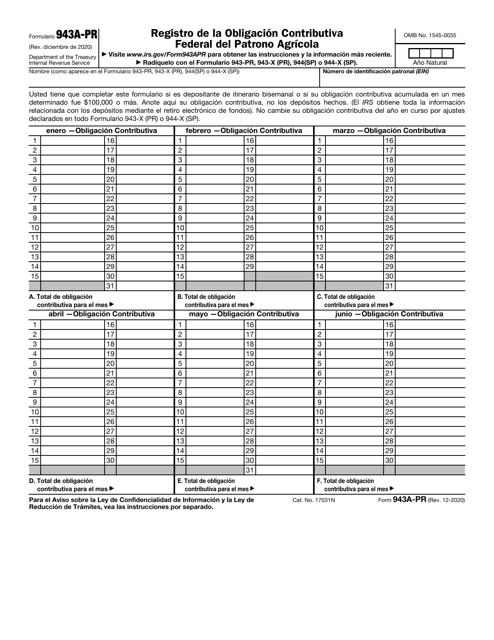

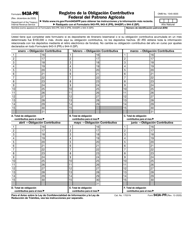

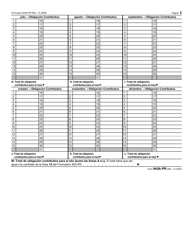

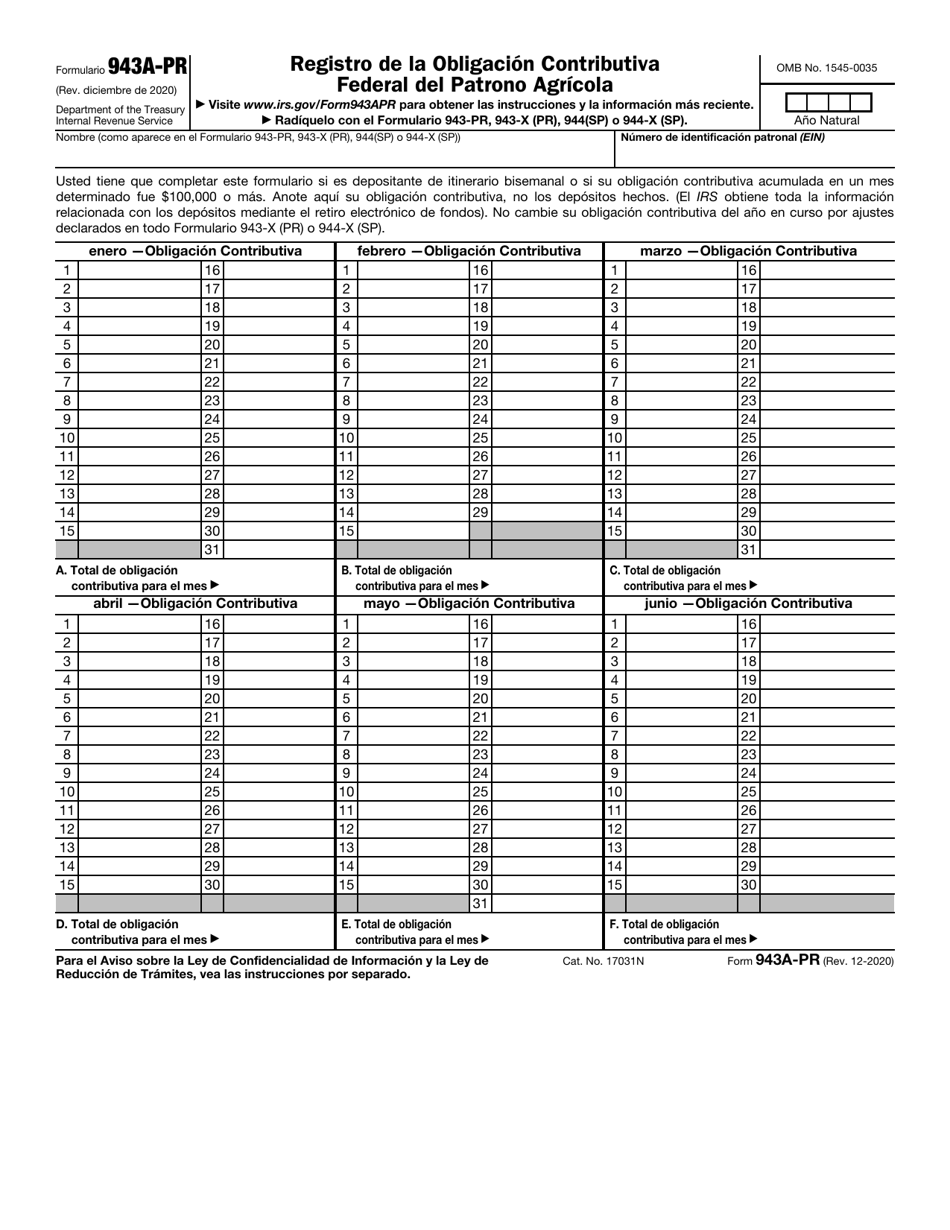

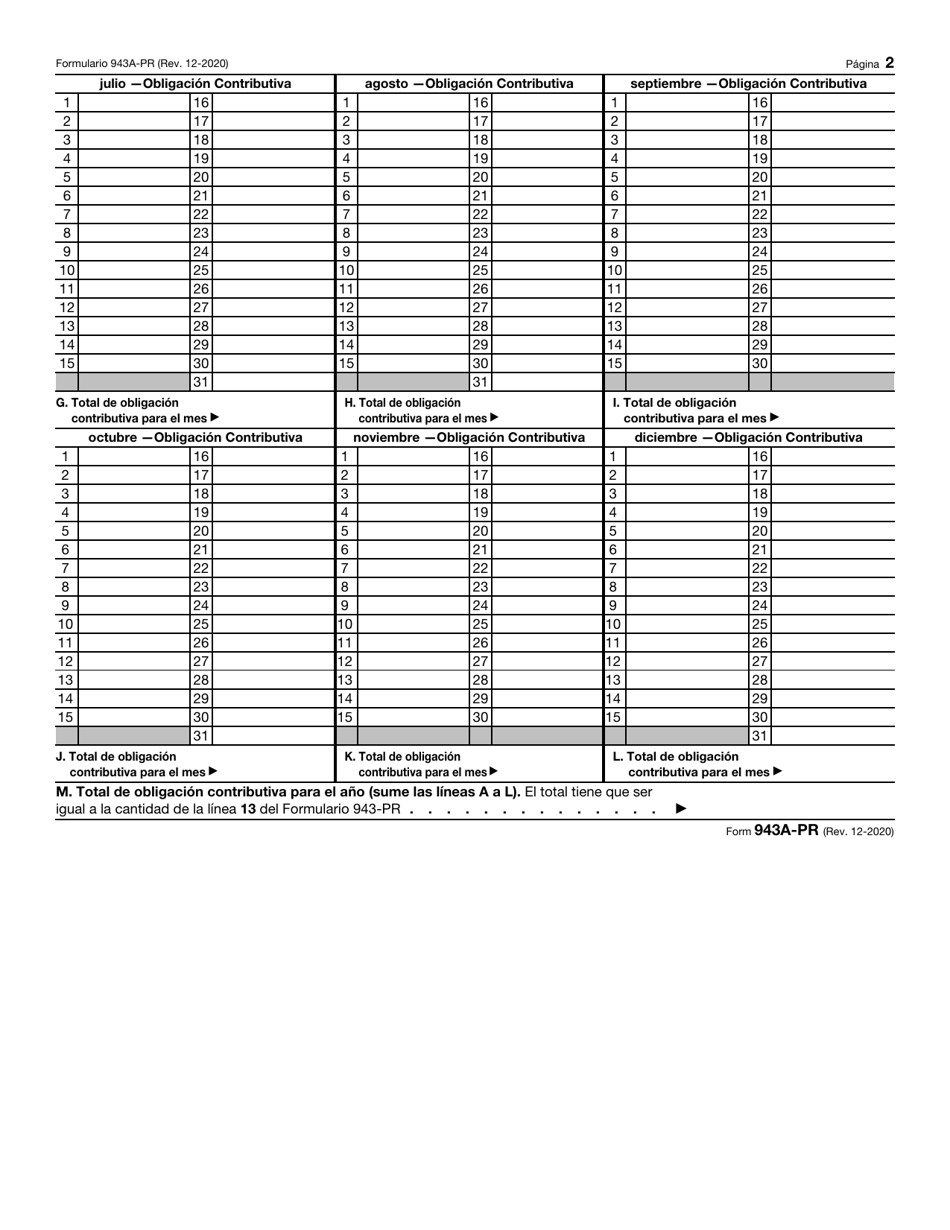

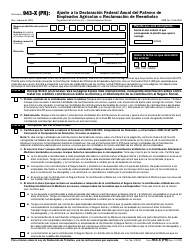

IRS Formulario 943-A (PR) Registro De La Obligacion Contributiva Federal Del Patrono Agricola (Puerto Rican Spanish)

Qué es IRS Formulario 943-A (PR)?

Esta es un formulario legal relacionado con impuestos que fue publicado por los Servicios de Ingresos Internos (IRS), una subdivisión del Departamento del Tesoro. A partir de hoy, el departamento emisor no proporciona en separado pautas de presentación para el formulario.

Detalles del formulario:

- Publicado el 1 de diciembre de 2020;

- La última versión proporcionada por el Servicios de Ingresos Internos (IRS);

- Actual y válido para el 2023;

- Lista para utilizar e imprimir;

- Fácil de personalizar;

- Compatible con la mayoría de las aplicaciones para visualizar PDF;

- Complete este formulario en línea.

Descargue una versión del IRS Formulario 943-A (PR) haciendo clic en el enlace debajo haciendo clic en el enlace debajo Servicios de Ingresos Internos (IRS).

FAQ

Q: What is IRS Formulario 943-A (PR)?

A: IRS Formulario 943-A (PR) is a form used by agricultural employers in Puerto Rico to report and pay their federal tax obligations.

Q: Who needs to fill out IRS Formulario 943-A (PR)?

A: Agricultural employers in Puerto Rico need to fill out IRS Formulario 943-A (PR) if they have employees, and they are required to pay federal employment taxes.

Q: What are the federal tax obligations for agricultural employers in Puerto Rico?

A: Agricultural employers in Puerto Rico are responsible for withholding and paying federal income tax, Social Security tax, and Medicare tax for their employees.

Q: Are there any special rules or regulations for agricultural employers in Puerto Rico?

A: Yes, agricultural employers in Puerto Rico may have special rules and regulations that differ from those in other states. It is important to consult the IRS or a tax professional to ensure compliance.