This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule J

for the current year.

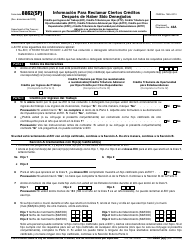

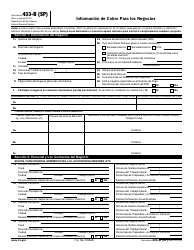

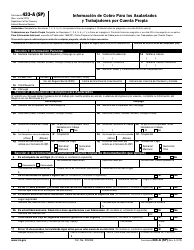

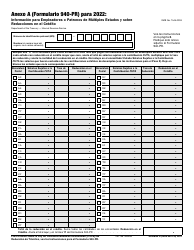

Instructions for IRS Form 990 Schedule J Compensation Information

This document contains official instructions for IRS Form 990 Schedule J, Compensation Information - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule J is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule J?

A: IRS Form 990 Schedule J is a form used by certain tax-exempt organizations to report compensation information.

Q: Who needs to file IRS Form 990 Schedule J?

A: Certain tax-exempt organizations that have highly compensated employees or independent contractors need to file IRS Form 990 Schedule J.

Q: What information does IRS Form 990 Schedule J require?

A: IRS Form 990 Schedule J requires organizations to report compensation information for key employees and independent contractors, including salary, bonuses, retirement benefits, and more.

Q: When is the deadline for filing IRS Form 990 Schedule J?

A: The deadline for filing IRS Form 990 Schedule J is the same as the deadline for filing the organization's annual Form 990.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.