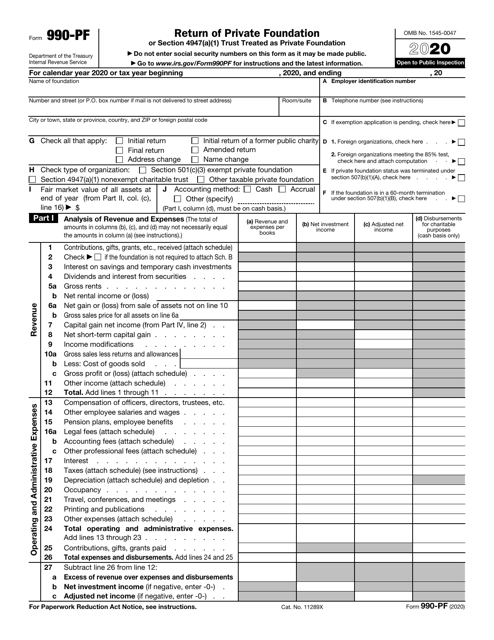

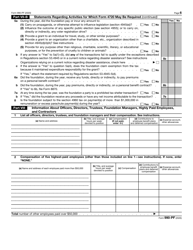

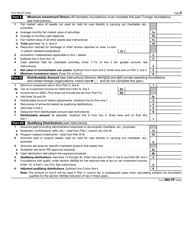

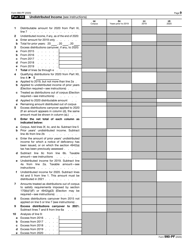

