This version of the form is not currently in use and is provided for reference only. Download this version of

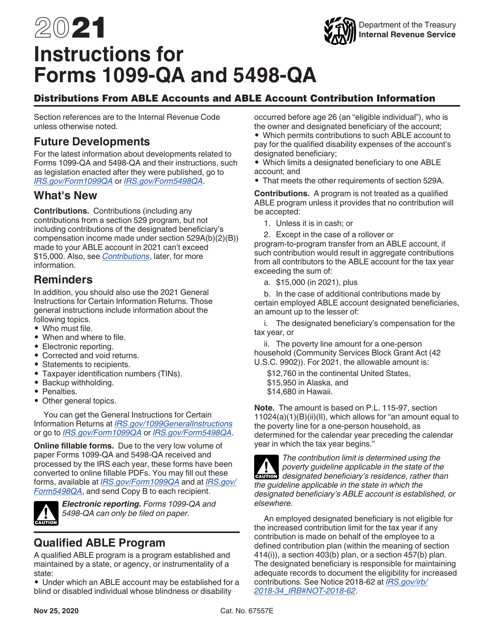

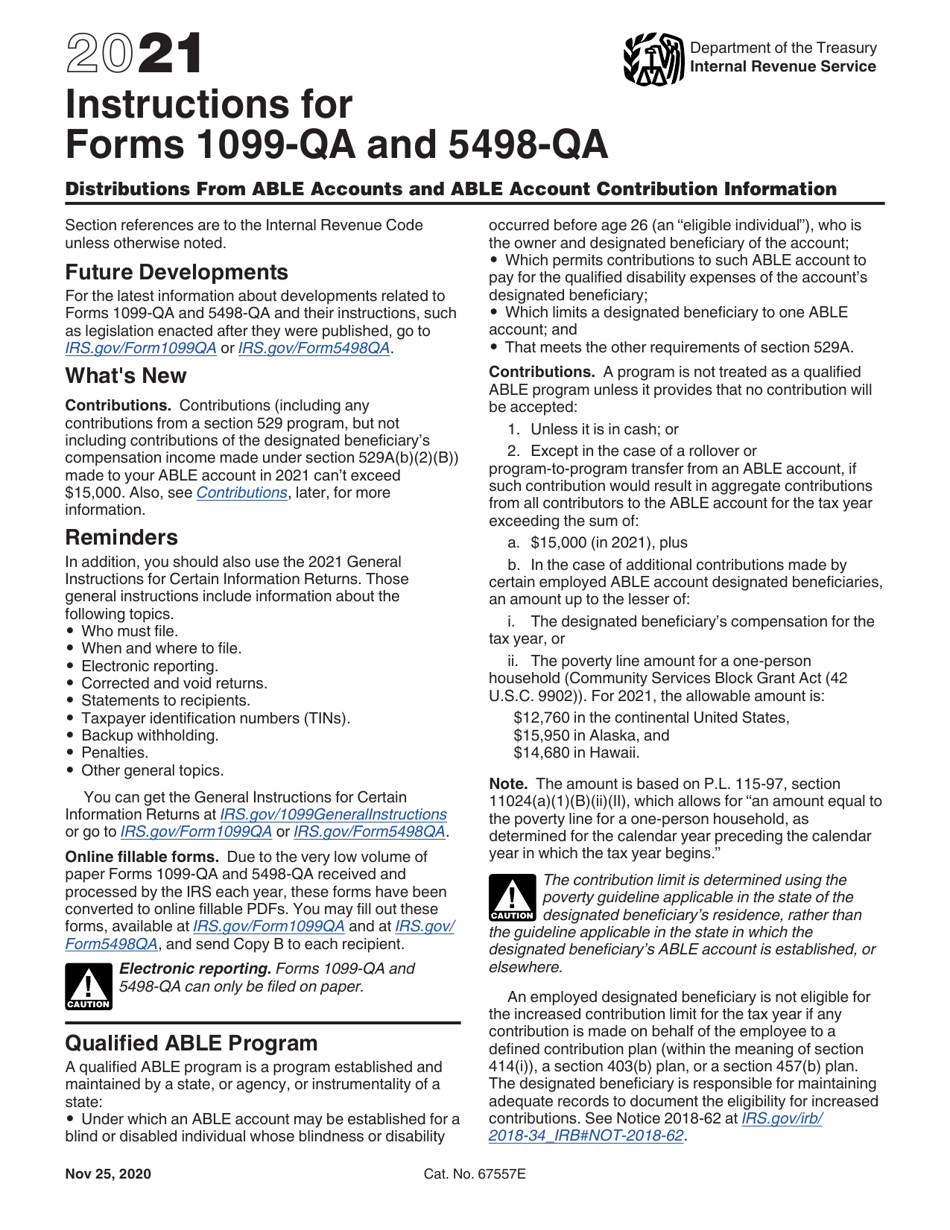

Instructions for IRS Form 1099-QA, 5498-QA

for the current year.

Instructions for IRS Form 1099-QA, 5498-QA

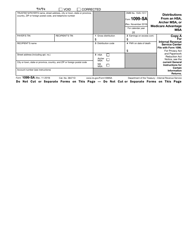

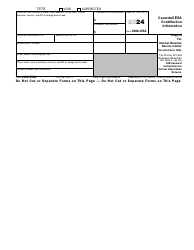

This document contains official instructions for IRS Form 1099-QA , and IRS Form 5498-QA . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-QA is available for download through this link. The latest available IRS Form 5498-QA can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-QA?

A: IRS Form 1099-QA is a tax form used to report distributions and transfers from qualified tuition programs.

Q: What is IRS Form 5498-QA?

A: IRS Form 5498-QA is a tax form used to report contributions and fair market values of qualified tuition programs.

Q: Who needs to file IRS Form 1099-QA?

A: Financial institutions and trustees that administer qualified tuition programs need to file IRS Form 1099-QA to report distributions and transfers made from these programs.

Q: Who needs to file IRS Form 5498-QA?

A: Financial institutions and trustees that administer qualified tuition programs need to file IRS Form 5498-QA to report contributions and fair market values of these programs.

Q: When are IRS Form 1099-QA and 5498-QA due?

A: IRS Form 1099-QA and 5498-QA are generally due to be filed by January 31st of the following year. However, specific due dates may vary, so it's best to consult the IRS instructions or a tax professional.

Q: Do I need to include IRS Form 1099-QA and 5498-QA with my tax return?

A: No, you do not need to include IRS Form 1099-QA and 5498-QA with your individual tax return. These forms are for informational purposes only and should be retained for your records.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.