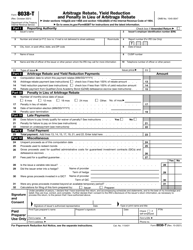

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8804, 8805, 8813

for the current year.

Instructions for IRS Form 8804, 8805, 8813

This document contains official instructions for IRS Form 8804 , IRS Form 8805 , and IRS Form 8813 . All forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8804 is available for download through this link.

FAQ

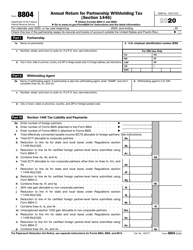

Q: What is IRS Form 8804?

A: IRS Form 8804 is used by partnerships to report the income and deductions related to effectively connected income (ECI) and withholding taxes.

Q: What is IRS Form 8805?

A: IRS Form 8805 is used by foreign partners to report their share of partnership income, deductions, and credits.

Q: What is IRS Form 8813?

A: IRS Form 8813 is used to report partnership withholding tax payments made on behalf of foreign partners.

Q: Are there any filing deadlines for these forms?

A: Yes, there are specific deadlines for filing these forms. It is important to refer to the instructions for each form to determine the appropriate filing deadline.

Q: Do I need to file all three forms?

A: Not necessarily. The need to file these forms depends on the specific circumstances of your partnership and the presence of foreign partners. Review the instructions for each form to determine which ones are applicable to your situation.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.