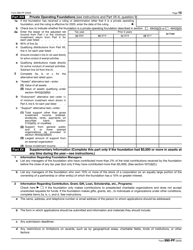

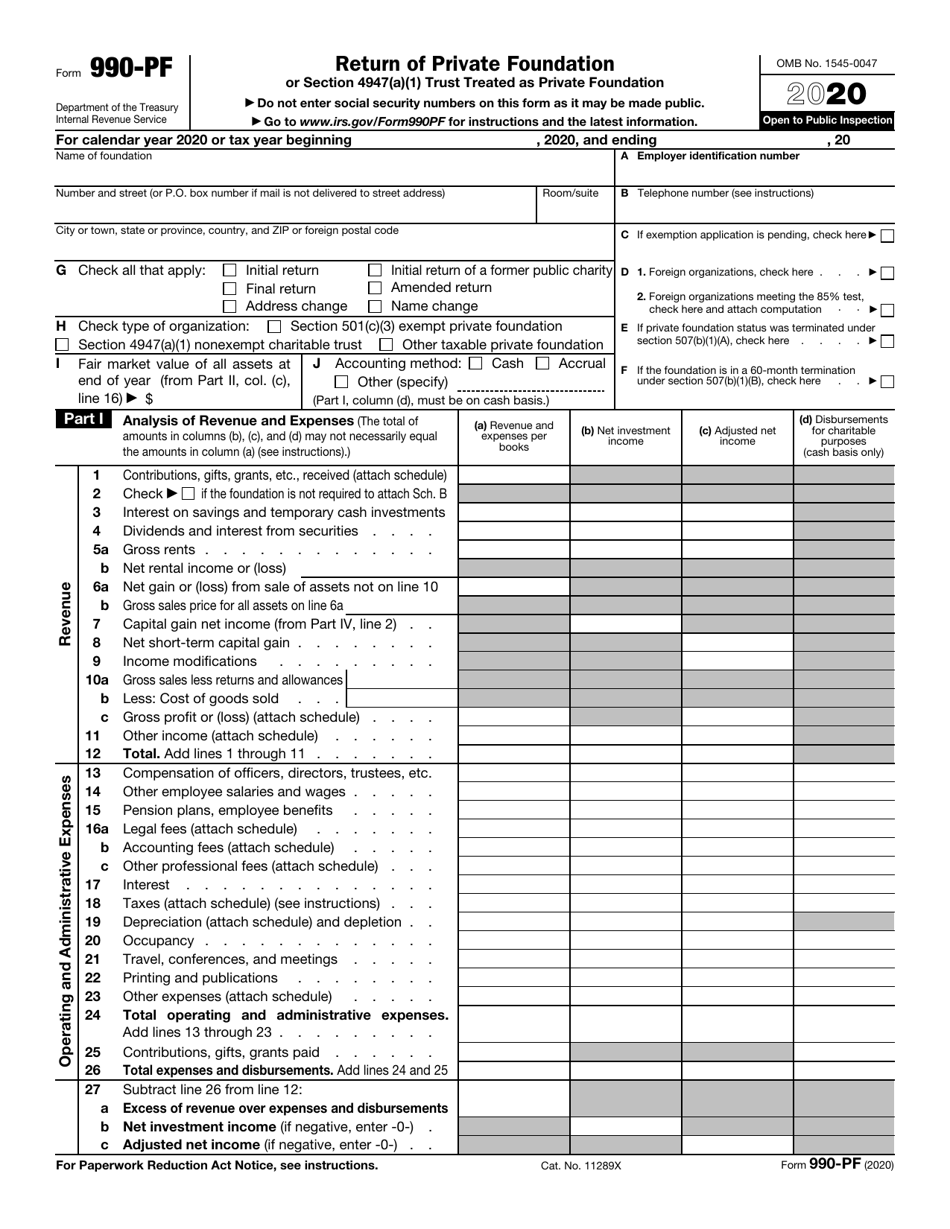

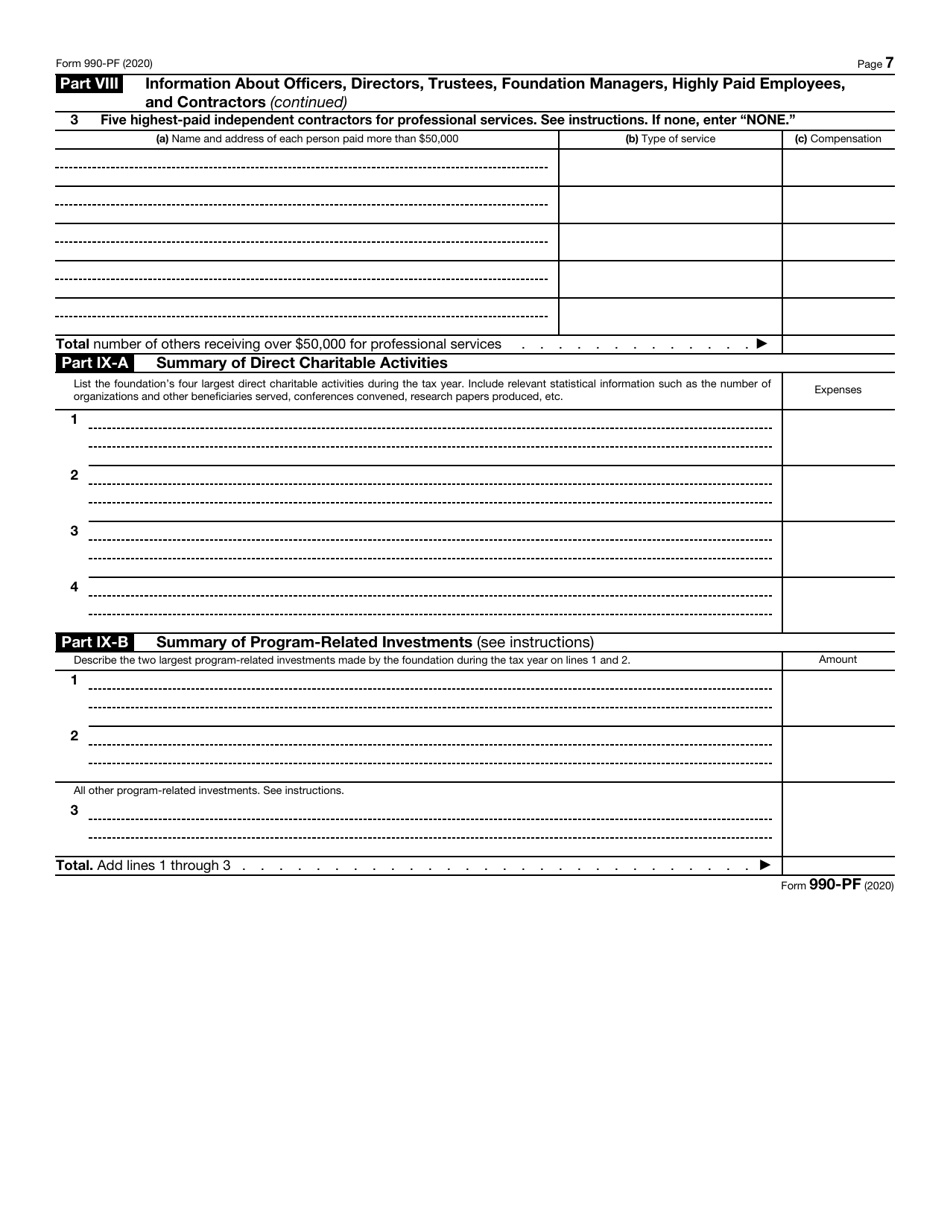

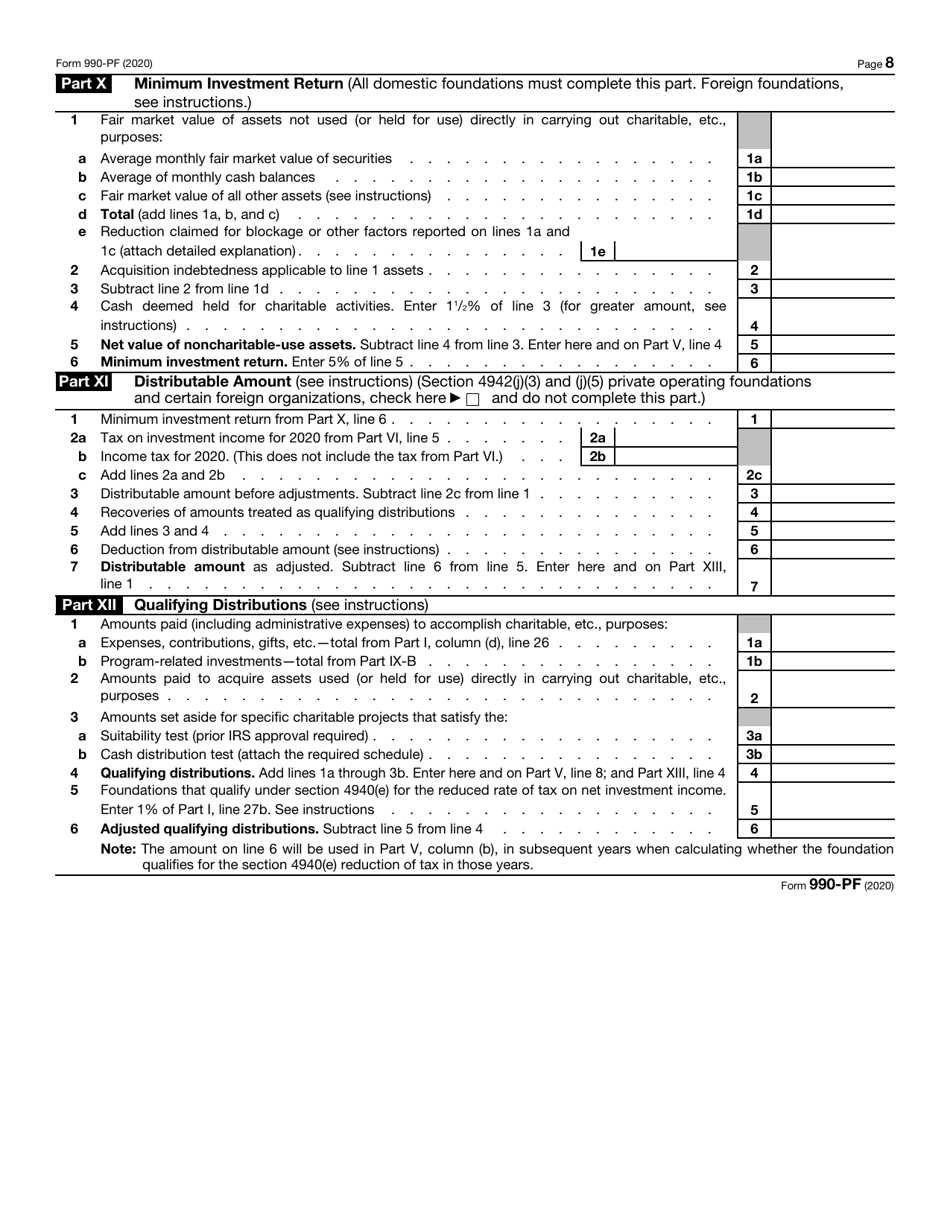

