This version of the form is not currently in use and is provided for reference only. Download this version of

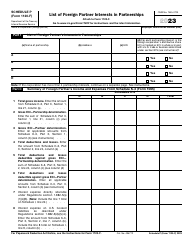

Instructions for IRS Form 1120-F Schedule V

for the current year.

Instructions for IRS Form 1120-F Schedule V List of Vessels or Aircraft, Operators, and Owners

This document contains official instructions for IRS Form 1120-F Schedule V, List of Vessels or Aircraft, Operators, and Owners - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-F Schedule V is available for download through this link.

FAQ

Q: What is IRS Form 1120-F Schedule V?

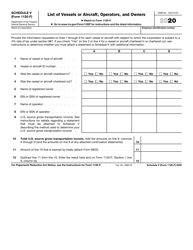

A: IRS Form 1120-F Schedule V is a form used to list vessels or aircraft, operators, and owners.

Q: Who needs to file IRS Form 1120-F Schedule V?

A: Any taxpayer who needs to report information about vessels or aircraft, operators, and owners for tax purposes.

Q: When is IRS Form 1120-F Schedule V due?

A: The due date for filing IRS Form 1120-F Schedule V depends on the taxpayer's tax year. It is typically due with the taxpayer's annual tax return.

Q: What information needs to be included on IRS Form 1120-F Schedule V?

A: IRS Form 1120-F Schedule V requires the listing of vessels or aircraft, operators, and owners, including their identification numbers and ownership percentages.

Q: Are there any penalties for not filing IRS Form 1120-F Schedule V?

A: Yes, there may be penalties for not filing IRS Form 1120-F Schedule V or for filing it late. It's important to meet the filing deadlines to avoid any potential penalties.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.