This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-H

for the current year.

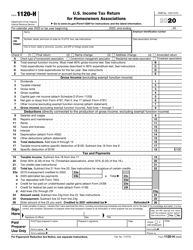

Instructions for IRS Form 1120-H U.S. Income Tax Return for Homeowners Associations

This document contains official instructions for IRS Form 1120-H , U.S. Income Tax Return for Homeowners Associations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-H is available for download through this link.

FAQ

Q: What is IRS Form 1120-H?

A: IRS Form 1120-H is the U.S. Income Tax Return for Homeowners Associations.

Q: Who needs to file IRS Form 1120-H?

A: Homeowners associations need to file IRS Form 1120-H.

Q: What is the purpose of IRS Form 1120-H?

A: The purpose of IRS Form 1120-H is to report the income, expenses, and taxes of homeowners associations.

Q: When is IRS Form 1120-H due?

A: IRS Form 1120-H is due on the 15th day of the 4th month following the end of the association's tax year.

Q: Can homeowners associations claim tax-exempt status?

A: Yes, homeowners associations can claim tax-exempt status by filing IRS Form 1120-H.

Q: What information is required to complete IRS Form 1120-H?

A: To complete IRS Form 1120-H, you will need information such as the association's income, expenses, taxes paid, and balance sheet.

Q: Are there any penalties for late filing of IRS Form 1120-H?

A: Yes, there may be penalties for late filing of IRS Form 1120-H, so it is important to file on time.

Q: Can homeowners associations file electronically?

A: Yes, homeowners associations can file IRS Form 1120-H electronically if they meet certain requirements.

Q: Is professional tax assistance recommended for IRS Form 1120-H?

A: It is recommended to seek professional tax assistance to ensure accurate and timely filing of IRS Form 1120-H.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.