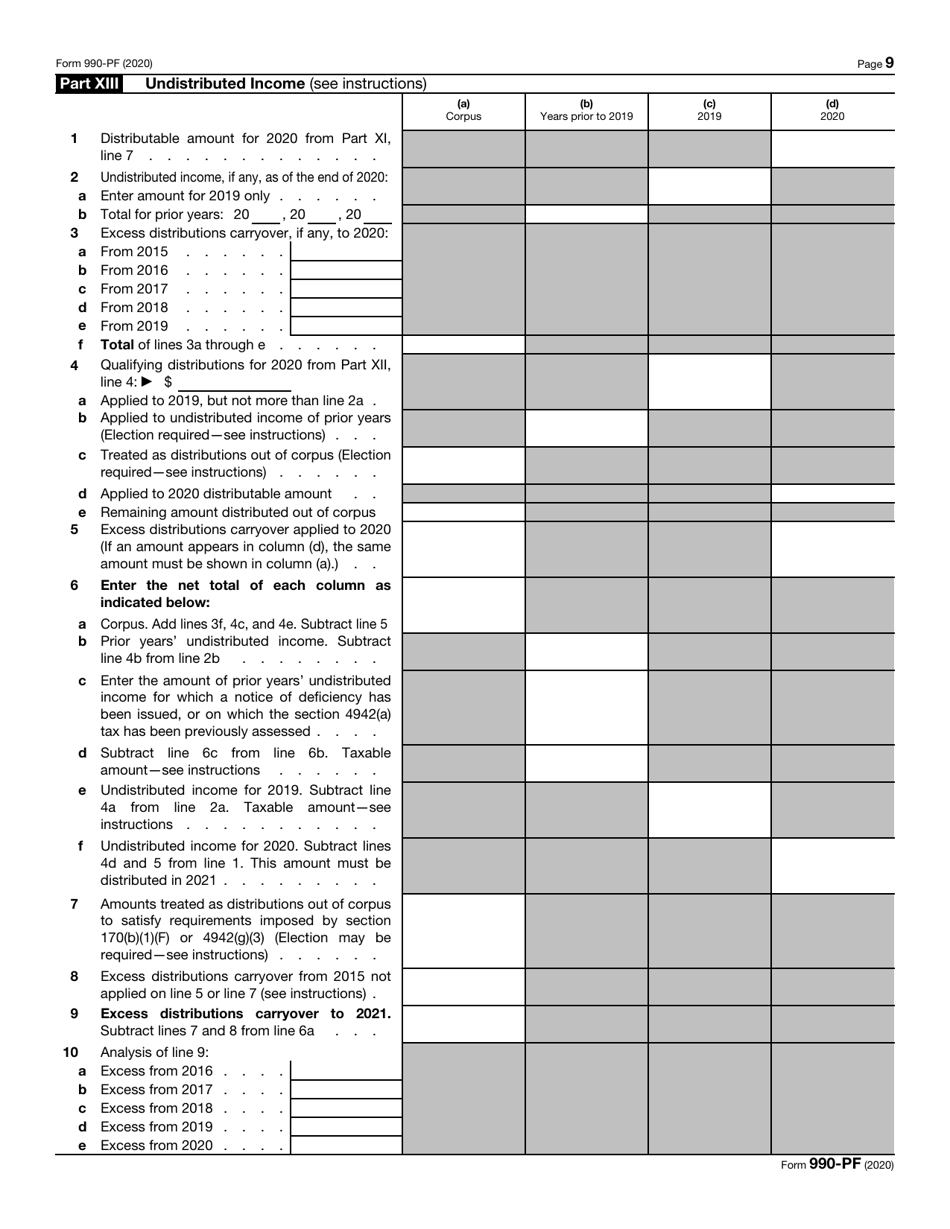

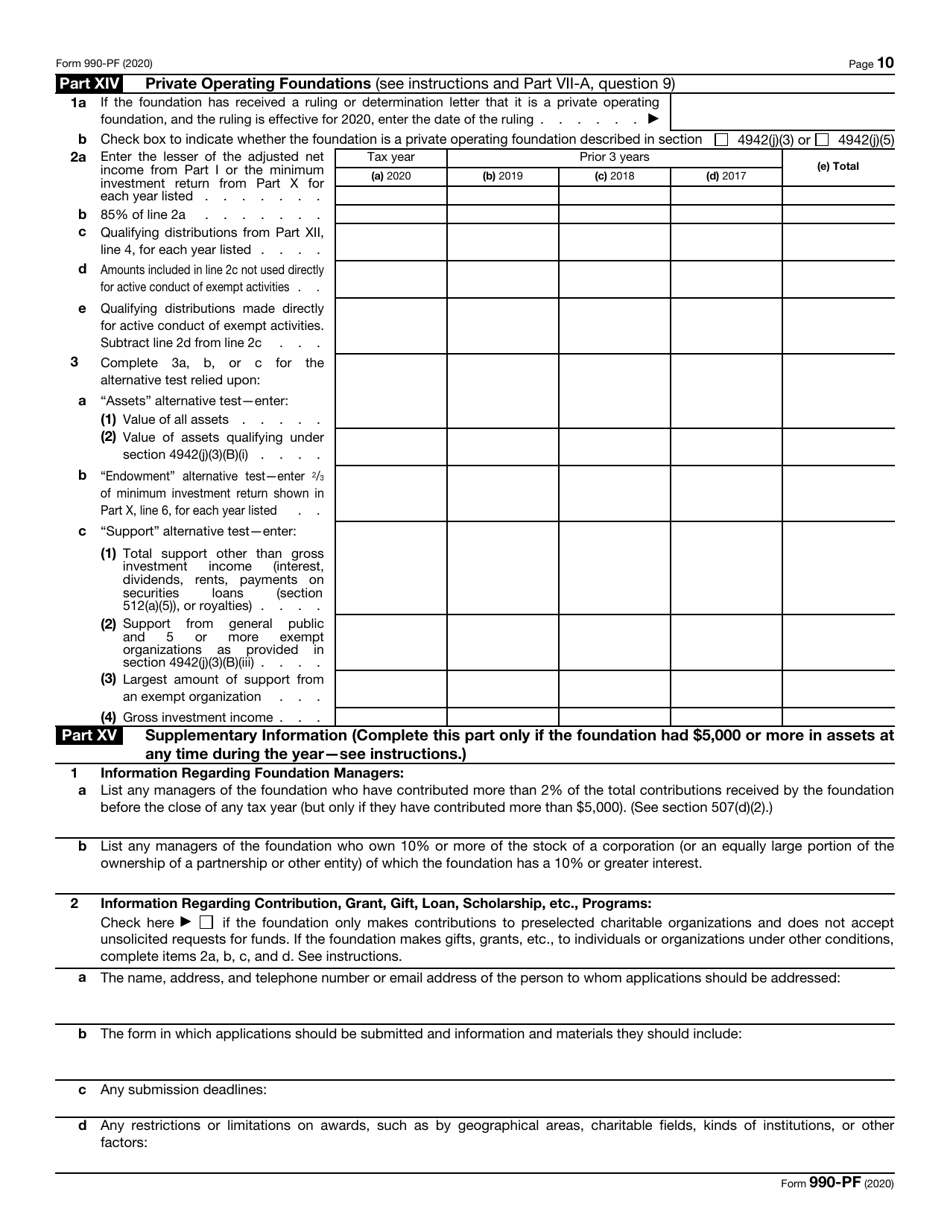

Form 990-PF Return of Private Foundation

What Is Form 990-PF?

