This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1041 Schedule J

for the current year.

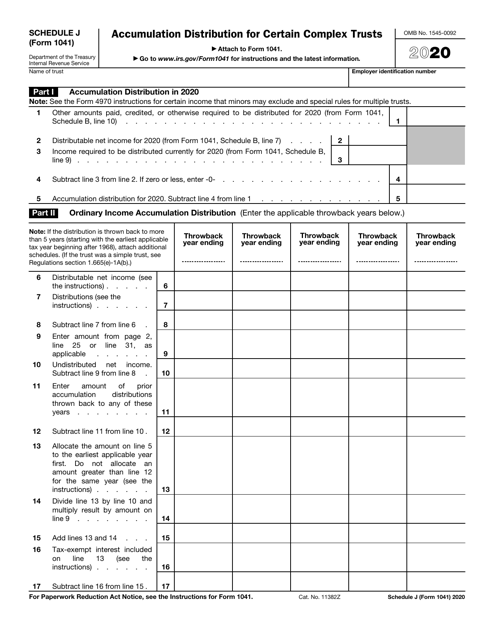

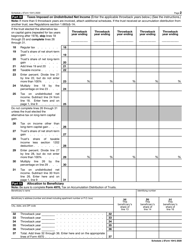

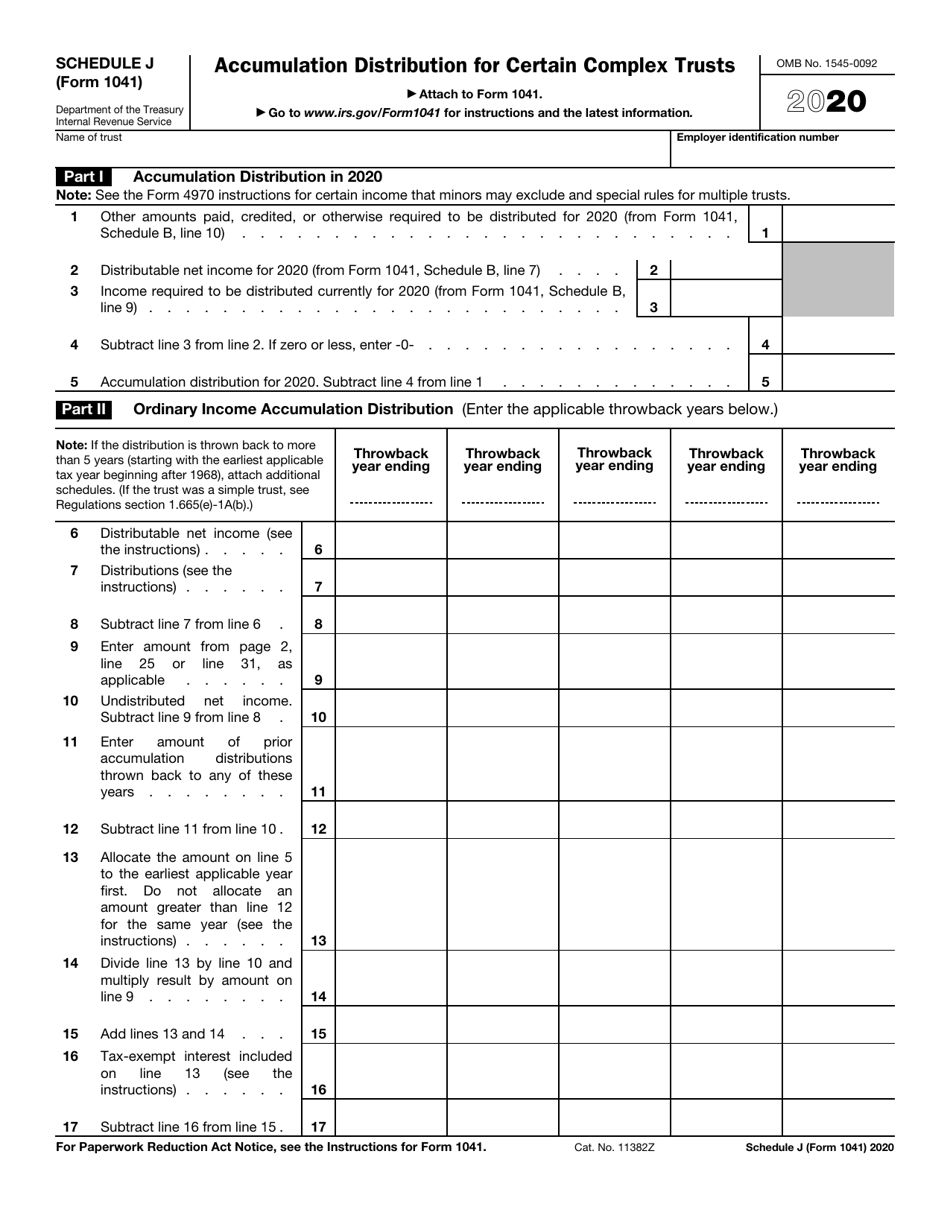

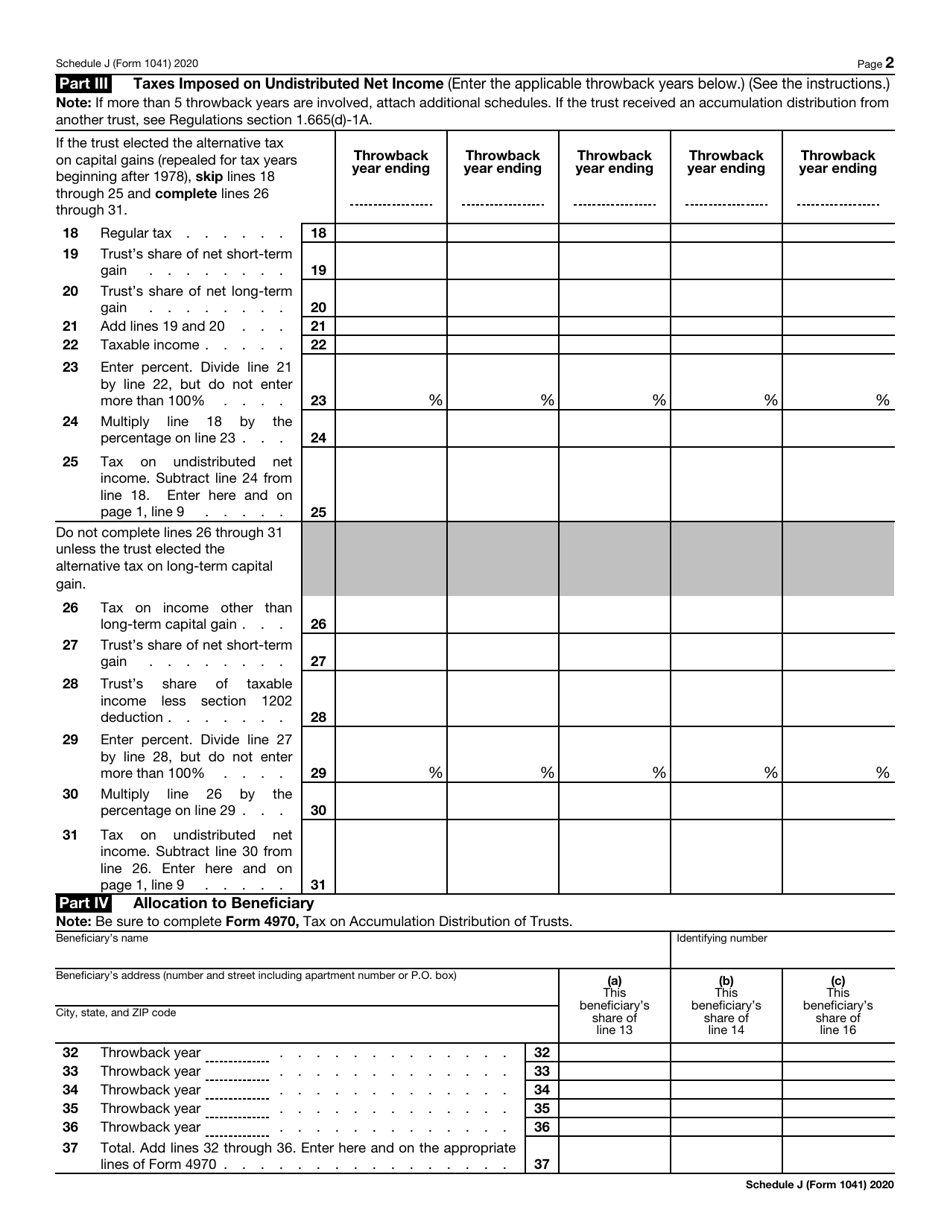

IRS Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts

What Is IRS Form 1041 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1041, U.S. Income Tax Return for Estates and Trusts. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1041 Schedule J?

A: IRS Form 1041 Schedule J is a form used to report the accumulation distribution for certain complex trusts.

Q: What is an accumulation distribution?

A: An accumulation distribution is the amount of income a trust accumulates instead of distributing to beneficiaries.

Q: Which trusts are required to file Schedule J?

A: Certain complex trusts that accumulate income are required to file Schedule J.

Q: What information is reported on Schedule J?

A: Schedule J reports the accumulation distribution, the trust's taxable income, and any tax owed by the trust.

Q: When is Schedule J due?

A: Schedule J is generally due on the same date as Form 1041, which is April 15th for most taxpayers.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule J through the link below or browse more documents in our library of IRS Forms.