This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 941-X

for the current year.

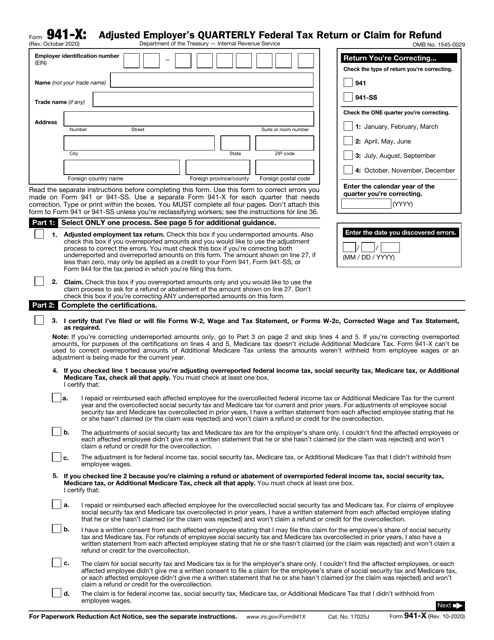

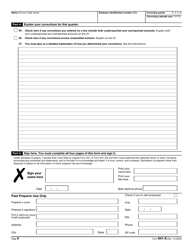

IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

What Is IRS Form 941-X?

