This version of the form is not currently in use and is provided for reference only. Download this version of

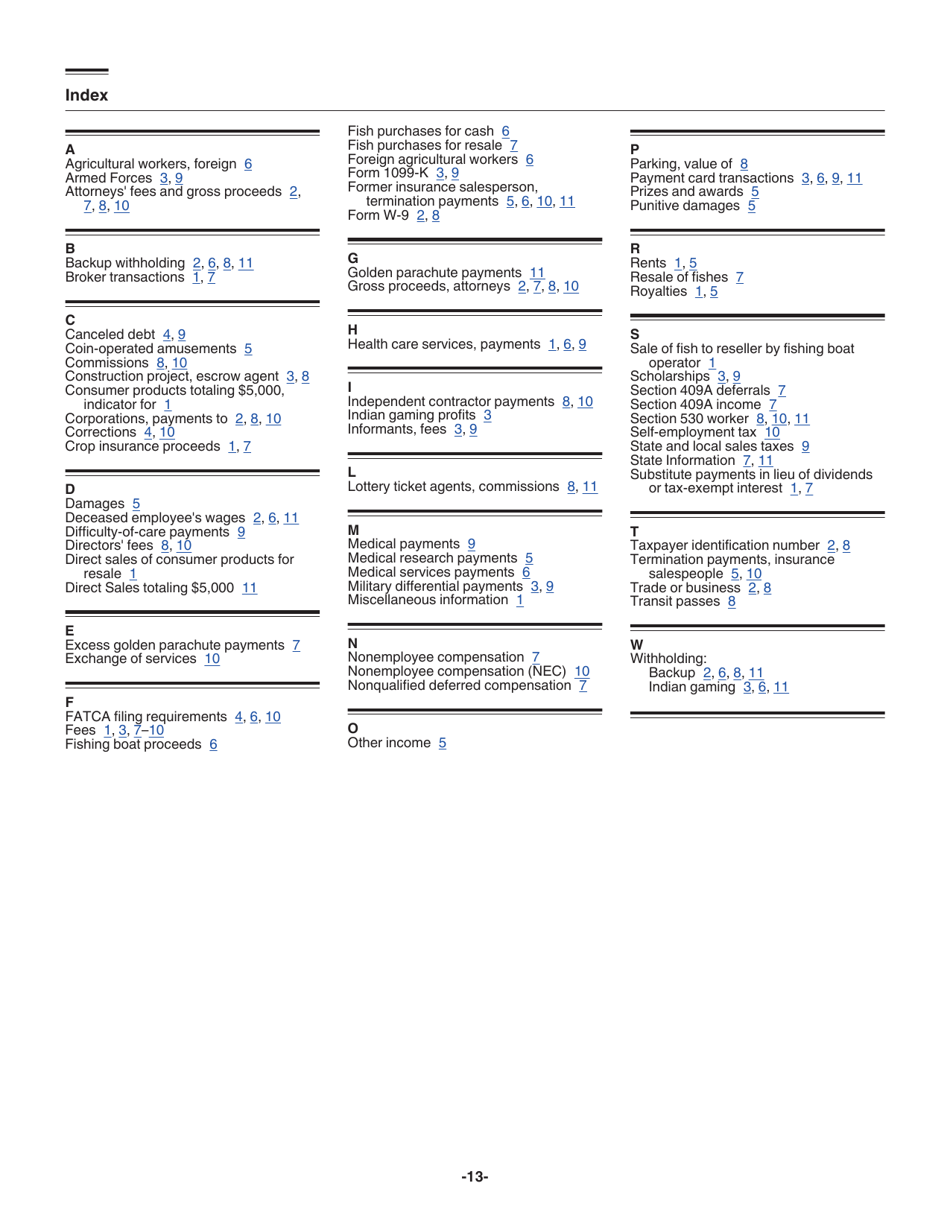

Instructions for IRS Form 1099-MISC, 1099-NEC

for the current year.

