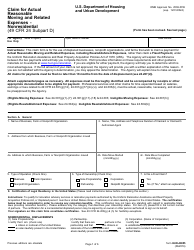

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3903

for the current year.

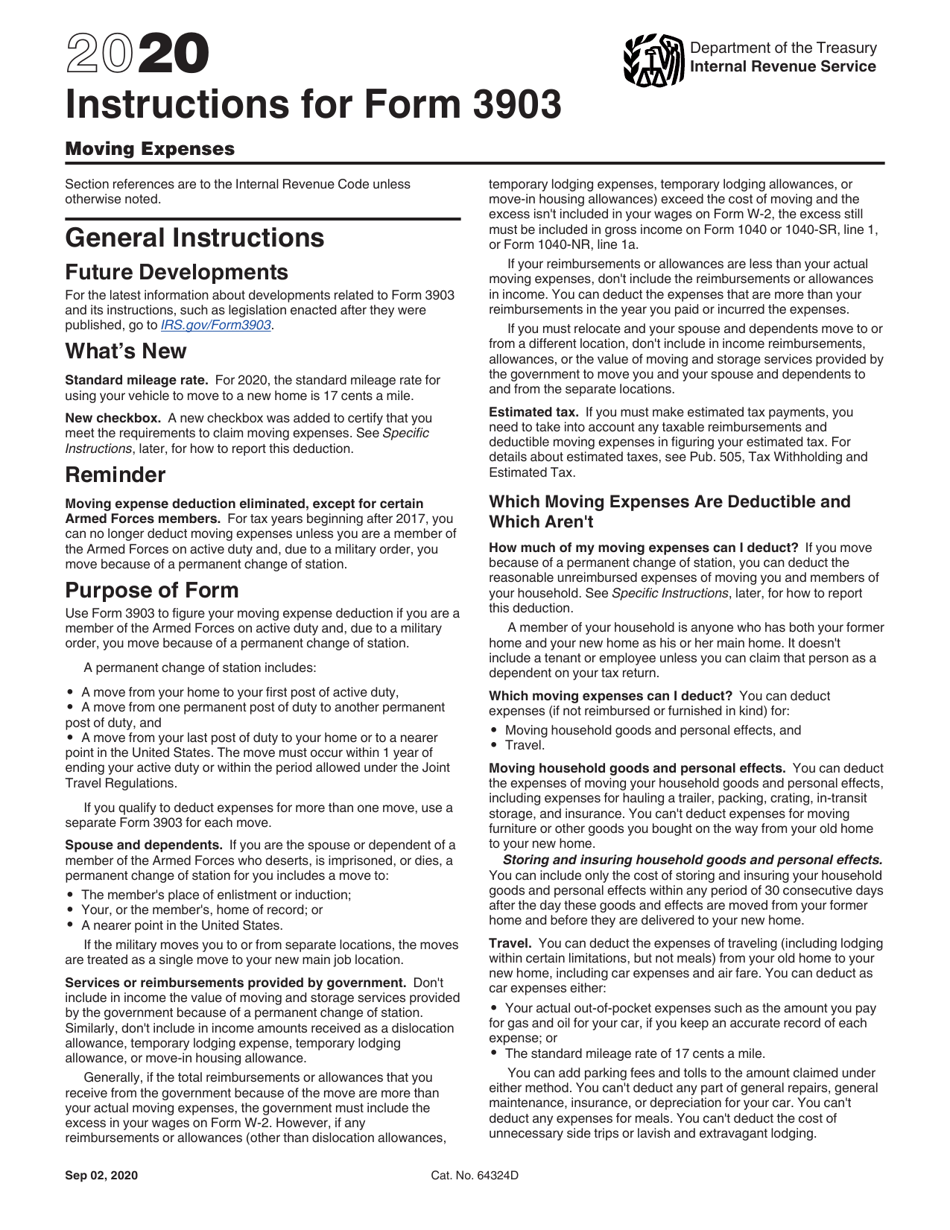

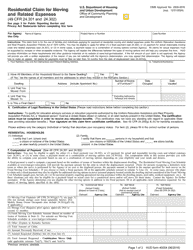

Instructions for IRS Form 3903 Moving Expenses

This document contains official instructions for IRS Form 3903 , Moving Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 3903 is available for download through this link.

FAQ

Q: What is IRS Form 3903?

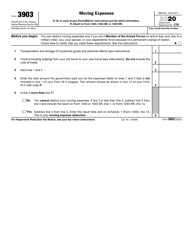

A: IRS Form 3903 is used to claim moving expenses on your federal tax return.

Q: Who is eligible to use IRS Form 3903?

A: You can use IRS Form 3903 if you have moved due to a change in your job or business location.

Q: What expenses can I claim using IRS Form 3903?