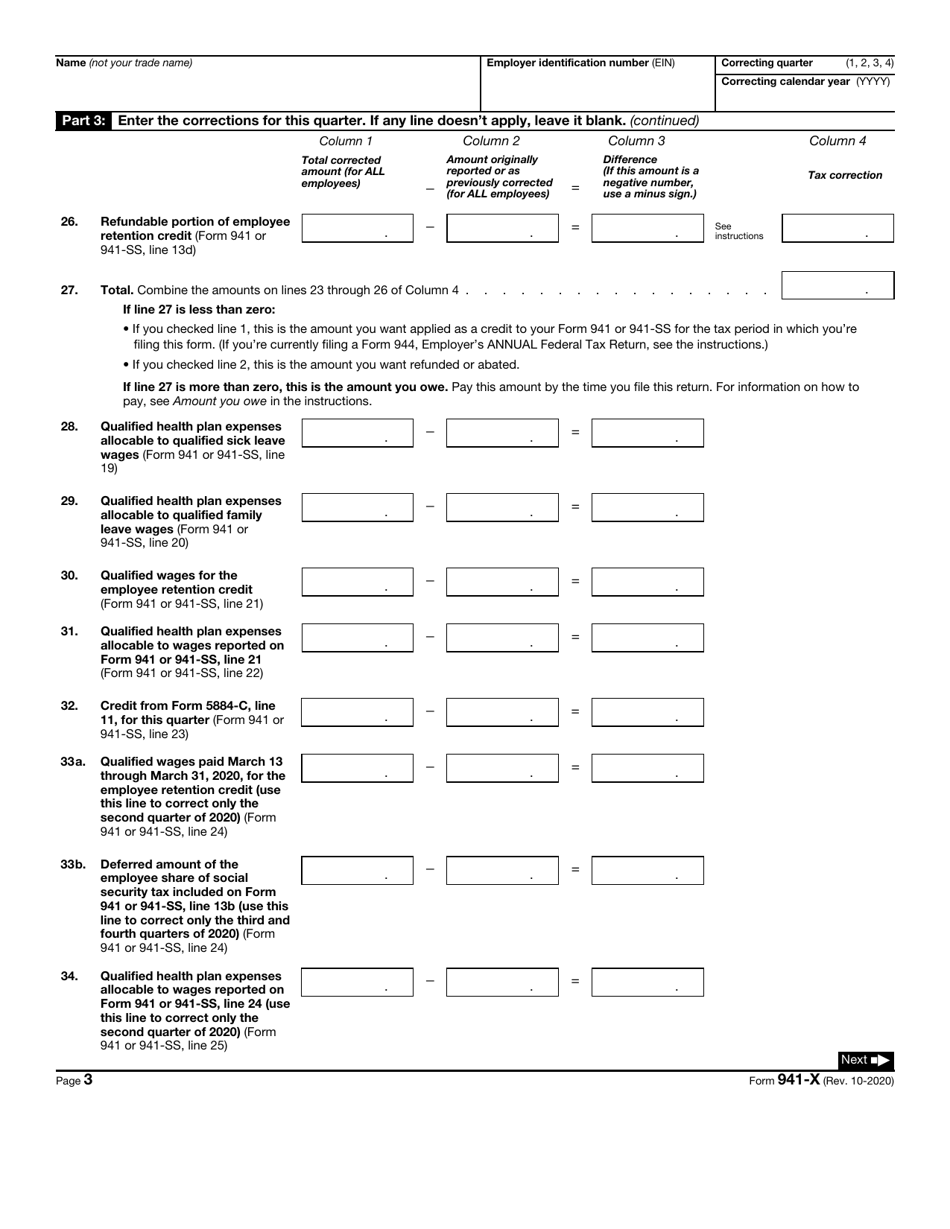

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2020. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 941-X?

A: IRS Form 941-X is the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund.

Q: Who needs to file Form 941-X?

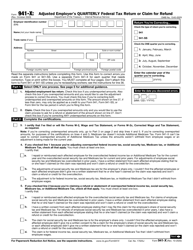

A: Form 941-X is filed by employers who need to correct errors or make adjustments to their previously filed Form 941.