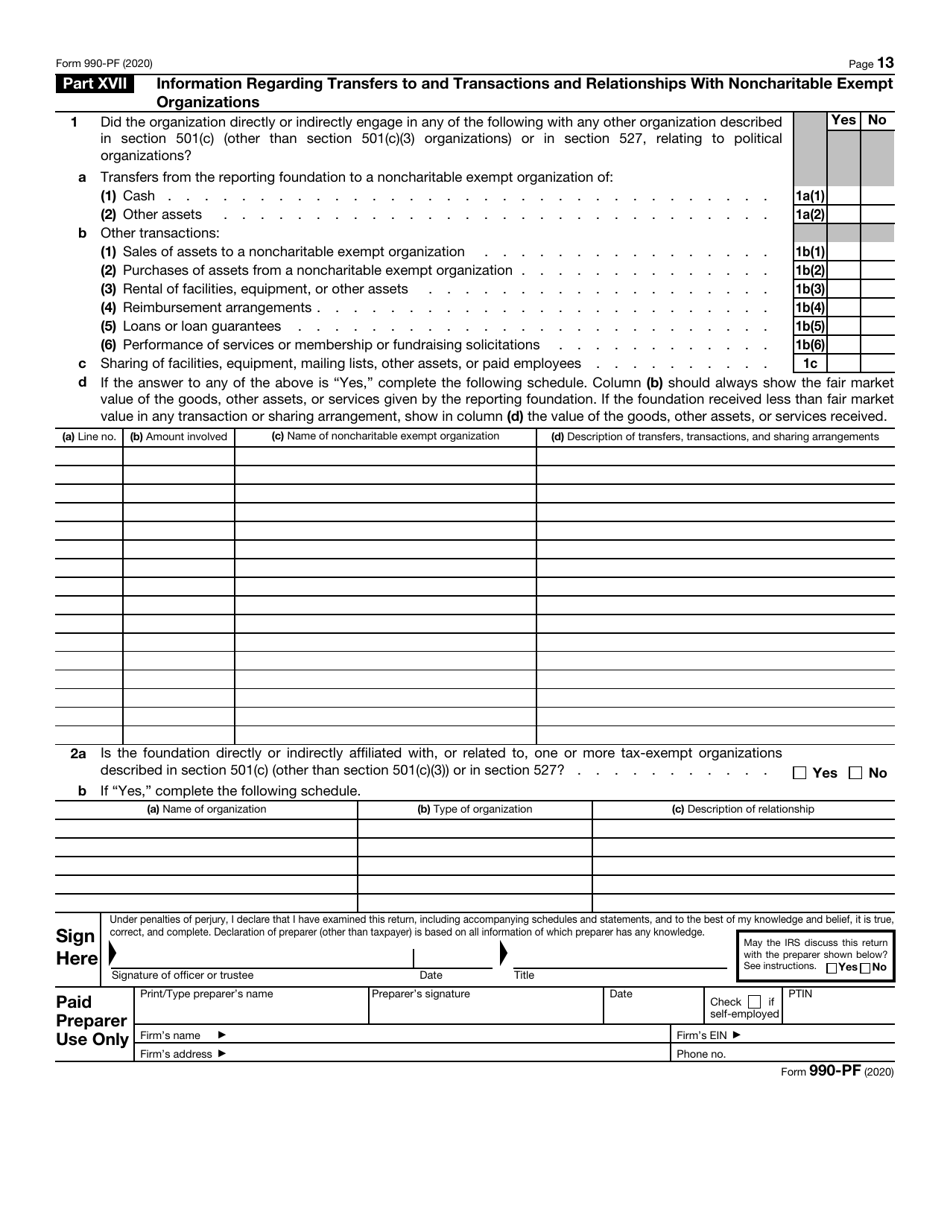

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 990-PF?

A: Form 990-PF is a tax return filed by private foundations to provide information on their financial activities.

Q: Who needs to file Form 990-PF?

A: Private foundations are required to file Form 990-PF if their gross income is above a certain threshold.