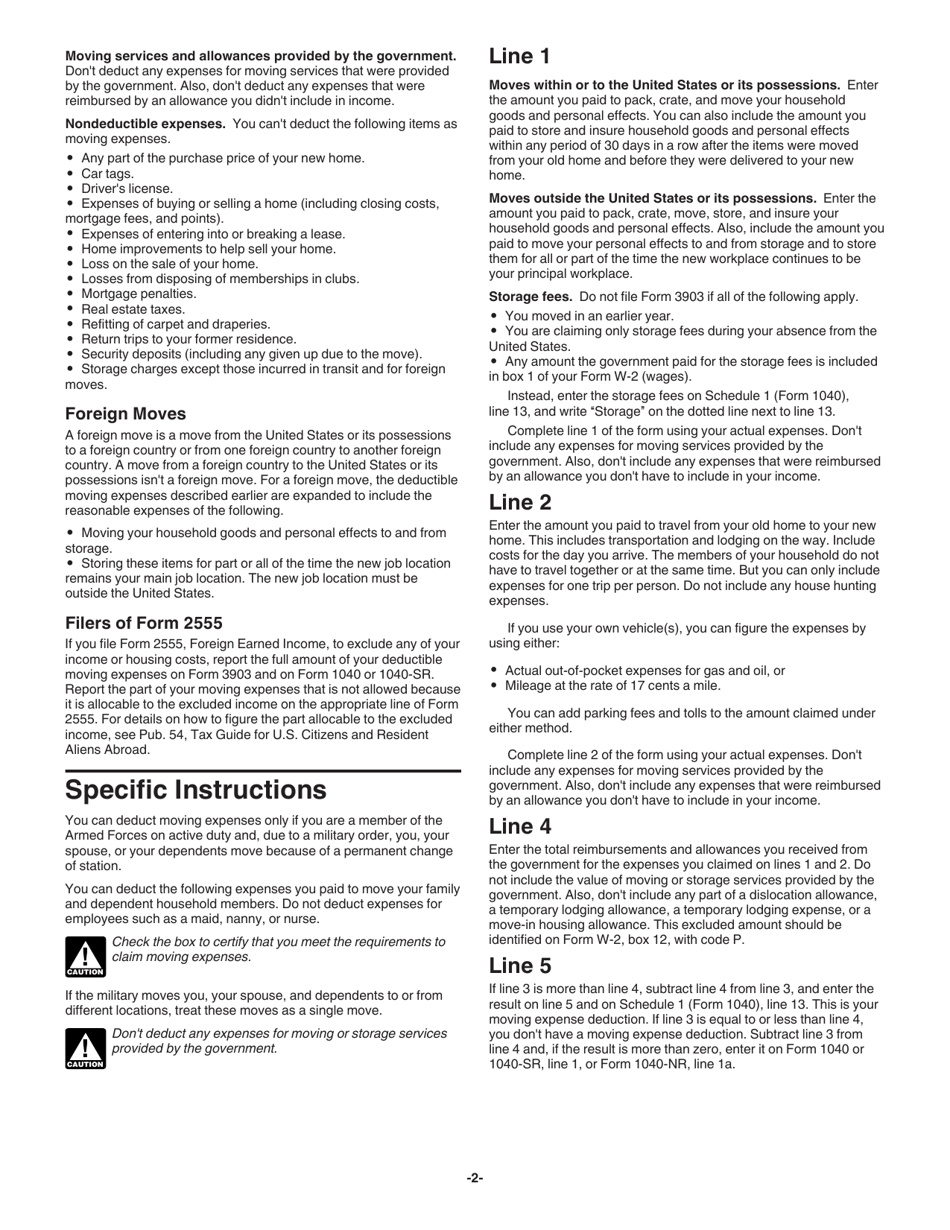

A: You can claim deductibles for transportation, storage, and lodging expenses incurred during your move.

Q: Are there any requirements for the distance of the move?

A: Yes, your new job location must be at least 50 miles farther from your old home than your previous job location.

Q: What documentation do I need to submit with Form 3903?

A: You should keep records of your moving expenses, including receipts and invoices, but you don't need to submit them with the form.

Q: Can I deduct the cost of meals during my move?

A: No, the cost of meals is not deductible when claiming moving expenses.

Q: Is there a limit to the amount I can deduct for moving expenses?

A: There is no limit to the amount you can deduct for eligible moving expenses, but you can only deduct expenses up to the amount of your income from the new job.

Q: When should I file IRS Form 3903?

A: You should file IRS Form 3903 with your federal tax return for the year in which you incur the moving expenses.

Q: Are moving expenses tax-deductible?

A: Yes, if you meet the eligibility requirements, you can deduct qualified moving expenses on your federal tax return.

Instruction Details:

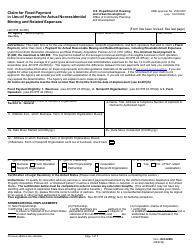

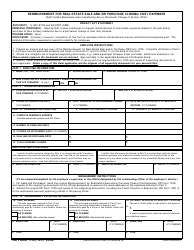

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.