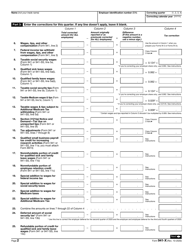

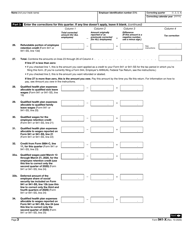

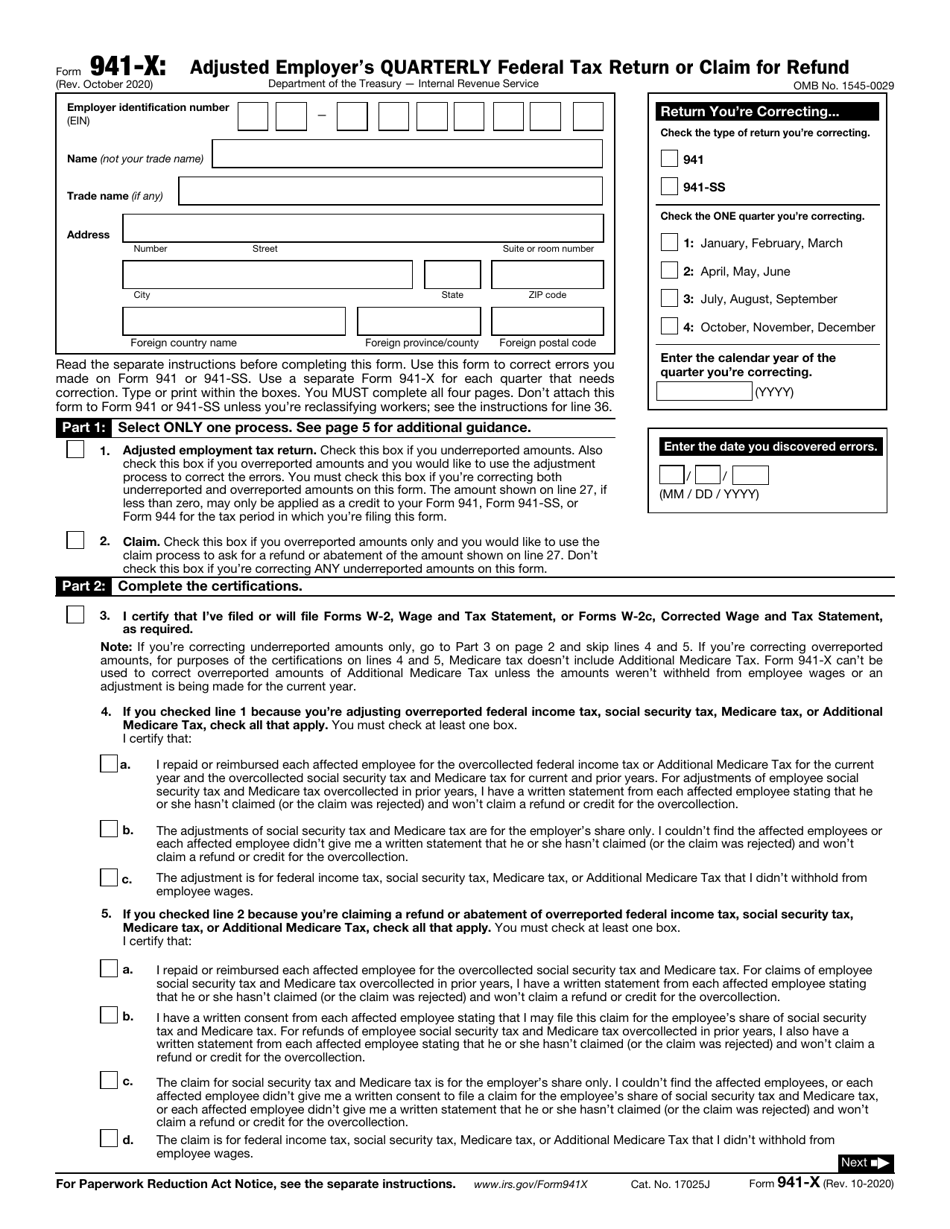

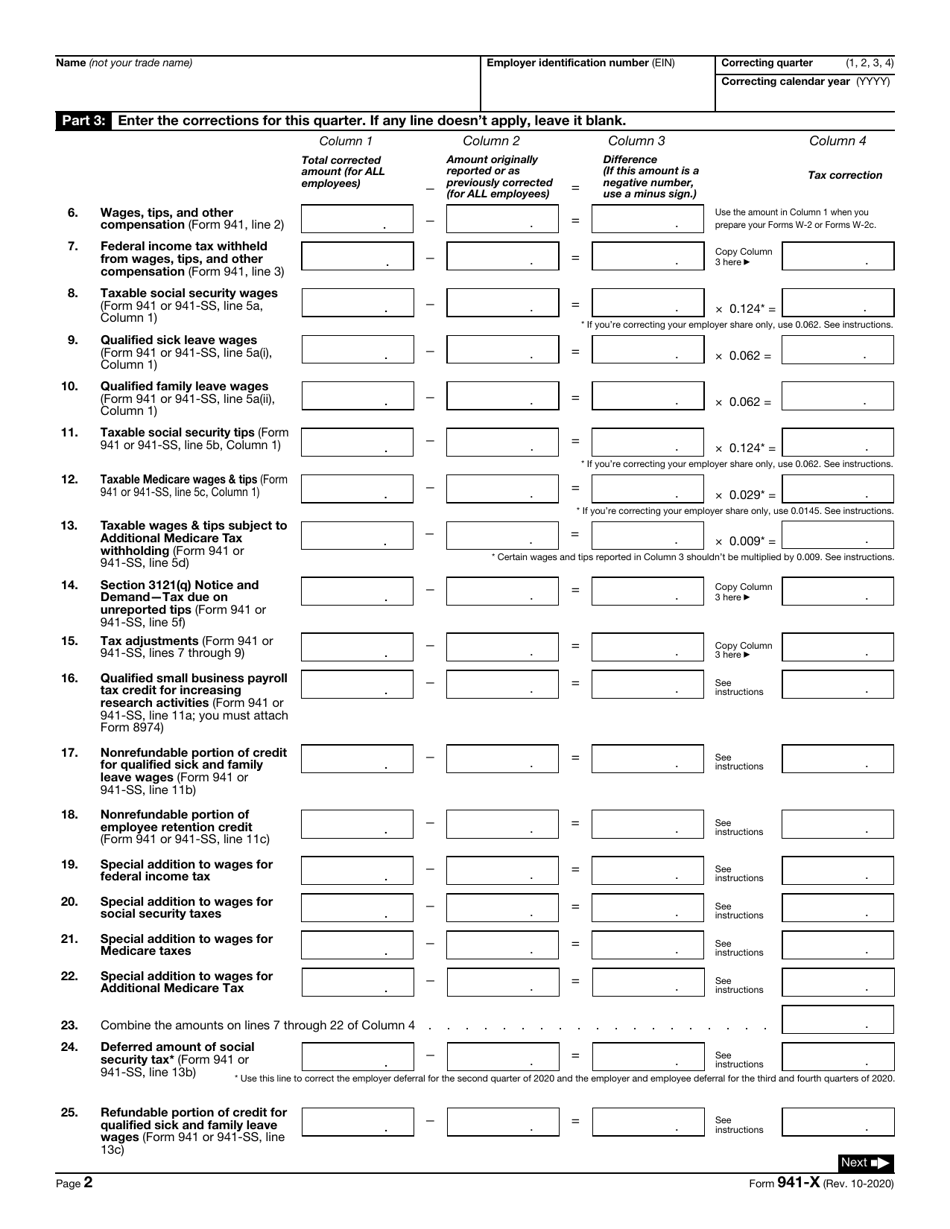

Q: What should be included in Form 941-X?

