This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule R

for the current year.

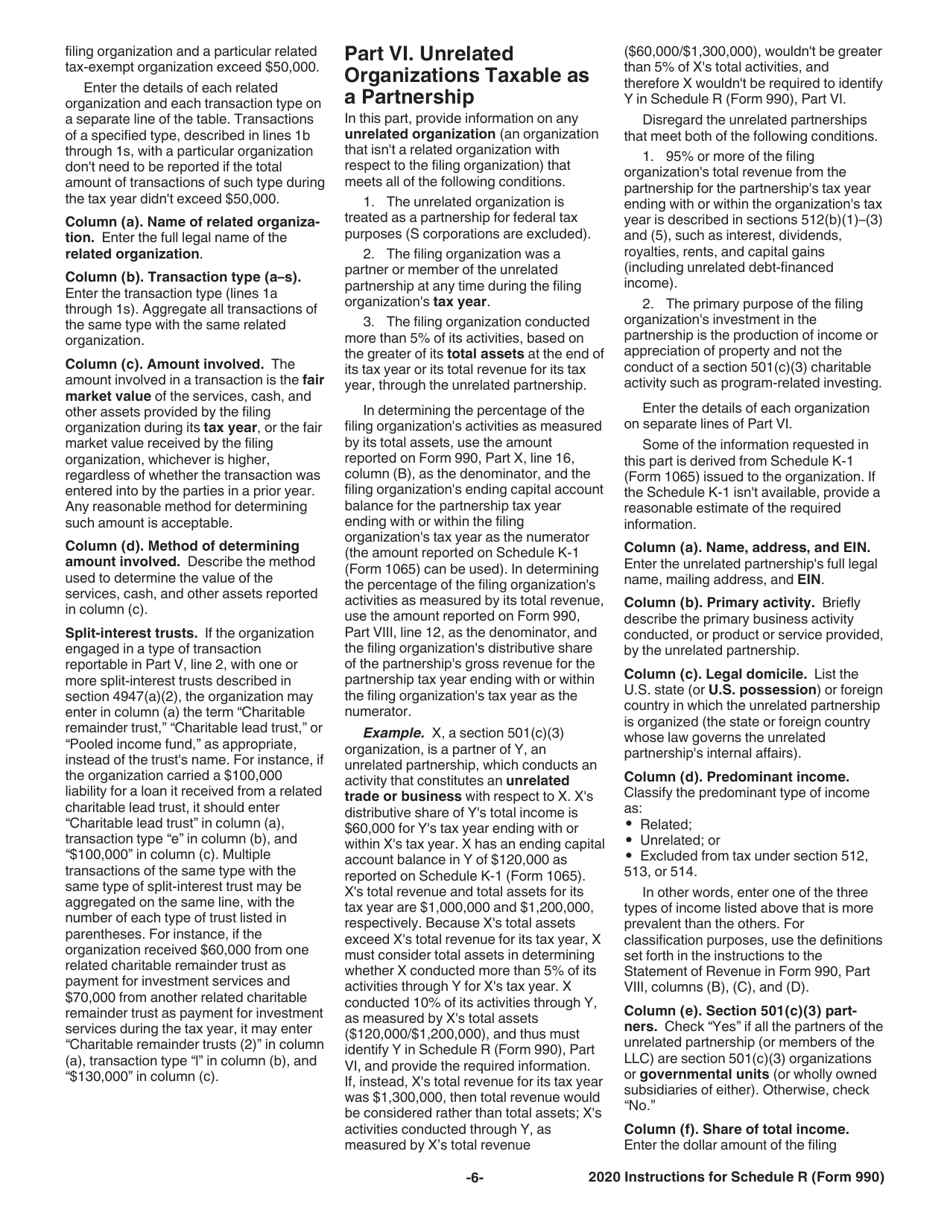

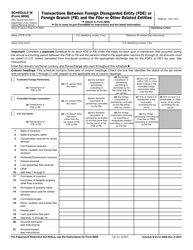

Instructions for IRS Form 990 Schedule R Related Organizations and Unrelated Partnerships

This document contains official instructions for IRS Form 990 Schedule R, Related Organizations and Unrelated Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule R is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule R?

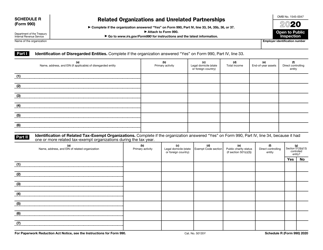

A: IRS Form 990 Schedule R is a form used by tax-exempt organizations to report certain information about related organizations and unrelated partnerships.

Q: Who uses IRS Form 990 Schedule R?

A: Tax-exempt organizations use IRS Form 990 Schedule R.

Q: What information is reported on IRS Form 990 Schedule R?

A: IRS Form 990 Schedule R reports information about related organizations and unrelated partnerships, including their names, addresses, and the nature of their relationships with the tax-exempt organization.

Q: What is the purpose of IRS Form 990 Schedule R?

A: The purpose of IRS Form 990 Schedule R is to provide transparency and ensure that tax-exempt organizations are properly disclosing their relationships with related organizations and unrelated partnerships.

Q: Is IRS Form 990 Schedule R required for all tax-exempt organizations?

A: No, IRS Form 990 Schedule R is not required for all tax-exempt organizations. It is only required for those organizations that have certain relationships with related organizations or unrelated partnerships.

Q: What are related organizations and unrelated partnerships?

A: Related organizations are other organizations that are connected to the tax-exempt organization in some way, such as parent organizations or subsidiaries. Unrelated partnerships are partnerships that the tax-exempt organization is involved in, but that are not considered related organizations.

Q: Are there any penalties for not filing IRS Form 990 Schedule R?

A: Yes, there can be penalties for not filing IRS Form 990 Schedule R. Failure to file the form or providing false information on the form can result in penalties imposed by the IRS.

Q: Are there any exceptions or exemptions for filing IRS Form 990 Schedule R?

A: There may be exceptions or exemptions for certain tax-exempt organizations depending on their specific circumstances. It is best to consult the instructions for IRS Form 990 Schedule R or seek professional tax advice to determine if any exceptions or exemptions apply.

Q: Can I file IRS Form 990 Schedule R electronically?

A: Yes, you can file IRS Form 990 Schedule R electronically through the IRS's electronic filing system (e-file) or through approved tax software.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.