This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 940

for the current year.

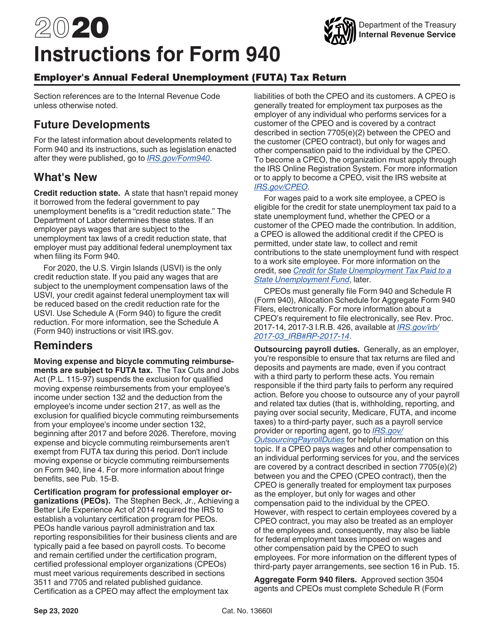

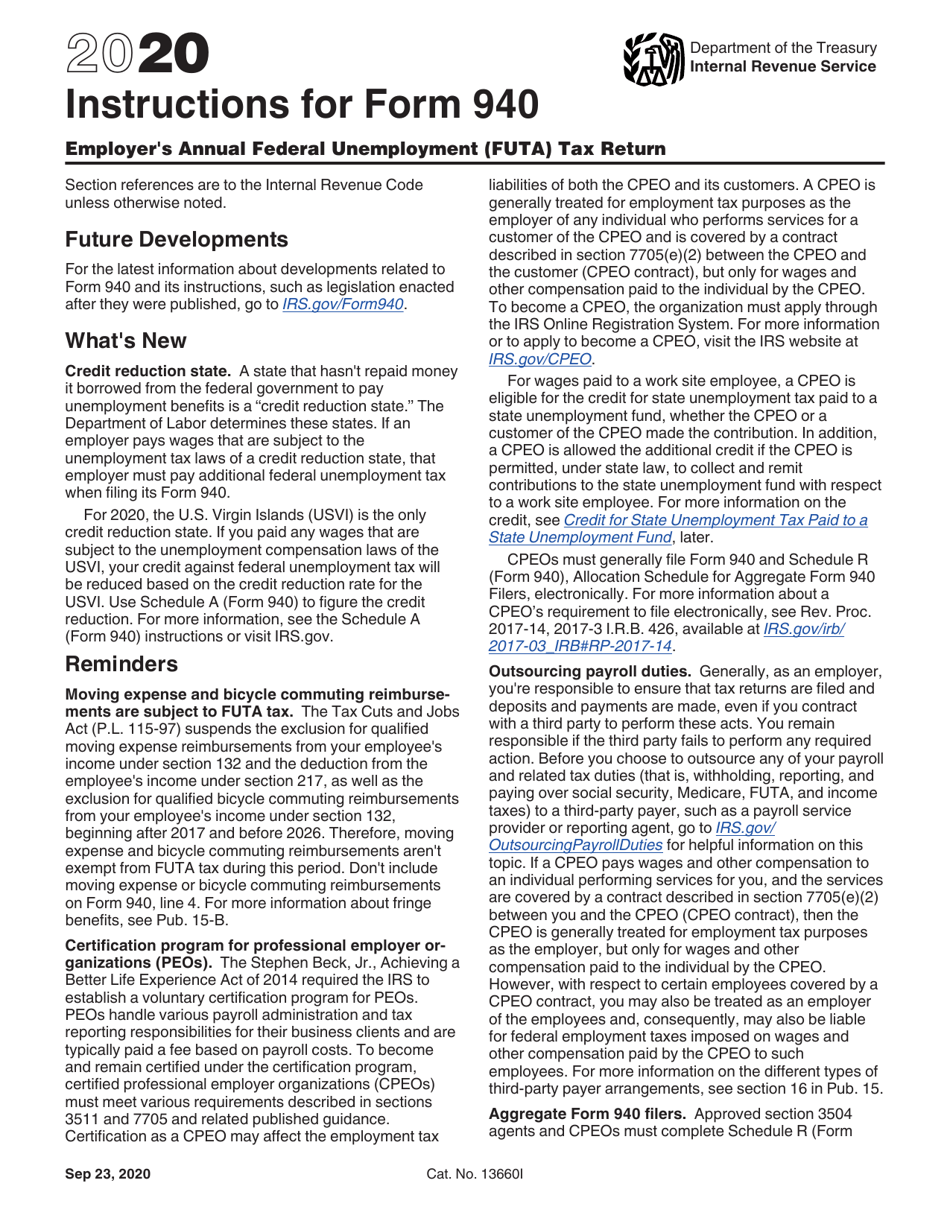

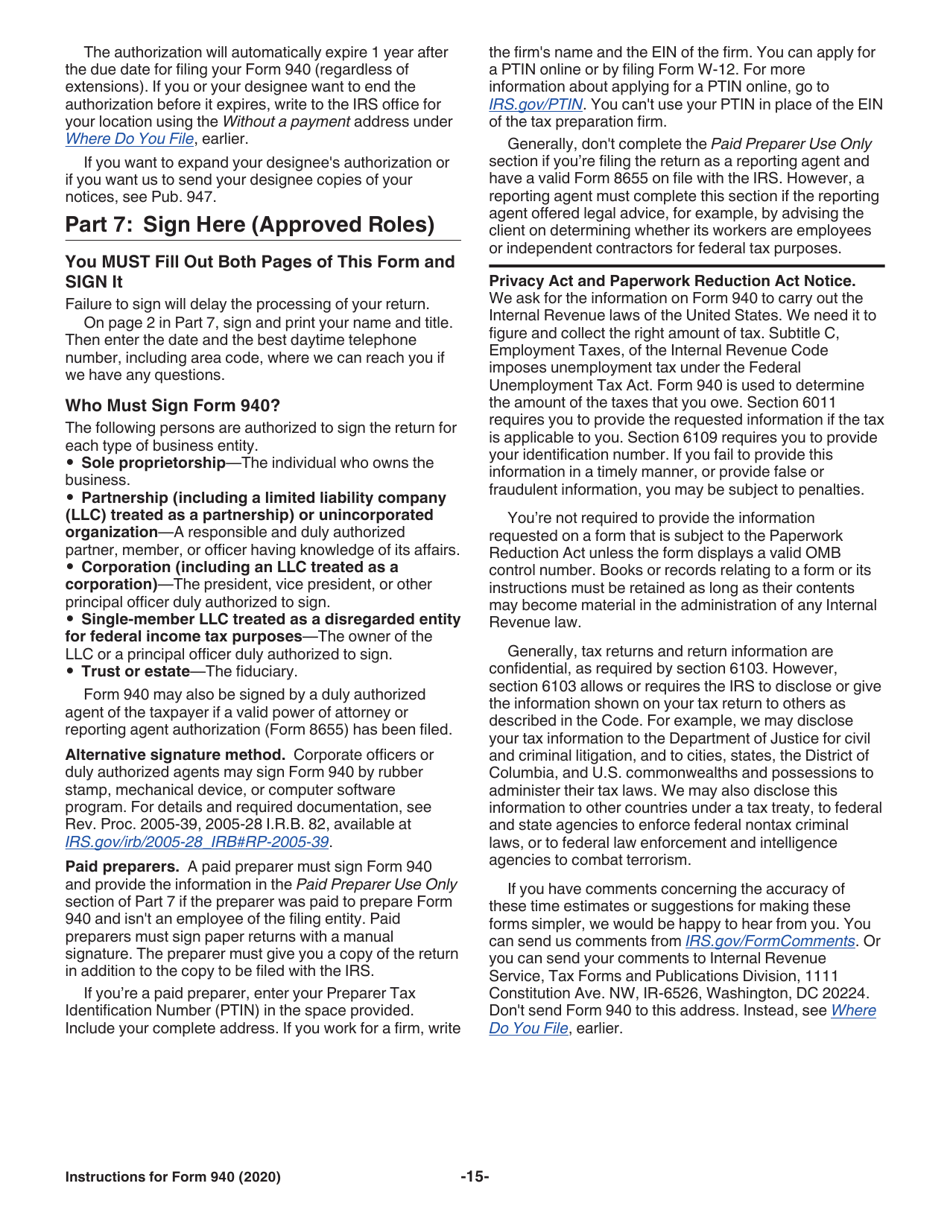