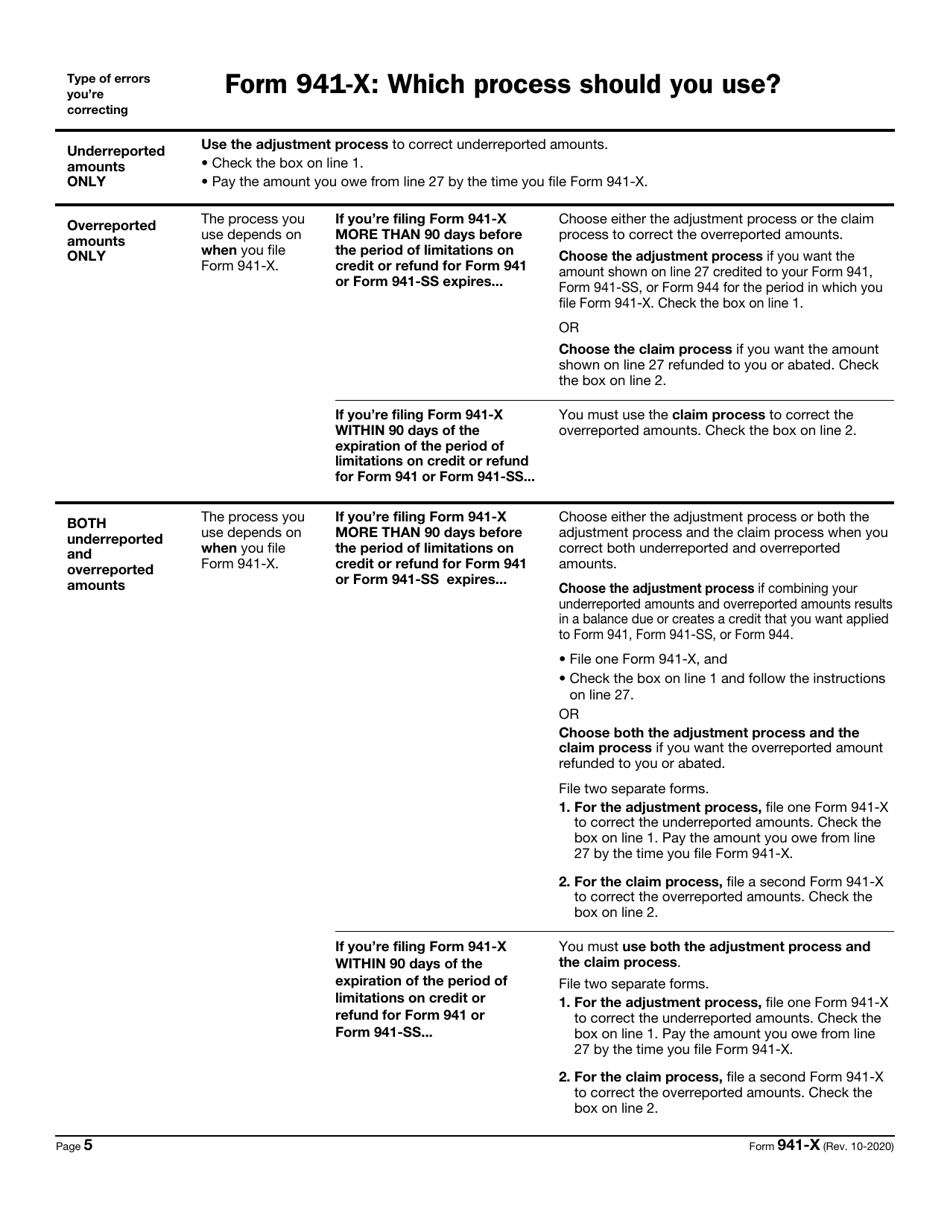

A: Form 941-X should include the corrections or adjustments being made and the reasons for those changes.

Q: Can Form 941-X be used to claim a refund?

A: Yes, Form 941-X can be used to claim a refund if an employer paid too much in taxes for a specific quarter.

Q: When should Form 941-X be filed?

