This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1042

for the current year.

Instructions for IRS Form 1042 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

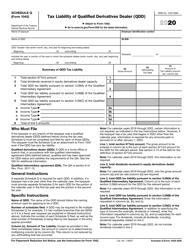

This document contains official instructions for IRS Form 1042 , Annual Source Income of Foreign Persons - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1042 Schedule Q is available for download through this link.

FAQ

Q: What is IRS Form 1042?

A: IRS Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons.

Q: Who needs to file Form 1042?

A: Form 1042 needs to be filed by withholding agents who are responsible for withholding taxes on certain types of income paid to foreign persons.

Q: What is the purpose of Form 1042?

A: The purpose of Form 1042 is to report and remit withholding taxes on U.S. source income paid to foreign persons.

Q: When is Form 1042 due?

A: Form 1042 is due on March 15th of the year following the calendar year in which the income was paid.

Q: Are there any penalties for late filing of Form 1042?

A: Yes, there are penalties for late filing of Form 1042. It is important to file the form on time to avoid these penalties.

Q: Are there any exceptions to filing Form 1042?

A: Yes, there are certain exceptions to filing Form 1042. It is best to consult the IRS instructions or a tax professional to determine if you qualify for any exceptions.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.