This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule R

for the current year.

Instructions for IRS Form 1040 Schedule R Credit for the Elderly or the Disabled

This document contains official instructions for IRS Form 1040 Schedule R, Credit for the Elderly or the Disabled - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule R is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule R?

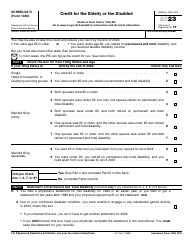

A: IRS Form 1040 Schedule R is a tax form used to claim the Credit for the Elderly or the Disabled.

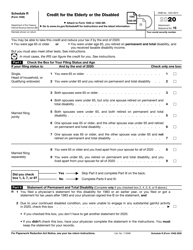

Q: Who is eligible for the Credit for the Elderly or the Disabled?

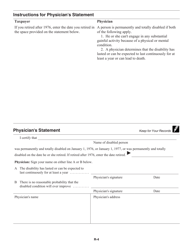

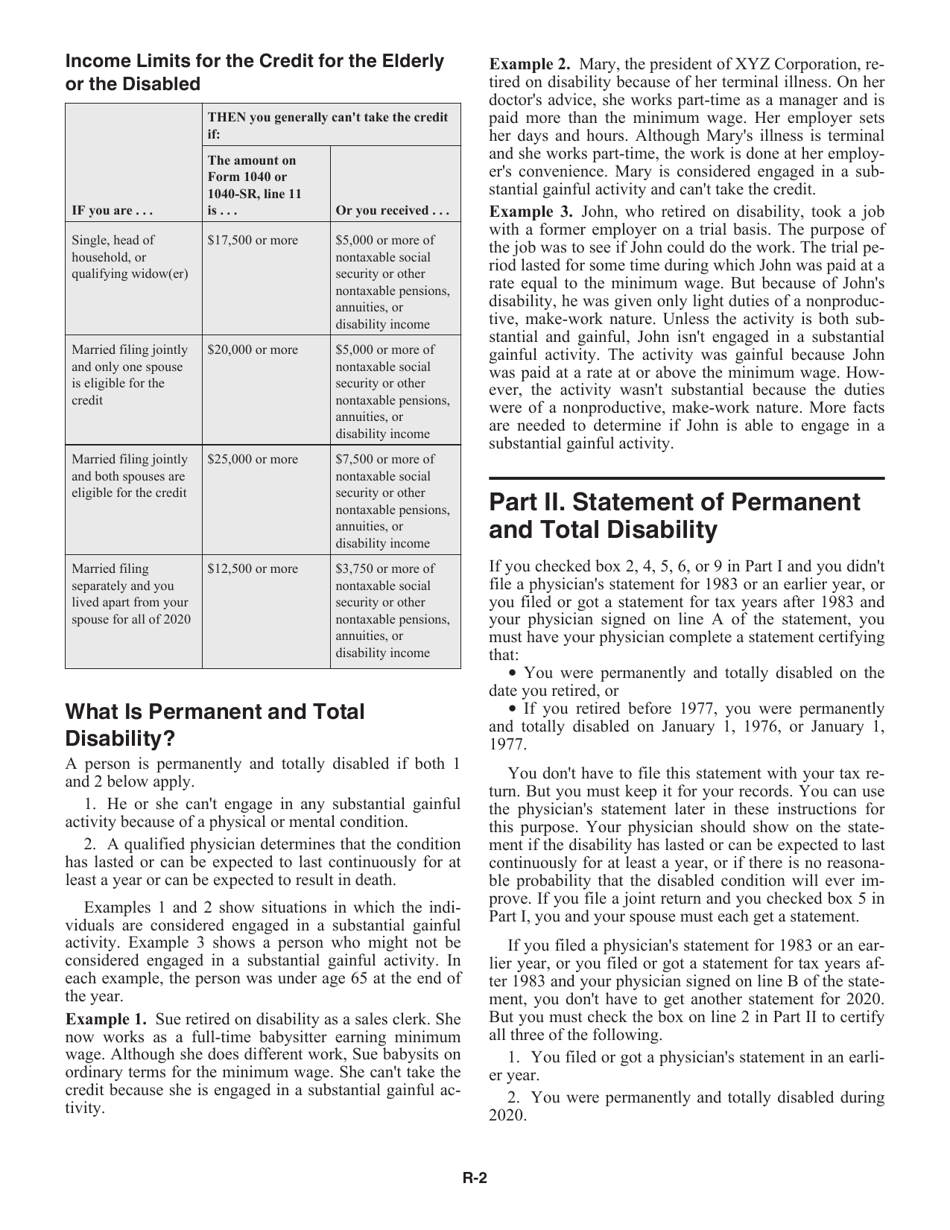

A: Individuals who are age 65 or older, or those who are under 65 but retired on permanent disability, may be eligible for the credit.

Q: How do I qualify for the Credit for the Elderly or the Disabled?

A: To qualify, you must meet certain income limits and criteria set by the IRS. It is best to consult the instructions for Schedule R or a tax professional for specific details.

Q: What expenses are considered for the credit?

A: Medical expenses, such as doctor's fees and prescription drugs, may be included in the credit calculation. Other sources of income and nontaxable pensions should also be considered.

Q: How can I claim the Credit for the Elderly or the Disabled?

A: To claim the credit, you need to complete IRS Form 1040 Schedule R and attach it to your Form 1040 tax return.

Q: When should I file IRS Form 1040 Schedule R?

A: IRS Form 1040 Schedule R should be filed along with your annual income tax return, typically due by April 15th each year, unless the filing deadline is extended.

Q: Is there a limit to the amount of credit I can receive?

A: Yes, there is a limit to the amount of credit you can receive. The exact limit depends on your income, filing status, and other factors. Consult the instructions for Schedule R or a tax professional for specific details.

Q: Can I claim this credit for someone else, such as a parent or grandparent?

A: No, you cannot claim the credit for someone else. The credit is only available to eligible individuals.

Q: What if I made a mistake on my Schedule R or forgot to file it?

A: If you made a mistake on your Schedule R or forgot to file it, you may need to file an amended tax return using IRS Form 1040X.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.