This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120 Schedule UTP

for the current year.

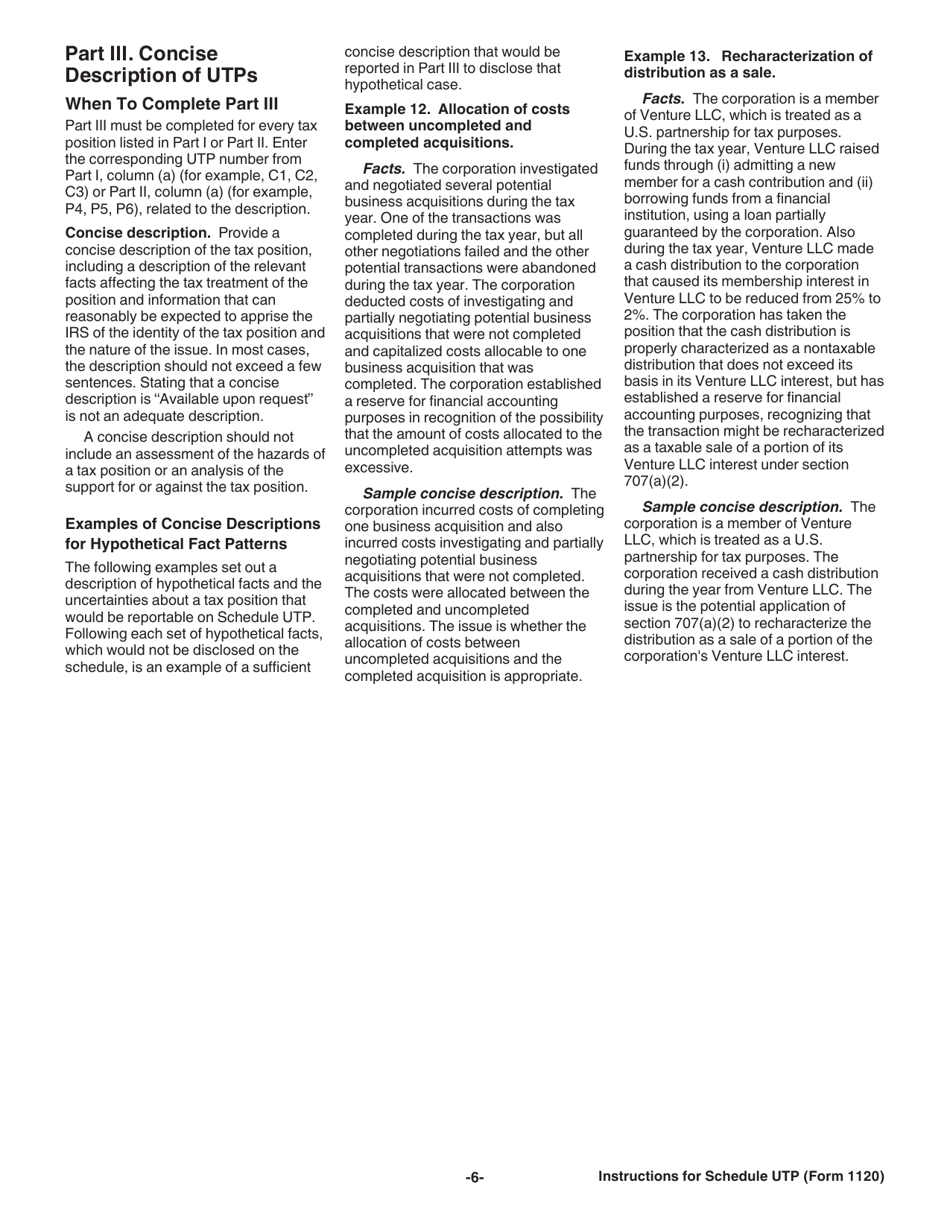

Instructions for IRS Form 1120 Schedule UTP Uncertain Tax Position Statement

This document contains official instructions for IRS Form 1120 Schedule UTP, Uncertain Tax Position Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120 Schedule UTP is available for download through this link.

FAQ

Q: What is IRS Form 1120 Schedule UTP?

A: IRS Form 1120 Schedule UTP is a form used by corporations to report uncertain tax positions.

Q: What is an uncertain tax position?

A: An uncertain tax position is a position taken on a tax return that is not fully supported by existing tax laws or precedents.

Q: Who is required to file IRS Form 1120 Schedule UTP?

A: Corporations that meet certain criteria, such as having total assets of $10 million or more, are required to file IRS Form 1120 Schedule UTP.

Q: What information is reported on IRS Form 1120 Schedule UTP?

A: IRS Form 1120 Schedule UTP requires corporations to provide detailed information about their uncertain tax positions, including a description of the position, the tax years involved, and the amount of the tax benefit claimed.

Q: Why is IRS Form 1120 Schedule UTP important?

A: IRS Form 1120 Schedule UTP provides transparency and helps the IRS identify and assess the tax risks associated with uncertain tax positions taken by corporations.

Q: When is IRS Form 1120 Schedule UTP due?

A: IRS Form 1120 Schedule UTP is generally due with the corporation's annual income tax return, which is typically due on the 15th day of the third month following the end of the corporation's tax year.

Q: Are there penalties for not filing IRS Form 1120 Schedule UTP?

A: Yes, failure to file IRS Form 1120 Schedule UTP or providing false or incomplete information can result in penalties imposed by the IRS.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.