This version of the form is not currently in use and is provided for reference only. Download this version of

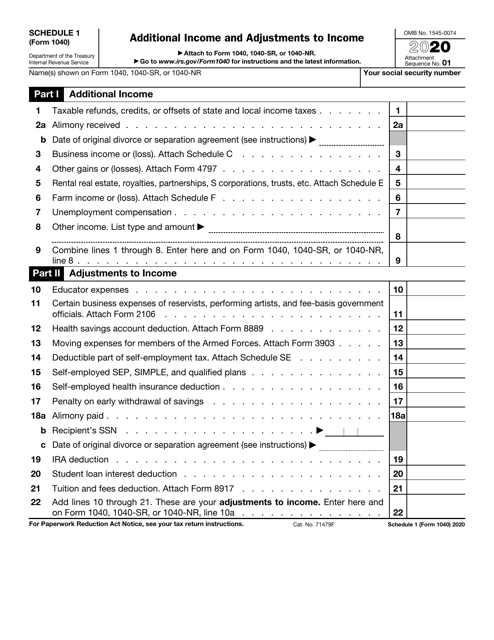

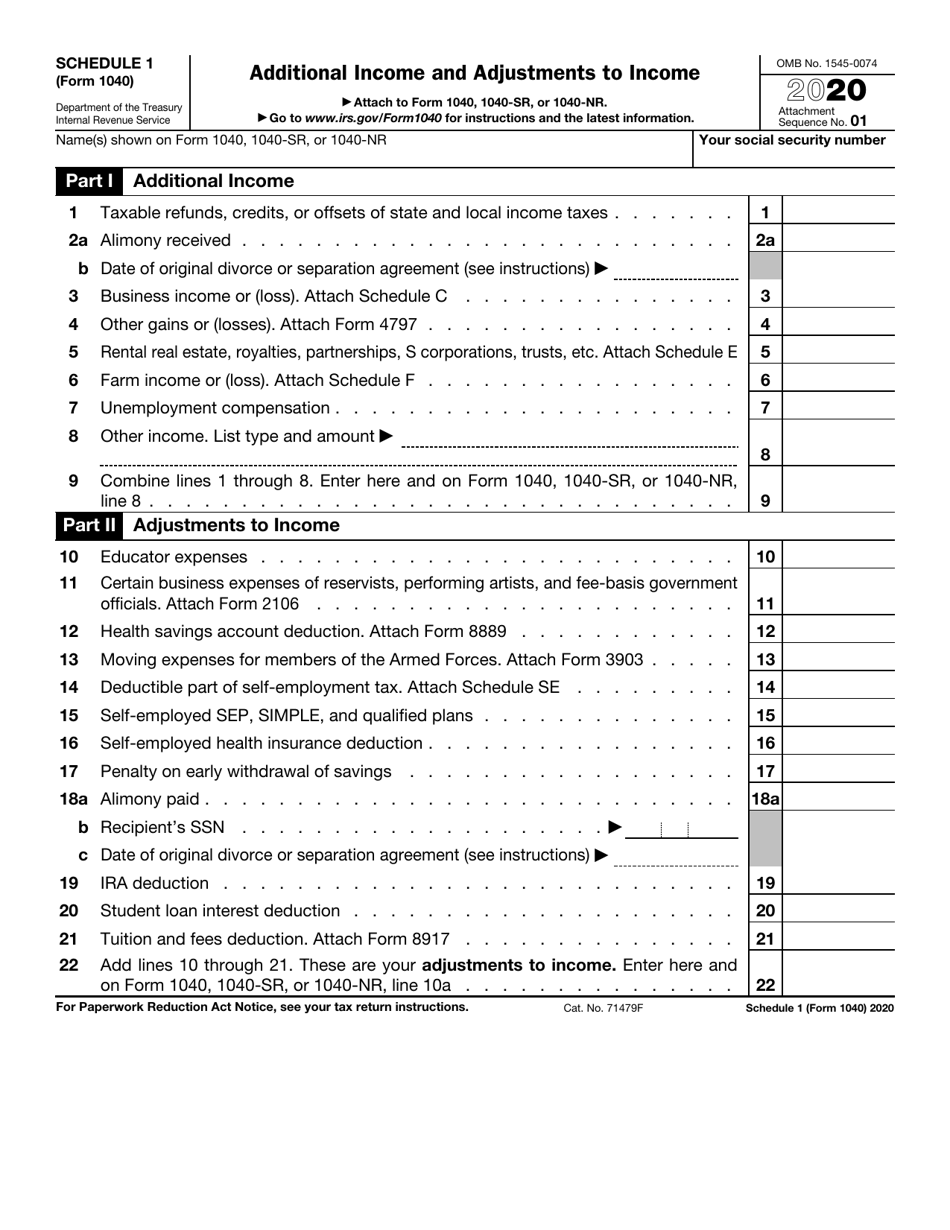

IRS Form 1040 Schedule 1

for the current year.

IRS Form 1040 Schedule 1 Additional Income and Adjustments to Income

What Is IRS Form 1040 Schedule 1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 1040 Schedule 1?

A: Form 1040 Schedule 1 is an attachment to the main Form 1040, used to report additional income and adjustments to income.

Q: Why would I need to file Form 1040 Schedule 1?

A: You may need to file Form 1040 Schedule 1 if you have additional sources of income or need to make adjustments to your income.

Q: What types of income should be reported on Form 1040 Schedule 1?

A: Income from sources such as rental properties, self-employment, unemployment compensation, and gambling winnings should be reported on Form 1040 Schedule 1.

Q: What are some examples of adjustments to income that should be reported on Form 1040 Schedule 1?

A: Examples of adjustments to income include deductions for student loan interest, self-employment tax, and contributions to retirement accounts.

Q: Do I need to file Form 1040 Schedule 1 if I have no additional income or adjustments to income?

A: If you have no additional income or adjustments to income, you generally do not need to file Form 1040 Schedule 1.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule 1 through the link below or browse more documents in our library of IRS Forms.