have foreign tax credits or are required to file a tax return with the IRS and have income from foreign sources may need to file IRS Form 1118.

Q: What is the purpose of IRS Form 1118?

A: The purpose of IRS Form 1118 is to calculate and report the foreign tax credit that a taxpayer can claim for taxes paid or accrued to foreign countries or U.S. possessions.

Q: Are there any penalties for not filing IRS Form 1118?

A: Yes, there can be penalties for not filing IRS Form 1118 or for filing an incomplete or incorrect form. It is important to consult the IRS guidelines and instructions or seek professional tax advice to ensure compliance.

Q: What are limitation fractions?

A: Limitation fractions are used to calculate the foreign tax credit limit for each separate limitation category. The numerators of these fractions are determined by adjustments reported on Schedule J of IRS Form 1118.

Q: What are year-end recharacterization balances?

A: Year-end recharacterization balances are the balances of foreign income or loss that may have been recharacterized at the end of the tax year for the purpose of calculating the foreign tax credit.

Q: What are overall foreign and domestic loss account balances?

A: Overall foreign and domestic loss account balances are used to determine the foreign tax credit limitation and represent the net foreign source income or loss for the tax year.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1118 Schedule J through the link below or browse more documents in our library of IRS Forms.