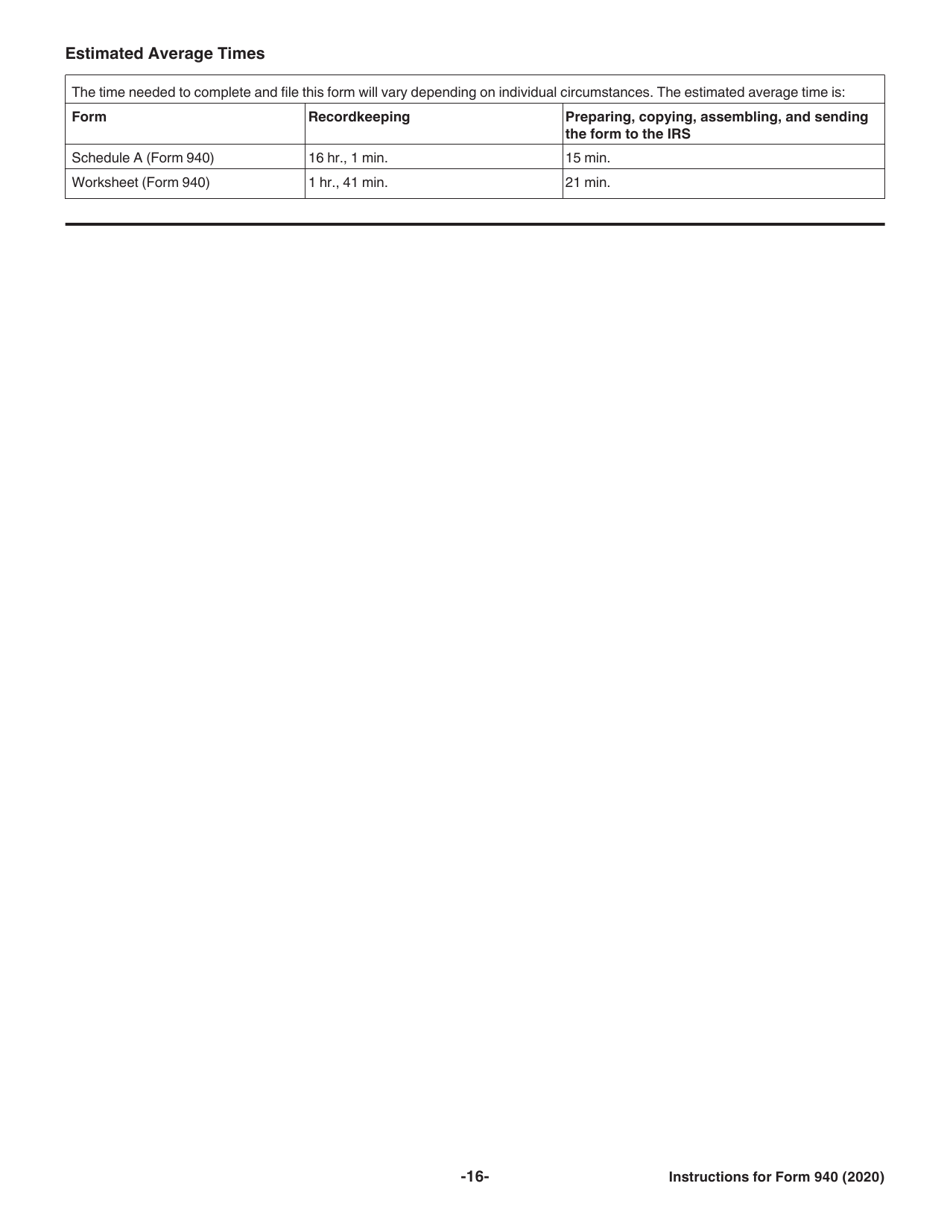

Instructions for IRS Form 940 Employer's Annual Federal Unemployment (Futa) Tax Return

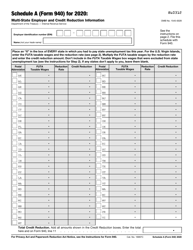

This document contains official instructions for IRS Form 940 , Employer's Annual Federal Unemployment (Futa) Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 940 Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 940?

A: IRS Form 940 is the Employer's Annual Federal Unemployment (FUTA) Tax Return.