A: Form 941-X should be filed as soon as an error or adjustment is discovered, but no later than three years from the date the original Form 941 was filed.

Q: Are there any penalties for not filing Form 941-X?

A: Yes, there may be penalties for not filing Form 941-X or for filing it late, so it's important to file the form promptly.

Q: Can I electronically file Form 941-X?

A: No, Form 941-X cannot be filed electronically and must be filed by mail.

Q: What other forms or documents may be needed when filing Form 941-X?

A: Depending on the changes being made, additional supporting documents may be required, such as W-2s or payroll records.

Form Details:

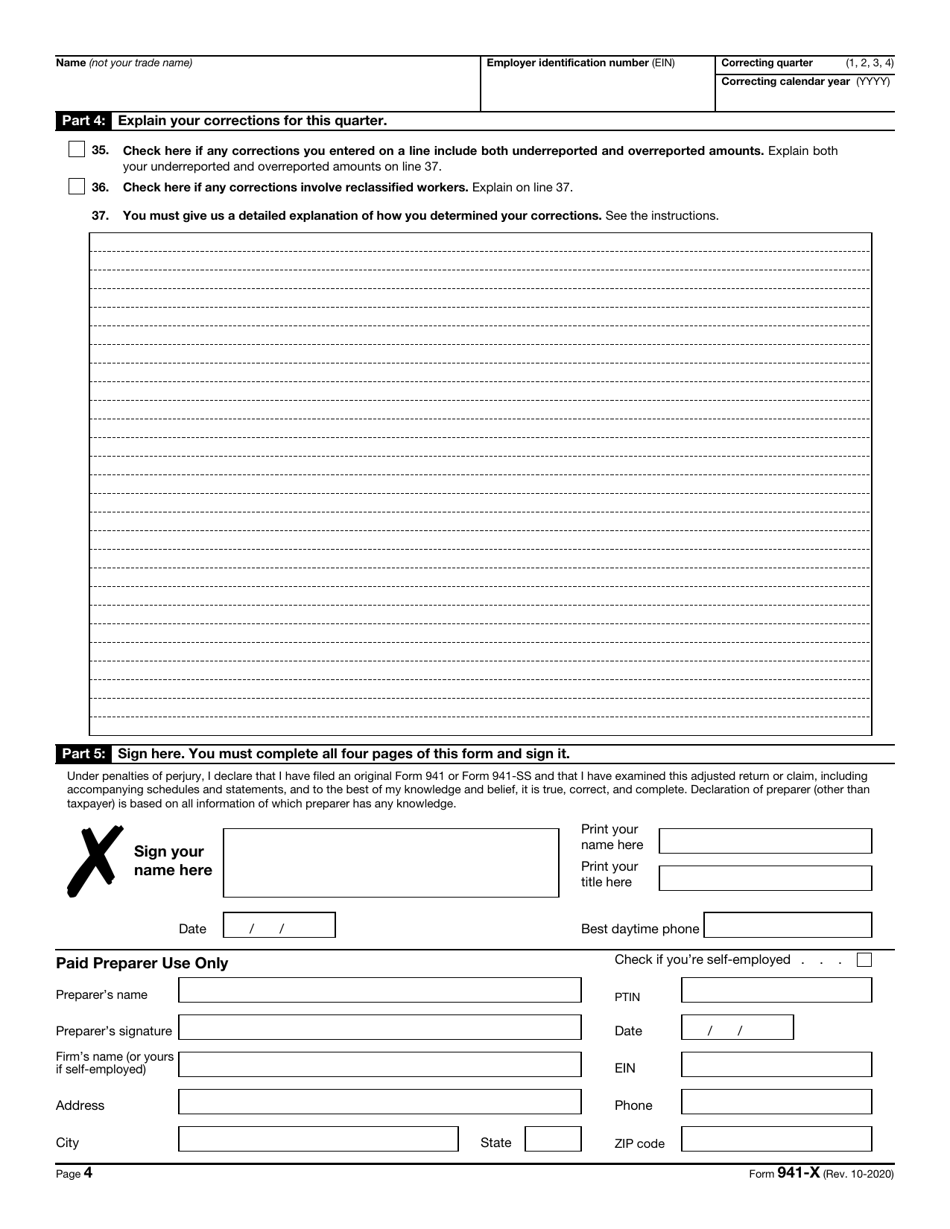

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 941-X through the link below or browse more documents in our library of IRS Forms.