Instructions for IRS Form 1099-MISC, 1099-NEC

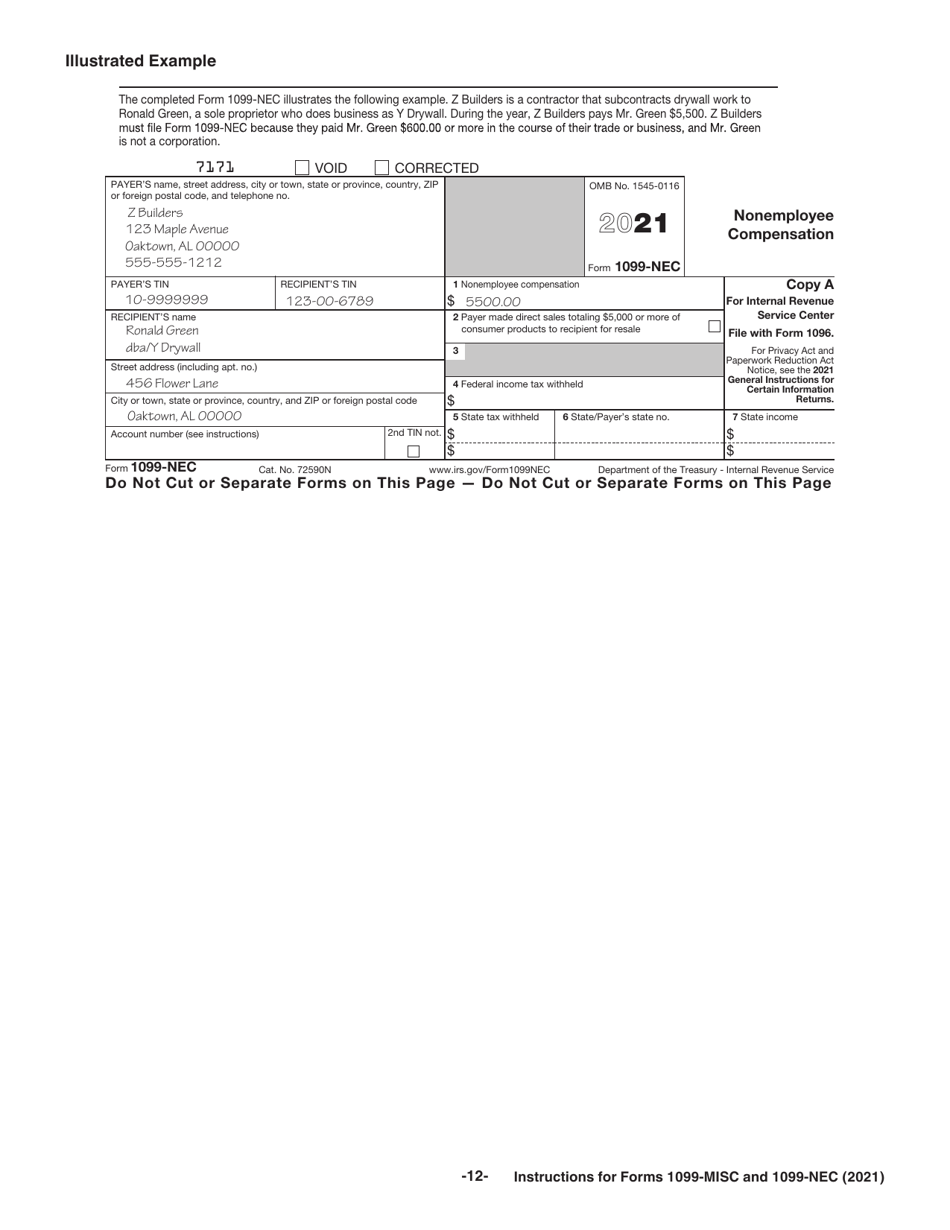

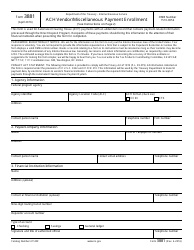

This document contains official instructions for IRS Form 1099-MISC , and IRS Form 1099-NEC . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-MISC is available for download through this link. The latest available IRS Form 1099-NEC can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-MISC used for?

A: IRS Form 1099-MISC is used to report income received as a self-employed individual or independent contractor.

Q: Who needs to file IRS Form 1099-MISC?

A: If you have paid $600 or more to a self-employed individual or independent contractor for services provided during the tax year, you need to file Form 1099-MISC.

Q: When is the deadline for filing IRS Form 1099-MISC?

A: The deadline for filing Form 1099-MISC with the IRS is typically January 31st of the year following the tax year in which the payments were made.

Q: How do I fill out IRS Form 1099-MISC?

A: You need to provide your information as the payer, the recipient's information, and details about the income paid. Make sure to correctly classify the type of income being reported.

Q: Are there any penalties for not filing IRS Form 1099-MISC?

A: Yes, there are penalties for not filing or filing incorrect 1099-MISC forms. The penalties vary depending on how late the forms are filed and if there was intentional disregard of the filing requirement.

Q: Is Form 1099-MISC the same as a W-2 form?

A: No, Form 1099-MISC is used to report income for self-employed individuals or independent contractors, while the W-2 form is used to report income for employees.

Q: Do I need to send a copy of Form 1099-MISC to the recipient?

A: Yes, you need to provide a copy of Form 1099-MISC to the recipient by January 31st of the year following the tax year in which the payments were made.

Instruction Details:

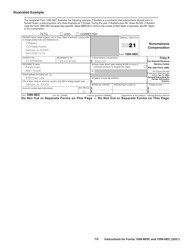

- This 13-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.