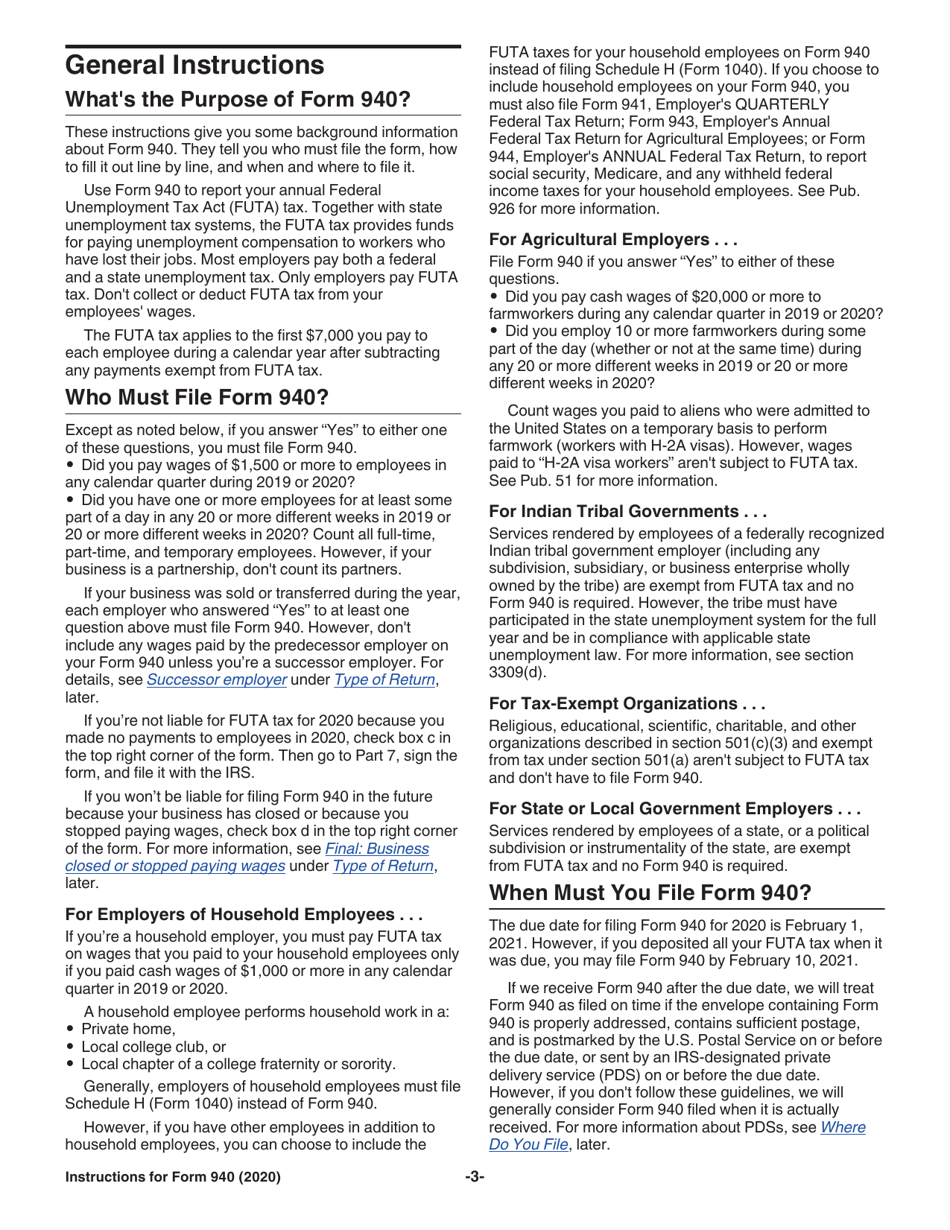

Q: Who needs to file IRS Form 940?

A: Employers who paid wages of $1,500 or more to employees during any calendar quarter in the previous year, or had one or more employees for at least 20 weeks in the previous year.

Q: What is FUTA tax?

A: FUTA tax is the federal unemployment tax employers are required to pay to the IRS.

Q: What is the purpose of IRS Form 940?

A: IRS Form 940 is used to report and pay FUTA tax.

Q: When is IRS Form 940 due?

A: IRS Form 940 is due on January 31st of the following year.

Q: What are the penalties for late filing or payment of IRS Form 940?

A: Penalties may apply for late filing or payment of IRS Form 940. It is important to file and pay on time to avoid penalties.

Q: Are there any exceptions or exemptions to filing IRS Form 940?

A: There may be exceptions or exemptions for certain types of employers. It is recommended to consult the IRS guidelines or a tax professional for specific information.

Q: What information do I need to complete IRS Form 940?

A: You will need information about your company, employee wages, and any FUTA tax already paid during the year.

Q: Can IRS Form 940 be filed electronically?

A: Yes, IRS Form 940 can be filed electronically through the IRS e-file system.

Q: What if I made a mistake on IRS Form 940?

A: If you made a mistake on IRS Form 940, you can file an amended return using IRS Form 940-X.

Instruction Details:

- This 16-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.