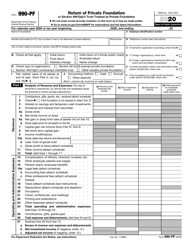

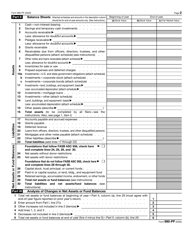

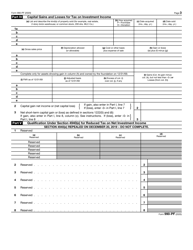

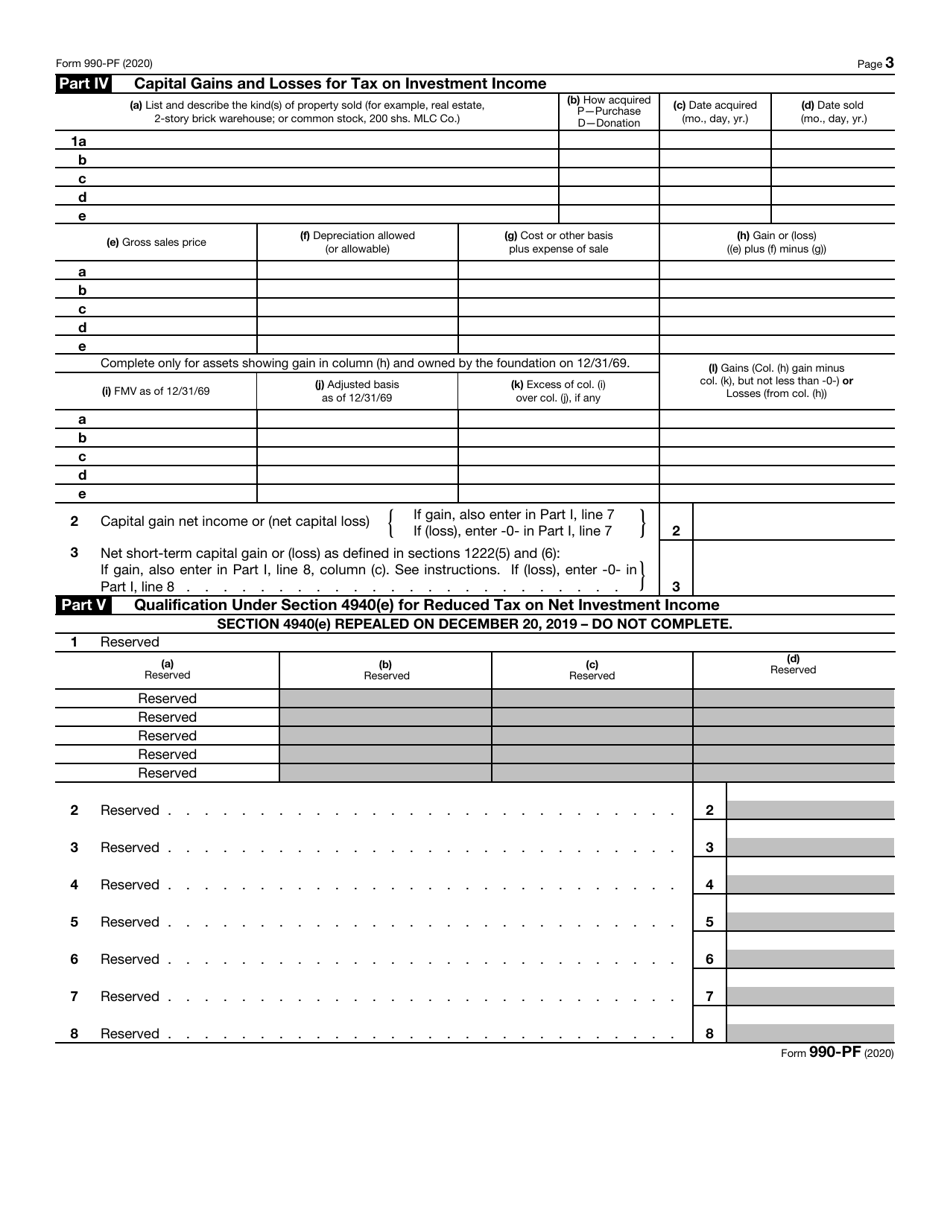

