This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1066

for the current year.

Instructions for IRS Form 1066 U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return

This document contains official instructions for IRS Form 1066 , U.S. Real Estate Mortgage Investment Conduit (Remic) Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1066 is available for download through this link.

FAQ

Q: What is IRS Form 1066?

A: IRS Form 1066 is the U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return.

Q: Who needs to file IRS Form 1066?

A: Those who operate a REMIC need to file IRS Form 1066.

Q: What is a REMIC?

A: REMIC stands for Real Estate Mortgage Investment Conduit. It is a type of entity that holds a pool of mortgages and issues mortgage-backed securities.

Q: When is the deadline to file IRS Form 1066?

A: The deadline to file IRS Form 1066 is usually March 15th of each year.

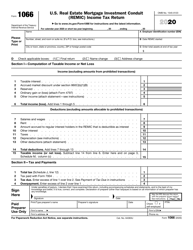

Q: What information is required to fill out IRS Form 1066?

A: Information related to the REMIC's income, deductions, and credits is required to fill out IRS Form 1066.

Q: Are there any penalties for not filing IRS Form 1066?

A: Yes, there can be penalties for not filing or filing late. It is important to file the form on time to avoid any penalties.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.