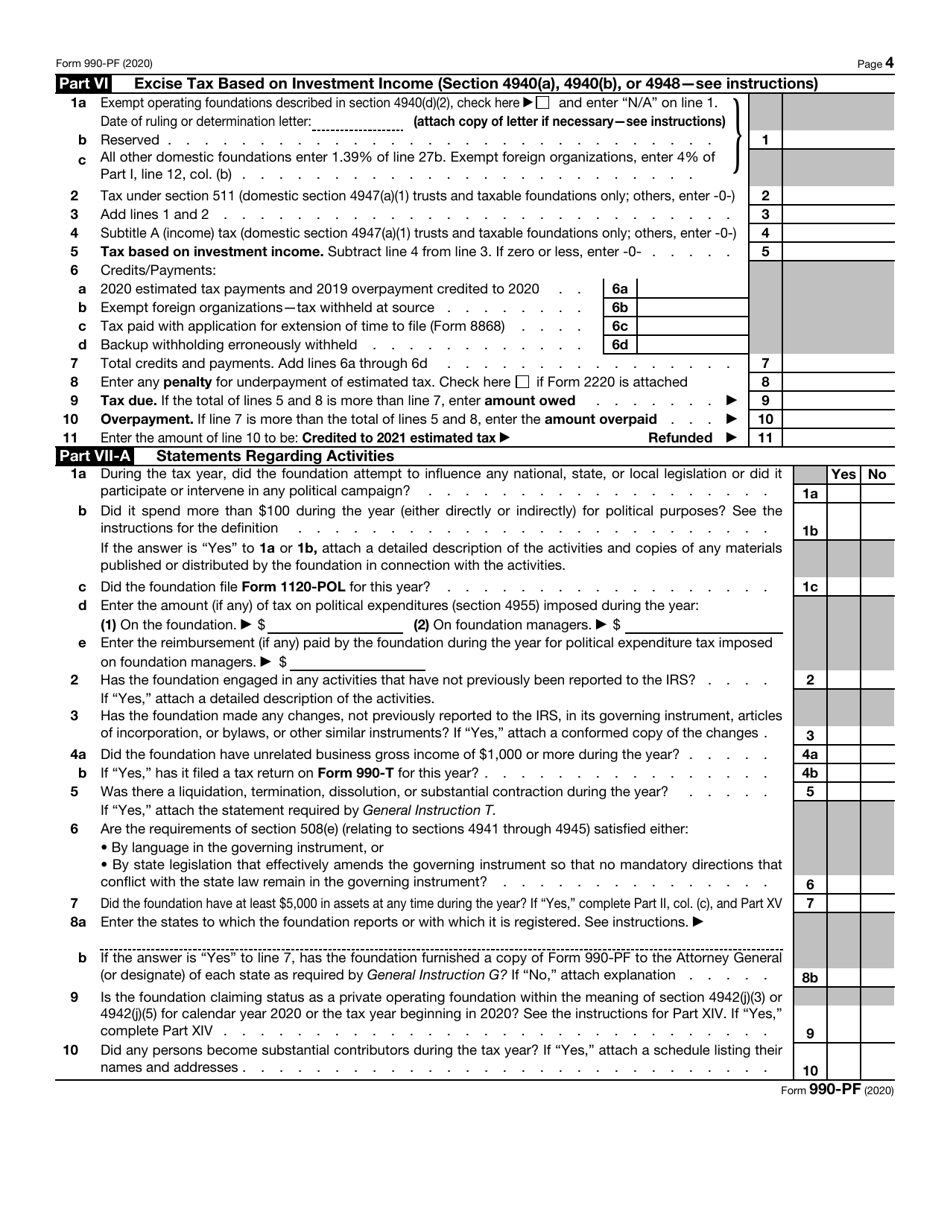

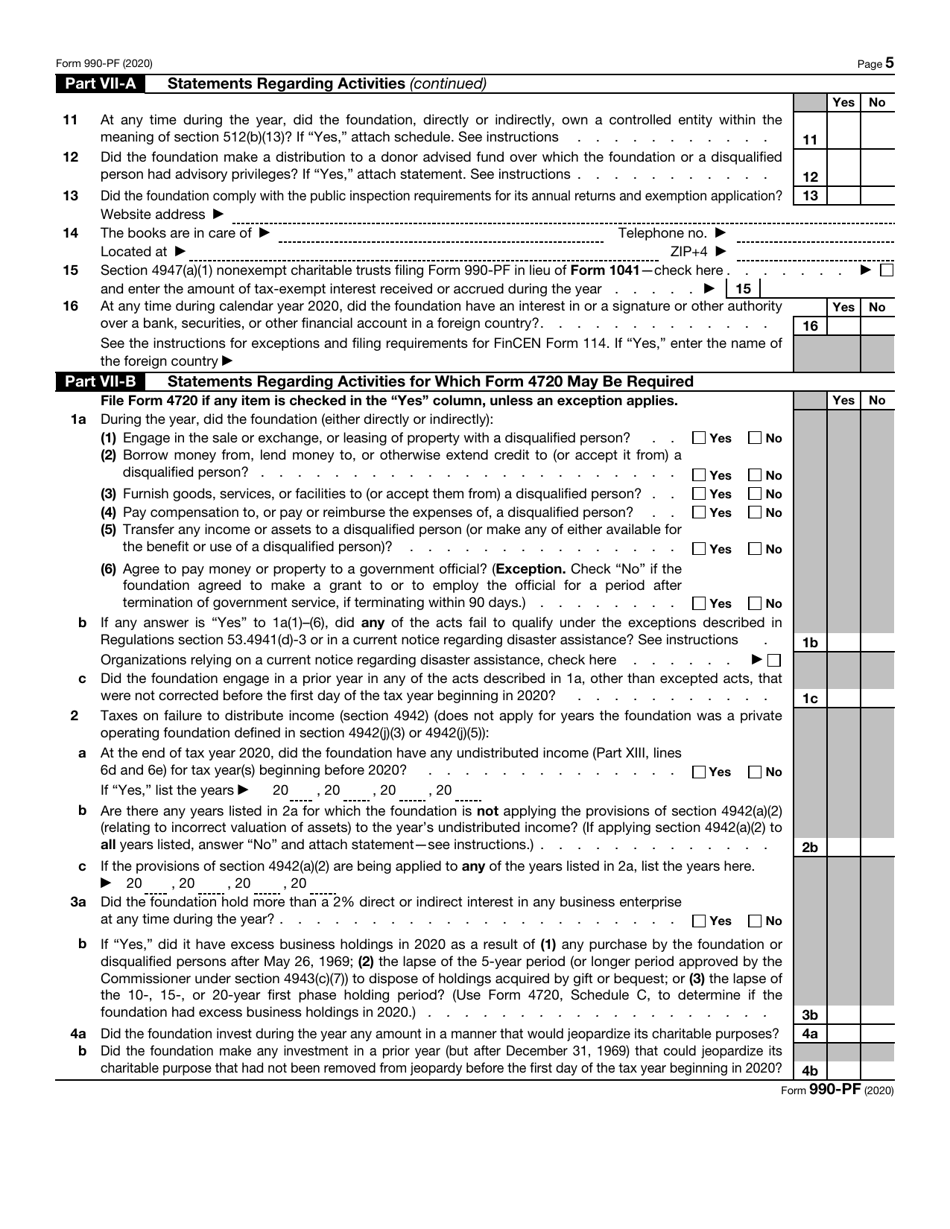

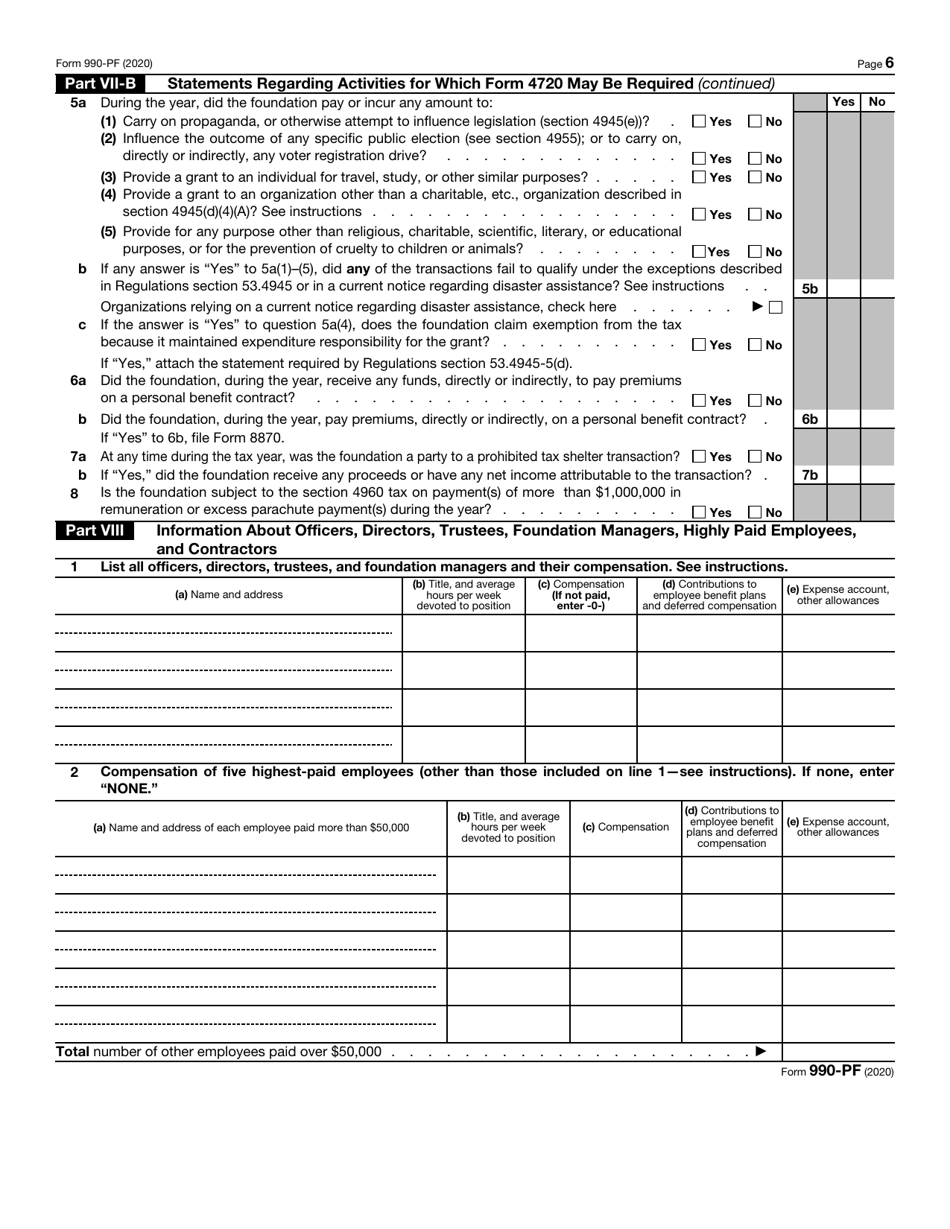

Q: What information is required on Form 990-PF?

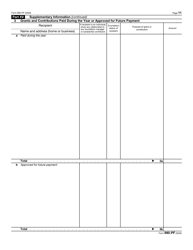

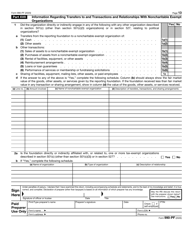

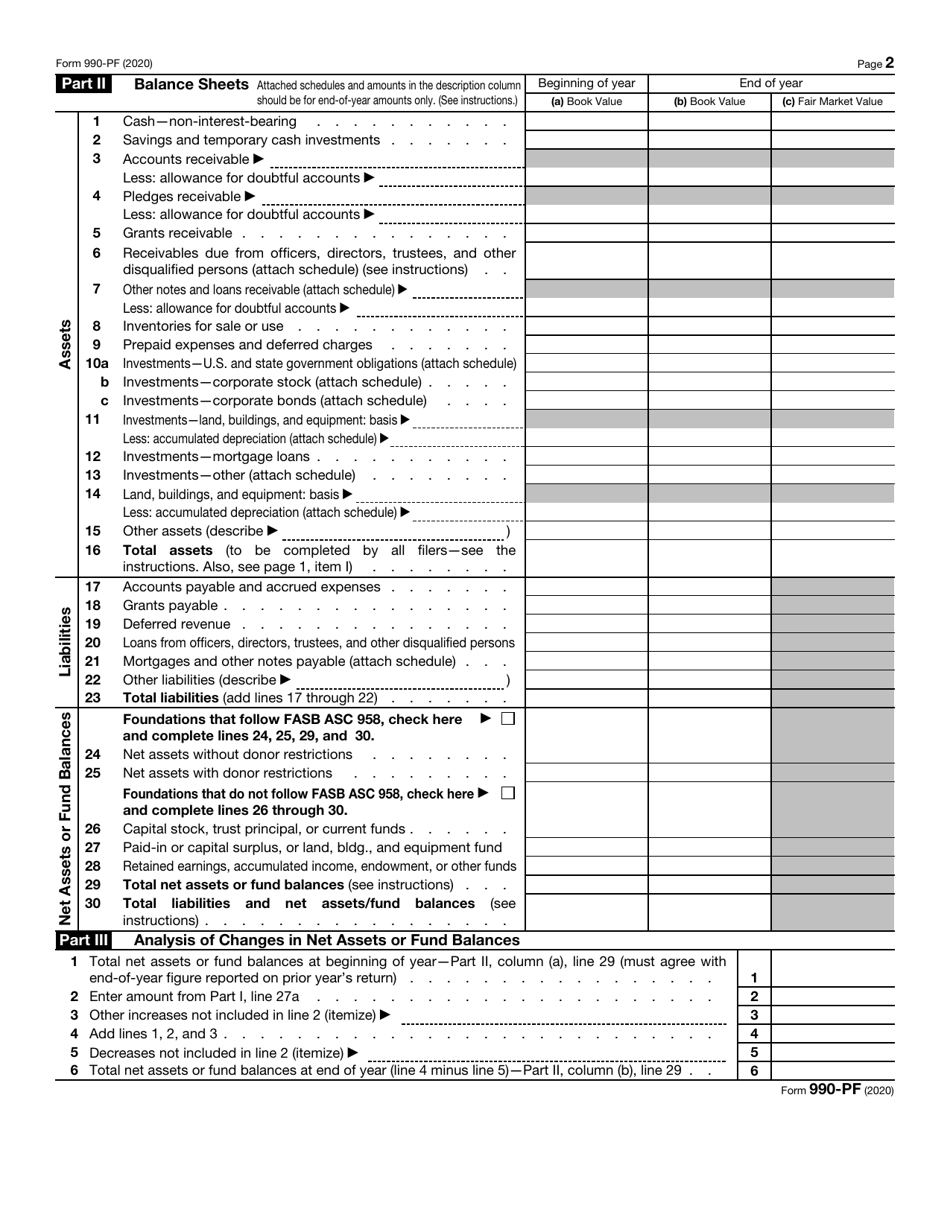

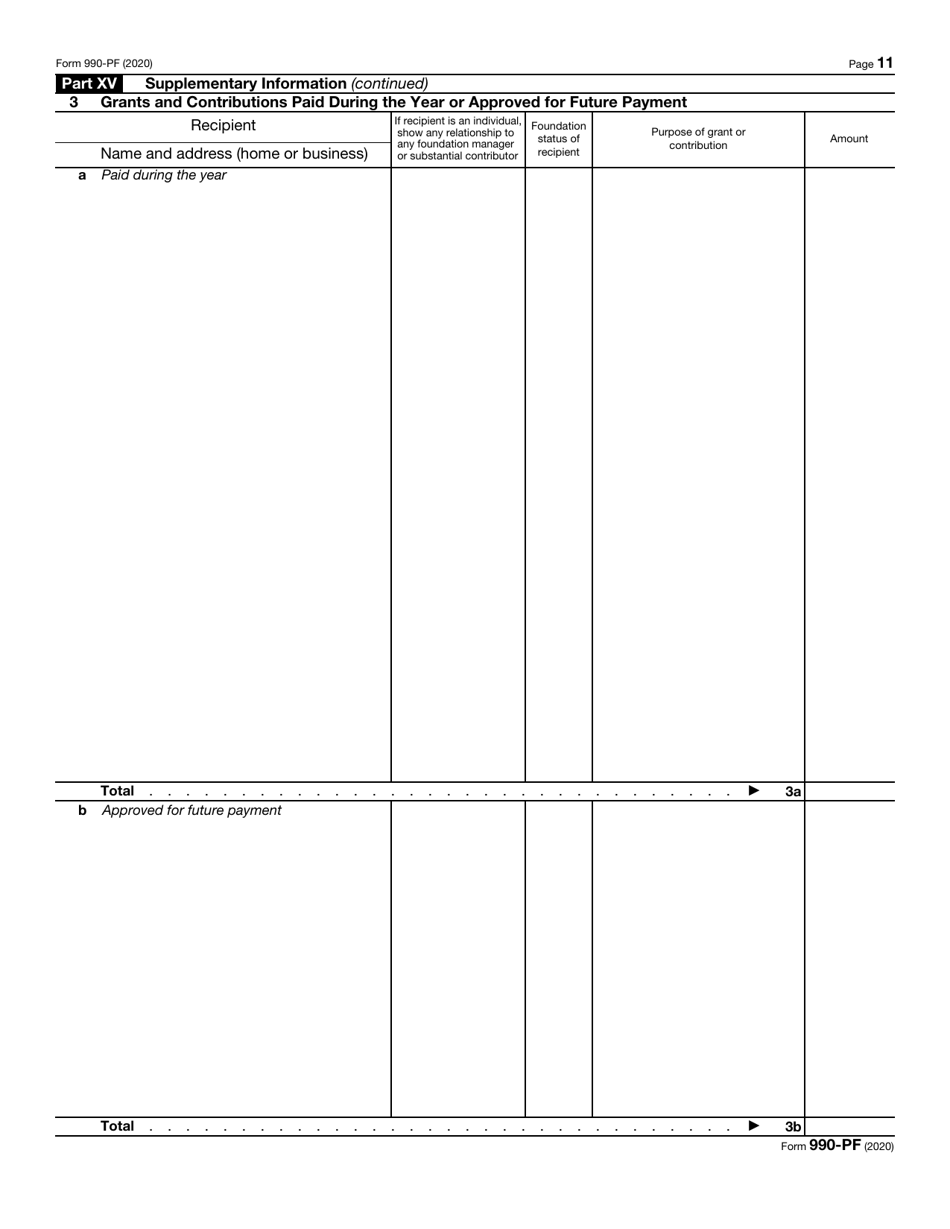

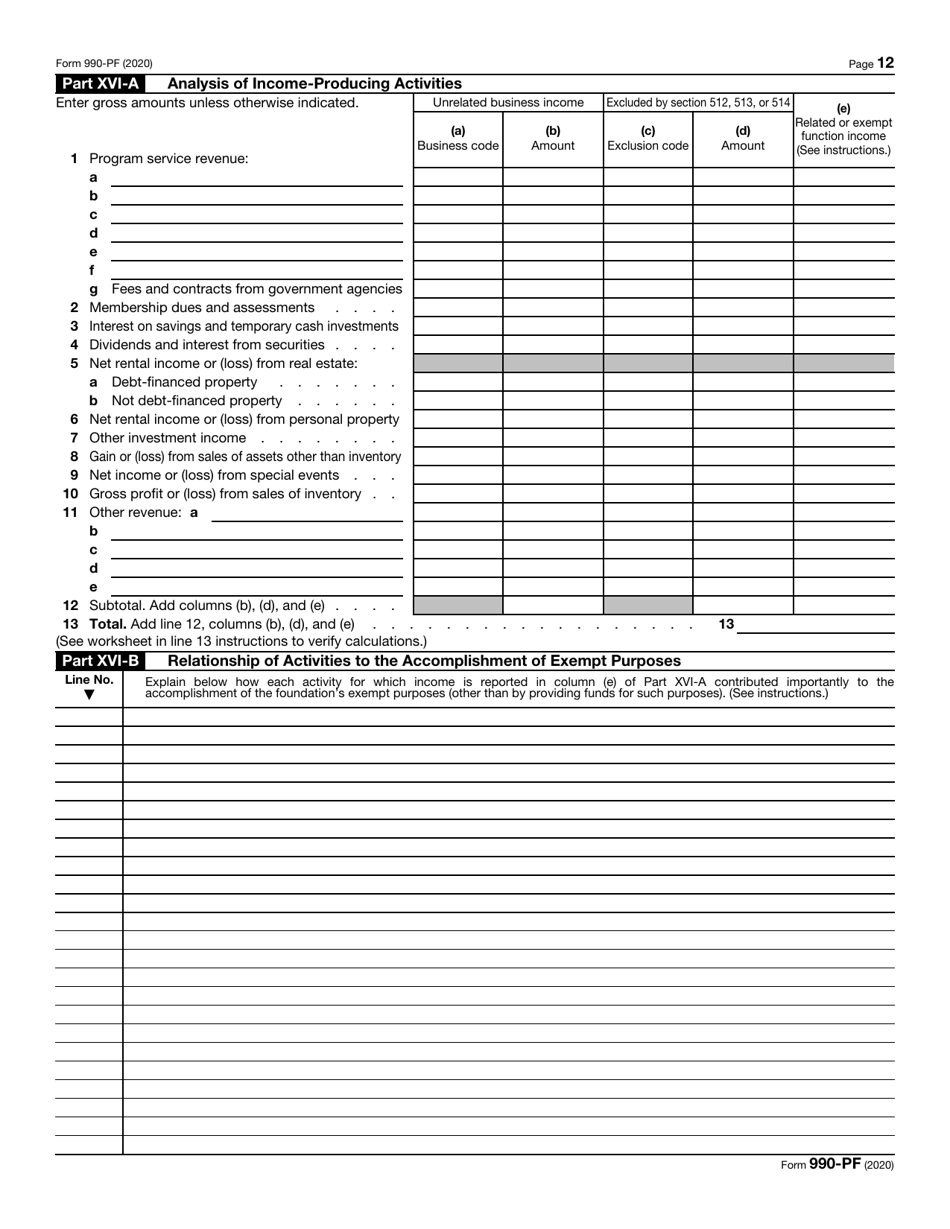

A: Form 990-PF asks for details about a foundation's income, expenses, investments, and grants made during the year.

Q: When is Form 990-PF due?

A: Form 990-PF is due on the 15th day of the 5th month after the foundation's fiscal year ends.

Q: Are there any penalties for late filing of Form 990-PF?

A: Yes, there are penalties for late filing or failure to file Form 990-PF. It's important to submit the return on time to avoid these penalties.

Q: Do I need to include any attachments with Form 990-PF?

A: Yes, certain attachments such as schedules and statements may be required depending on the foundation's financial activities.

Q: Can I e-file Form 990-PF?

A: Yes, private foundations can choose to e-file their Form 990-PF using the IRS's Modernized e-File (MeF) system.

Q: What is the purpose of Form 990-PF?

A: The purpose of Form 990-PF is to provide the IRS and the public with information about a private foundation's finances and activities.

Q: Is Form 990-PF confidential?

A: No, Form 990-PF is a public document and is generally available for public inspection.

Form Details:

- A 13-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of Form 990-PF through the link below or browse more documents in our library of IRS Forms.